To the satisfaction of many prognosticators, hoards of “pandemic darling” stocks have now fallen more than 30%, 50% and even 70%. However, it’s worth noting that some of them actually have impressive businesses and now trade at dramatically more compelling valuation multiples—even after taking into consideration the risks created by the fed’s aggressive interest rate hike trajectory (to battle inflation) which could drive us into recession and decisively warrant discounted valuation multiples being assigned to these businesses still on track to achieve significantly higher future earnings. In this report, we highlight 25 examples, including a special focus on Micron (MU).

Macroeconomic Context:

To quickly review, we’ve gone from extraordinarily dovish monetary and fiscal policies (e.g. near-zero interest rates, massive bond buying, lots of economic stimulus programs) to a dramatically hawkish inflation-fighting stance (e.g. higher rates, aspirations to reduce the fed’s balance sheet) in less than one year. What this means is that the stocks that arguably benefitted the most from low interest rates (e.g. high growth stocks with little current earnings but high “expected” future earnings) have gone from loved to hated in less than one year. And this about-face has been magnified by the fact that many of these high growth darlings are also naturally socially-distanced businesses, which is now less “in vogue” as investors (perhaps mistakenly) think the pandemic is over (anecdotally, I have covid as I type). And as the short-term market narrative (and investor opinion) has shifted, the selloff for high-growth stocks has been intense.

The two macroeconomic takeaways here are: (1) The best economists in the world are usually only right about half of the time (i.e. it’s much easier to pick good long-term businesses than to predict the direction of the overall economy), and (2) some babies are now being thrown out with the bathwater as short-term narratives have taken a vice grip on the psyche of many investors (i.e. the market is a voting machine in the short-term (especially with Twitter and Reddit, etc.), but a weighing machine in the long-term).

Micron:

Micron is an impressive growth stock that has sold off hard in the recent fed-induced growth-stock selloff (it’s about 30% below its 52-week high). And despite the sell off, the business continues to post impressive numbers, including revenue growth, high margins, a compelling valuation, and an impressive total addressable market opportunity.

Micron’s Business:

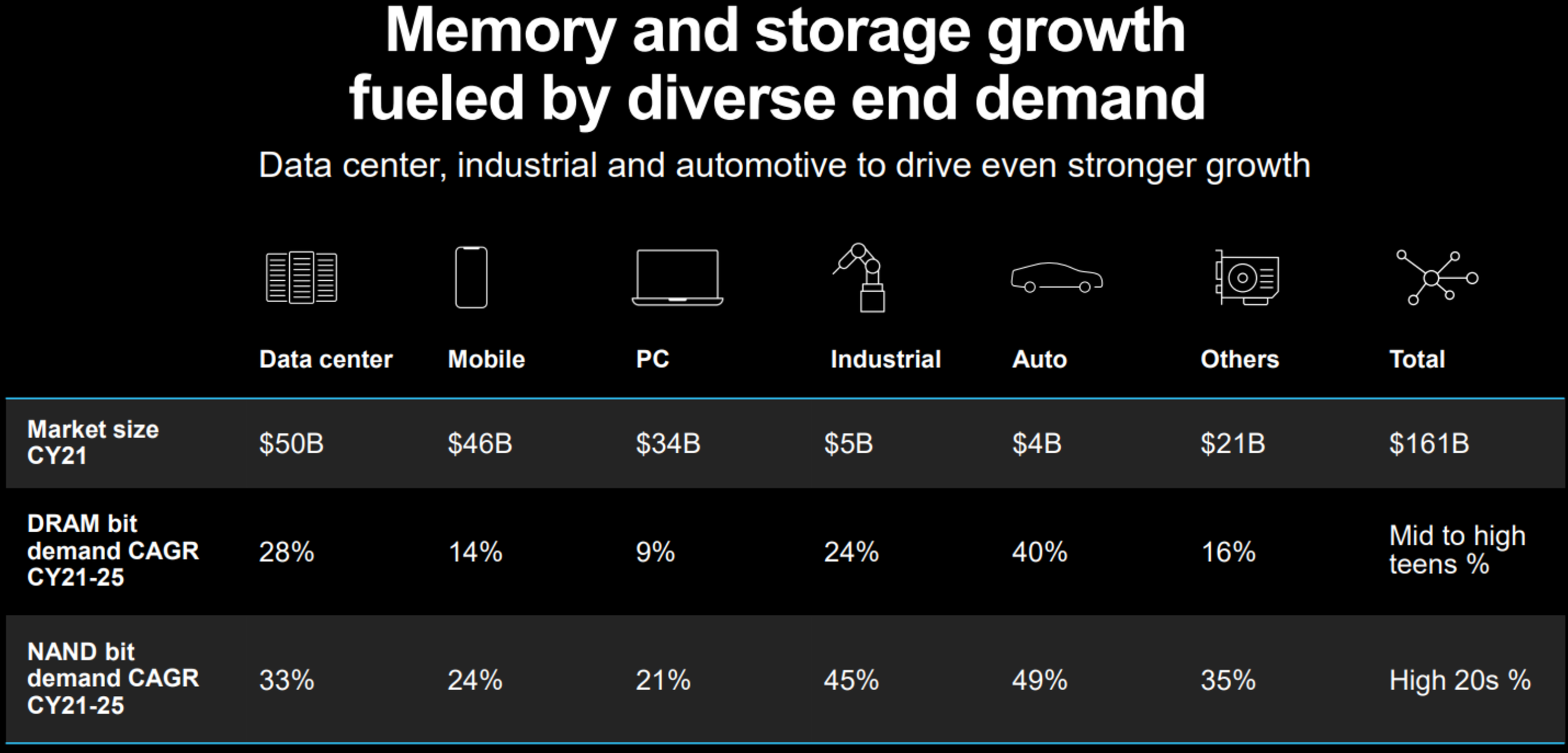

If you don’t know, Micron designs and produces memory storage solutions that are used in an expanding host of devices such as PCs, mobile, automotive, data centers (the cloud), Artificial Intelligence and the overall “Internet of Things” (IoT). More specifically about 73% of the company’s revenues are from DRAM (dynamic random-access memory), and the rest are from NAND. DRAM provides data storage and retrieval while a device in “on,” and NAND is memory that retains its content when the power is turned “off.”

(source: investor day presentation)

Micron is the world’s third biggest memory/storage provider behind Samsung and SK Hynix, it has over 40,000 employees (located globally) and is headquartered in Boise, Idaho.

Micron by the Numbers:

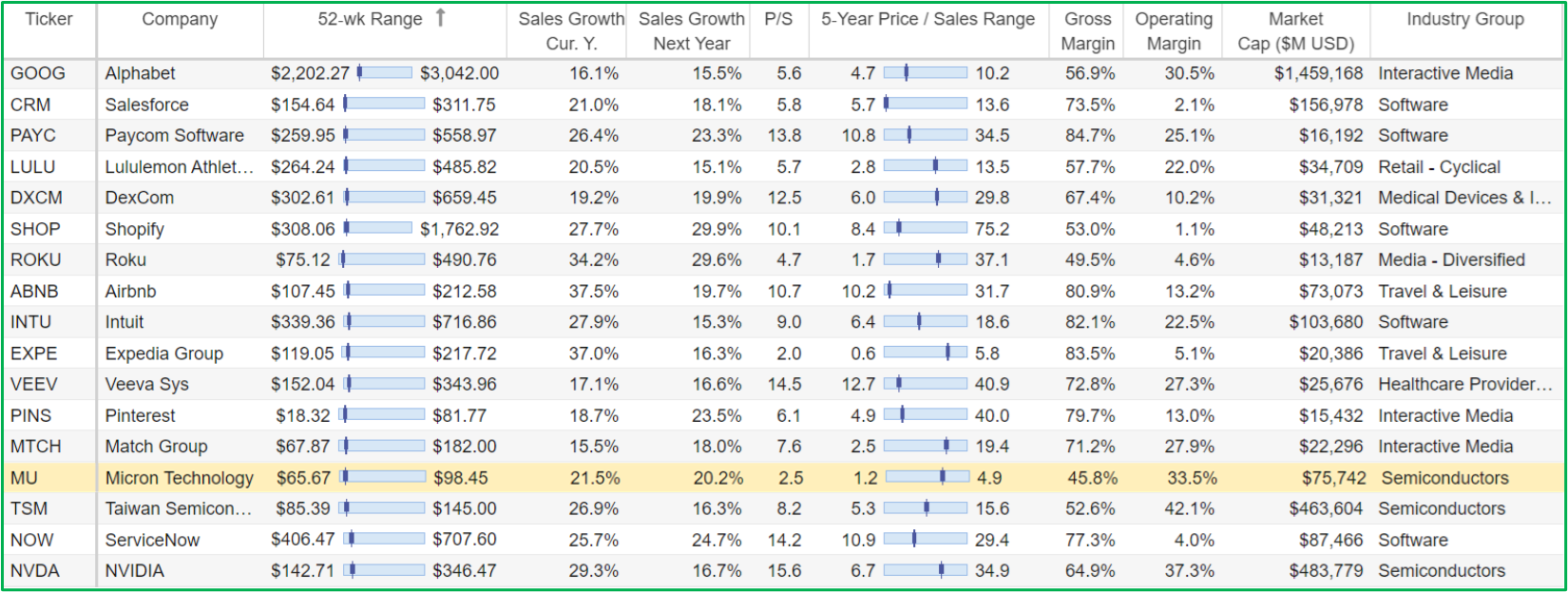

What makes Micron particularly interesting (besides its impressive growing business) is its low (attractive) valuation multiples. For starters, it currently trades at only about 2.5 times sales and 8.6 times earnings. You can see how favorable these numbers are versus other top growth stocks included in the table later in this presentation, and versus the overall S&P 500 (which currently trades at around 19.5 times earnings).

What’s more, Micron has extremely impressive margins (45.8% gross and 33.5% operating) and powerful growth numbers (revenue is expected to grow at over 20% this year, and next).

A few of the reasons why Micron trades at such low (compelling) valuation multiples (as compared to its very strong business) are because the products are largely considered to commodities, the business is perceived to be highly cyclical (although the big three, mentioned above, have been doing a good job of not overproducing because they learned the hard way that it gets them in trouble), and because the market still doesn’t appropriately recognize the dramatically expanding uses of DRAM and NAND (it’s not just for desktop PCs anymore!).

25 More Growth Stocks to Rip Higher:

Micron is a bit of an anomaly on our list because its valuation is so low (compelling) compared to the business growth, high margins and total addressable market (for the reasons we explained above). However, there are plenty more impressive growth business that have sold off hard recently as the fed has decided (for now) to fight inflation at any cost to the economy (recession anyone?).

The following table includes 25 more growth stocks that have recently sold off hard.

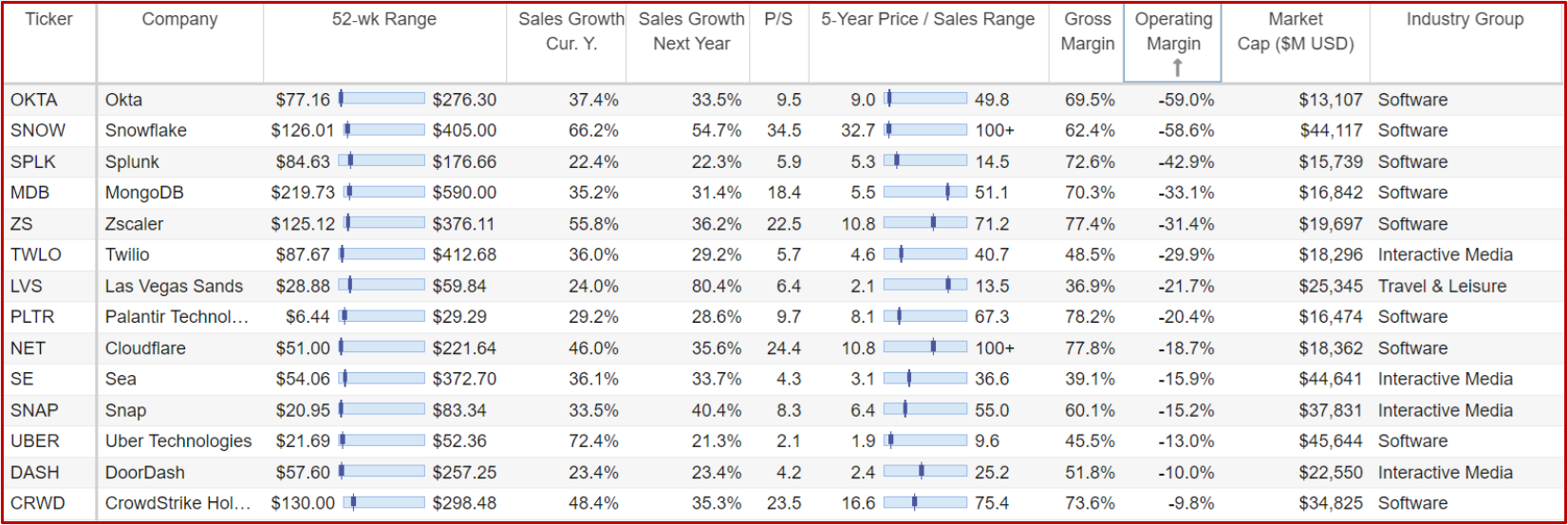

To be included in the table, businesses were required to have at least 15% expected revenue growth (this year and next) as well as a positive operating margin. There are plenty more “popular” stocks that have even higher expected revenue growth rates, but did not make our list because they’re operating margins (basically operating earnings divided by revenues) were quite negative. Here are a few examples (j-curve or not):

Investment Goals and Time Horizon

Disagreements about investment opportunities often come down to differing investment goals and time horizons. For example, If you’re already retired and prone to lose sleep over extreme investment volatility, it probably doesn’t make a lot of sense to load up on investments from the table outlined in red above. But if you are a 31-year old with a high-paying job, a long-investment horizon and a prudently diversified portfolio, you could end up being extremely well served to selectively pick up a few long-term high-growth stocks that are currently down big.

Conclusion:

The fed’s increasingly draconian posture in addressing inflation may drive the economy into recession. It has mostly certainly already driven forward-looking stock prices significantly lower. Depending on your own personal goals and time horizon, you may want to bravely consider owning a few shares from our lists above (there are some impressive business trading at dramatically lower prices), or you may simply be too repulsed by the highly-volatile risk-reward potential they offer. At the end of the day, it’s your money, and you need to do what’s right for you.