Magnite is a digital advertising industry company that has made inroads into the fast-growing Connected TV (“CTV”) space (thanks to its April 2020 merger with Telaria). The company is now the world’s largest sell-side platform (“SSP”) for buying and selling advertising inventory available across multiple channels, including mobile, desktop and CTV. Magnite experienced demand erosion in 2020 as the global pandemic resulted in reduced ad spending. However, revenues have started to re-accelerate, and the share price has been rebounding dramatically off 2020 lows. What’s more, there is a massive total addressable market opportunity ahead. In this report, we analyze Magnite’s business model, its market opportunity, challenges, current valuation, and conclude with our opinion on investing (including a specific trading idea).

source: yCharts

Overview:

In our previous report on Magnite back in September 2020 (titled: “Why This Tiny Digital Advertiser’s Shares Could Soar”), we explained that:

“The COVID-19 pandemic has created tremendous challenges and opportunities. And in the case of this tiny digital advertising firm, the opportunity has been magnified not only by the pandemic, but also by the firm’s own specific challenges and now recent merger. In fact, advertisers have significantly reduced digital ad spend in the short-term (which has magnified pressure on these shares), but as we head into 2021, digital ad spend is expected to resume rapidly, and it could slingshot these shares higher, especially considering the improved long-term business model and enormous market opportunity.”

As we explained, Magnite is the world’s largest SSP facilitating the buying and selling of advertisement inventory available across several ad channels such as mobile or desktop websites, applications, or Connected TV. The company was earlier known as The Rubicon Project until its merger with Telaria in April of last year. Telaria is focused on the Connected TV advertisement business and through this merger, Magnite has become one of the only omni-channel digital advertising SSPs.

Magnite’s technology solution offers a transparent and independent advertisement marketplace that connects buyers and sellers together, facilitates intelligent decision making, and automates the entire transaction process. Revenue is generated in the form of service fees which are calculated as a percentage of the total amount of volume transacted on its platform, also known as the take rate. Magnite also generates revenue from fees charged for its Demand Manager product offered to ad publishers. Demand Manager offers configuration tools and analytics to publishers to better optimize and effectively monetize their ad inventory.

Channel-wise, Mobile ads contribute the largest share of overall revenue at 48%, whereas, Desktop and Connected TV contribute 34% and 18% respectively.

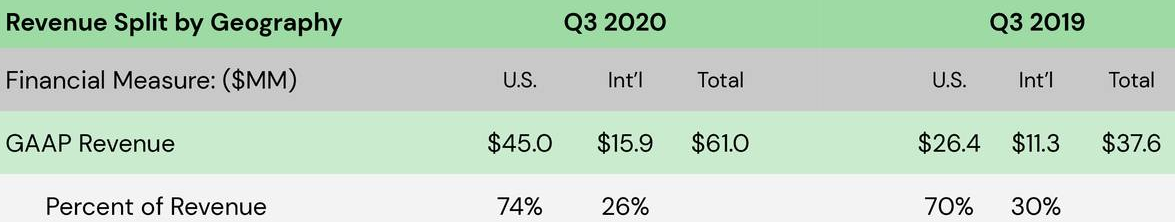

Going forward, CTV is expected to be the major growth driver for Magnite as it continues to expand at a much faster rate in comparison to both mobile and desktop mediums. While geographically, the US is the largest market for Magnite contributing 74% of the top-line, the company has made considerable progress in expanding into international markets in the last few years.

Despite 2020 headwinds, long-term secular growth is expected

Digital advertising has experienced strong structural growth over the last few years and is expected to continue its upward trajectory in 2021 (after a temporary setback in 2020 due to the coronavirus pandemic). As per an eMarketer 2019 report, US digital ad spend totaled $69 billion in 2019 and was expected to increase to over $92 billion by 2021. Currently, 83.5% of US digital display ad dollars are transacted using programmatic advertising technology which is estimated to expand to 86.5% in the next 2 years.

In a more recently updated report incorporating the effects of the pandemic, eMarketer estimated that worldwide digital ad spending will grow by just 2.4% in 2020, its slowest on record but will sharply rebound to 17% in 2021. As per the forecast, global digital ad spending is on track to cross $500 billion by 2024. Magnite being an omni-channel SSP provider will gain from this structural shift. Investors must note that the walled gardens including Facebook (FB), Google (GOOGL), and Amazon (AMZN) together occupy over 50% of the global digital ad spend, excluding China.

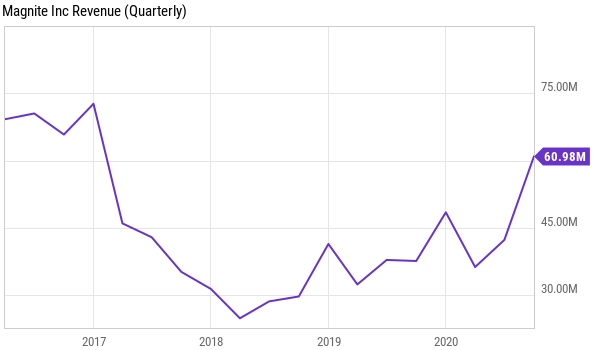

Regaining momentum after a business overhaul

Magnite faced financial and operational challenges in the pre-pandemic period, particularly after the introduction of header bidding technology in 2015. Header bidding brought a substantial change in the overall ad inventory auction process. Header bidding is a programmatic bidding technology in which publishers or sellers can offer the same inventory for auction to multiple ad exchanges. Prior to this, each SSP would enter into contracts with publishers to carry their inventory exclusively on their exchanges. Further, SSPs would separate premium ad spaces for advertisers as part of direct deals. The less valuable ad inventory would be left for open auctions on which the price would be decided through bids. Introduction of header bidding leveled the playing field amongst SSPs. The size advantage that larger SSPs, including Magnite enjoyed by getting exclusive access to premium ad inventory were gone as the same inventory was now available on several ad exchanges at the same time. Earlier Magnite used to generate an average take rate of 25% from both ad buyers and sellers, whereas post header bidding, company’s business was cut in half as it had to reduce fees to maintain its relevance in the industry.

source: Ycharts, Seeking Alpha

Despite being one of the largest ad tech companies, Magnite was slow in reacting to the changing trends in its industry. This hiccup led to a major restructuring with several top executives being asked to leave. Even the company’s founder Frank Addante, who served as CEO was replaced by Michael Barrett. Frank had earlier served as the CEO of Millennial Media and AdMeld which were sold off to AOL and Google respectively under his watch. This led to speculation that Magnite was getting itself ready to sell, however, those speculations did not materialize. Since then, Magnite has recovered to a large extent after adjusting its business model to the changing competitive environment. According to former CEO Frank Addante, during the Q4 2016 earnings call:

“Even though with the header bidding piece is quite a little bit of a hiccup for us, our ability to turn that around so quickly, I think it makes us more bullish about our ability to continue to deploy new products in the market in the future.”

Well placed to leverage its omni-channel presence and grow market share when SPO comes into effect

The ad tech industry is on the move again with rise of Supply Path Optimization (SPO). Although publishers are able to generate higher revenues for their ad inventory with the use of header bidding technology, it has led to several challenges for demand side platforms. Since most ad inventory is available across several exchanges, DSPs have to process far more impressions than their infrastructure can handle to buy an ad space programmatically. This slows down the entire automated transaction procedure which increases latency and reduces efficiency. Additionally, as per 2018 eMarketer survey, it was found that only 40% of the transacted amount on the exchange actually goes to the ad publisher. With SSPs and DSPs taking a cut of 10% each of the ad spend on average, 40% goes towards tech charges to support the technology platform, which given the nature of the header bidding supply chain is difficult to track and cap.

Supply path optimization (SPO) is a process through which a DSP narrows down the number of SSPs it wants to transact with to only those SSPs that offer most efficient and cost-effective path to securing ad inventory. Magnite, being one the largest sell side platform that carries ad inventory in all the 4 channels of digital media, including CTV, is well placed to make significant gains from this structural shift in programmatic advertising industry. In a recent press release, OpenX which is another omnichannel SSP and a prime competitor of Magnite stated that they have started to benefit from the SPO process and have entered into new as well as renewed direct partnerships with several DSPs. Below is a comment on SPO by Magnite CEO, Michael Barrett, during the Q2 2020 earnings call:

“On the SPO front, we have seen a flight to quality that has benefited Magnite. DSPs, agencies, and publishers are narrowing their programmatic partners to a handful of fullservice omnichannel players with sufficient resources to weather the COVID impacted economy. We expect this trend to accelerate in the coming quarters, and are also seeing a pickup in ad spend as a result of larger DSPs, consolidating spend with us away from smaller industry players through SPO.”

Connected TV is the next big opportunity

Post-merger with Telaria, Connected TV will be a key growth driver for Magnite. Faster internet speeds through the development of 4G and 5G have resulted in more digital content being viewed through TVs connected with the internet as compared to cable sets. As per a June 2020 study by Leichtman Research Group, 80% of the US TV households now have at least one CTV, whereas eMarketer has estimated that around 50 million people in the US have already cut the cord (i.e. canceled pay-TV services by 2019 and shifted to CTV). Connected TV ad spend was around $7 billion in 2019 and is expected to reach over $14 billion by 2023, growing at a CAGR of over 20%. CTV is the fastest growing digital platform and Telaria (part of Magnite) being a market leader is poised to benefit from the structural growth. In fact, in Q3 2020, Magnite experienced accelerating revenue growth of 51% in its CTV business on a YoY basis.

source: eMarketer

Robust liquidity position provides enough cushion to endure volatile market conditions

Magnite continued to recover in Q3, after Q2—which was a challenging quarter for the company (as it was severely impacted by the coronavirus pandemic). The pandemic hit when Magnite was just starting to enjoy the benefits of structural changes it made to adapt its business to the header bidding technology. Revenue stood at $42 million in Q2 2020, which represents a YoY increase of 12%. This increase was primarily because of inclusion of Telaria’s revenue. Excluding the effect of the merger, top line was down 23% on a YoY basis. However, the company recently indicated that business is returning to normalcy, and overall revenue in Q3 was strong (+12% YoY). Note: Magnite is expected to report Q4 earnings on February 24th.

source: yCharts

Specifically, revenue is accelerating, and connected TV is outperforming all other digital channels. And although the company has been experiencing challenging quarters (as we hopefully continue to turn the corner on the pandemic), we expect Magnite to experience strong growth over the long term as a result of adoption of supply path optimization processes by DSPs and secular growth in CTV.

Magnite successfully reported an adjusted EBITDA gain of $13.7 million in Q3 (after reporting a loss of $3.5 million for Q2 2020, as compared to a gain of $5.4 million in Q2 2019 for the combined entity). The return to positive adjusted EBITDA is a result of revenue rebounding (post-pandemic) and cost synergies from the merger. Also important, Magnite has a robust balance sheet with liquidity of $103.8 million at the end of the most recent quarter. Given that the company does not carry any debt, we believe the current cash position provides enough cushion for Magnite to navigate through the recovering economic environment.

Climbing Valuation

Magnite’s stock price has remained volatile in the past few years. It lost a significant portion of its market cap when its revenue declined as header bidding was introduced in the programmatic advertising industry. However, it regained investor confidence as it made substantial changes to its organizational structure and streamlined its business. Magnite’s stock is currently trading at a price to sales ratio of 15.8 times, which is up significantly from the 3.1x multiple it carried just a few months ago. However, the valuation remains attractive relative to the growth rate and the large total addressable market (i.e. the business still has a lot of room to run).

source: yCharts

For a little more perspective, here is a look at the average price target and rating, per the 7 Wall Street analysts covering the shares and reporting to Factset.

source: Factset

source: Factset

Specifically, these analysts all rated the shares a “Buy,” but the share price has already sailed above their target prices.

Further, here is a look at Magnite’s expected growth rate and price-to-sales valuation multiple as compared to other companies (not peers) in the digital advertising world, including The Trade Desk (TTD), Roku (ROKU) fubuTV (FUBU), Facebook and Google.

source: StockRover

Specifically, Magnite’s expected 26.3% sales growth rate in 2021 is strong, but lags higher expected rates for Roku and The Trade Desk, but Magnite also trades at a signifiantly lower price-to-sales ratio, and continue to have attractive long-term growth opportunities well beyond 2021. Again, these business are not the same, but the comparison is meaningful in the sense they all have high growth rates and are connected to the CTV opportunity.

Also worth mentioning, Magnite’s price recently took a very temporary hit following a well-publicized short-seller report (and the shares do continue to carry a significant amount of short interest, see table above). However, the shares also reacted positively following a recent management presentation at the Needham Annual Growth Conference. where CEO Michael Barrett was upbeat.

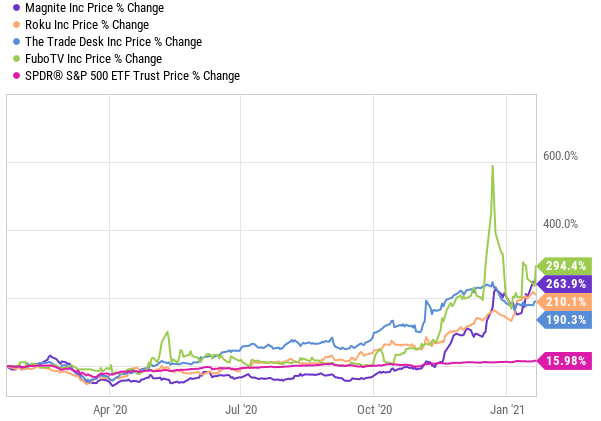

Connected TV Excitement

Although Magnite’s business model is very different than other players benefiting from the expected growth in CTV, the shares are often lumped together, and are trading higher in tandem. Here is a look at a 1-year performance chart for popular digital advertisers with some connection to CTV.

source: yCharts

And while the trend is higher, the total addressable market is large and expected revenue growth is very high, these companies will continue to be volatile, and that presents a significant risk to investors, especially those with a low tolerance for volatility.

Competition

Perhaps the biggest threat for Magnite is competition. Magnite operates in the highly competitive ad tech industry which is constantly evolving. It has faced difficulties in the past because of its inability to adapt to changing market trends. Failure to consistently innovate could lead to market share losses. Having said that, we believe the company is now in significantly better shape than it was a couple years back thanks to its new leadership, recent omnichannel upgrade, and significantly more attractive valuation and cash availability.

Trading Strategy: Selling Out-of-the-Money Puts

If you like Magnite’s business, but are nervous about the near-term price volatility, you might consider selling out-of-the-money put options. For example, by selling the February 19th, $30 strike price put options (approximately 17% below the current market price), you can generate $115 of extra income, which equates to an approximately 3.8% return ($1.15/$30.00) in less than 1-month (that’s pretty good!). And the trade also gives you a shot at picking up shares of this attractive business at a lower price (if the share price falls below your $30 strike before expiration and the shares get put to you). Worth mentioning, Magnite isn’t expected to announce earnings until February 24th (after this contract expires) so that takes some volatility risk off the table for this trade.

source: TD Ameritrade

Note: depending on your outlook, you might also consider selling the $25 puts, for lower upfront income but also a chance to pick up shares at an even lower price.

Conclusion

Post the acquisition of Telaria, Magnite has become the largest and one of the few omnichannel SSP vendors globally. The coronavirus pandemic created near-term headwinds, but the company remains on track to experience significant long-term gains from structural shifts towards SPO as well as secular growth in the digital ad industry (especially connected TVs). And despite the recent share price run up, Magnite continues to have dramatic, albeit volatile, long-term price appreciation potential, and we continue to keep it high on our growth stock watchlist (for the chance to add on pullbacks). We’ve owned shares of Magnite for over 3-months (since below $10, as per our earlier report, linked above), and intend to let this winner ride—despite our expectation for continuing high volatility.