If you are looking for big stable growing income, Enterprise Products Partners (EPD) is worth considering. This midstream energy services provider offers an attractive 6.1% distribution yield, and the shares are on sale, in our view. Considering the company’s large and strategic footprint, stable fee-based income, vertical integration, and growth (both in assets and distributions), we have added it to our list of 10 Attractive High-Yield Blue Chips Worth Considering.

Overview of the Company

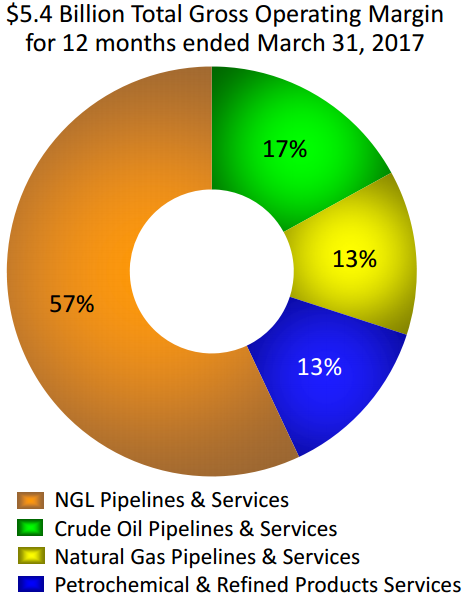

Enterprise Products Partners L.P. is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, petrochemicals and refined products. Its assets and operating margin breakdown are shown in the following graphics

Importantly, EPD is a publicly-traded Master Limited Partnership (MLP) not a stock. This means investors are unitholders (not stockholders) and they receive distributions (not dividends). The partnership itself is not taxable, and all the annual income and gains/losses pass through to the unitholders. Each unitholder receives an annual K-1 statement with their allocated share of the partnership items to be reported on their state and federal tax returns. MLPs are often an income-investor favorite because they often pay big steady distributions. In the case of EPD, the distribution yield is currently 6.1%, and the distribution payment has been increased for 51 consecutive quarters.

Very Stable Business, Despite Energy Markets

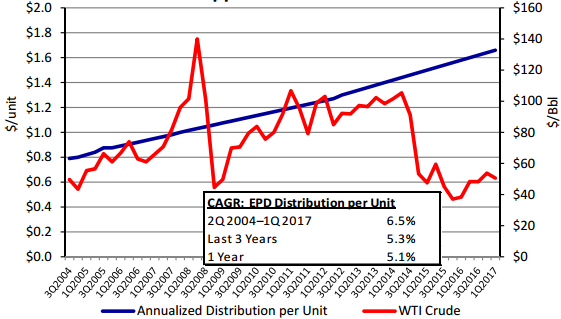

As a testament to EPD’s stability, it has continued to grow the distribution (as shown in the following charts) despite challenging energy market conditions.

In its most recent annual report, EPD’s management team explained this accomplishment as follows:

“We are proud of how Enterprise performed in 2016 despite the challenging environment for the energy industry, and we are optimistic that the industry has weathered the harshest part of the cycle.”

For perspective, crude oil prices (WTI) have broken through the $50 range, significantly higher than the $26 per barrel low in early 2016 (this is important considering 17% of EPD’s operating margin is related to crude oil pipelines and services as shown in our earlier chart). Also, EPD has effectively weathered low natural gas prices which fell from $4.43 per MMBTU in 2014 to $1.64 in early 2016 (natural gas has rebounded to $3.18 currently). And also, lower US natural gas prices have supported EPD’s growing petrochemical business. Specifically, petrochemical products are supported by lower natural gas prices, and this has acted as a bit of a natural hedge on EPD’s business, thereby contributing to its stability.

Further, EPD’s stability is increased by its large economies of scale (it’s one of the largest publicly-traded partnerships), its low cost of capital (it has one of the highest credit ratings among MLPs: Baa1 / BBB+), and its strategic assets (it can aggregate energy commodities from a variety of major basins such as Permian, Eagle Ford, DJ, and then deliver it to multiple users such as refiners, petrochemicals, and exports).

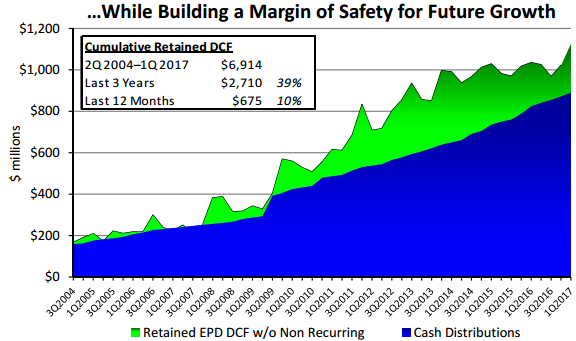

Further still, a significant majority of EPD’s business is fee-based, and based on long-term contracts, thereby making the cash flow that much steadier. For perspective, distributable cash flow (“DCF”) was $4.1 billion in 2016 thereby representing 1.2 times coverage of cash distributions paid for 2016. Further, EPD retained more than $700 million of DCF in 2016 (and over $11 billion or 32 percent of its DCF since its IPO) thereby enhancing its ¬financial flexibility, providing capital for growth projects and providing a margin of safety for investors.

Continued Growth Opportunities

Not only is EPD a steady business, it has continued steady growth ahead (as mentioned above, EPD is able to retain a portion of DCF to provide capital for growth projects). For example, in 2016 EPD expanded its asset base by completing construction of $2.2 billion of capital growth projects. Further, EPD currently has $7.1 billion of new capital growth projects under construction to be completed through 2019 that are supported by long-term customer commitments. These growth projects will help ensure EPD will be able to grow distributions to unitholders in the future.

Strong Management Team

Worth mentioning, EPD has a highly experienced management team that has worked to align the interests on the general partner (“GP”) and the limited partners (“LP”). For starters, the GP appears committed for the long-term considering it owns 32% of the common units outstanding. Also, the GP has purchased approximately $1.6 billion in EPD common units since its IPO in 1998. Also, the GP (with the help of its affiliate Enterprise Products Company (“EPCO”) took actions to eliminate GP incentive distribution rights (“IDRs”) in 2010, thereby eliminating a point of consternation and confusion (and potentially removing conflicts of interest) for the benefit of its LPs. Arguably, this move (eliminating IDRs) helps reduce EPD’s cost of capital and strengthen its credit rating.

Valuation

To gauge EPD’s valuation we compare its current and historical distributable cash flow to its current and historical price, as shown in the following two charts.

The green line in the first chart shows that EPD has been consistently increasing its DCF (even excluding non-recurring items) since its IPO (this is a good thing). And the blue line in the next chart shows that EPD’s price has also been increasing since the IPO, however perhaps not as quickly as it could be recently (compared to history) considering the price trend is not as steep as the DCF increase trend, and considering the price has pulled back in recent years. The pullback has a lot to do with the challenging energy markets (as described earlier), but despite the challenges EPD has continued to generate growing DCF, it has continued to increase the actual distribution to unitholders, and management expects DCF and distributions to continue to increase, as described earlier.

Risks

A potential risk to EPD’s price is simply that it has grown so big that it will be challenging to find enough long-term growth projects to maintain its high long-term growth rate. However, if you invest in EPD for the distribution, it’s really a matter of how safe do you believe the distribution is (we believe it’s very safe), and how much are you willing to pay for it (it’s still relatively cheap on a historical price to DCF basis).

Another risk is that the current rising interest rate environment will make EPD’s yield (which is low compared to other MLPs) less attractive. However, considering rates are still low, and EPD’s distribution is very safe, the real question is how much are you willing to pay for EPD’s big safe distribution? (again, relative to historical price versus DCF, EPD is not unattractive, in our view).

Hydrocarbon demand is another risk that EPD faces. As described earlier, prices can fluctuate dramatically for oil, natural gas and petrochemicals. And as such, it can have a significant negative impact on companies that utilize EPDs midstream services, and ultimately on EPD. EPD has done an excellent job weathering hydrocarbon price volatility in recent years, however it continues to pose a ris going forward.

Limited voting rights for unitholders is another risk. For example, according to EPD’s 2016 10-K, “unitholders have limited voting rights and are not entitled to elect our general partner or its directors. In addition, even if unitholders are dissatisfied, they cannot easily remove our general partner.” Further, the general partner may issue an unlimited amount of addition limited partnerships at any time which would be immediately dilutive to existing limited partners. EPD management has historically acted prudently with regards to limited partners (for example, the elimination of IDRs, as mentioned previously), however that’s not a guarantee that they will continue to do so in the future.

Conclusion

Despite the risks (such as uncertain hydrocarbon markets, rising interest rates, and limit unitholder voting rights), we like EPD's big stable growing income. And with its current 6.1% distribution yield, we've ranked it #9 on our list of Top 10 High-Yield Blue Chips, for contrarians. Specifically, if you're looking for a high-income MLP to add to your diversified investment portfolio, Enterprise Products Partners is worth considering.