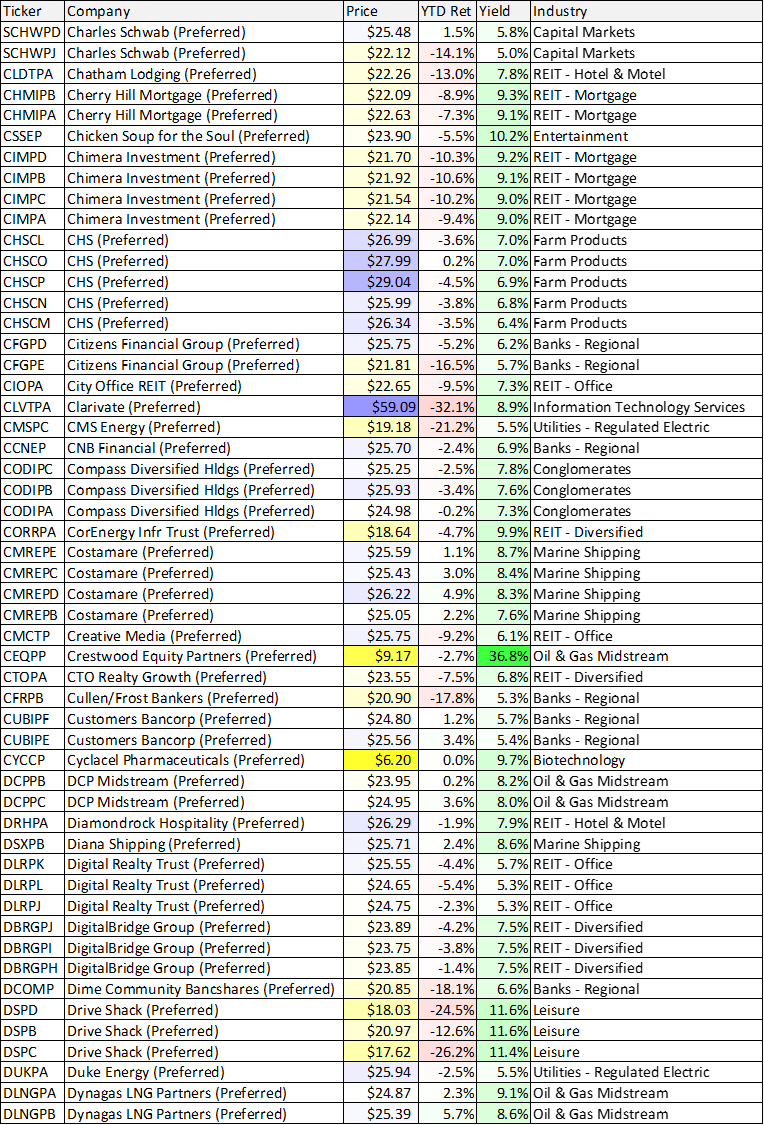

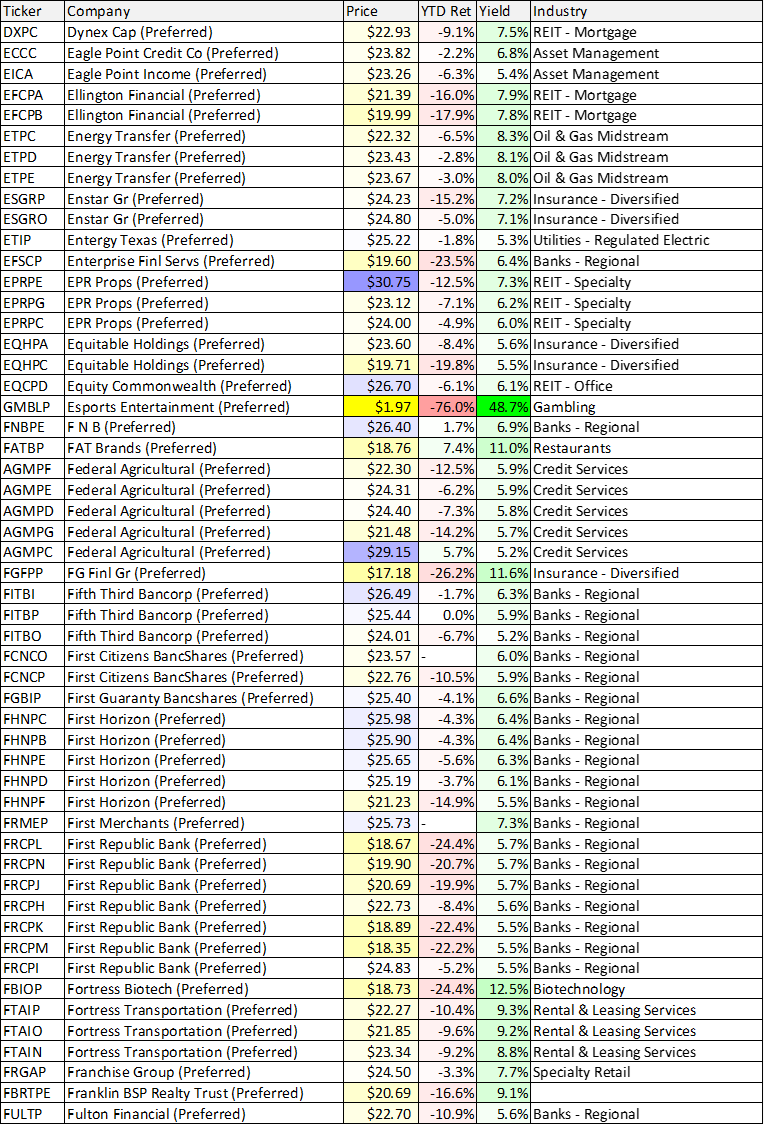

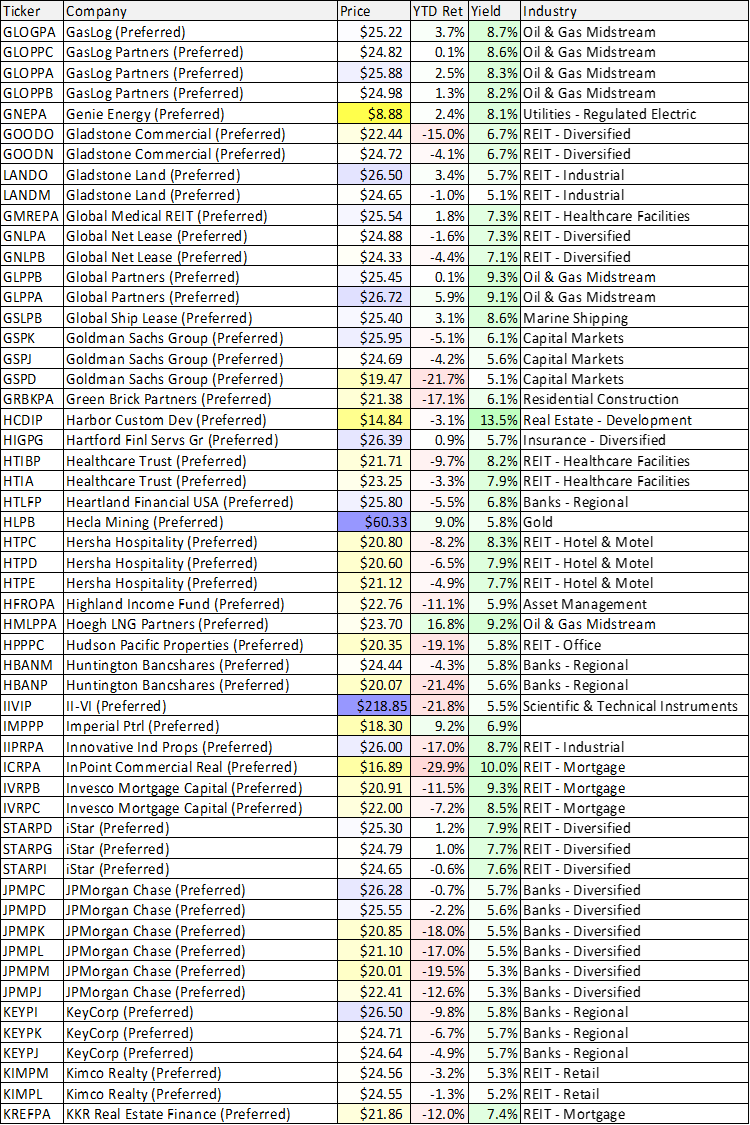

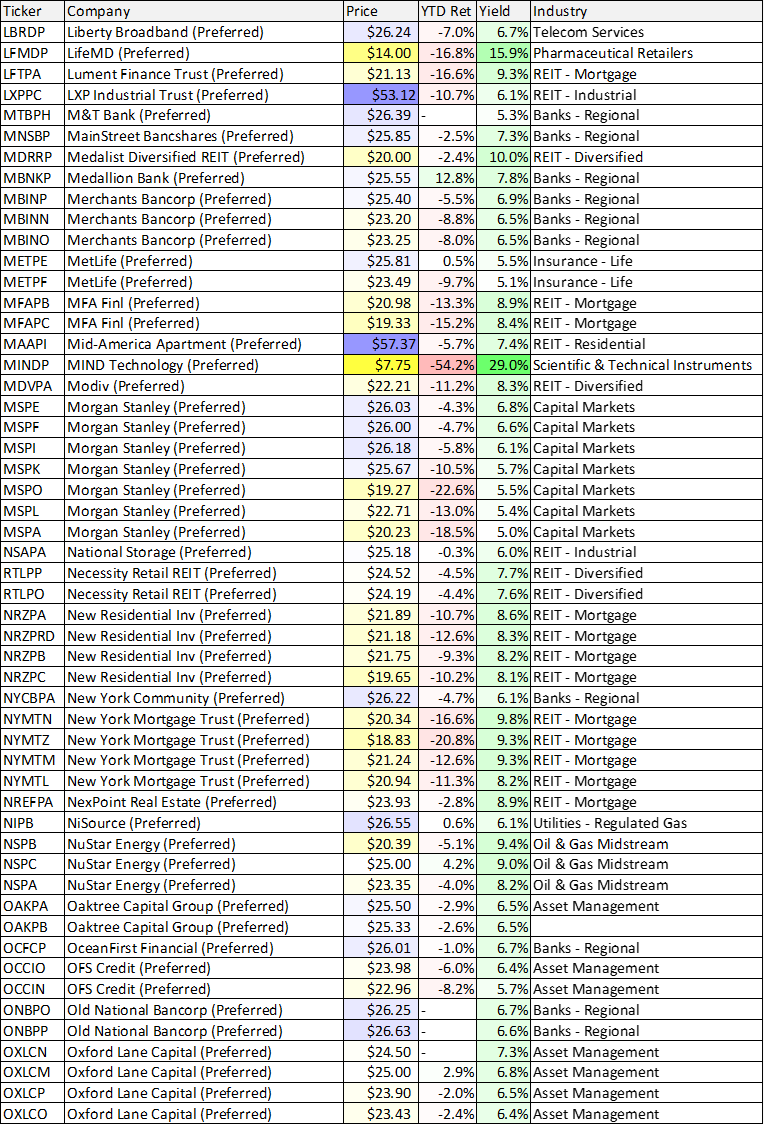

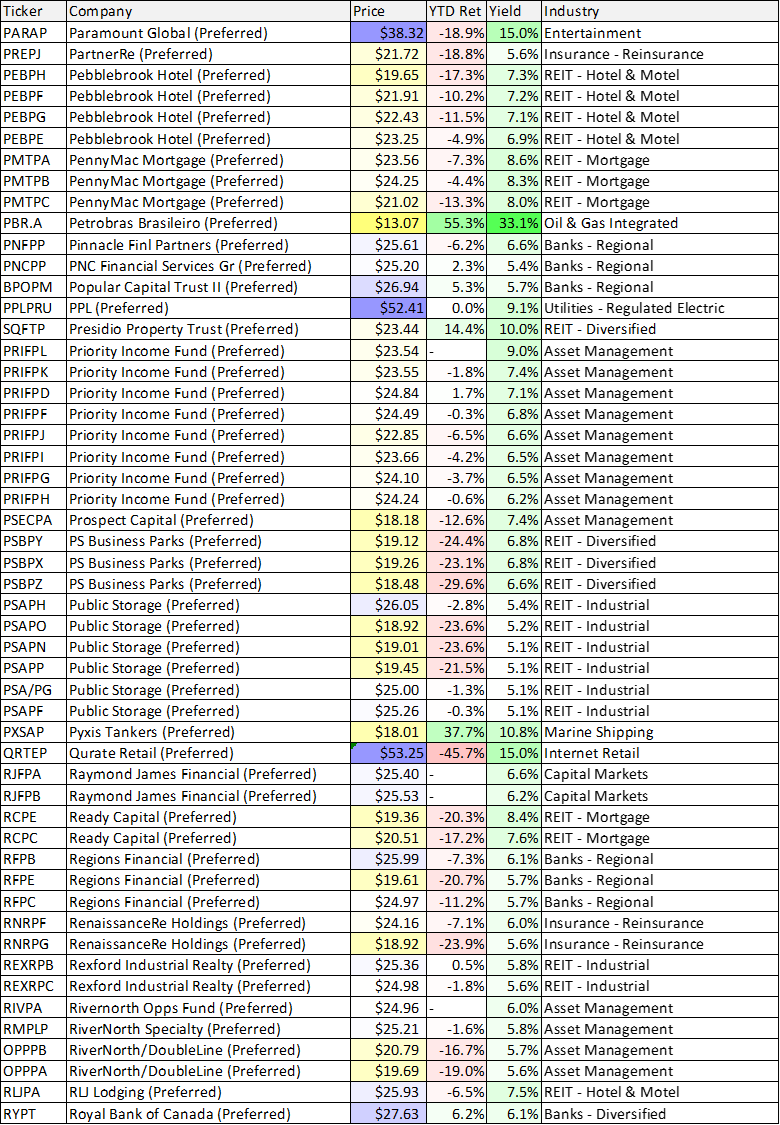

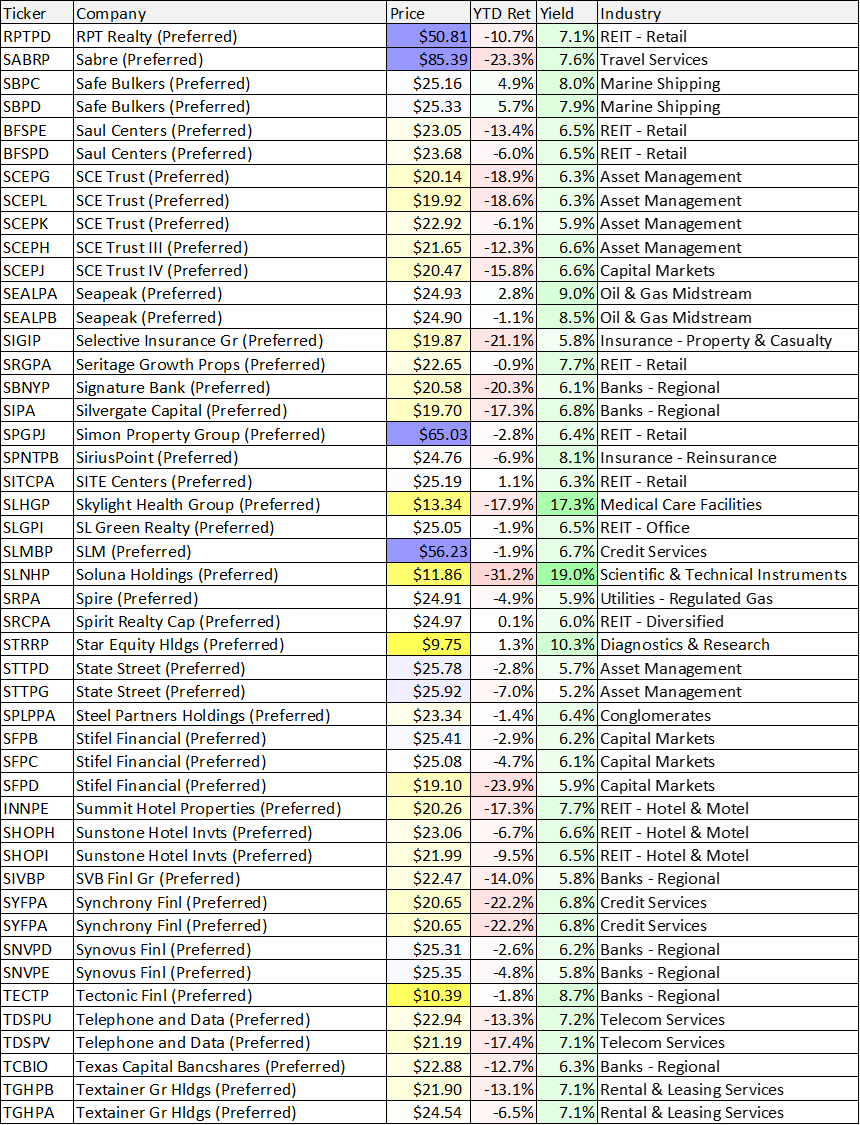

From time to time, it can make a lot of sense to peruse the preferred stock landscape in terms of prices, yields, performance and industry. For your reference, this report includes over 400 big-dividend preferred stocks sorted alphabetically. Data is as of Friday July 29th (the last trading day of July). We also conclude with a little color on what to look for and our favorites from the list.

How to read the list:

In the price column, the brighter the yellow—the lower the price. And the brighter the indigo, the higher the price.

In the year-to-date return column, the brighter the red—the worse the performance. The brighter the green—the better the performance.

In the yield column—the brighter the green—the higher the yield.

As you review this list, you may see a few names you are familiar with.

How Preferred Stocks Work

Preferred stocks are a hybrid between common equity (which is lower in the capital structure—more risky) and bonds (which are higher in the capital structure—less risky). Preferred stocks often stipulate a potential future redemption price by the company (often $25 per share) whereby they are allowed to buy back the shares. This redemption price keeps the preferred share price from ever rising too high (they don’t have as much upside as common shares), and the redemption price also introduces some interest rate risk (as interest rates rise—like this year—preferred share prices generally fall). Additionally, preferred share prices can fall when the market perceives the risk to be high (for example, the underlying company could go bankrupt and not pay back the preferred shares at all).

What to Look for, and Our Favorites from the List

Generally speaking, we like to invest in preferred stocks that are backed by strong businesses and that trade below $25 so there is some price appreciation potential (although we don’t mind paying slightly above 25 if the yield and the business is right). We also like to review the specific rules and stipulations of each individual preferred stock at QuantumOnline.com. For example, click on the tickers at this link for the rules on each individual AGNC preferred stock.

In particular, we do like the AGNC preferred shares. For example, the 6.125% Series F “Fixed-to-Floating” are attractive because they offer a high yield, trade at a low price and are backed by a business than can continue to operate. An important stipulation of these shares is as follows:

“From and including 04/15/2025 at a floating rate equal to Three-Month LIBOR plus a spread of 4.697% per annum.”

This can turn into a compelling floating rate dividend on 4/12/2025 or they could get redeemed at $25 before then. We recently wrote up a detailed free report on AGNC here. And for these reasons, we’ve included AGNC preferred shares as one of our 3 Top Preferred Stocks Worth Considering.

However, at the end of the day, you need to do what is right for you. Disciplined, goal-focused, long-term investing is a winning strategy.