Real Estate Investment Trusts, or REITs, are often an income-investor favorite because they can offer very big dividend yields with relatively low market risk. However, many popular big-dividend REITs have sold-off extremely hard in recent weeks and months, while the overall market (e.g. the S&P 500) has sailed to new all-time highs. In our view, this has created some very attractive buying opportunities in select big-dividend REITs, and we have ranked our Top 10 in this article. We provide extensive detail for each big-dividend REIT that made it onto our top 10 list, and we also provide an explanation on why REITs sold-off in the first place, as well as why market conditions remain extremely attractive for big-dividend REITs, right now.

Why Big-Dividend REITs Sold-Off

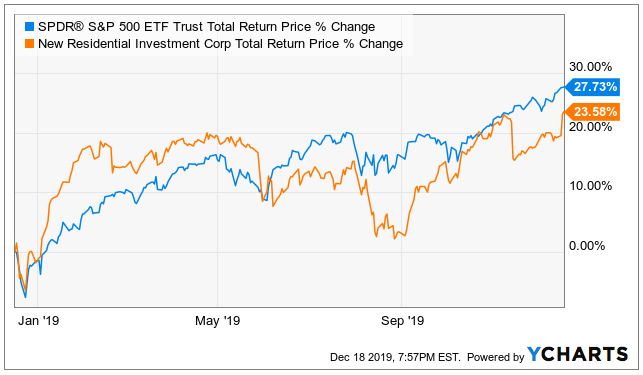

Big-Dividend REITs sold-off based largely on macroeconomic noise, and you can get a feel for just how indiscriminate the sell-off has been by viewing the recent performance of many of the most popular big-dividend REITs in the following chart (for perspective, be sure to compare each REIT’s performance to the S&P 500 (SPY) (the light blue line), which has continued to set new all-time record highs).

And for a little more perspective, here is a look at how strongly the exact same REITs were performing this year, right up until the abrupt sell-off (Notice the S&P 500, the light blue line, is now the worst performer in this group).

So What Happened? The short answer is that the Fed changed its interest rate posture at the end of October. Specifically, the Fed cut rates for the third time this year on October 30th, but the big news was their indication that they may pause on adjusting rates further in the immediate future. And based on the following CME Fed Watch chart, the market believe the Fed and changed its expectations dramatically based on the new language from the Fed (there was uncertainty regarding future rates, but the purple probability clearly increased, and the green line probability clearly decreased, following the Fed announcement).

So why does the interest rate posture change from the Fed impact REITs? Two big reasons (and one has more merit than the other). First, REITs rely heavily on the capital markets (e.g. borrowing) to grow their businesses, and higher interest rates means the cost of borrowing is higher too (more on this in a moment).

The other big reason why REITs sold off is essentially “macroeconomic noise.” Specifically, the sell-off has largely been driven by a shift from “risk-off” to “risk-on” in the market (REITs are generally considered a “flight to quality” or “risk off” asset class because their big dividends and low betas can help investors reduce volatility in their investment portfolios).

REIT’s had been performing extremely well through the first three quarters of 2019 as a “flight-to-quality” trade as a large portion of the market feared a growing US-China trade war, tariffs and general uncertainty. This fear was personified by the flattening yield curve (believed by many to be a recessionary indicator) whereby the yield on 2-year treasuries ominously rose above the yield on 10-year treasuries, as you can see in the following chart.

However, with a phase one trade deal recently reached between the US and China, continuing positive economic data, and a pause to interest rate cuts by the Fed, the market has moved back to a “risk on” mode, and REITs have sold-off, as riskier higher-beta assets (such as tech stocks, or even just the S&P 500) have risen to new all time highs. Further still, REITs were arguably due for a bit of a pullback anyway.

Why Big-Dividend REITs Are Currently Attractive

REIT naysayers and media punditry will point to the Fed’s new interest rate posture as an indication that the sky is falling for REITs. However, in reality, this is ridiculous for several reasons. First, interest rates remain extraordinarily low by historical standards, which is a very good thing for REITs (it cost less for REITs to grow). Second, the economy is strong, which is also a good thing for REITs (especially considering rates remain extraordinarily low). Third, an argument can be made that interest rates cannot realistically go much higher from here because it would make it difficult for the US to compete globally (where rates are lower), and because the US simply cannot expect to raise rates much further without crushing itself under the cost of it’s own debt. And fourth, no one really knows exactly where rates are headed in the future, and if you’re an income-investor it’s just smart to be prudently diversified across multiple market sectors such as REITs, especially if you know how to identify attractive individual REIT opportunities, which we are attempting to help you out with in this article.

Our Top 10 Big-Dividend REITs

To make it onto our Top 10 list, we required a dividend yield of at least 4%. That may not sound like much, but it’s more than twice the dividend yield of the S&P 500, and many names on our list yield significantly more than 4% (some of them currently offer double-digit yields). And as an investor, it’s important to consider total returns (dividends plus price appreciation potential). For example, a 4% dividend yield may be more palatable to you if the shares have dramatic price appreciation potential (especially after the recent sell-off), in addition to a big healthy growing dividend. Without further ado, here is our ranking of the Top 10 Big-Dividend REITs.

10. EPR Properties (EPR), Yield: 6.6%

EPR Properties (EPR) is a specialty REIT that invests primarily in Entertainment, Recreation and Education properties (such as movie theaters, family entertainment centers, golf and ski areas, and charter schools, private schools and early education centers. And as you can see in the following chart, the shares have recently sold off dramatically.

Aside from the indiscriminate “macroeconomic noise” we discussed earlier, we believe EPR’s business and dividend remain healthy and have continuing long-term growth potential. We also really appreciate that it pays dividends monthly. You can access our full report on EPR here:

9. Annaly Capital (NLY), Yield: 10.5%

Annaly Capital (NLY) is a rare counter-cyclical company that has a long history of offering high income to investors. Annaly is a bit of an outlier on our list because it is a mortgage REIT, investing in mortgage securities tied to the residential and commercial real estate market.

As you can see in the above chart, Annaly has not recently sold-off to the same extent as many of the other REITs on our list. However, the company is currently benefiting from attractive Agency MBS spreads, and it’s trading at an attractive price-to-book ratio. In our view, market conditions remain very attractive for Annaly, and you can access our recent full Annaly report here.

8. Ventas (VTR), Yield: 5.7%

Ventas (VTR) is a healthcare REIT, and it has been undergoing some very significant portfolio restructuring in recent years. We warned investors back in June that there could be some significant bumps in the road for Ventas before it finally turned the corner.

And sure enough, in addition to the industry-wide sell-off for REITs, Ventas delivered a disappointing earnings announcement at the end of October, and the shares sold off even harder.

In our view, Ventas currently offers a much more attractive risk-versus reward trade-off now (than it did back in June, before the sell-off), and we’ve ranked it #8 on our list. You can access our latest full report on Ventas here:

7. Brookfield Property REIT (BPR), Yield: 7.2%

Brookfield is a leading commercial real estate company with ~$85 billion in total assets. It primarily focuses on premier retail properties, high-end malls and office buildings in some of world’s renowned cities such as New York, London and Berlin. Some of its properties include Hudson Yards and Brookfield Place (formerly the World Financial Center) in Manhattan, Canary Wharf in London, and the Fashion Show mall in Las Vegas. And as you can see in the following chart, the shares have recently sold-off.

However, in our view, Brookfield is a high-quality real estate company that is likely to generate compelling returns over the coming years, through a combination of an attractive dividend yield and substantial share price gains. In particular, the shares are trading at ~34% discount to net asset value and offer over a 7% yield. And we see more upside ahead. If you are a long-term income focused investor, BPR is worth considering. You can access our full Brookfield write-up here:

6. New Residential (NRZ), Yield%: 12.3%

New Residential is the second (and final) mortgage-investment related REIT that made it onto our top 10 list (Annaly was the other), and in this case—we actually own it (we are long New Residential in our Blue Harbinger Income Equity portfolio). NRZ continues to be an opportunistic business led by an experienced management team, and it trades at a compelling price.

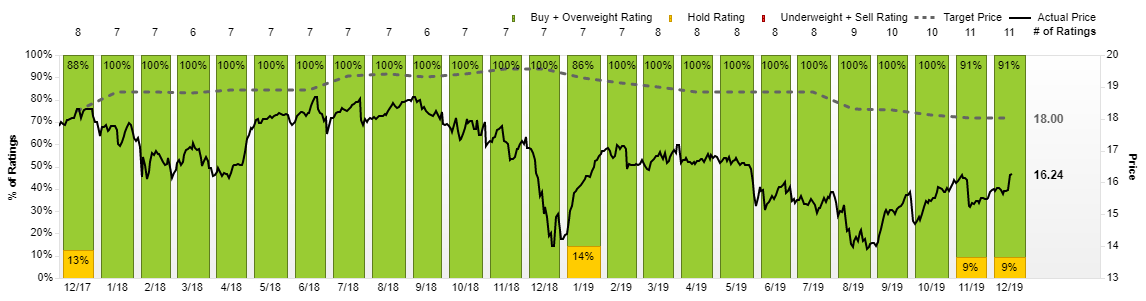

For some perspective (and please take it with a grain of salt—because these are “sheepish” Wall Street analysts), 10 out of 11 analysts reporting to FactSet (as shown in the following chart) currently rate the shares a “Buy,” and the average price target is $18—suggesting the shares have more than 10% upside from here, and that’s in addition to the company’s big healthy 12.3% dividend yield.

You can access our full report on New Residential (NRZ) using the following link:

5. Monmouth Real Estate (MNR), Yield 4.6%

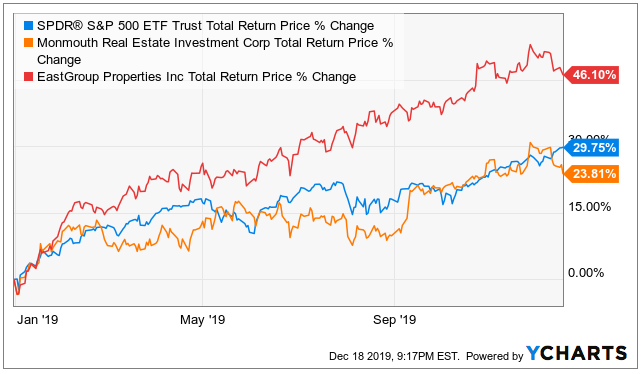

Monmouth is an Industrial REIT that has experienced some selling pressure in the last month (as part of the overall indiscriminate REIT sell-off). However, we believe it remains a very compelling dividend with attractive price appreciation potential considering it is trading at a discount. Further, it has attrative long-term leases with investment-grade tenants.

Important to note, we also included another Industrial REIT in this chart, EastGroup Properties (EGP). We currently own EGP (and have owned it for several years), but it did not make our top 10 list because its yield didn’t surpass our 4% yield minimum (EGP currently yields only 2.3%—it’s very strong performance in recent years has mathematically driven the yield lower, even though the dollar amount has increased). Both EGP and MNR have experienced a sell-off in recent weeks, and you can access our recent full write-up on MNR here:

4. Welltower Inc (WELL), Yield: 4.5%

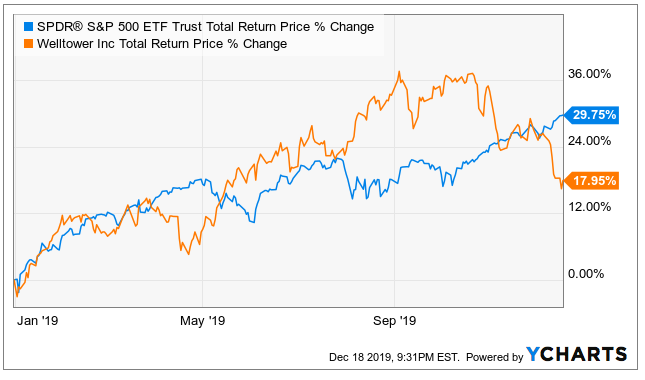

In a nutshell, Welltower is a healthcare REIT similar to Ventas (see #8 on this list), but Welltower has been better managed. Specifically, Welltower has done a better job steering clear of several of the big troubled property operators that have gotten Ventas in trouble. Nonetheless, Welltower has been pulled sharply lower macroeconomic headwinds that have dragged down the entire sector.

We currently own shares of Welltower, and have no expectation of selling considering the demographic tailwinds it has at its back and its current attractive forward price-to-FFO ratio. During its late October earnings call, Welltower raised the midpoint of its FFO guidance, but the shares still sold-off as part of the indiscriminate selling pressure. Our last full report on Welltower is from over the summer, however the business and the dividend remain healthy and the shares are attractively valued.

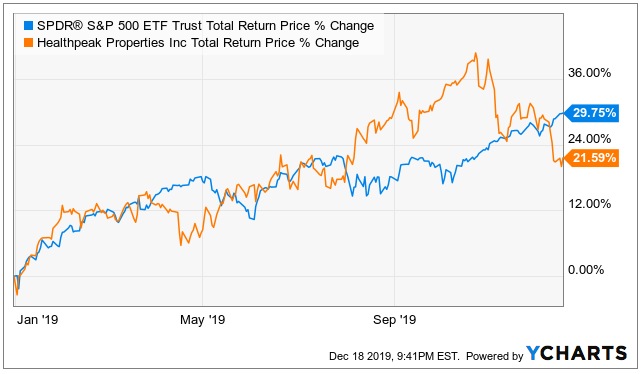

3. HealthPeak Properties (PEAK), Yield: 4.6%

If you don’t know, HealthPeak is the old HCP Inc (it recently announced a name change at the end of October), and we continue to own the shares of this healthcare REIT within our Blue Harbinger Income Equity portfolio. HCP was formerly a dividend aristocrat (an S&P 500 company that has increased its dividend payout for at least 25 year straight), but ran in to some troubles with one of its big skilled-nursing facility operator a few years back, and forced to cut its dividend. It eventually spun out the troubled operator to give itself a fresh start, and has done an excellent job restructuring itself back into a healthy growing business with a very healthy dividend payout. However, HealthPeak also got caught up in the recent indiscriminate REIT sell-off, and the shares are attractively priced now for income-focused investors.

We recently shared a more detailed write-up (and an attractive income-generating HealthPeak option trade, and you can read that report here:

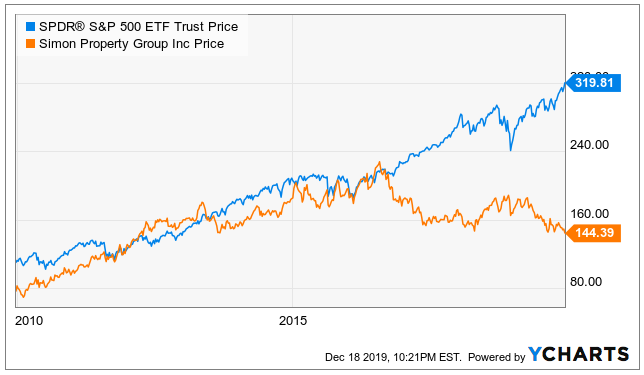

2. Simon Property Group (SPG), Yield: 5.7%

Simon Property Group (SPG) has the most financial strength and highest dividend safety of any REIT on our list. It is the largest REIT as well as the the only publicly traded REIT with an “A” credit rating. Simon has continued to raise its dividend payout to investors, year after year. However, because it is a shopping mall REIT, it has continued to face selling pressure month after month.

The negative narrative that has been putting selling pressure on Simon says that the internet is going to put all shopping malls and retail stores out of business, and that’s why Simon continues to sell-off. However, this has created an attractive buying opportunity because the narrative is false in Simon’s case. Specifically, some less desirable “B-class” shopping malls are facing real challenges as shoppers change their habits. However, Simon owns attractively located, experiential “A-class” malls, and the business continues to set new positive financial records, quarter after quarter. On a price-to-FFO basis, Simpn has simply gotten too attractively-priced to ignore, especially considering the dividend yield has now climbed to an impressive 5.7%. We’ve written about Simon multiple times in the last year, often about the attractiveness of generating additional income by selling income-generating put options (a strategy that has continued to work well). However, the price, valuation and dividend yield of SPG is getting to attractive to not consider, in our view. We are long shares of SPG in our Blue Harbinger Income Equity portfolio, and you can read an example of one of our previous SPG reports here:

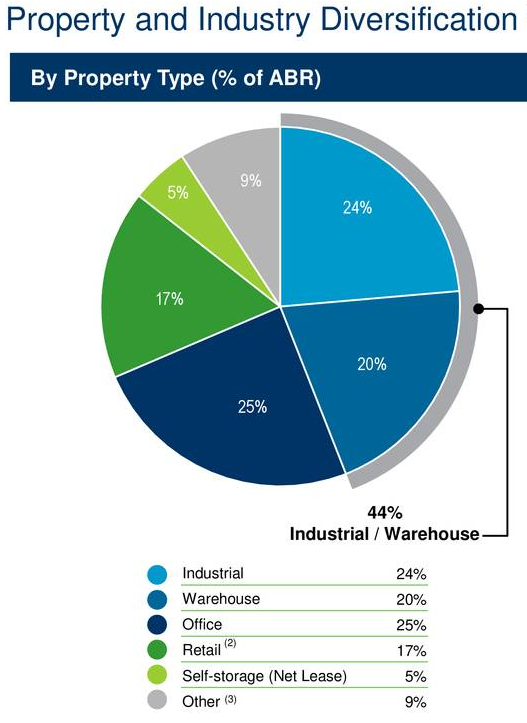

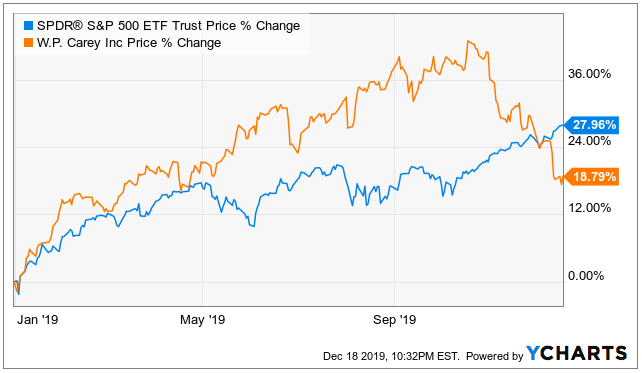

1. W.P. Carey REIT (WPC), Yield: 5.4%

This one has very nice price appreciation potential, and a very attractive growing dividend. If you don’t know, W.P. Carey REIT is the second largest net REIT with an enterprise value of approximately $19 billion and a diversified portfolio of operationally-critical commercial real estate. WPC’s portfolio is located primarily in the US and Northern and Western Europe and is well diversified by tenant, property type, geographic location and tenant industry.

And WPC has been one of the hardest hit REITs during the recent industry-wide sell-off, with the shares currently down more than 17% from their all-time high less than 2 months ago.

However, the business remains strong considering it beat FFO guidance last quarter, and continues to regularly raise its dividend payout to investors. The company has close tie-ups with high-quality tenants, it has recently worked to stabilized its earnings and significantly reduced its exposure to economic fluctuations, and it has streamlined its business operations. Due to the recent sell-off, the shares have fallen back below the price when we completed our last full WPC report back at the end of May while the business and the dividend payout amount have continued to improve. Your can read our previous full write-up on W.P. Carey here:

The Bottom Line:

REITs remain an attractive option for income investors, especially after the indiscriminate market-wide sell-off. The fact that interest rates remain low by historical standards is a good thing for REITs, and so is our currently strong economy. Valuations are attractive, and we’ve highlighted our favorite big-dividend REITs in this report. You can view all of our current holdings, by portfolio strategy, here.