It was a very ugly week for big dividend investors, as technically it is the share prices that just crashed (well over 20% in some cases) and distribution yields are now soaring (well above 10% for many mortgage REITs and bond CEFs, in particular). But before you go bargain hunting, it’s worth understanding what is happening so you can use prudent discretion before even considering the two select “big-dividend” opportunities we highlight in this report. After reviewing the opportunities, we conclude with a critically important takeaway about how to structure your own personal “big-dividend” investment portfolio.

100 “Big-Dividend” Investments, Down Big:

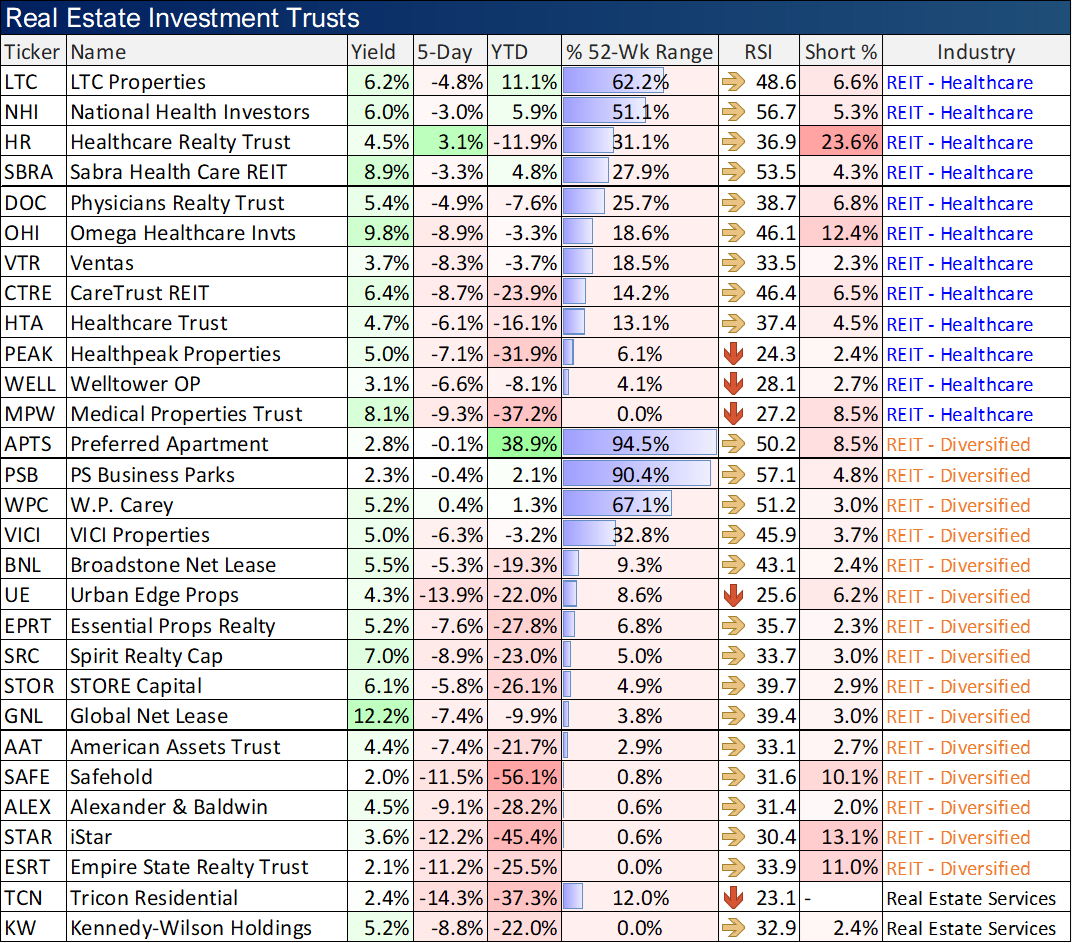

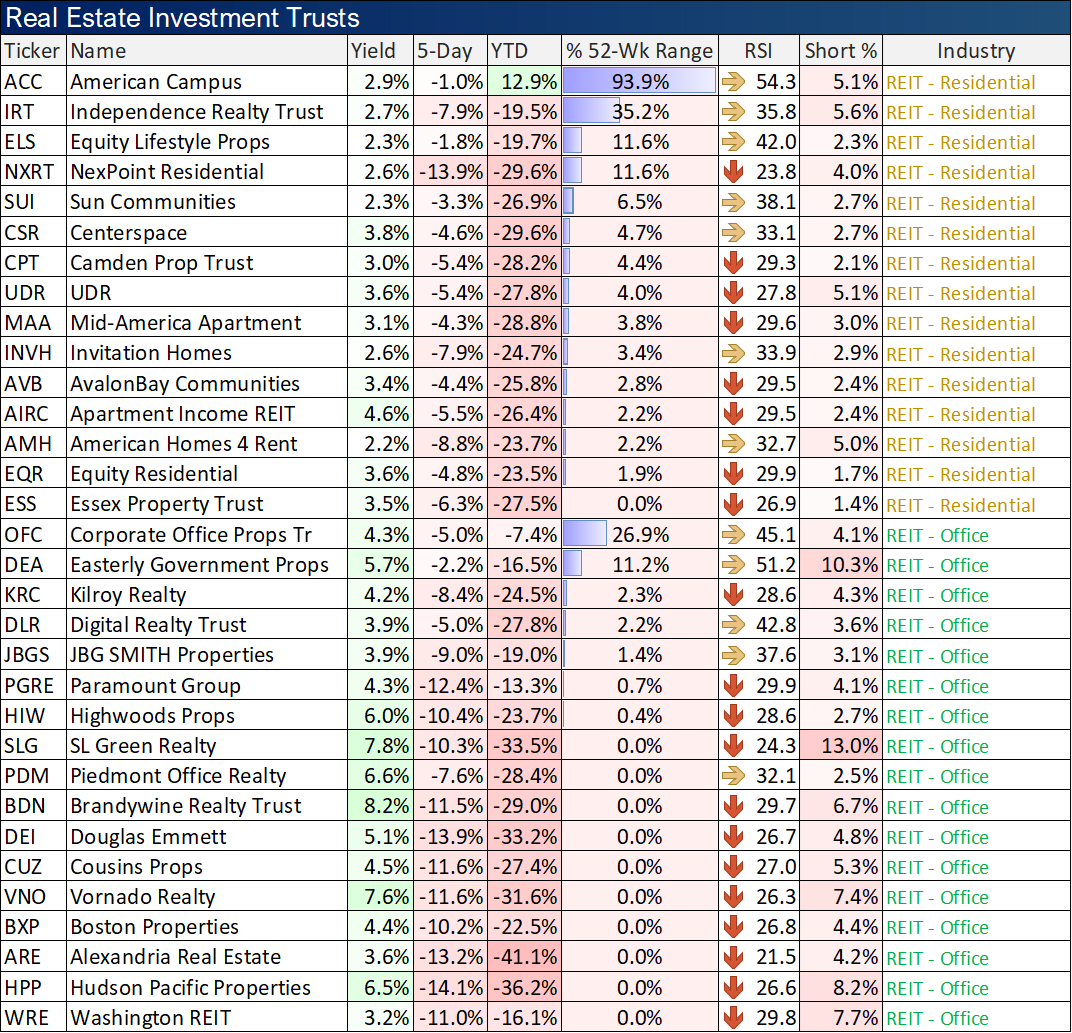

Before getting into the discussion, here is a look at the massive share price declines, and now ballooning distribution yields, for over 100 high-income investments, including bond CEFs and a variety of REITs.

Bond CEFs:

REITs:

As you can see, the already terrible year-to-date numbers just got dramatically worse over the last week. So what is happening?

High Leverage and Interest Rate Hikes Don’t Mix Well

Highly-levered investments (such as many bond CEFs and even more so for mortgage REITs) don’t mix well with sharp interest rate hikes, but that is exactly what happened this week (as the Fed raised rates 75bps) as many popular high-yield investments sold off extremely hard (thereby adding to their already sharp declines this year).

This video shares our high-level explanation of what is happening in the market, and the video also covers the two investment ideas we focus on in the remainder of this report.

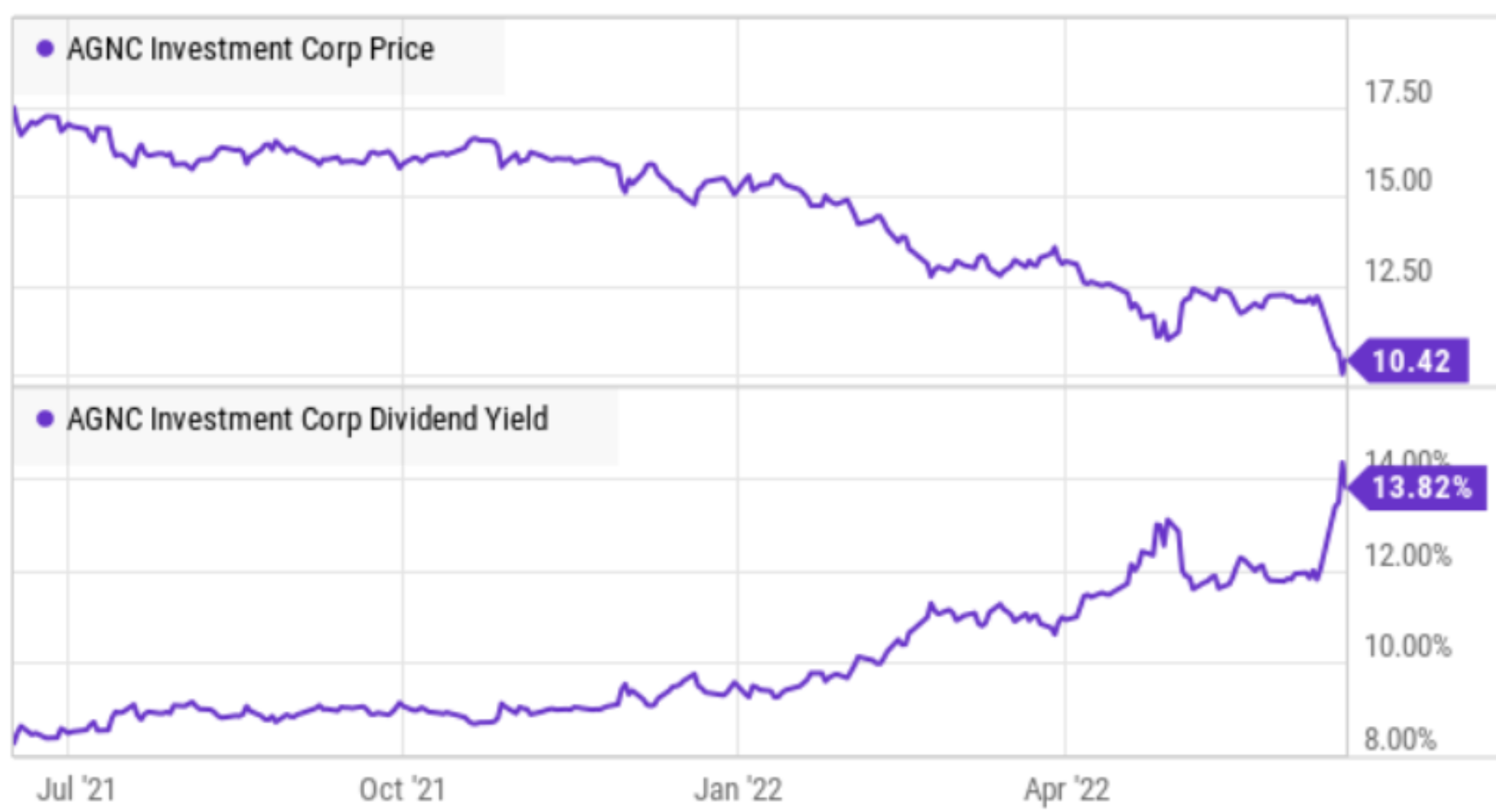

1 . AGNC Investments Corp (AGCN), Yield: 14.4%

AGNC is a mortgage REIT that invests almost entirely in US government Agency-backed securities. These securities are basically backed by the US government, which makes them very safe in their own right. However, AGNC invests in them using a significant amount of leverage (or borrowed money) and that makes AGNC a lot riskier that a lot of people like to believe (and certainly a lot riskier than the agency securities they invest in). The agency-backed securities don’t yield a lot in their own right, but by applying leverage AGNC is able to magnify the returns. This leverage can be great in the good times, but terrible in the bad times (such as this last week, whereby the fed raised rates 75 basis points and indirectly increased AGNC’s cost of borrowing thereby essentially reducing the amount of leverage they can use).

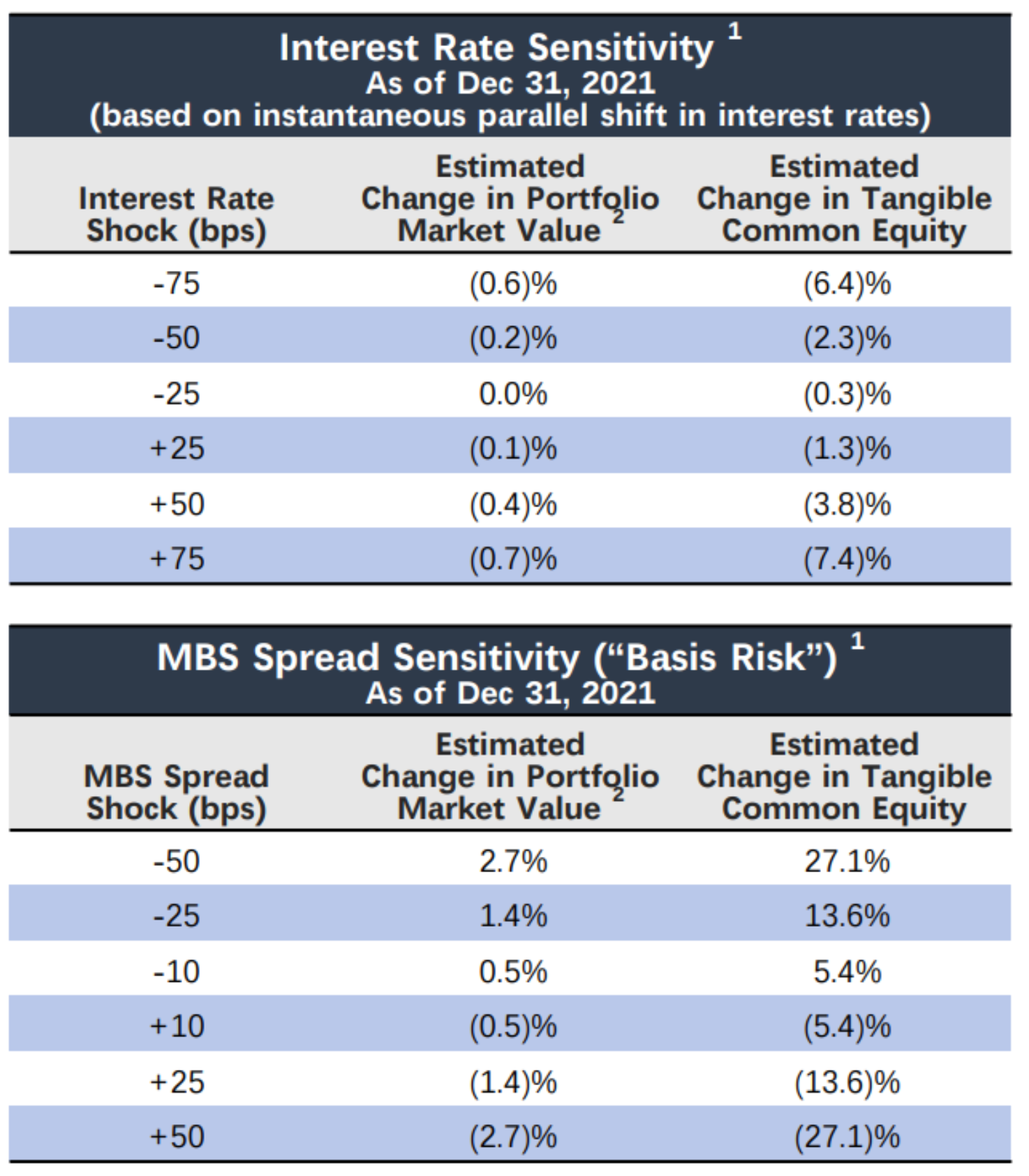

Back in December, no one thought the Fed could possibly raise rates as much as 75 basis points, but they did, and that comes after already hiking rates earlier this year. Here is a graphic showing AGNC’s sensitivity to rate from their first quarter presentation.

The Fed’s rate hike has decreased the value of the portfolio and decreased the companies equity. As a result, AGNC has certainly been required to readjust their investment portfolio this year, including possibly significant sales of assets to cover new interest rates and leverage limit requirement. Here is what AGNC CEO Peter Federico recently had to say about it:

"This abrupt shift by the Fed led to an uptick in interest rate volatility amid greater monetary policy uncertainty… [and] Against this backdrop, agency mortgage-backed securities underperformed in the fourth quarter as spreads to benchmark rates widened moderately and valuations declined relative to interest rate hedges."

He also explained that:

“the spread widening hurts book value in the short term but improves expected return on new investments and cash flows on higher coupon specified pools through slower prepayment speeds. "Thus, the spread widening that occurred in 2021 and accelerated in January of this year is beneficial to our business over the long term," Federico said. With market conditions likely to stay challenging, the company plans to operate with a more defensive position.”

So essentially, if rates are relatively stable from here (which they may not be) AGNC is in a much better position going forward to earn higher returns. However, the damage has already been done to investors that were already holding the shares (likely book value reductions, perhaps significant). After the sharp declines, AGNC is worth considering for investment because the resturn prospects are now improved (considering widened net interest margins). We have owned AGNC in the past, and may consider investing again in the near future.

2. PIMCO Dynamic Income (PDI), Yield: 12.8%

PIMCO’s Dynamic Opportunity Fund is a closed-end fund that invests in a variety of fixed income (e.g. bond) securities. Bond funds can be attractive for a variety of reasons, including outsized yield offerings (particularly after applying leverage). PDI has been an income-investor favorite for years (because of its stellar track record), but the fund has bumped into significant challenges so far this year. As you can see in the following chart from CEF Connect, both the share price and net asset value have been in steep decline.

The specific challenges facing PDI include rising interest rates, a rising leverage ratio and the lower credit rating assets PDI holds in its book. For more detail, here is an excerpt about these risks from our recent report: Top 10 Big Dividends:

PIMCO’s PDI has been an income investor favorite for years, but it is facing dire challenges this year. For starters, it owns a lot of fixed income investments (e.g. bonds) and as the Fed keeps raising rates, bond prices keep falling (as rates go up, bond prices come down). A lot of bond investors aren’t used to this because interest rates have been essentially coming down (with a little volatility) over the last 40 years straight—and now they seem set to keep going up, meaningfully!

And for PDI, the declines in the bond market have been magnified because the fund uses a significant amount of leverage (i.e. borrowed money). As mentioned, leverage can magnify returns in the good times, but magnify losses in the bad.

And making matters even worse, as PDI’s value has been falling, its leverage level has been mathematically rising. This is particularly problematic because the regulatory leverage limit is 50%, and as PIMCO funds bump into this limit (see table above), management is forced to sell underlying holdings at unattractive prices (recall, bond prices are down a lot this year). PIMCO funds ae among the most leveraged funds, fortunately they have some short duration and near-term maturity assets that help keep interest rate risks down.

And further still, PIMCO has a fair amount of higher risk (lower credit rating) assets, which presents yet another risk if we go into a deep recession (i.e. credit risk).

So with all the challenges PDI currently faces, why would anyone even consider investing at this point? The answer is threefold. First, PIMCO has an exceptional management team with the resources and skill to navigate this environment; second, PICMO holds a significant amount of shorter maturity bonds that will make liquidity raising very feasible (for any forced sales driven by regulatory leverage limits and falling prices); and third PDI’s once very large premium to NAV has shrunk dramatically (to an actual discount, see NAV-Price chart above), thereby making for a more attractive entry point, especially for contrarian investors. We actually sold our shares of PDI earlier this year, but may add them back soon, depending on how this market environment unfolds.

The Bottom Line:

Macroeconomics have combined with fear to create some interesting opportunities for high-income investors, especially as interest rates will eventually settle down, and mortgage REIT and bond CEF prices will eventually rise. In addition to the two opportunities we have highlighted, you may see a few more that interest you in the tables we have provided.

In our view, high-yield mortgage REITs and bond CEF can be highly attractive opportunistic plays (if you are selective), but they don’t always make the best long-term buy-and-hold forever stocks (because they are known to experience rough spots in each market cycle, such as right now). For these reasons, we believe it is important for income-focused investors to build a diversified portfolio of income investments to reduce the concentration risks, but still keep the income levels high. At the end of the day, it is your nest egg, and you need to do what is right for you. For more ideas, consider our recent report, Top 10 Big Dividends.