A lot of people don’t understand preferred stocks, yet they can be quite attractive sources of income. And with interest rates near all-time lows, and market volatility and fear elevated, now is an outstanding time to consider select preferred share investments. In this report, we countdown our top 7 big-dividend preferred stocks, starting with number 7 and finishing with our top idea.

What is a preferred share and how does it work?

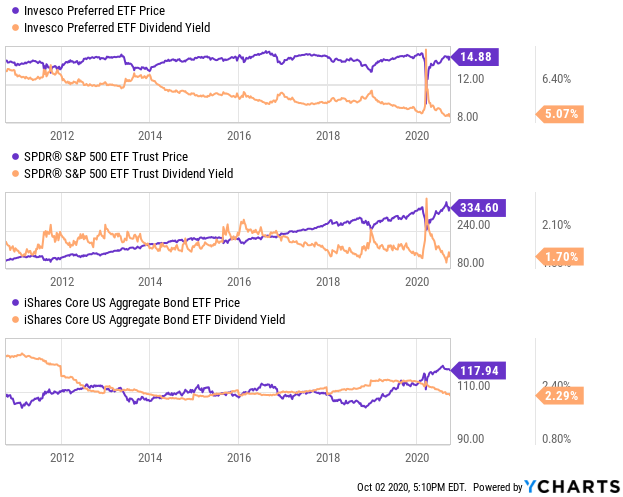

Before getting into the top 7, it’s worth noting that preferred stocks are often considered to be a hybrid security with characteristics of both common stocks and bonds. For example, preferreds often offer big steady income payments (like bonds), but they can also have share price volatility that (at times) tracks more like a muted common stock than a bond. For perspective, check out the historical prices and yields of preferred stocks, common stocks and bonds in the charts below.

From our perspective, the goal for a preferred stock investor is to find the right shares to meet your income needs, and that can also provide some price appreciation. In this regard, be aware that most preferred stocks have a face value of $25, and then can trade at a discount or premium to this price based on market conditions (e.g. interest rates) and based on the company’s individual situation (i.e. company-specific risks).

And unlike the preferred stock ETF above (which contains many preferred shares), individual preferred stocks can provide higher yields and better prices, if you select them right.

For your consideration, the remained of this report counts down our top-7 big-dividend preferred stocks, starting with number 7 and finishing with our top idea.

7. Tsakos Energy Navigation (TNP.PE), Yield: 11.9%

If you are an income-focused investor, these preferred shares are worth considering. Despite the risks (which we will cover in the full report linked below) we like the fixed-rate chartering policy (it provides stability), diversified fleet and consistently improving debt profile.

Further still, efforts to improve the common stock’s price (via a reverse stock split), the expected recovery in charter rates (from an anticipated oil demand rebound in 2021) and a possible tanker supply imbalance (created by the implementation of IMO regulations), all bode well for Tsakos. Overall, we like the discounted price on the preferred shares, especially considering the big stable dividend payments to investors. You can access our full report on Tsakos here:

6. Annaly Capital (NLY.PG), Yield: 7.7%

Annaly Capital is a mortgage REIT (the company basically borrows money against its book value to buy mortgage related assets, mainly agency RMBS), and it often captures the eye of income-focused investors because it offers a high yield.

Mortgage REITs have been through a lot this year as liquidity challenges caused heightened volatility. However, not all mortgage REITs are created equally. And in the case of Annaly preferred shares, they offer compelling high yields, price appreciation potential and they are safer than the common. In the following report (linked below) we consider Annaly’s current balance sheet and liquidity, credit spreads, share price action, valuation and the big risks. These shares are worth considering:

5. Teekay LNG Partners (TGP.PB), Yield: 9.3%

Teekay LNG Partners’ business has been improving, and there are reasons to believe the common shares have significant price appreciation ahead. However, if you prefer a similar high yield without as much volatility, you might also consider the preferred shares (they too offer price appreciation potential, just not as much).

In particular, and despite the highly cyclical LNG shipping industry, Teekay LNG Partners’ has an impressive history and opportunity for consistency in the quarters and years ahead, stemming from its fully-fixed fleet for the remainder of this year and 94% fixed for 2021 (thereby largely insulating it from the current weak short-term LNG shipping market). In the following article, we review the health of the business, cash flow position, balance sheet flexibility, valuation, risks, and dividend safety.

The Top 4

The remainder of this report (i.e. the top 4) is reserved for members only, and it can be accessed here. The list includes another attractive mortgage REIT, an energy-related company and two shipping companies (although very different types of shippers). We currently own shares of all four of the companies. The yields are very attractive and the current market prices are compelling.

The Bottom Line:

If you are an income-focused investor, preferred shares can be an attractive addition and complement to your portfolio if you understand and appreciate how they work, and if you select them right. The share prices of preferred stocks don’t have the same unlimited upside as common stocks, but they do have attractive price appreciation potential if you select them right, and that is in additional to some very attractive steady big dividend payments to investors.