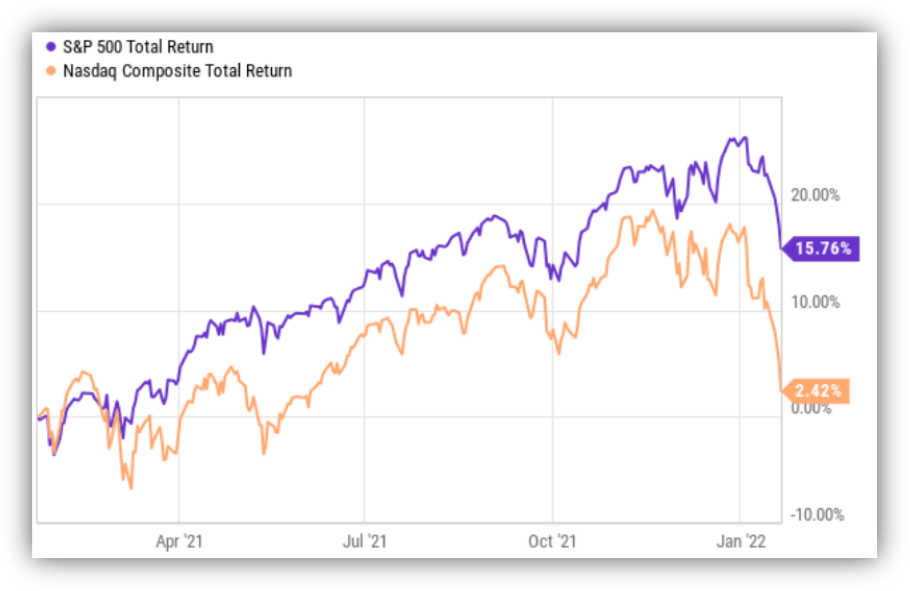

The stock market often rewards investors that pay less attention. That may sound counterintuitive, but investors that pay too much attention (for example, to media headlines), often end up overreacting (i.e., panicking), and making rash, costly, short-term decisions. The market has been volatile so far this year (see chart below), but that doesn’t mean you should sell all your stocks and start hiding cash underneath your mattress.

data as of Friday’s close (1/21/22), source YCharts

Don’t panic.

Disciplined long-term investing is a winning strategy. It’s okay to be a little bit opportunistic when the market gets volatile (we just made a couple updates to our Disciplined Growth Portfolio, for example), but for goodness sake—don’t lose sight of your long-term goals. The number one thing investors can do right now is to stay focused on your long-term objectives—be disciplined.

“It’s the Economy Stupid”

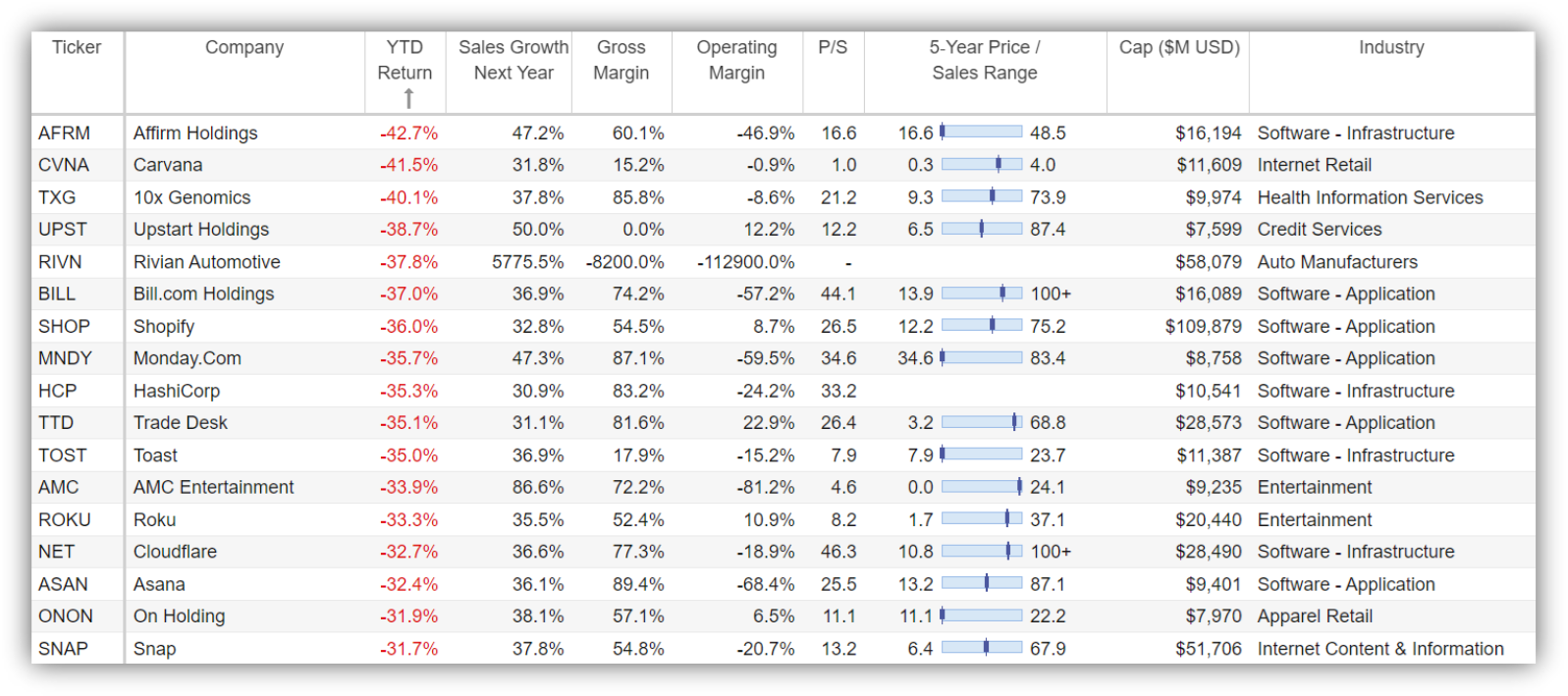

In the short term, the stock market gets whipped around by whimsical headlines, narratives and whatever the latest soup du jour is. For example, this latest sell off is driven by news stories about the dangers of inflation (and rising interest rates) combined with the unwinding of the pandemic trade (apparently no one likes naturally “socially distanced” pandemic darlings anymore (see appendix for 50 Top Growth Stocks Down Big). But the reality is, many of the stocks that are down big are still attractive business, and it is attractive businesses that will eventually lift the economy (and the stock market) higher—much higher.

And the economy is not about to crumble. Betting against the spirit, drive and ingenuity of the American people (and the world) would be a mistake. Another mistake would be selling all your stocks (because you’re panicking) and then missing out on the subsequent rebound and years of compounding growth (compound growth is the eighth wonder of the world).

The best way to “win” in the stock market

It’s worth repeating: Disciplined long-term investing is a winning strategy. That means assembling a portfolio of investments that meet your goals. And then sticking to it when the market gets volatile. That doesn’t mean be stubborn (it’s okay to be a little opportunistic when the market presents). Rather, it means stay disciplined. A lot of great long-term businesses have gotten a lot less expensive (i.e., “buy low”) in recent weeks.

Planning Your Retirement Distributions

Whether you are still building and growing your nest egg, about to start taking retirement distributions, or well into your golden years—there are a few important concepts to keep in mind.

First, not all of your retirement income needs to come from dividends or interest. It’s perfectly acceptable (and in most cases, preferred) to generate some of your future spending cash from growth (such as stocks that pay little dividends, but offer plenty of long-term price appreciation potential).

Second, when you are about to start taking retirement distributions (whether they are required minimum distributions from an IRA, or otherwise), it can make sense to avoid tapping you most volatile assets for cash. It generally doesn’t feel good to sell your best stocks for cash when they’ve just sold off (such as the last few weeks) when you know they have lots of upside in the years ahead. It can make sense (and feel a lot better) to get your cash from a pool of less volatile dividend stocks, or even interest-bearing money market investments.

Third, use rebalancing as a source of Income. It is important to rebalance your portfolio holdings from time to time (perhaps annually) for risk management purposes. For example, your best performing stocks may have grown to a large percentage piece of your total account. Selling during rebalancing can be a great way to manage risk (don’t put too many eggs in one basket) and generate the spending cash (distributions) you need.

The Bottom Line.

Don’t panic. Stay focused on your long-term goals. Disciplined long-term investing is a winning strategy.

Lastly, if you liked the ideas presented in this report, you might also consider a membership Blue Harbinger. We share a steady flow of top investment ideas for you to consider, plus the current holdings in our Disciplined Growth Portfolio and our Income Equity Portfolio. We’re currently offer a 10% discount to all new members as part of our January sale. Learn more—get instant access.

Appendix:

50 Top Growth Stocks Down Big

For a little more perspective on the recent market sell off, it has impacted top growth stocks (those with the highest expected future revenue growth) the most. The narrative (and there is some truth to it) is that because interest rates are rising—the value of future revenues (and future earnings) are worth less now (because they have to be discounted back to their present values using a higher discount rate (i.e. higher interest rates). Nonetheless, there remain some very attractive businesses in the following list, and you may even notice a few of your personal favorites:

data as of Friday’s close (1/21/22), source: StockRover