Let’s face it, stocks are likely to be volatile in the weeks ahead. The market fear index (VIX) has been jittery, arguments can be made that social-distancing stocks have rallied too far (and not far enough), and there is this little thing in the United States called the upcoming presidential election on November 3rd. My investment philosophy is to always buy good businesses and then hang on (despite potential volatility) the for long term. And in this article, I will rank my top 10 growth stocks. However, I’ll also share specific options trading strategies that I believe are particularly compelling (based on current market conditions), potentially very lucrative and also consistent with my long-term philosophy. But before we start counting down the Top 10, it’s worth considering the tremendous and wide-ranging recent performance, valuation and expected revenue growth for top growth stocks.

The Market Has Been Volatile

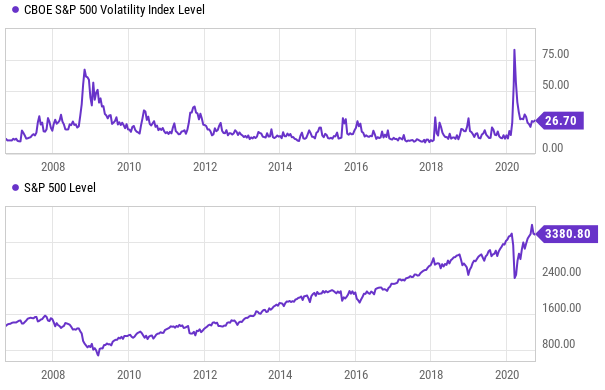

If you have not been paying attention to the market this year (which may actually be a good strategy for some easily panicked investors), it’s been a wild ride, and this month has been no exception. For your reference, here is a look at recent market performance.

In particular, the S&P 500 (SPY) was up to start the year, it plummeted during the COVID-19 selloff, it rebounded, and now it is having a tough September. And those moves were even more dramatic for the tech-heavy Nasdaq 100 (QQQ), and even more dramatic still for “cloud computing” stocks (WCLD) which have been particularly popular among many of the most aggressive growth stock investors and traders.

Valuation: Is Now a Good Time to Buy?

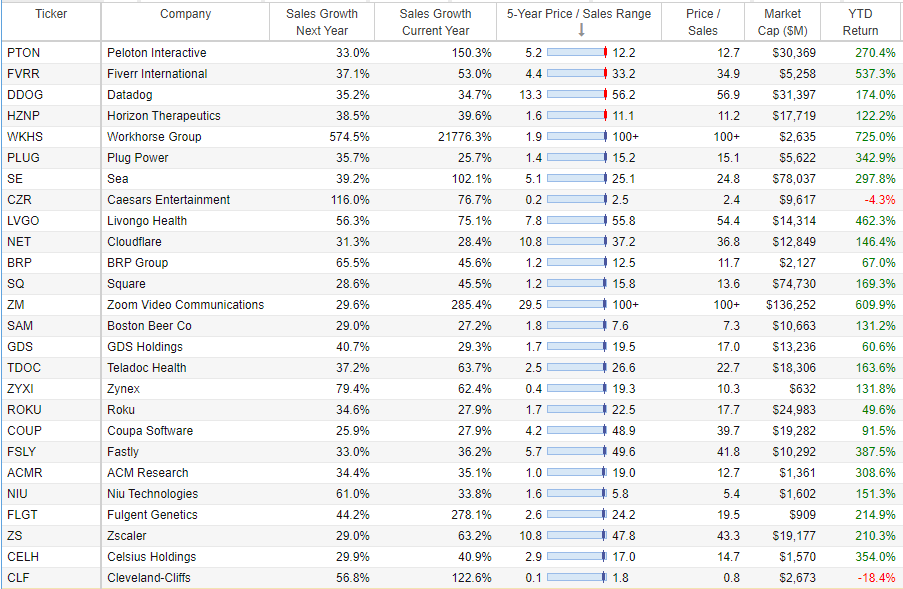

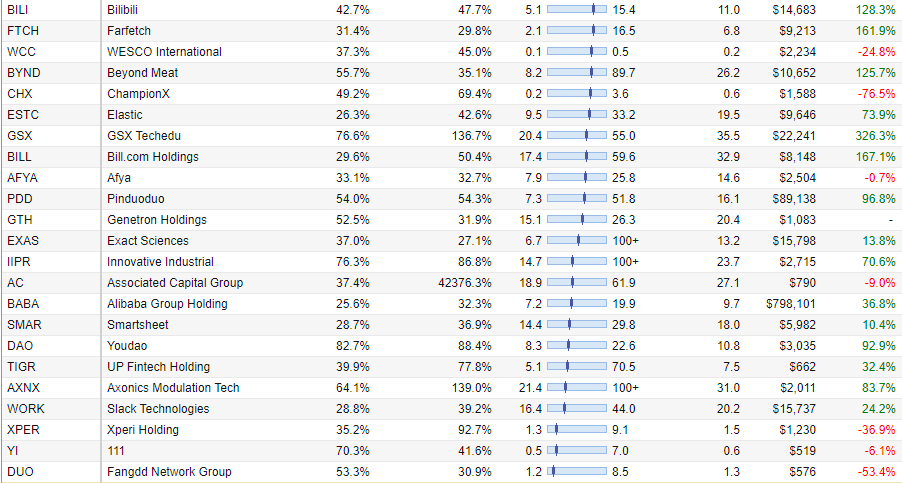

And if you are wondering if this month’s latest price pullback (for top growth stocks, in particular) provides enough margin of safety for you to add shares to your portfolio, consider this price-to-sales valuation table (below). It shows the top sales growth stocks are still generally expensive on a price-to-sales basis.

source: Stock Rover, data as of 01-Oct-20

However, these high price-to-sales ratios are not necessarily a bad thing for all of the companies on the list, especially when you consider their high expected sales growth rates this year and next (as shown in the table), plus their high potential growth for many more years into the future based on their leadership positions in their respective large and growing total addressable markets

In particular, it’s worth mentioning, Wall Street analysts chronically underestimate the long-term potential of top growth stocks because they are too focused on modeling the latest quarterly earnings announcements and guidance, instead of the actual long-term potential (this is why, sadly, most Wall Street Analyst price targets just follow the sensationalized short-term information flow instead of the actual long-term opportunities).

Long-Term Investors: Buy and Hang On

One simple strategy for long-term investors is to selectively buy the best top growth stocks now (we’ll highlight 10 of them in this article) based on your conviction that the individual businesses will eventually drive the share prices much higher.

This is actually a very good strategy if you are a long-term investor with the stomach to handle a lot of potential volatility in the weeks, months and years ahead. For example, as you can see in the chart below, over the last 15 years, every time fear and volatility spike (as measured by the VIX), the market sells off but then ultimately rebounds thereafter.

Options Trading Strategies: Volatility Can Be Good

Another strategy for investing in these top growth stock opportunities is through the use of simple options trades. For example, if there are businesses you really like, but you are nervous that near-term valuations are too high, you could sell out-of-the money put options now, which generate very attractive upfront income (that you get to keep no matter what) and give you a chance to own shares at an even lower price (if they fall even further—below your strike price—and get put to you before expiration). And importantly, the upfront premium income you receive for this type of trade is likely to keep increasing leading up to the November election because as volatility increases—so does upfront premium income. For a little more perspective on volatility (in addition to the jittery VIX mentioned earlier) check out this note I received from Interactive Brokers just last week.

This is another clear indication that volatility could rise—a good thing for some options trades. I will review specific examples of compelling options trade opportunities based on the current market environment as I count down my Top 10 Growth Stocks in the remainder of this report.

The Top 10 Growth Stocks:

before getting into the official top 10, I start with an honorable mention…

*Honorable Mention: Microsoft (MSFT)

You might be wondering how a behemoth like Microsoft makes it onto a top 10 growth stocks list when there are so many smaller high-growth businesses (we cover many in this report) where accelerating the business might seem easier to achieve and sustain. However, Microsoft has done an amazing job transforming itself into a constantly innovating, high-growth, cloud company with the critical mass to keep capitalizing on the massive global digital transformation that has only just begun.

As you can see in our earlier table, Microsoft’s growth trajectory is expected to remain high (this year’s sales growth is expected to be 13.0%, and next year at 11.5%), and its valuation remains attractive (it trades at 10.9 times sales, EV/Sales is 10.3x) after the recent sell off (the shares have been dragged ~13% lower along with the high-growth cloud sell off that has been transpiring this month.

We believe the shares have attractive sustainable long-term upside appreciation potential, and you can read all the details in our recent Microsoft report, here:

Furthermore, if you are simply too nervous to purchase shares of Microsoft now (i.e. heading into an election, and considering elevated market volatility may likely elevate further), you might consider one of two options trading strategies. The first is simply selling out-of-the-money put options with an October 16th expiration (we like the $200 strike price) because it generates attractive upfront income now (currently $1.32 upfront premium income), and because it gives you a chance to pick up shares at an even lower price.

And if you like to get slightly more complex with your trading strategy, you can consider the following Microsoft bullish vertical put spread strategy (as we wrote about in the link below) because it also generates attractive income, and gives you a chance to own at a lower price, but it also requires less upfront income, and it gives you insurance on the extreme market price downside.

Overall, we like Microsoft’s businesses, the opportunity that lies ahead, the price (even though there could be increasing near-term volatility), and we currently own shares.

10. Exact Sciences (EXAS)

If Microsoft’s huge market cap and high (but not super high) growth rate turned you off, you might want to consider shares of molecular diagnostic company (focusing on early detection and prevention of various cancers), Exact Sciences. It’s market cap is only 14.2 billion (tiny compares to Microsoft), and it’s expected growth rate is 27.1% this year and 37.0% next year. Furthermore, the shares have recently pulled back already (we explain why in our article linked below), which is compelling for those of you who like to buy very high growth at a more reasonable price. You can read all the details about Exact Sciences in the following recent report.

However, if you don’t have the stomach to buy shares of Exact (ahead of what could be a lot of upcoming election-related volatility), you might consider implementing an out-of-the-money put option selling strategy (such as the one we described for Microsoft in the previous sections). We like the $95 strike price with an October 16th expiration, for upfront premium income of around $0.98 (because it generates attractive upfront income and gives us the chance of owning shares at an even lower price). However, if you have the fortitude to buy and hang on through possible volatility, we believe these shares are going dramatically higher in the long-term, and a lot of those gains could come in the next 6-12 months (as we wrote in our Exact Sciences report, linked above). Overall, Exact Sciences is one of the few names on our list that we don’t currently own, but we may add shares soon.

9. Fiverr (FVRR)

Fiverr (FIVRR) is a global marketplace connecting freelancers and businesses for their digital service needs. It offers sellers and buyers over 400 categories ranging from digital marketing, to writing and translation, to programming and technology, to name a few. Fiverr is still only a $4.75 billion market cap company, but it has been growing revenues very rapidly and it has a very large total addressable market. However, many investors are nervous considering the recent strong price performance, high valuation and the expectation of high market volatility in the weeks ahead. Rather than purchasing shares outright, we like the extremely high upfront premium income available in the options market (for selling puts) because it gives us a chance to own the shares at a significantly lower price, and we get to keep that extremely high upfront income, no matter what. You can access my recent report on Fiverr here:

8. DocuSign (DOCU)

This is a powerful growth stock (next year’s expected sales growth is 31.2% and this year’s is 41.7%), that recently sold off significantly, and the valuation has become quite attractive relative to the business. DocuSign was recently added to the Nasdaq 100 index (replacing American Airlines), and a few of the things we like about it are the large total addressable market, the significant tailwinds from Covid, it’s first mover advantage, and its expanding margins (thanks to its growing scale). You can dig into all the DocuSign details in this recent article from Left Brain Investment Research:

(full disclosure: I frequently share investment research ideas with Left Brain, and I am currently long shares of DocuSign in my Blue Harbinger Disciplined Growth portfolio).

Overall, DocuSign is another stock you might consider just buying outright (without implementing any options trades). I am currently long shares of DocuSign.

7. Paylocity (PCTY)

Paylocity is in the right business, at the right time, and with the right strategy. This is a cloud-based, payroll processing company that has been (and will continue) benefiting tremendously as an increasingly number of businesses move towards digital cloud-based automation for simplicity and cost-savings purposes. And the current share price is very attractive relative to the valuation.

More specifically, the share price has somewhat struggled this year (relative to where it should be) as many of its smaller and mid-sized clients have been hit hard by the pandemic, and the company’s expected revenue growth rate this year is “only” 12.5% (I say “only” in quotes because that is still an impressive number, even if it is lower than prior years and below the rate of other names on this list). However, the growth rate is expected to snap back to 22.5% next year, and it trades at a lower price to sales ratio (14.5x) than many other companies with similar expected high growth (the EV/Sales number is only 13.5x for those of you that prefer that metric).

I have owned Paylocity since 2015 (I owned it when it traded below $30, now it trades at $162) and my last full report on the company was in April (see report link below). Here is how I concluded my original Paylocity report back in September 2015:

“Based on the market opportunity, this company could turn extremely profitable within the next five years. And any signs of improvement in the near term should cause the stock price to increase towards our price target of $40 to $50 per share. Realistically, this company could greatly exceed our growth targets and continue to grow dramatically for many years to come.” -Sept 2015

In my view, given the market’s short-term reaction to this year’s covid headwinds on revenue growth, this one could rally sharply higher in the months and years ahead (it could also get acquired at a significant premium to its current price, which wouldn’t be the worst thing in the world either).

Top 6

The remainder of this report (i.e. The Top 6) is reserved for members-only and it can be accessed here. I currently own 5 of the top 6 stocks, and 5 of 6 of them are also included in the Top Growth Stock table included earlier in this report (above). More specifically, the list includes leading businesses, with very high growth rates, attractive valuations, and very large total addressable markets. I include detailed research reports for each name, and suggest a variety of compelling options trade opportunities. Overall, I believe the upside return potential for each idea is extremely attractive, especially considering current market conditions.

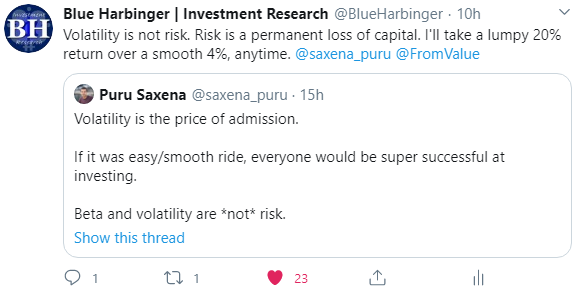

Please keep in mind that investing in high growth businesses is not for everyone. These are high-volatility, high-potential-reward, opportunities. However, please remember that despite what modern portfolio theory tells you, high volatility is not the same thing as high risk. Risk is a permanent loss of capital. As a long-term investor, I’ll take a lumpy 20% return, over a smooth 4%, anytime.