The 4.3% dividend yield of mega-cap pharmaceutical company Pfizer (PFE) is worth a closer look. Specifically, its return on capital is above its cost of capital (a good thing), its margins should increase as a result of the Upjohn spinoff, its covid vaccine is in addition to an already strong core business, it’s paid 328 consecutive quarterly dividend (and has increased the dividend 11 years straight), and the share price just dipped. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion on investing.

Overview:

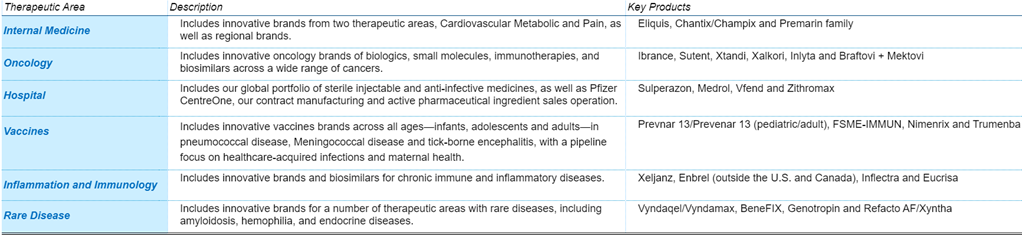

Pfizer Inc. (PFE) is one of the world’s largest pharmaceutical companies with annual sales of more than $40 billion. While Pfizer sells many types of healthcare products, prescription drugs and vaccines currently account for the majority of sales. The company focuses on six therapeutic areas - Oncology, Inflammation & Immunology, Rare Disease, Hospital, Vaccines and Internal Medicine. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, cardiovascular treatment Eliquis, and immunology drug Xeljanz. Pfizer has a large global presence with international sales representing ~53% of its total sales. Within international sales, emerging markets are a major contributor accounting for nearly 44% of the sales.

source: Company data

Pfizer’s patent protected drug portfolio gives it a significant competitive advantage, and its strong pricing power allows it to generate excess returns on invested capital (i.e. above its cost of capital). Further, the patents enable the company to dedicate sufficient time and resources to development of next generation drugs (before generic competition comes into play). Pfizer had guided for R&D investments in the range of $8.8 billion to $9.1 billion in 2020. And Pfizer’s recent spin-off of Upjohn (its off patent drug portfolio, which was facing increasing generic competition) is a positive as the remaining company is now in a stronger position to grow its top-line.

Solid Growth Potential in 2021

Pfizer expects to register strong growth in 2021. At the J.P Morgan Health Care Conference held in January 2021, Pfizer’s CEO Albert Bourla projected the company’s adjusted EPS to grow to $3.00-$3.10 in 2021, which implies growth of 30%-32% over FY 2020 expected EPS. We note that the guidance includes additional contracts the company hopes to secure for its Covid-19 vaccine made in partnership with BioNTech over the coming year.

Pfizer expects to produce nearly 2 billion doses of the COVID-19 vaccine in 2021, boosting previously expected output by more than 50% in response to surging global demand. The European Union has placed orders for nearly 600 million doses, while the US has ordered 200 million doses so far.

Despite a strong outlook for 2021, PFE shares have fallen nearly 14% over the last ~1 month (see chart above). There have been concerns around slow delivery of vaccines by Pfizer. This creates some risk that competitors may move quickly to capture sales. However, Pfizer can easily withstand any potential COVID-19 vaccine sales shortcomings considering the company’s core drug portfolio continues to generate steady cash flows and has limited competition. Management noted that it expects its core business to register a revenue CAGR of at least 6% through 2025 and double digit growth for earnings excluding the COVID-19 impact.

Safe & Sustainable Dividends

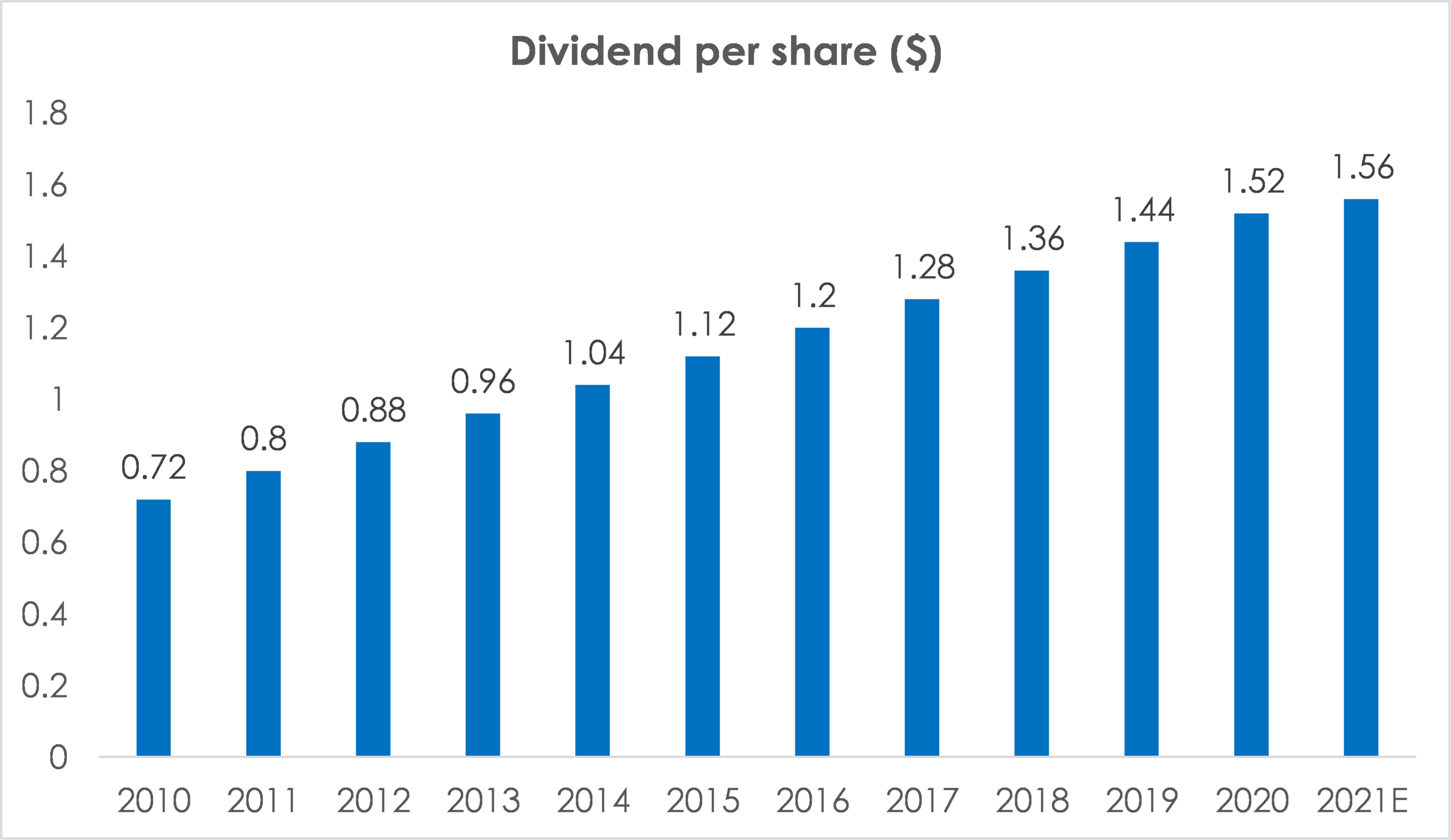

Pfizer has increased its dividend every year since 2010, growing from $0.18 to the current $0.39 per quarter. The most recent raise was in December 2020 wherein Pfizer increased Q121 dividend by ~3% to $0.39 per share. The first quarter 2021 dividend will be the 329th consecutive quarterly dividend paid by Pfizer. As Pfizer’s CEO noted in a recent press release:

“Our commitment to returning capital to shareholders is strong and the dividend increase reflects our continued confidence in the business and in our scientific pipeline.”

Pfizer’s current dividend yield of ~4.2% is attractive for income investors. The dividend is sustainable given Pfizer has the cash flow to support it. Through the first nine months of the year (2020), Pfizer generated $8.8 billion in cash from operating activities. And after adjusting for capital expenditure, free cash flow was nearly $7.3 billion which far exceeds ~$6.3 billion paid out as dividends during the period.

Further, the company expects strong earnings growth and operating cash flow in FY 2021. While EPS is likely to increase by more than 30% YOY, operating cash flow is expected to be in the range of $10-$11 billion. Thus, from both an earnings and cash flow perspective, Pfizer looks well positioned to grow its dividend.

Further, the recent spin-off of the Upjohn business may lead to a decrease in topline, but the bottom line is unlikely to be impacted significantly given that Upjohn comprised only 14% of total earnings.

Overall, Pfizer’s core business is experiencing solid growth which provides ample room for dividend increases into the foreseeable future.

source: Company data

Valuation:

Pfizer is relatively inexpensive on of price-to earnings basis. Specifically, the company currently trades at 11.5x FY 2022E EPS, and this is towards the lower end of the 5-year historical range, wherein the stock has typically traded above 15x. The current multiple offers room for price appreciation, especially if Pfizer is able to successfully execute on its growth strategy (i.e. its healthy core business plus its COIVID-19 vaccine opportunities).

For a little more perspective, here is a look at the average rating and price target of the 19 Wall Street analysts following the stock and reporting to Factset.

source: Factset

All of the analysts rate the shares a “buy” or a “hold” (no “sell” recommendations), and the average price target implies the shares are nearly 14% undervalued.

Risks:

R&D investment: The pharmaceutical business requires high investments in research & development to continue to replenish product lines which lose their market exclusivity. And there is no guarantee that investments in R&D will ever lead to successful new product launches.

Generic competition: Competition from manufacturers of generic drugs is a major challenge for PFE’s branded products around the world. Generic competition could lead to the loss of a major portion of a products revenues in a very short period of time. A number of PFE’s products have experienced significant generic competition over the last few years.

Dependence on key products: PFE recorded revenues of more than $1 billion for each of eight biopharmaceutical products in 2019: Prevnar 13/Prevenar 13, Ibrance, Eliquis, Lyrica, Xeljanz, Lipitor, Enbrel and Chantix/Champix. And those products accounted for 49% of total revenues in 2019. If any of these products were subject to problems (such as loss of patent protection, changes in prescription growth rates, material product liability litigation or unexpected side effects), the adverse impact on revenues could be significant.

Conclusion:

If you are looking for a healthy growing big dividend, Pfizer’s 4.2% dividend yield is worth considering (because it’s large, healthy and growing). Further, the shares offer the potential for price appreciation (considering the healthy core business, the new covid vaccine and the current relatively low valuation). We do not currently own shares of Pfizer, but it is high on our watch list for our income-focused investment portfolio.