Real Estate Investment Trusts, or REITs, are often an income-investor favorite because they can offer very big dividend yields with relatively low market risk. However, many popular big-dividend REITs have sold-off extremely hard in recent weeks and months, while the overall market (e.g. the S&P 500) has sailed to new all-time highs. In our view, this has created some very attractive buying opportunities in select big-dividend REITs, and we have ranked our Top 10 in this article. We provide extensive detail for each big-dividend REIT that made it onto our top 10 list, and we also provide an explanation on why REITs sold-off in the first place, as well as why market conditions remain extremely attractive for big-dividend REITs, right now.

Why Big-Dividend REITs Sold-Off

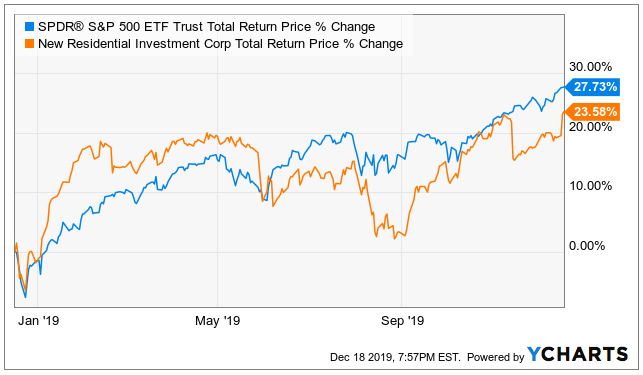

Big-Dividend REITs sold-off based largely on macroeconomic noise, and you can get a feel for just how indiscriminate the sell-off has been by viewing the recent performance of many of the most popular big-dividend REITs in the following chart (for perspective, be sure to compare each REIT’s performance to the S&P 500 (SPY) (the light blue line), which has continued to set new all-time record highs).

And for a little more perspective, here is a look at how strongly the exact same REITs were performing this year, right up until the abrupt sell-off (Notice the S&P 500, the light blue line, is now the worst performer in this group).

So What Happened? The short answer is that the Fed changed its interest rate posture at the end of October. Specifically, the Fed cut rates for the third time this year on October 30th, but the big news was their indication that they may pause on adjusting rates further in the immediate future. And based on the following CME Fed Watch chart, the market believe the Fed and changed its expectations dramatically based on the new language from the Fed (there was uncertainty regarding future rates, but the purple probability clearly increased, and the green line probability clearly decreased, following the Fed announcement).

So why does the interest rate posture change from the Fed impact REITs? Two big reasons (and one has more merit than the other). First, REITs rely heavily on the capital markets (e.g. borrowing) to grow their businesses, and higher interest rates means the cost of borrowing is higher too (more on this in a moment).

The other big reason why REITs sold off is essentially “macroeconomic noise.” Specifically, the sell-off has largely been driven by a shift from “risk-off” to “risk-on” in the market (REITs are generally considered a “flight to quality” or “risk off” asset class because their big dividends and low betas can help investors reduce volatility in their investment portfolios).

REIT’s had been performing extremely well through the first three quarters of 2019 as a “flight-to-quality” trade as a large portion of the market feared a growing US-China trade war, tariffs and general uncertainty. This fear was personified by the flattening yield curve (believed by many to be a recessionary indicator) whereby the yield on 2-year treasuries ominously rose above the yield on 10-year treasuries, as you can see in the following chart.

However, with a phase one trade deal recently reached between the US and China, continuing positive economic data, and a pause to interest rate cuts by the Fed, the market has moved back to a “risk on” mode, and REITs have sold-off, as riskier higher-beta assets (such as tech stocks, or even just the S&P 500) have risen to new all time highs. Further still, REITs were arguably due for a bit of a pullback anyway.

Why Big-Dividend REITs Are Currently Attractive

REIT naysayers and media punditry will point to the Fed’s new interest rate posture as an indication that the sky is falling for REITs. However, in reality, this is ridiculous for several reasons. First, interest rates remain extraordinarily low by historical standards, which is a very good thing for REITs (it cost less for REITs to grow). Second, the economy is strong, which is also a good thing for REITs (especially considering rates remain extraordinarily low). Third, an argument can be made that interest rates cannot realistically go much higher from here because it would make it difficult for the US to compete globally (where rates are lower), and because the US simply cannot expect to raise rates much further without crushing itself under the cost of it’s own debt. And fourth, no one really knows exactly where rates are headed in the future, and if you’re an income-investor it’s just smart to be prudently diversified across multiple market sectors such as REITs, especially if you know how to identify attractive individual REIT opportunities, which we are attempting to help you out with in this article.

Our Top 10 Big-Dividend REITs

To make it onto our Top 10 list, we required a dividend yield of at least 4%. That may not sound like much, but it’s more than twice the dividend yield of the S&P 500, and many names on our list yield significantly more than 4% (some of them currently offer double-digit yields). And as an investor, it’s important to consider total returns (dividends plus price appreciation potential). For example, a 4% dividend yield may be more palatable to you if the shares have dramatic price appreciation potential (especially after the recent sell-off), in addition to a big healthy growing dividend. Without further ado, here is our ranking of the Top 10 Big-Dividend REITs.

10. EPR Properties (EPR), Yield: 6.6%

EPR Properties (EPR) is a specialty REIT that invests primarily in Entertainment, Recreation and Education properties (such as movie theaters, family entertainment centers, golf and ski areas, and charter schools, private schools and early education centers. And as you can see in the following chart, the shares have recently sold off dramatically.

Aside from the indiscriminate “macroeconomic noise” we discussed earlier, we believe EPR’s business and dividend remain healthy and have continuing long-term growth potential. We also really appreciate that it pays dividends monthly. You can access our full report on EPR here:

9. Annaly Capital (NLY), Yield: 10.5%

Annaly Capital (NLY) is a rare counter-cyclical company that has a long history of offering high income to investors. Annaly is a bit of an outlier on our list because it is a mortgage REIT, investing in mortgage securities tied to the residential and commercial real estate market.

As you can see in the above chart, Annaly has not recently sold-off to the same extent as many of the other REITs on our list. However, the company is currently benefiting from attractive Agency MBS spreads, and it’s trading at an attractive price-to-book ratio. In our view, market conditions remain very attractive for Annaly, and you can access our recent full Annaly report here.

8. Ventas (VTR), Yield: 5.7%

Ventas (VTR) is a healthcare REIT, and it has been undergoing some very significant portfolio restructuring in recent years. We warned investors back in June that there could be some significant bumps in the road for Ventas before it finally turned the corner.

And sure enough, in addition to the industry-wide sell-off for REITs, Ventas delivered a disappointing earnings announcement at the end of October, and the shares sold off even harder.

In our view, Ventas currently offers a much more attractive risk-versus reward trade-off now (than it did back in June, before the sell-off), and we’ve ranked it #8 on our list. You can access our latest full report on Ventas here:

7. Brookfield Property REIT (BPR), Yield: 7.2%

Brookfield is a leading commercial real estate company with ~$85 billion in total assets. It primarily focuses on premier retail properties, high-end malls and office buildings in some of world’s renowned cities such as New York, London and Berlin. Some of its properties include Hudson Yards and Brookfield Place (formerly the World Financial Center) in Manhattan, Canary Wharf in London, and the Fashion Show mall in Las Vegas. And as you can see in the following chart, the shares have recently sold-off.

However, in our view, Brookfield is a high-quality real estate company that is likely to generate compelling returns over the coming years, through a combination of an attractive dividend yield and substantial share price gains. In particular, the shares are trading at ~34% discount to net asset value and offer over a 7% yield. And we see more upside ahead. If you are a long-term income focused investor, BPR is worth considering. You can access our full Brookfield write-up here:

6. New Residential (NRZ), Yield%: 12.3%

New Residential is the second (and final) mortgage-investment related REIT that made it onto our top 10 list (Annaly was the other), and in this case—we actually own it (we are long New Residential in our Blue Harbinger Income Equity portfolio). NRZ continues to be an opportunistic business led by an experienced management team, and it trades at a compelling price.

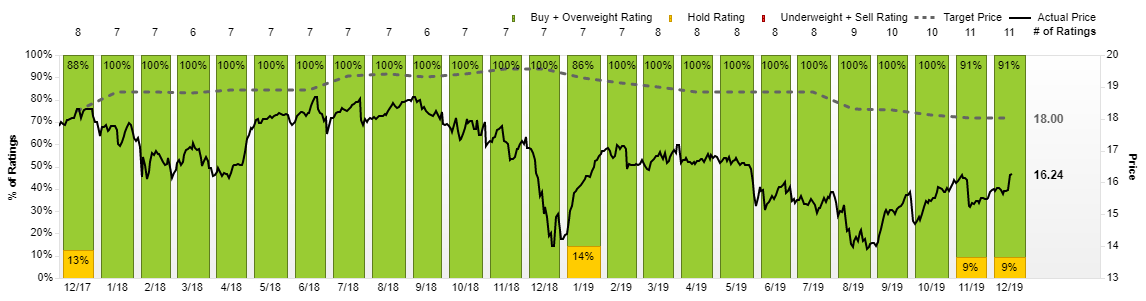

For some perspective (and please take it with a grain of salt—because these are “sheepish” Wall Street analysts), 10 out of 11 analysts reporting to FactSet (as shown in the following chart) currently rate the shares a “Buy,” and the average price target is $18—suggesting the shares have more than 10% upside from here, and that’s in addition to the company’s big healthy 12.3% dividend yield.

You can access our full report on New Residential (NRZ) using the following link:

The Top 5 Big-Dividend REITS

Our top 5 big-dividend REITs are reserved for members-only. They include an industrial REIT, two healthcare REITS, a retail REIT and a diversified REIT. They all all offer big attractive dividend yields and significant price appreciation potential.