If you are looking for a very high long-term growth stock, then put this Hong Kong based online brokerage and wealth management firm near the top of your watchlist. Revenues are expected to grow at over 100% this year and next. And the company’s impressive integrated platform (e.g. stock trading, margin financing, wealth management, market data and interactive social features) is expanding thanks to its high R&D budget and important relationship with Tencent (the preeminent Chinese internet juggernaut). In this report we review the business, growth, financials, valuation and risks. We conclude with our opinion on investing.

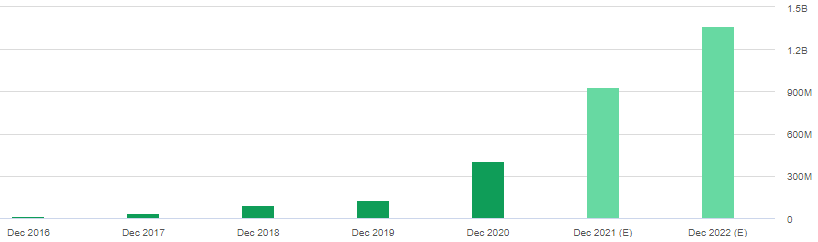

Revenue Growth: Futu Holdings

Overview: Futu Holdings (FUTU)

Futu Holdings Limited (FUTU) is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. Futu was listed on Nasdaq on March 8, 2019. Futu and its subsidiaries provide investing services, including stock trading and clearing, margin financing, wealth management, market data and information, and interactive social features for Hong Kong, US, China Connect and Singapore stocks, to individual investors through its proprietary one-stop digital platforms, Futubull and moomoo. By creating a network centered around its users, Futu provides connectivity to users, investors, companies, analysts, media, and key opinion leaders. Futu also provides Employee Stock Ownership Plan (ESOP) solutions and IPO distribution services through its enterprise service brand FUTU I&E.

For more color, the company’s offerings include:

Investing Services: encompasses the primary fee generating trade execution for stocks, warrants, options and exchange-traded funds, as well as margin financing and securities lending services for Hong Kong, US and China Connect stocks. Investing services are provided through the proprietary digital platform, Futubull.

Wealth Management Service: was introduced in August 2019 with the launch of Futu Money Plus, which offers fund products from 39 global fund houses. Futu had over 42,000 clients holding wealth management positions, and had total client asset balance of HK$10.2 billion (US$1.3 billion) as of 31 December, 2020.

IPO Subscription, Investor Relations and ESOP Solution Services: offered to corporate clients under the integrated enterprise service brand, Futu I&E. The company had 159 ESOP solution clients and 105 IPO subscription and investor relations clients at the end of 2020.

Market Data and Information Services: encompasses Yahoo Finance type services such as news, research and analytical tools to enhance users’ and clients’ investing experience.

Social Network Services: Futu operates the social network, NiuNiu Community, which serves as a powerful engagement tool and assists in continuous development and monetization of its investment platform. This can be gauged from the fact that there were about 679k daily active users (DAU) on the platform in December 2020, and the users active on a daily basis spent an average 37.8 minutes per trading day on Futubull platform.

Integrated Platform:

Unlike its Chinese rivals (such as Tiger Securities) which rely on third party infrastructure for important business functions (such as execution and clearing for a substantial portion of trades in foreign stocks), Futu has an end-to-end integrated proprietary technology platform that drives every function of the business including trading, risk management, clearing, mutual fund distribution, market data, news feeds and social functions. This helps Futu address the diverse needs of its clients through a single platform, which significantly improves operating efficiency. Further, the proprietary technology infrastructure has been fully funded, which means Futu is able to bring in new products and enter new markets with moderate investment and marginal costs.

In addition, Futu has a technological collaboration with Tencent Holdings (also a strategic investor in Futu) in traffic, content and cloud areas through Tencent’s online platform. The companies are also exploring additional opportunities in financial technology related products and services to expand their international operations. This technology collaboration helps drive a lot of traffic to Futu’s platform.

Attractive High Growth:

Futu continues to demonstrate a variety of attractive high-growth metrics thanks to its highly scalable platform, efficient client acquisition strategies, cross selling success and the network effect created by its social network, NiuNiu Community. For perspective, here is a look at the company’s rapidly growing user base and clients.

Source: Company Data

The growth in Futu’s paying client base over the years has been particularly impressive, and more so in 2020 as it added 320k net new paying clients to bring the number to 516k. Further, Futu expects to more than double this number in 2021. And this expectation is reasonable considering the company’s strong pipeline (of the 11.9 million users on Futu platform as of 31 December 2020, only about 1.4 million were registered as clients), Also worth mentioning, Futu maintains a very strong paying client retention rate of over 98% on average, which will further aid its paying client count.

Along with paying client growth, trading volumes on also continue to grow rapidly. For example, 2020 was an extraordinary year as it registered a 296.9% increase in total trading volumes to HK$3,463.6 billion. Notably, the fourth quarter of 2020 alone saw total trading volume jump by 438.1% y/y to HK$1,209.9 billion as a growing number of Chinese retail investors continued to use Futu’s platform to trade primarily in stocks listed on US exchanges. Hong Kong has also continued to be a major market as the company doubled its market share of Hong Kong trading volume to over 2.6% in 4Q20.

Source: 4Q20 Earnings Release

For perspective, here is a look at the company’s impressive revenue growth trajectory.

Source: Company Data

Expanding Margins:

From a profitability standpoint, Futu’s gross margins have expanded from 65% in 2017 to 79% in 2020 (a good thing). And the company’s higher revenues have helped the drive operating leverage. We also appreciate the high level of R&D spending, which helps drive improvement. Overall operating margins have improved, as you can see in the chart below.

Source: Company Data

Well Capitalized:

Coming on the heels of its US$90 million IPO in March 2019 and the US$314 million follow-on offering in August 2020, Futu plans to raise another US$1.4 billion through its recently priced offering of 9.5 million American depositary shares at US$130 per ADS. Futu has also completed a US$260 million pipe offering with a leading global investment firm in December 2020. The company has been growing its capital base to invest in further development of its technological infrastructure, enhance its service offerings (for example, grow the margin financing business), new license applications, and potential investment and acquisitions to support growth opportunities presented by the rapidly emerging affluent Chinese population and international markets.

Affluent Customer Focus:

Futu primary focus is on serving the emerging high earning and tech savvy younger Chinese population. As per a 2019 McKinsey study, by 2022, China’s upper middle class urban households (a close proxy to Futu’s target clients) are estimated to account for 54% of the 357 million households versus just 14% a decade earlier.

Source: McKinsey

And Futu is very well positioned to benefit from this emerging affluent class that is willing to invest in foreign markets. Also, Futu has the opportunity to significantly grow its wealth management business and introduce other financial service offerings to this affluent class by building a digital gateway into broader financial services.

Further, the company has immense growth opportunities in international markets (with similar market characteristics as Hong Kong and China), such as Singapore, which has a relatively large wealthy retail investor base that is underserved by incumbent players that have lackluster trading technology capabilities. Futu had recently launched its business in Singapore and has seen strong momentum so far. For example, according to CEO Leaf Li, during the 4Q20 earnings call:

“For Futu, 2021 is the year of internationalization. We officially launched our Moomoo app in Singapore on March 8 and have since then seen strong growth momentum and received encouraging feedback. We believe that our product and service delivered differentiated value proposition in many more markets outside of Mainland China and Hong Kong and we want to take advantage of the elevated retail stock market participation around the world.”

Synergies from Tencent Relationship:

Tencent, China’s dominant social media operator (and the world’s largest games publisher) is one of Futu’s major investors (with a 22.8% ownership stake, as of 31 March 2020). And Tencent is also a in close collaboration with Futu regarding technology and innovation. Incidentally, Futu’s founder, chairman and CEO, Leaf Hua Li was one of Tencent’s early employees, and has a major position (37.2%) in the company. This strong relationship with Tencent will likely help drive growth signifiantly.

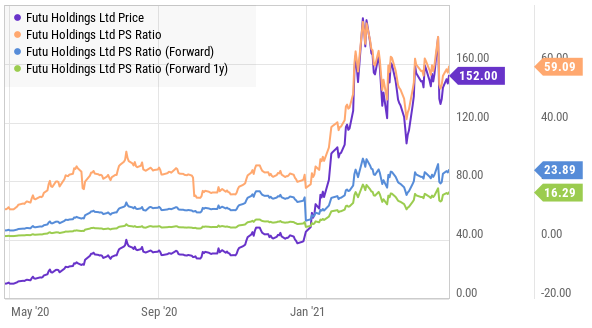

Valuation:

Futu currently trades at 59 times sales, which seems like an extremely expensive stock. However, the price-to-sales ratio quickly drops to more reasonable levels when compared to expected forward sales figures. And given the large market opportunity, we view the valuation as very attractive (i.e. the share price can go much higher).

Source: YCharts

Worth mentioning, the recent announcement of the new follow-on offering and its pricing at $130, led the shares to trade very near to this figure.

Also worth mentioning, the majority of Wall Street analysts covering the shares, rate Futu a “Buy” with a price target more than 30% higher than the current share price. In our view, these analysts are conservative and short-sighted, and the shares have significantly more upside than this in the years ahead.

source: Factset

Risks:

Political Risks: Futu’s biggest risk is the Chinese government’s political pressures on large financial firms expanding into wealth management. The recent crackdown on Ant Group is a case in point. Moreover, Futu does not hold a securities brokerage license in China and its current operation model entails redirecting users and clients based in China to open accounts and make transactions outside of China, which is not deemed as operating securities brokerage business in China. As such, it had earlier received inquiries regarding its procedures and methods employed for onboarding China based clients, and it will be all the more exposed to the risk of more such inquiries by Chinese regulators as it expands its selection of financial services.

Competition: Futu currently derives a large portion of its revenues from brokerage commissions. With intensifying competition from large financial institutions, traditional brokerage houses and innovative new online brokers offering similar services, the brokerage commissions will eventually come down significantly, which can have a negative impact on Futu’s revenues and profits. Nonetheless, Futu is focused on growing its adjacent businesses such as margin lending and wealth management, which we believe will offset the impact of lower brokerage commissions in the future.

Conclusion:

Futu is an impressive business. Its offerings are extremely attractive today considering it combines so many important functions (from trading to social media) and has an important relationship with Tencent. Its valuation (price to sales) may seem exorbitant, but it’s not when you compare the price to the likely very high ongoing future growth. The big risk is the Chinese government (they are difficult to predict and highly meddlesome), but the extremely high growth and low price are hard to ignore. We do not yet own shares of Futu, but we are watching closely and may add shares in the near future.