The young small-cap healthcare company we review in this report is growing rapidly and has a large total addressable market opportunity. It also has an attractive recurring revenue model with a very high retention rate (customers like it) and attractively improving margins (as the business continues to scale). The company provides personalized data-driven solutions that help individuals understand healthcare better, as well as assisting them in navigating workplace benefits available to them. In this report, we review the business, the opportunity, financials, valuation and risks. We conclude with our opinion on investing.

Overview: Accolade (ACCD)

The company we are covering is Accolade (ACCD), and as mentioned, it provides technology-enabled solutions that help people understand, navigate, and utilize the healthcare system and their workplace benefits in the United States. Accolade’s primary customers are employers that deploy Accolade’s offerings to increase their employee satisfaction levels via better healthcare benefits as well as lower claim costs.

Founded in 2007, the Seattle-based company saw a business turnaround in 2015 driven by changes in the executive management team and significant investments into its product, technology, sales, and distribution segments. Since then, the company has experienced significant business growth driven by increased adoption of its service offerings not just among high-cost claimants but across a broader group consisting of low cost and medium cost claimants. It follows a subscription-based business model where it earns revenue by charging its customers that are primarily self-insured employers on a recurring Per-Member-Per-Month (PMPM) basis. These charges typically consist of a fixed base fee and a performance-based variable component that depends upon cost-efficiency attained by the customer after deploying Accolade’s services.

The company primarily offers three solutions that can be accessed on a single integrated platform. These are “Accolade Total Health and Benefits” for its premium customers, “Accolade Total Benefits” and “Accolade Total Care” for its budget-conscious customers. It also offers add-on services such as “Accolade COVID response”, “Accolade Boost”, and “Trusted Supplier Program,” mainly to target specific customer needs. Accolade’s corporate customers have grown at a CAGR of almost 88% from 15 in 2018 to more than 100 in 2020 with over 2.2 million members consisting of employees and their dependents utilizing its platform as of FY2020.

Source: Investors Presentation

A proven model that simplifies complex consumer journey and delivers cost savings

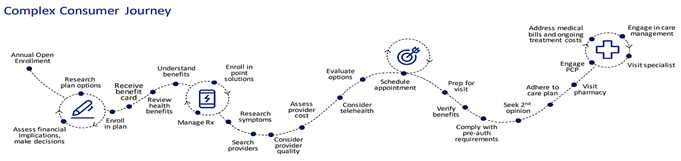

Navigating healthcare benefits can be a complex and frustrating experience for people. According to the company, only 25% of individuals are fully capable of understanding their healthcare plans. Furthermore, people who try to understand the plans are negatively impacted by lack of coordinated services including unnecessary duplicate testing, and conflicting opinions from multiple healthcare providers. The automated responses from call centers of these large insurance companies in combination with their transaction-oriented customer service further deteriorate customer engagement. Moreover, healthcare providers such as physicians and doctors, are compensated on a fee-for-service model which motivates them to focus on the number of patients served rather than comprehensive integrated care, thus creating misaligned incentives that result in suboptimal patient experience.

Source: Investors Presentation

Accolade’s integrated platform combines cloud-based Artificial Intelligence (AI) technology with support from Accolade’s healthcare assistants and clinicians; it helps provide highly personalized support to its members. Members are assigned a personal concierge who assists them with numerous health-related services such as choosing the best healthcare plan based on personal needs, finding providers, managing medical bills, or finding a physician that is part of each employers’ provider network. Moreover, Accolade’s broad ecosystem of “partners services” providers such as Teledoc (TDOC), a telemedicine and virtual healthcare company, assists its members in getting primary care for almost all kinds of health issues through virtual interaction with doctors directly from the platform. Here is a small excerpt from an article recently published on the “Second Opinion” regarding Accolade’s “Trusted Supplier Program” and a broad ecosystem of its partners.

“Accolade, for instance, has a “Trusted Supplier” program, which involves vetting vendors clinically, financially and technically. That makes sense. Employers don’t have the bandwidth to evaluate all of the different solutions on the market for sleep, women’s health, diabetes care and more. And these partnerships also can result in more data integration, which is critical given the sheer quantity of vendors.” – Second Opinion

Source: Investors Presentation

Accolade’s customers (who are employers) benefit from increased employee satisfaction and reduction in overall claim costs. In fact, according to a study by Aon, customers without Accolade’s offerings saw an 8% increase in healthcare costs from 2018 to 2019 as opposed to customers with Accolade’s offerings that experienced no increase in healthcare costs during the same period. Furthermore, the same study found that those cost savings aren’t a blip. Over two years between 2018 and 2020, customers with Accolade’s offerings saw a 2% increase in healthcare costs against a 6% increase for non-Accolade users. Additionally, the same study found that Accolade’s customers can save up to 4% on average in year 1 and its more tenured customers can save up to 10% YoY on average due to a decrease in inpatient, outpatient, and professional medical spending as shown below.

Source: Company’s Form S-1, Investors Presentation

Leveraging advanced Artificial Intelligence (AI) technology to drive personalized experiences

Accolade has a highly advanced open cloud-based platform that utilizes AI, micro-services and data analytics to draw personalized insights for its members and customers. The company’s platform connects separate data points from external sources such as claims, pharmacy benefit formulary details, ecosystem partner interaction data, and provider-generated data with its internal data, self-serve member activity, and risk scoring. After the data points are connected, Accolade’s AI engine draws actionable insight that materialize in the company’s services in a variety of ways such as members health scores as well as assists its healthcare assistants and clinicians to directly deliver self-service suggestions to the members. Accolade has been consistently achieving more than 50% annual engagement rate on its platform across member base and recorded a gross dollar retention rate of 99% for the fiscal year ending February 2020. These statistics suggest that the company’s platform can deliver significant ROI to its customers in the form of better clinical and financial outcomes. Investors must note that the platform has been developed internally by the company which gives the company immense flexibility in making updates and changes when needed.

Source: Investors Presentation

Large and growing total addressable market (TAM)

Accolade primarily serves self-insured employers based in the US, inclusive of states, local governments, and unions. The company identifies approximately 300 employers with more than 35,000 employees as its “Strategic segment”, 2,100 employers with 5,000 to 35,000 employees as its “Enterprise segment”, and 19,100 employers with 500 to 5,000 employees as its “Mid-market segment”. Accolade’s contracts run on a multi-year (on average 3 years) Per-Member-Per-Month (PMPM) basis. Given the average revenue per customer and the identified 21,500 employers with approximately 500 employees, the company estimates a TAM of $11.7 billion alone from its core self-insured employer market. Besides the core market, Accolade also estimates an additional $12.4 billion TAM from adjacent markets consisting of $1.7 billion from fully insured employers and $10.7 billion from government-sponsored plans such as Medicare, Medicaid, TRICARE, and those administered by Veteran Affairs. More recently, it acquired 2nd.MD, a virtual health consultation company that expanded its TAM by an additional $22 billion through inclusion of 300 new customers and more than 7 million new members.

Source: Investors Presentation

Attractive recurring revenue model with consistent improvement in margins

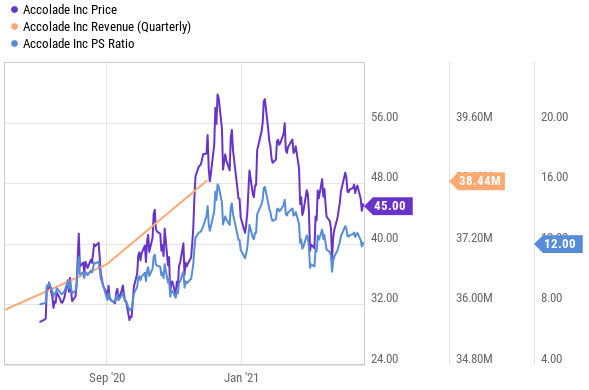

Since 2018, Accolade has consistently delivered significant top-line growth primarily resulting from its efforts in expanding its business footprints both organically and through acquisitions. The company recently acquired 2nd.MD, an online platform that connects members with leading medical specialists for expert opinions through video or phone, for $460 million. With this acquisition, Accolade has expanded its addressable market by almost $22 billion as mentioned earlier. These initiatives have led the company’s top-line to grow at a CAGR of approximately 31% from $76.8 million in FY 2018 to $132.5 million in FY 2020. Investors must note that Accolade’s annual contract value (ACV) has grown at a CAGR of almost 34% from FY 2018 and it has averaged a gross dollar retention of 98% during the same period, which suggests high customer satisfaction.

Source: Investors Presentation

Like several other growth-oriented companies, Accolade’s operating margins are currently suppressed as it is heavily investing in marketing and innovation to improve its product and technology. However, the company is continuously improving its margins and narrowing losses as it scales its business and simultaneously achieves more operational efficiency. Its adjusted gross margins improved from 36% in FY 2019 to almost 42% in Q3 2021 primarily driven by economies of scale. Adjusted EBITDA loss margins improved from -47% in Q3 2020 to -30% in the recent quarter. This improvement was driven by a significant reduction in adjusted operating expense as a percentage of revenue which declined from 88% in Q3 2020 to almost 71% in Q3 2021. The company is expecting a positive Adjusted EBITDA of $1.4 million at mid-point for Q4 2021 driven by an expected 49% increase Q-o-Q in top-line and a significant reduction in planned spending and hiring expenses due to COVID-19. As Accolade scales its business operations in the coming quarters, we expect it to enjoy better unit economics and improved margins.

Robust liquidity with no long-term debt

The company recorded cash and cash equivalents of $418.9 million as of November 2020 that includes net proceeds of approximately $231 million from its initial public offering (IPO) in July 2020 and proceeds from the follow-on public offering in October 2020. Given the company’s attractive growth characteristics, we do not believe it will face any trouble raising capital in the future to fund its growth.

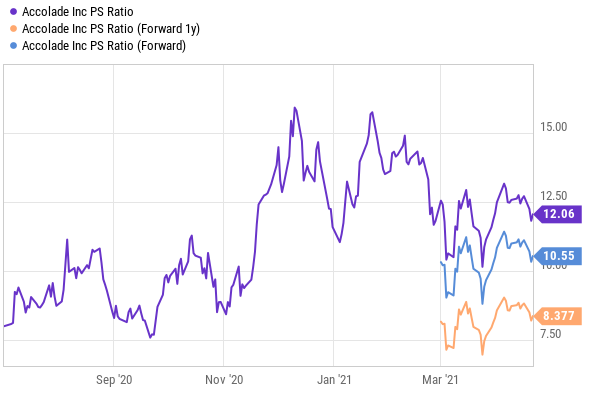

Premium valuation justified by immense growth potential

In terms of the valuation, Accolade trades at a premium with a Price-to-Sales ratio of 12.6x which is robust, but healthy. In our view, however, the valuation is justified given the high growth rate and large TAM (espcially as economies of scale continue to kick in and margins continue to improve). Not to mention an attractive industry tail wind due to the pandemic, as well as the constant challenge of navigating health care (which Accolade helps with and makes easier).

Risks

Customer Concentration: Accolade’s four largest customers namely American Airlines, Comcast Cable, Lowe’s, and State Farm contributed 59% of total revenue for FY 2020. Its largest customer, Comcast Cable accounted for 45%, 35%, and 24% of total revenue for FY 2018, FY 2019, and FY 2020, respectively. Despite a significant concentration of revenue among few customers, the company has been constantly improving its customer mix as it scales its business. As of Q3 2021, the company has reduced its revenue exposure attributable to Comcast Cable by 1000 basis points i.e., from 27% in Q3 2020 to 17% in Q3 2021). Moreover, its top 3 customers representing more than 10% of total revenue also decreased from 52% in Q1 2020 to 37% in Q3 2021 suggesting consistent efforts by the company to diversify its customer base.

Conclusion

Accolade is an attractive disruptive growth story in the healthcare industry. We expect the company to see above-average revenue growth driven by its highly integrated, personalized, and advanced advocacy & navigation platform. While trading at a somewhat robust valuation, Accolade’s large addressable market, AI-driven model and a broad ecosystem of partners present a strong moat.

We remain highly optimistic about the long-term growth prospects of the company. We do not currently own shares, but we have bumped this one to the top of our watch list, and we may add shares in the relatively near future. Accolade appears to present quite an attractive investment opportunity.