With interest rates higher this year, big-dividend REITs have been hit hard, particularly those with higher levels of debt. And one name that just sold off even harder (following its earnings announcement on Wednesday) is Medical Properties Trust (MPW). MPW provides capital to hospitals, has a 7.2% dividend yield and has increased its dividend every year for the last nine years in a row. In this report, we compare MPW to 50 other big-dividend REITs (in terms of a variety of financial metrics) and then dig into its business model, current valuation, dividend safety, the four big risk factors it currently faces and finally conclude with our strong opinion on investing.

50 Big-Dividend REITs Compared

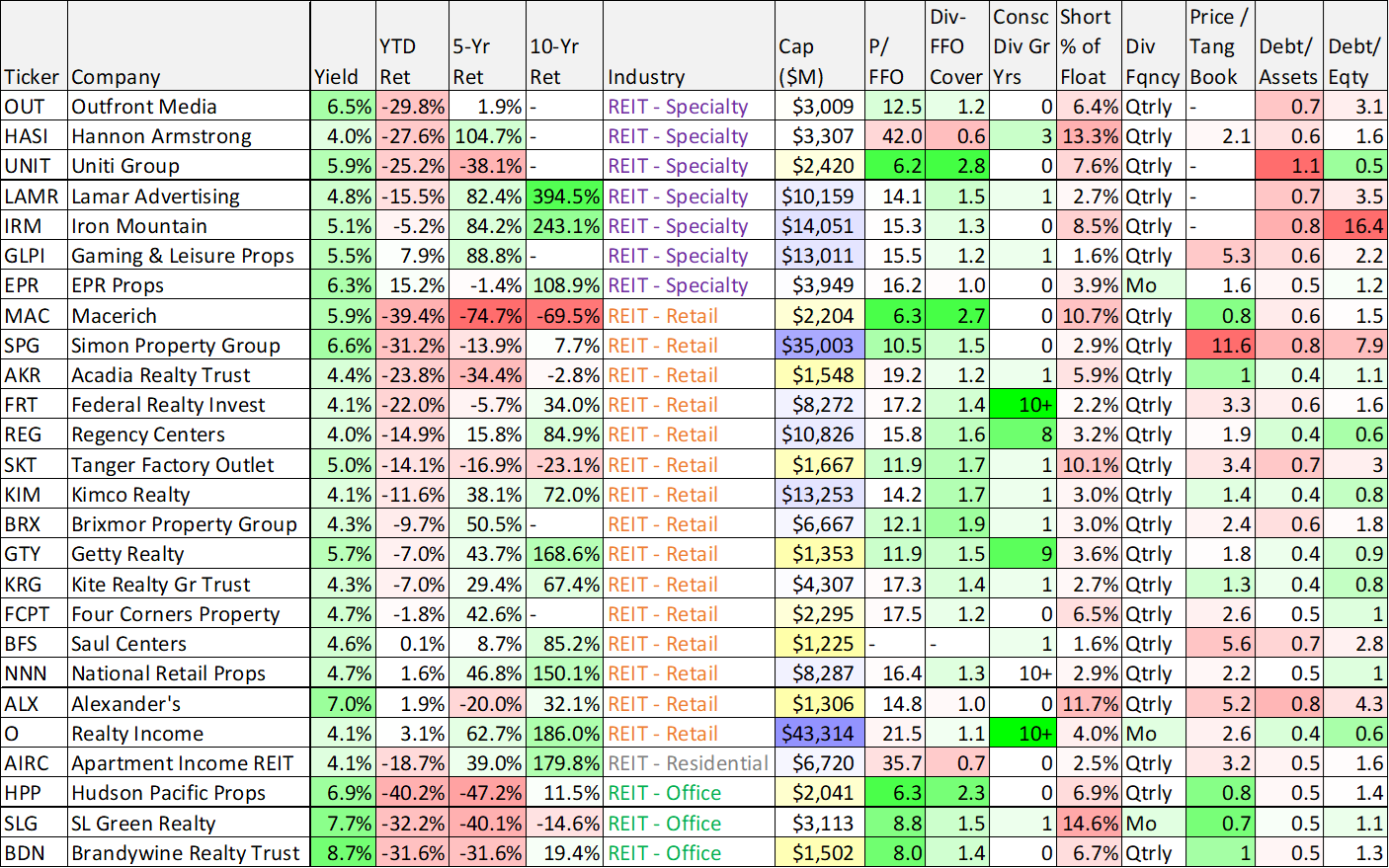

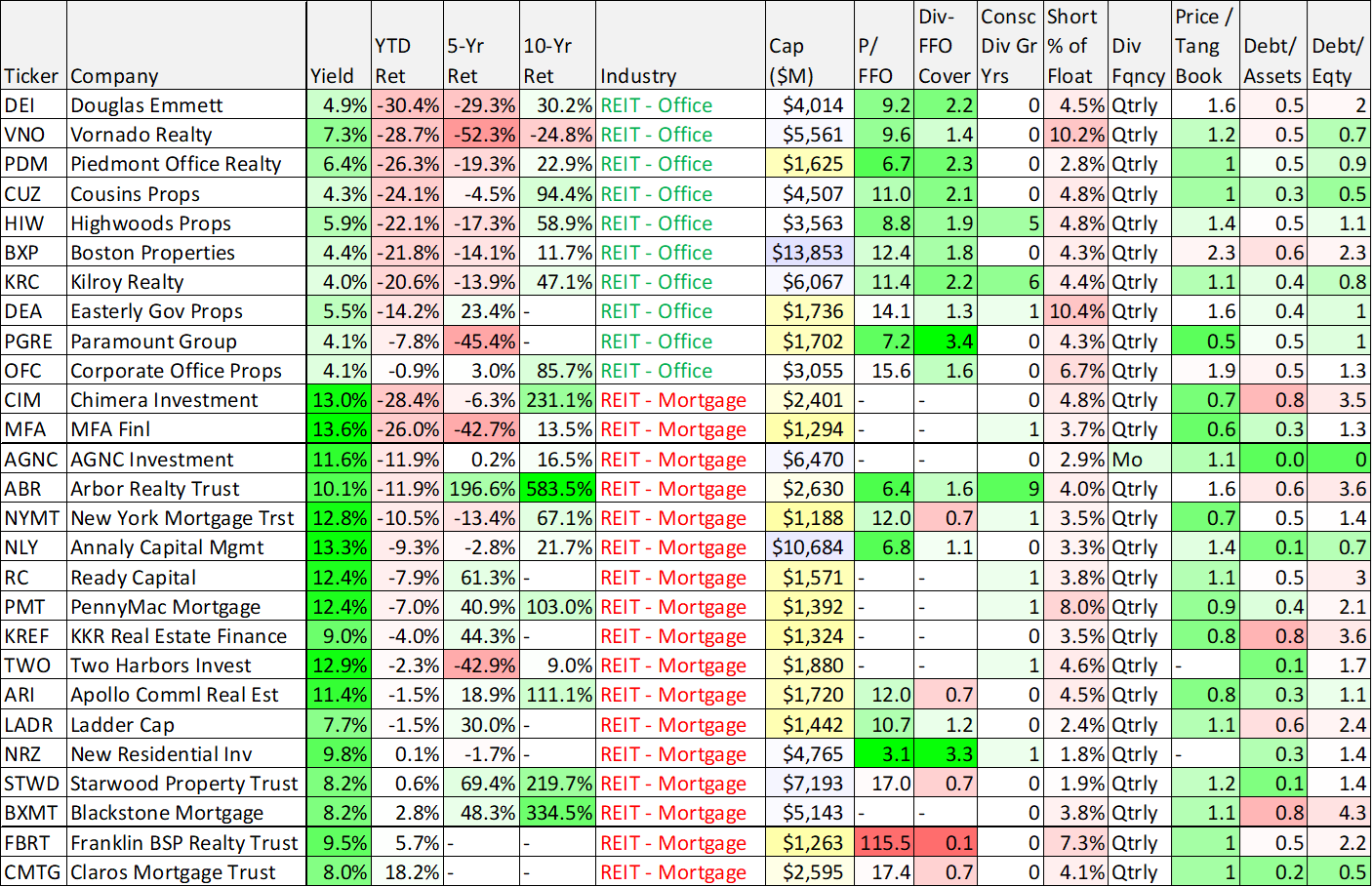

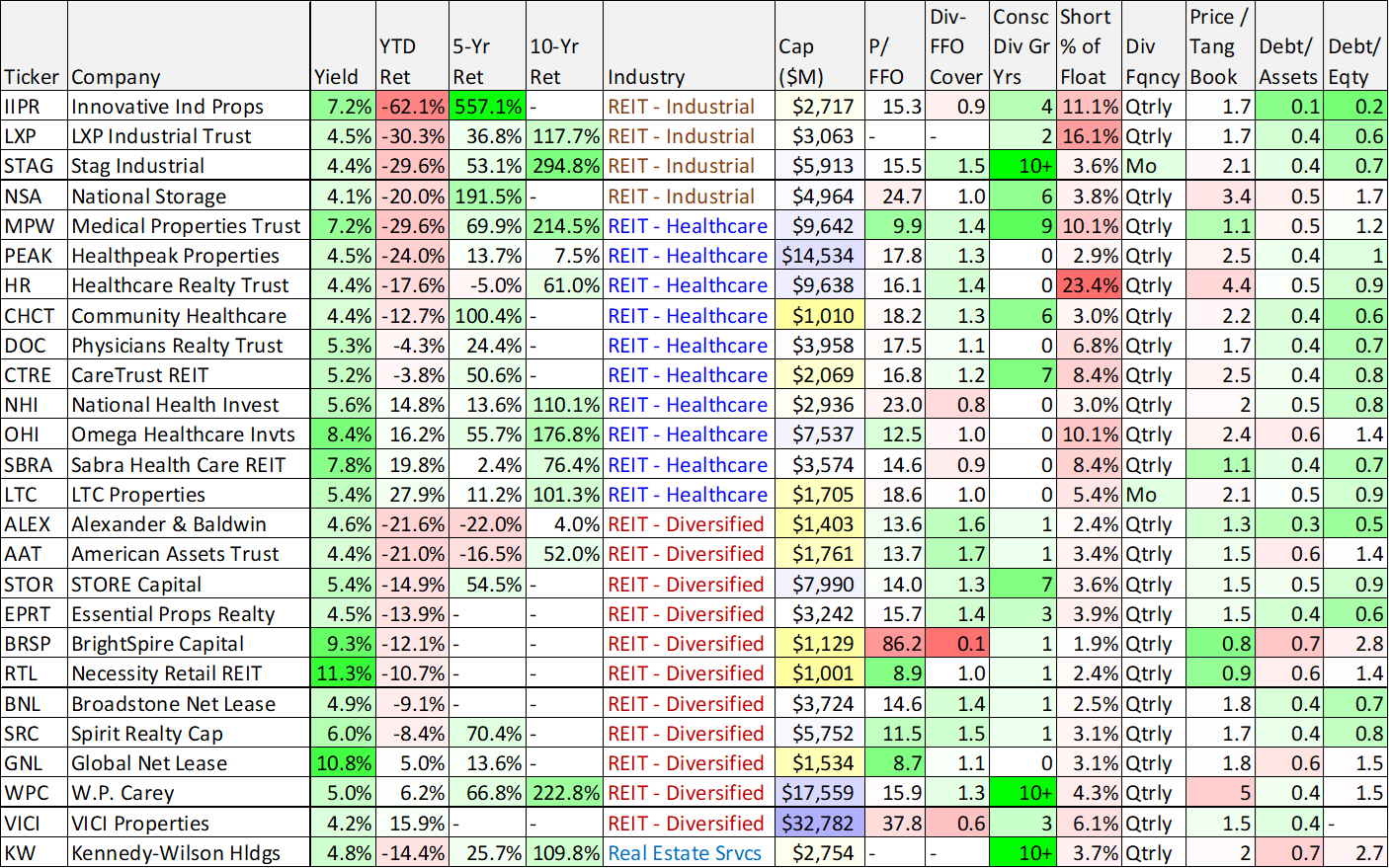

For starters, here is a look at MPW compared to 50 other big dividend REITs. The table is sorted by REIT industries (MPW is a healthcare REIT).

A few things you might notice in this table (aside from a variety of your favorite REIT names) is that MPW stands out for its big dividend yield (7.2%), its consecutive years of dividend increases (9), its strong FFO-dividend coverage ratio and its low price-to-FFO valuation multiple. You can also see it has sold off particularly hard this year (and it also sold off harder after its quarterly earnings announcement on Tuesday).

With that backdrop in mind, let’s take a closer look at MPW to see if we can understand why the price is down so much and if the shares are worth considering for investment.

Overview: Medical Properties Trust

Medical Properties Trust describes itself as “the global source for hospital capital.” Basically, MPW provides cash to hospitals that are struggling financially by buying the physical hospital real estate (hopefully at a low price, for MPW investors’ sake) so that hospitals have the cash they need to improve their operations.

In theory, the business model goes something like this. Individual hospitals face dire cost cutting pressures and many of them have gotten into financial trouble whereby it costs them an arm and a leg to borrow capital to improve their operations because lenders don’t trust that they’ll even be able to pay back the loans. MPW can help alleviate this problem by giving the hospitals the cash they need to improve their operations in exchange for ownership of the physical hospital real estate. And MPW can get the real estate for a low price because the hospitals don’t have a lot of other financing options.

Furthermore MPW is not is great financial shape itself (it has a stable BB+ credit rating, which is below investment grade), but it’s still in much better financial shape than the hospitals themselves. And MPW can reduce its risks by diversifying across many hospitals (it owns hospitals in 32 U.S. states, seven European countries, Australia and South America) which they have done increasingly well over the years (its single largest property is less than 3% of its total portfolio). Furthermore, because MPW is organized as a REIT, it can avoid paying most corporate taxes by paying out most of its income as dividends to shareholders.

We’ll talk more about how MPW is further reducing the risks of its business model in the section on risk factors, but for now it’s important to simply understand that it has the financial wherewithal to provide much needed capital to hospitals while simultaneously reducing risks through portfolio diversification and its own lower cost of capital as compared to the at-risk hospitals themselves.

Current Valuation

Price to funds from operations (“FFO”) is a basic and common way to value a real estate investment trust. And as you can see in our earlier 50+ stock table, MPW trades at a low price to FFO multiple of 9.9 times. This can generally be a sign of a potentially attractive low price, but it can also be a sign of risk.

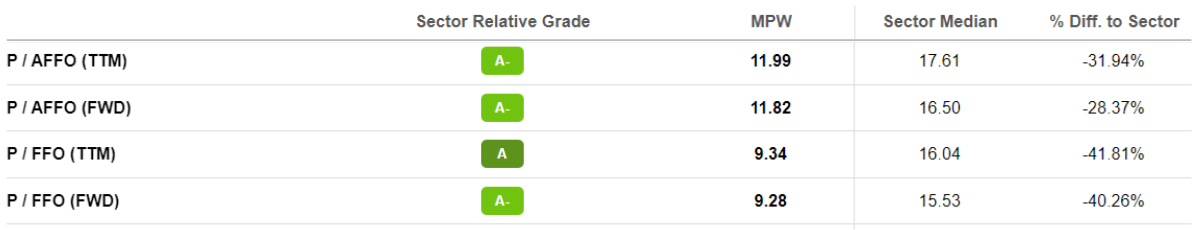

To give a little more perspective, MPW reports its normalized FFO in Q2 as $0.46 meaning it currently trades at only 8.7 times normalized FFO. And the company’s various FFO valuation multiples compare favorably to the sector.

Also noteworthy, the company’s FFO per share has recently improved while its share price has declined, as you can see in the following chart.

Also attractive, MPW’s book value per share has continued to grow while the share price is down this year.

Dividend Safety

Many income-focused investors are attracted to MPW because its dividend yield is high (currently 7.2%), but also because the yield has increased for the last nine years in a row (a sign of strength and attractiveness to some investors). And from a dividend coverage standpoint, as we saw in our earlier chart, MPW’s dividend is very well covered by FFO at 1.4 times. Further, in Tuesday’s earnings announcement, MPW reported they expect 2022 normalized FFO (guidance) of $1.78-$1.82 per share, unchanged from the previous quarter, and an indication that the FFO outlook remains more than strong enough to continue supporting the $1.16 annual dividend.

4 Big Risk Factors

So a preliminary look at MPW says the dividend is safe (and growing) and the valuation is attractive. So what gives? There are risk factors that need to be considered, and we have highlighted four big ones below.

1. Struggling Hospital Operators:

First and foremost, the hospitals MPW provides capital too are struggling financially (that’s why they need the capital) and they run the risk of filling bankruptcy. Further, they run the risk of needing additional financial support from MPW if they cannot cover their financial obligations and MPW doesn’t necessarily want to run through an expensive bankruptcy whereby they’re forced to also find a new hospital operator. Fortunately, because MPW is well diversified across many hospitals, the consequences are less dire if a hospital cannot survive.

Also important to note, as CEO Edward Aldag explained on the latest earnings call:

long-term collection of our rent does not depend on the financial results of a particular operator. In the few times that we've had to transition from one operator to another, we have been successful in attracting high capable and qualified operators because we had acquired hospital real estate that was essential to the community and in the right hand could be operated profitably.

Critically important to note, many of the hospital operators that were struggling pre-covid, have had those struggles exacerbated during covid, and the latest Omicron surge has continued to create significant challenges, to put it mildly. Fortunately, MPW is well diversified and owns hospitals with real estate that is critically important to the communities, regardless of the success or failure of any operator.

2. Significant Debt Load

The next risk is simply that MPW itself is not the most financially strong business in the world. As mentioned, it has a below-investment-grade credit rating (albeit stable), and the business faces increased challenges when financial stress ticks up (like it has recently, as you can see in the following debt graphics).

Fortunately, MPW has continued to find solutions to its liquidity needs by selling its own properties (hopefully at gains) when needed. One big example of this was MPW’s relatively recent deal with a Macquarie private equity fund, whereby its sold off partial ownership of properties it owned in Massachusetts (to Macquarie) for $1.3 billion dollars. Not only did this free up capital for MPW, but it was a huge deal considering the current total equity value of the company is only around $8.8 billion. Furthermore, it opens the door for more such deals when the need arises again in the future. And the private equity funds will always have more capital available considering their great track record of selling new funds to large institutional owners (such as pension funds) where capital is essentially unlimited, as compared to the size of MPW and “the Macquaries” of the world. For example, here is what CFO Steve Hamner had to say on Tuesday’s earnings call:

…the absolute certainty that governments and people are going to support their infrastructure like hospitals. And so all of that has led to a very high level of interest in the private area, and that's with sovereigns and pension funds and asset managers and people like you just mentioned KKR.

The bottom line here is that despite the distress, MPW has value. Its currently trades at around 1.1 times its book value.

3. Rising Interest Rates

Interest rates have ticked up significantly, and that poses increased risk to MPW because it increases the cost of debt financing (when debt matures and they are forced to refinance), but it also increases the cost of borrowing to fund new deals, which is a major part of its business strategy. As such, you can see a strong correlation between MPW’s share price and the 10-year treasury yield. Specifically, as interest rates rise, MPW’s valuation falls.

Fortunately, interest rates have ticked down significantly over the last month, and the share price has risen significantly. Furthermore, fed funds futures are now predicting that interest rates will not increased significantly more than the 50-75 basis point hike expected at the September fed meeting, which is largely already price into the shares of MPW and the market in general.

However, if the fed continues its interest rate hikes significantly beyond September, that poses a real risk to the MPW busines model—which is based heavily on hospital real estate acquisitions.

4. Hospital Regulation

Finally, hospital regulation poses a significant risk to MPW’s business. Hospitals are heavily regulated and rely on government funding through a variety of sources, such as Medicare and Medicaid. And as the government is constantly pressured to reduce the growth rate in these costs, regulatory changes pose a significant risk for MPW. Worth mentioning, a common theme from MPW CEO Ed Aldag is that he simply doesn’t believe the government will let hospitals all go out of business (because they are too important to the communities) and for this reason he has increased faith in the MPW busines model. This is similar to the earlier quote from CFO Steve Hamner about the resources stepping in to support these hospital real estate assets (which MPW owns).

Conclusion:

Medical Properties Trust is facing significant challenges stemming from its struggling hospital operators and rising interest rates (which negatively impact debt-reliant businesses like MPW). However, it owns compelling hospital real estate assets that have critical value to the communities where they exist, and its increasing dividend is hard to ignore, especially as per its increasingly attractive valuation.

An investment in Medical Properties Trust is not right for the most risk-averse investors, but if you can handle the uncertainty and own it within the constructs of a prudently concentrated portfolio, the shares are worth considering at the current low price. We have taken a small position in MPW within our Income Equity Portfolio.