Mortgage REIT AGNC Investment Corp (AGNC) announced quarterly earnings on Monday, and not surprisingly—book value took a hit (amongst all the interest rate and agency-spread movements). The dividend yield is now over 11.5%, and some investors are left wondering if the shares are worth owning or if the risks are too great. In this report, we review the business, the outlook, valuation and three big risks investors should be aware of. We also consider the preferred shares, and then conclude with our opinion on investing.

Business Overview:

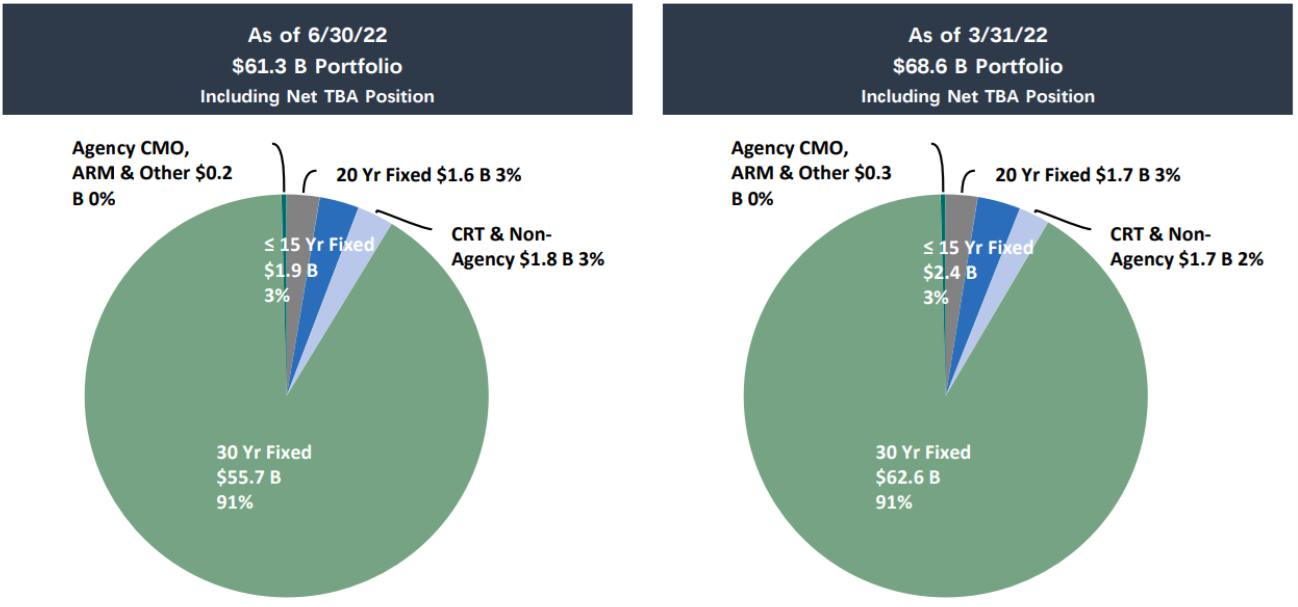

Unlike property REITs (that own actual real estate), mortgage REITs own mortgage-related assets. For example, AGNC (one of the largest mortgage REITs with a market cap of around $6 billion) owns mostly mortgage-backed securities issued by US government agencies (i.e. “agency MBS”). And this creates an entirely different business model and risk profile for mortgage REITs.

In the case of AGNC, it may sound like a safe investment, considering most of its assets (i.e. agency MBS) are basically backed by the US government. However, AGNC buys these assets with significant leverage, or borrowed money (the balance sheet is currently levered about 7.4 times) and this introduces a dramatically higher level of risk for investors.

For example, the leverage helps get the yield up to around 12% (because agency MBS don’t yield anywhere near that high on their own), but the leverage also magnifies the risks—especially when interest rates and agency spreads (versus treasuries) are moving dramatically like they have been this year (more on this later).

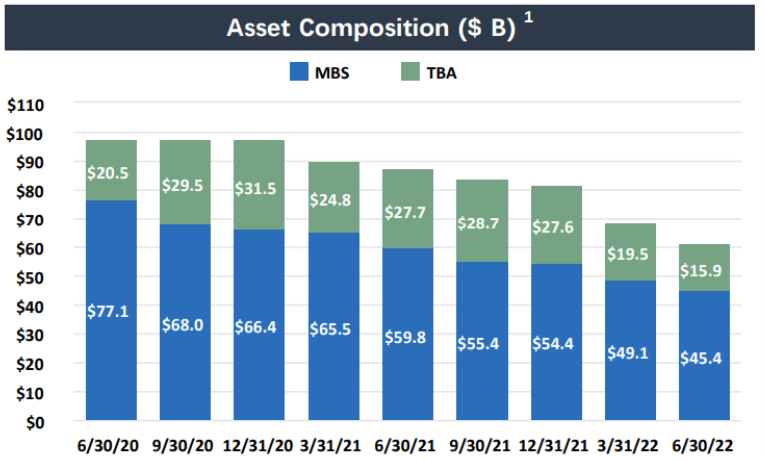

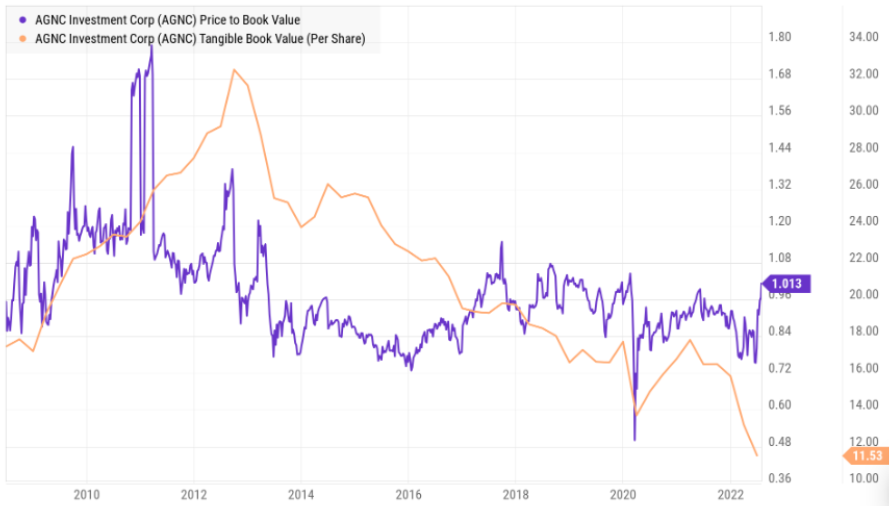

In fact, all the recent interest rate volatility caused AGNC’s book value (which is updated and released only quarterly) to fall to $11.53 per share (it was $13.12 per share last quarter).

And a falling book value matters a lot because book value is the major factor that determines how much money mortgage REITs can borow (i.e. leverage) and how much they can earn. And when book value falls, mortgage REITs can be forced to sell off some of their assets to keep the leverage at an appropriate level for lenders to keep lending.

Business Outlook:

As mentioned, because book value has declined—the amount of money AGNC can earn has decreased (all else equal). However, all else is not equal in this case because as interest rates are now higher—AGNC can earn a higher rate of return on its assets.

According to AGNC CEO, Peter Federico:

"Looking ahead, while the near-term outlook continues to be uncertain, the longer-term outlook for Agency MBS has improved substantially. At current valuation levels, Agency MBS are extremely attractive relative to historical levels. The Federal Reserve has begun to reduce its portfolio organically, but that runoff will occur at a slower pace than previously anticipated as a result of reduced prepayments. Finally, and perhaps most importantly, the net supply of Agency MBS is now expected to be meaningfully lower than prior expectations.

"These positive developments provide reason for optimism that this period of weakness in the Agency MBS market is nearing its end. The favorable returns associated with Agency MBS in this wider spread regime and an improving technical outlook for mortgage supply and demand should provide a supportive backdrop for Agency MBS investors. Moreover, in this compelling investment environment, we believe AGNC is well-positioned to generate strong risk-adjusted returns for our stockholders."

Also worth mentioning, AGNC is currently taking a defensive position and utilizing lower leverage because of the current market uncertainty. According to Bernice Bell, EVP and CFO:

"As a result of the challenging market conditions during the quarter, AGNC continued to maintain a defensive position, highlighted by lower leverage and our low interest rate exposure."

Valuation:

Price to book value is one of the most common and most basic ways to value a mortgage REIT, and AGNC currently trades at a slight premium to its most recent book value of $11.53. For perspective, here is a look at the historical price-to-book value for AGNC.

Arguably, now that interest rates and agency spreads have increased—AGNC has more earnings power (even though leverage is lower by historical standards). In fact, the lower leverage provides more dry powder to invest at better yields once AGNC feels the environmental uncertainty has returned to a more reasonable level. This is a good thing for AGNC, however there are risks that should be considered.

3 Big Risks:

AGNC Investment Corp faces three big risks that investors should be aware of, including interest rate risk, agency spread risk and balance sheet complexity risks.

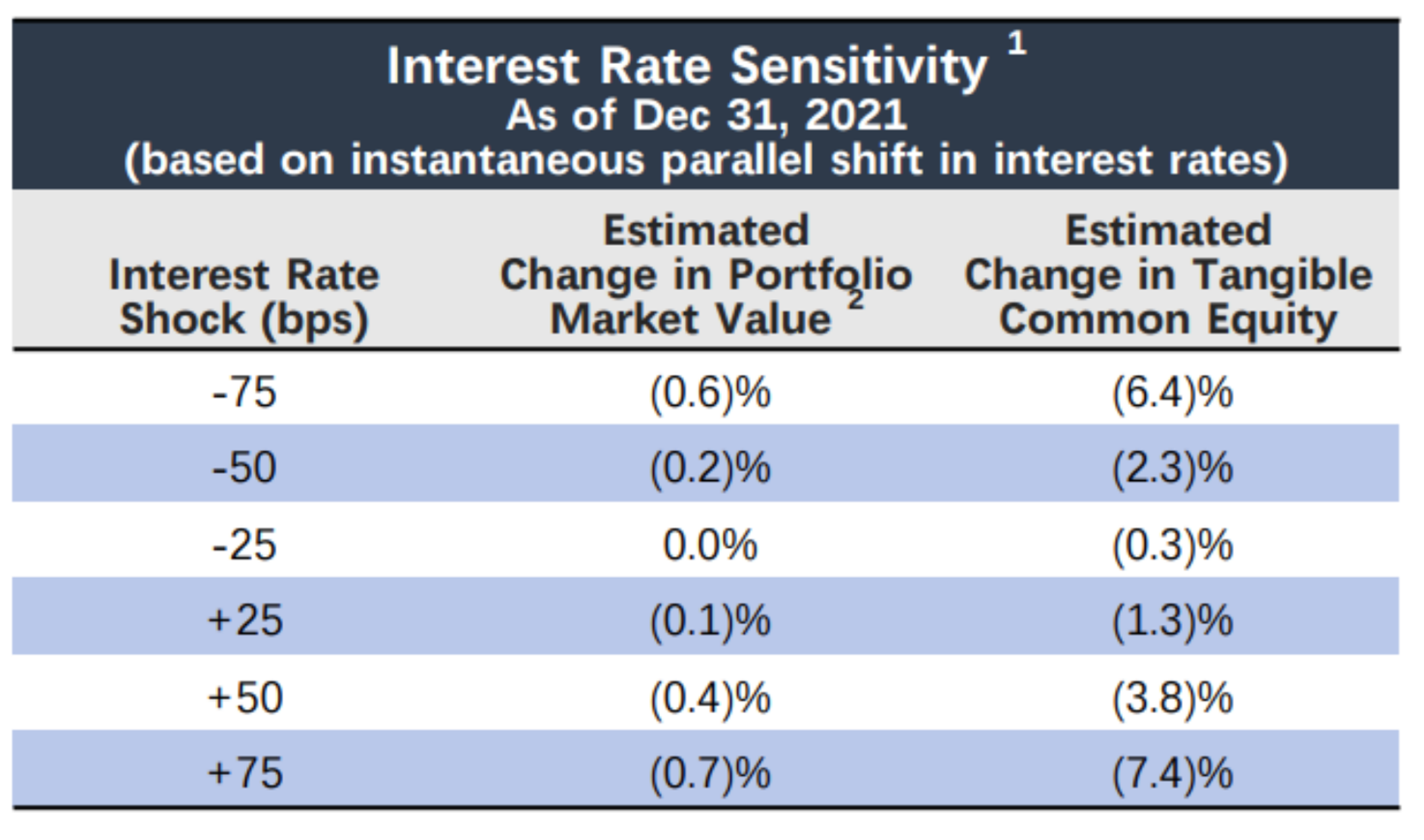

1. Interest Rate Risks:

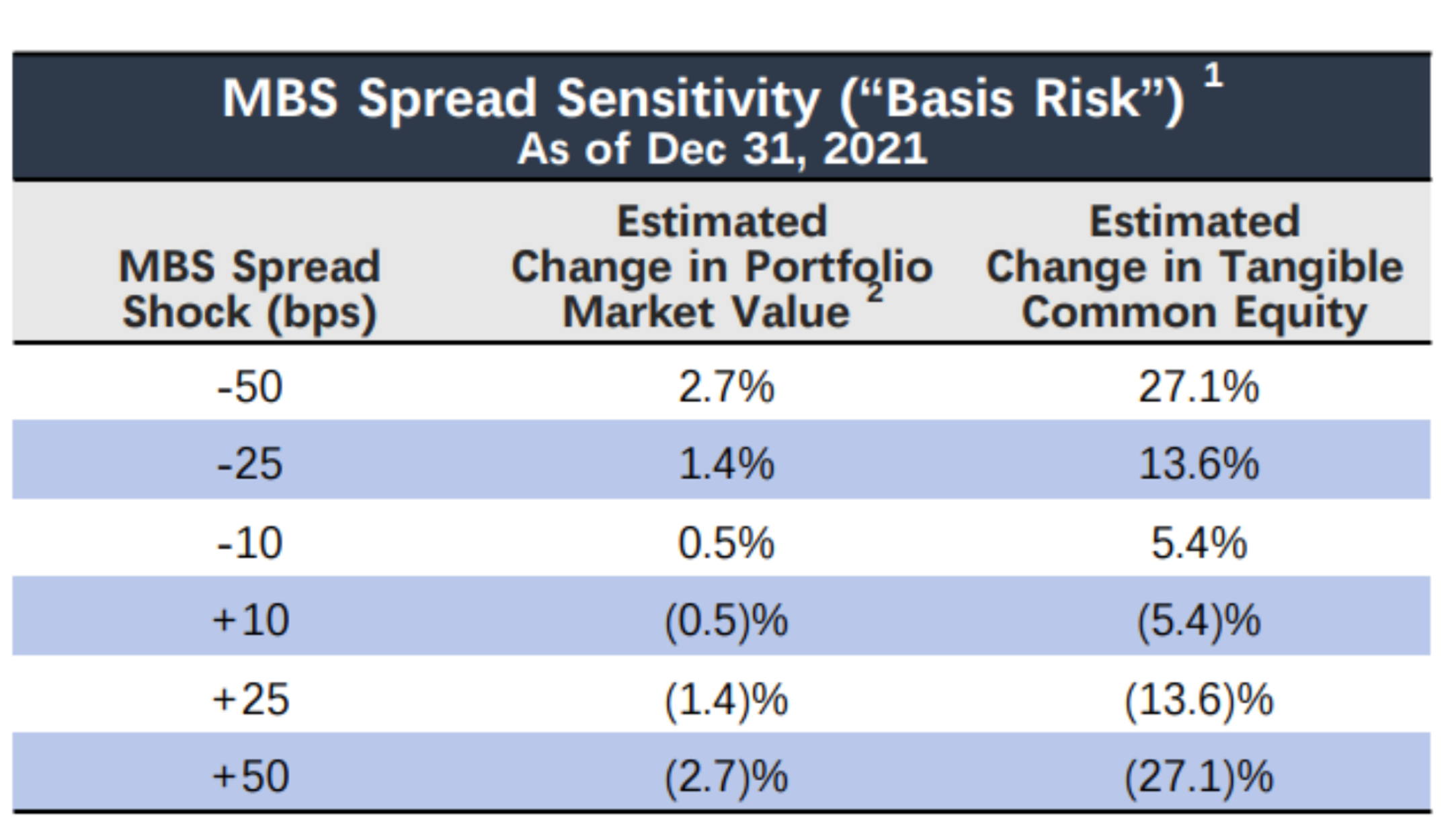

To understand AGNC’s interest rate risks, think of it as a bond fund (because it basically owns a bunch of agency-backed mortgage bonds) and when interest rates go up (like this year)—bond fund prices go down (like this year). For example, here is a look at a graphic from AGNC back at the end of 2021 (before all the interest rate carnage began).

As you can see in the chart above, as rates rise, AGNC gets hurt. We’ve seen interest rates fall a bit in recent week’s (and AGNC’s share price subsequently rise a bit), but the longer-term interest rate trajectory is still to the upside (if you believe the fed) and that could create a lot more pain ahead for AGNC.

2. MBS Spread Risks:

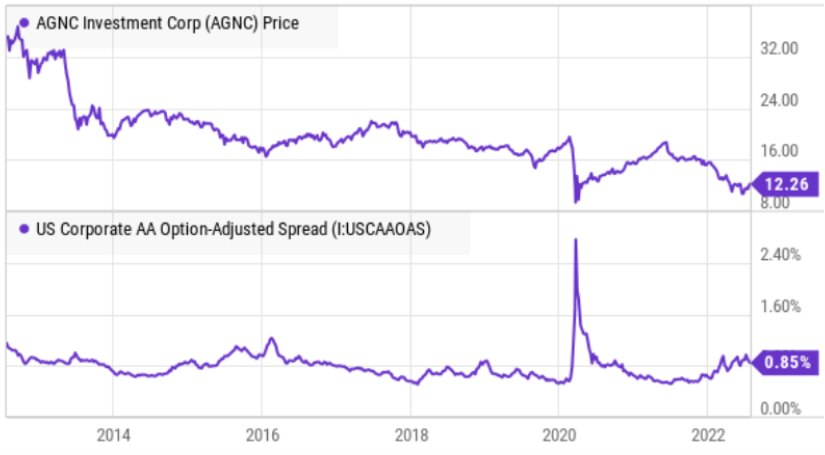

The yield spread between treasuries (the “safe” bonds) and mortgage backed securities (the “riskier” bonds that AGNC owns) is another major risk for AGNC. As you can see in the chart below—when this spread rises, AGNC takes a big hit (in terms of market value and book value).

And as you are probably aware, the mortgage market has been moving significantly this year as home prices have become dramatically less affordable (due to inflation and higher borrowing/interest rates). This impacts the level of new mortgage originations, prepayment speeds and other factors that create headaches for AGNC.

Granted, AGNC is in a good position going forward (because they have lower leverage than normal and because higher rates are good for future returns), but the market is volatile right now (and that creates balance sheet challenges, as we will get into in a moment).

For a little more perspective, we can use corporate credit spreads as a proxy (in the chart below) for the level of risk in the market, and we can see when the market gets bumpy—AGNC shares tend to take a hit.

3. Balance Sheet Complexities:

So far, we have oversimplified AGNC’s business model, considering they do own some assets that are not agency MBS, and considering their balance sheet is dramatically more complicated as they attempt to hedge away some of their interest rate and credit spread risks (which is expensive and never exact).

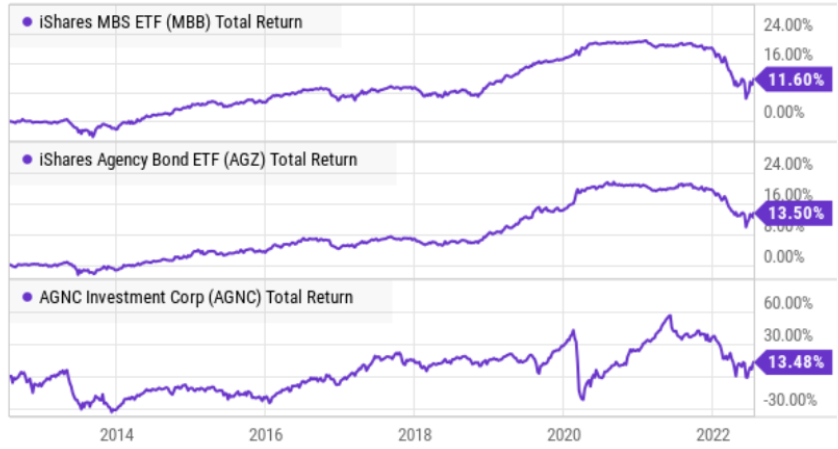

To step back for a moment (to understand the big picture risks) it is worth comparing AGNC’s historical returns and yield to those of basic, passive, non-levered, MBS and Agency ETFs, such as MBB and AGZ (pictured below). And as you can see, over the least 10-years, the two ETFs have followed very similar return patters, and AGNC has too—just with a lot more volatility (due mainly to the leverage, the various balance sheet hedges, expenses, and small allocations to other types of assets and duration differences). In fact, you might have expected AGNC to have delivered much higher returns than the non-levered ETFs, but that is not the case because of the added risks (and losses) of the intricacies and nuances of AGNC’s complicated balance sheet.

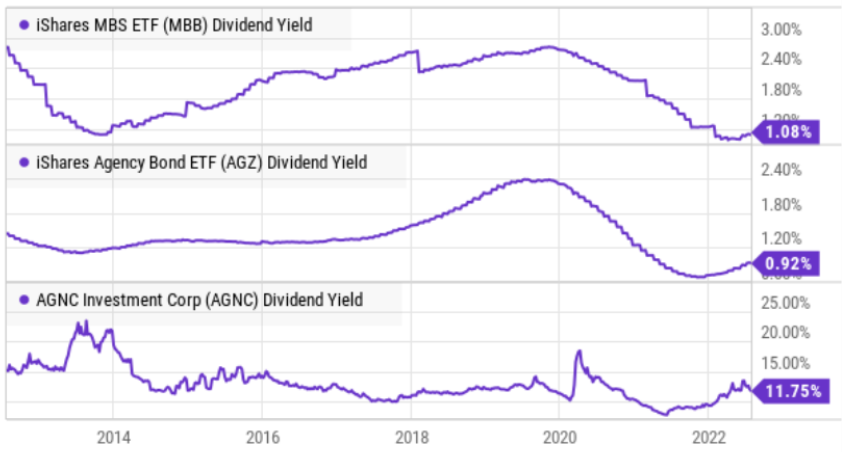

And while the returns in the above charts include dividends (i.e. they are total returns), it is worth comparing the three by yields as well.

As expected, AGNC has a much higher yield (and it’s important to realize that a much larger percent of total returns in our earlier charts come from yield in the case of AGNC than from actual price returns). Also, the yield follows a very different pattern considering the hedging programs and periodic dividend cuts for AGNC (such as the one right after covid hit, as well as several others in the past 10-years).

In a nutshell, AGNC is like a bond fund (that invests in agency MBS bonds), but with a lot more leverage and balance sheet nuances and complexities. And every time interest rates move a lot—or when agency spreads widen—AGNC faces significant risks and often pays for it with forced assets sales to cover leverage and that hurt its book value (like we just saw this last quarter). AGNC goes to great extent to limit some of these risks through balance sheet hedges, but at the end of the day the long-term results have not been as compelling as one might expect, and this is due largely to the expensive balance sheet complexities of operating this business model.

AGNC Preferred Shares

AGNC also offers a variety of big-dividend preferred shares, and we’d be remiss to not discuss them. If you don’t know, preferred shares are a stock-bond hybrid whereby they’re higher than common stock and lower than bonds in the capital structure (i.e. preferreds are safer than common stock but riskier than bonds). AGNC preferred shares are redeemable by AGNC at $25 per share (subject to stipulations) which basically limits their price appreciation potential as compared to common shares, and also creates interest rate risk considering the dividend payments are generally a fixed amount that is worth relatively more or less as market interest rates lower and rise.

In our view, AGNC preferred shares are currently attractive, depending on your own personal situation and goals. For example, if you want the high dividend income but don’t care that the price appreciation is limited as compared to the overall stock market, the preferred shares may be interesting to you.

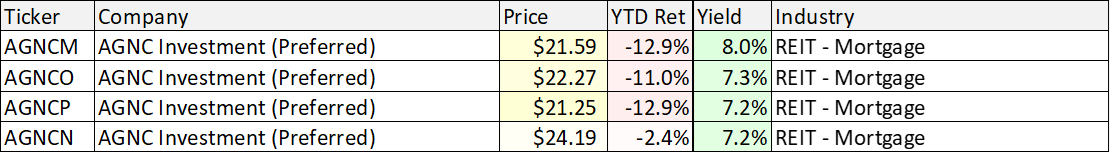

source: Blue Harbinger, data as of Friday 29-Jul-22

Here is a look (above) at the preferred shares AGNC currently has outstanding, and as you can see they currently trade below the $25 redemption price. This is an indication of risk and also an adjustment to rising interest rates as the market adjusted the price to make the income commensurate with similarly risky income-producing opportunities. You can read more about the specific stipulations (e.g. fixed-to-floating rates, earliest redemption dates) by clicking on the appropriate tickers here.

Conclusion:

If you are a long-term growth investor, AGNC is probably not right for you. But if you love those big dividends (and care less about price returns) AGNC may be worth considering. Just know that the majority of its long-term returns come from income—not price appreciation. And know also that the shares tend to suffer price losses (and book value losses) every time the market gets bumpy.

Furthermore, the preferred shares are less risky than the common shares and offer some compelling dividend income. We actually view AGNC preferred shares as one of the three top preferred share opportunities in our recent report 400 Big-Dividend Preferred Stocks because of the lower price, high-dividend yield and relative safety as per the business and as compared to the common shares.

We have owned AGNC common shares in the past (in our Income Equity Portfolio), but we currently do not own shares. At the end of the day, you need to do what is right for you. Our strong belief is that disciplined, goal-focused, long-term investing will continue to be a winning strategy.