Here is a link to Warren Buffett’s Annual Letter to Shareholders of Berkshire Hathaway (released on 2/26, annual meeting to be held 4/29-5/1). Buffett is a very good writer that does an excellent job holding a reader’s attention. Plus, the letter is chock full of outstanding nuggets of wisdom. In no particular order, and with no one particular theme, here are my top 10 favorite takeaways from the letter.

1. Berkshire Pays A Lot of Taxes:

To start us off, and as a tribute of Berkshire Hathaway’s significant size, this quote is truly amazing:

In 2021, for example, we paid $3.3 billion {in taxes] while the U.S. Treasury reported total corporate income-tax receipts of $402 billion.

2. Berkshire Owns Businesses:

This is classic Buffett/Berkshire, and worth repeating:

Please note particularly that we own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves. That point is crucial: Charlie and I are not stock-pickers; we are business-pickers.

3. Buffett is Pro American Capitalism

Absent our American home, however, Berkshire would never have come close to becoming what it is today. When you see the flag, say thanks.

But Buffett is NOT the greedy capitalist (the media likes to portray all capitalists as greedy, bad people that pollute the world). For example, this is a great line about Berkshire Hathaway Energy (Berkshires 4th largest business):

…not in any way one of those currently-fashionable “green-washing” stories. BHE has been faithfully detailing its plans and performance in renewables and transmissions every year since 2007.

Also, Buffett’s like to work with other capitalists that are good people. For example, Buffett writes:

Last year, Paul Andrews died. Paul was the founder and CEO of TTI, a Fort Worth-based subsidiary of Berkshire. Throughout his life – in both his business and his personal pursuits – Paul quietly displayed all the qualities that Charlie and I admire.

…At the service, Greg and I heard about the multitudes of people and organizations that Paul had silently supported. The breadth of his generosity was extraordinary – geared always to improving the lives of others…”

4. Berkshire Has More Cash than Normal:

Buffett also explained why Berkshire currently holds a high level of cash relative to history (currently around 20% cash). This is good stuff:

Berkshire’s current 80%-or-so position in businesses is a consequence of my failure to find entire companies or small portions thereof (that is, marketable stocks) which meet our criteria for long-term holding…

Today, though, we find little that excites us. That’s largely because of a truism: Long-term interest rates that are low push the prices of all productive investments upward, whether these are stocks, apartments, farms, oil wells, whatever. Other factors influence valuations as well, but interest rates will always be important.

And in a related note, and a truly amazing statistic (about Berkshire’s significance in the US treasury market):

Berkshire’s balance sheet includes $144 billion of cash and cash equivalents (excluding the holdings of BNSF and BHE). Of this sum, $120 billion is held in U.S. Treasury bills, all maturing in less than a year. That stake leaves Berkshire financing about 1⁄2 of 1% of the publicly-held national debt.

5. The US dollar is Going to Zero

Okay, this one is a recent Charlie Munger quote (not Warren Buffett), but is is related, and an important one to think about:

“Inflation is a very serious subject. You can argue it's the way democracies die. So it's a huge danger once you've got a populace that learns it can vote itself money. If you look at the Roman Republic, they inflated the currency steadily for hundreds of years. And eventually, the whole damn Roman Empire collapsed. So it's the biggest long-range danger we have probably, apart from nuclear war. The safe assumption for an investor is that over the next 100 years, the currency is going to zero. That's my working hypothesis.”

6. The Power of Share Repurchases

And Buffett also provided a good reminder about the importance (and power) of share repurchases (when done correctly):

During the past two years, we therefore repurchased 9% of the shares that were outstanding at yearend 2019 for a total cost of $51.7 billion. That expenditure left our continuing shareholders owning about 10% more of all Berkshire businesses, whether these are wholly-owned (such as BNSF and GEICO) or partly-owned (such as Coca-Cola and Moody’s).

Related, Buffett also noted this about Apple (Berkshire’s second largest business):

Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here, our ownership is a mere 5.55%, up from 5.39% a year earlier. That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job.

…Yet our “share” of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud. Tim Cook, Apple’s brilliant CEO, quite properly regards users of Apple products as his first love, but all of his other constituencies benefit from Tim’s managerial touch as well.

7. Investor Psychology

Buffett has a truly brilliant point here about investor behavior. I interpret it to be a reminder/warning about the dangers of letting your emotions (and the sensationalized media) cause you to make unforced short-term trading/investing errors:

And people who are comfortable with their investments will, on average, achieve better results than those who are motivated by ever-changing headlines, chatter and promises.

8. The Big 4:

If you don’t know, Berkshire Hathaway’s “Big 4” investments include:

The Insurance Group: “Leading this list is our cluster of insurers. Berkshire effectively owns 100% of this group, whose massive float value we earlier described. The invested assets of these insurers are further enlarged by the extraordinary amount of capital we invest to back up their promises.”

Apple (AAPL)

Railroads (Burlington Northern Santa Fe: “BNSF, our third Giant, continues to be the number one artery of American commerce, which makes it an indispensable asset for America as well as for Berkshire. If the many essential products BNSF carries were instead hauled by truck, America’s carbon emissions would soar.”

Berkshire Hathaway Energy: "BHE, our final Giant, earned a record $4 billion in 2021. That’s up more than 30-fold from the $122 million earned in 2000, the year that Berkshire first purchased a BHE stake. Now, Berkshire owns 91.1% of the company…. BHE’s record of societal accomplishment is as remarkable as its financial performance. The company had no wind or solar generation in 2000. It was then regarded simply as a relatively new and minor participant in the huge electric utility industry. Subsequently, under David Sokol’s and Greg Abel’s leadership, BHE has become a utility powerhouse (no groaning, please) and a leading force in wind, solar and transmission throughout much of the United States.

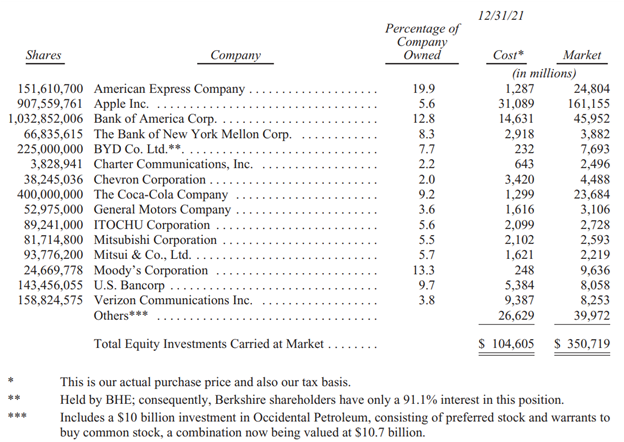

And for good reference, here are Berkshire Hathaway’s 15 largest equity holdings (of companies they don’t have control of):

The Bottom Line:

No matter what your level of investment expertise, a lot can be learned from Warren Buffett. If you have 15 free minutes, I recommend reading his annual letter to shareholders of Berkshire Hathaway.