Whether it be pending mergers and acquisitions, regulatory uncertainty, or simply high market volatility, "special situations" can create some very attractive investment opportunities. This article highlights six of them.

6. Verizon (VZ)

Despite relatively recent revelations of a dramatically more widespread data breach than originally announced, Verizon plans to plow ahead with its acquisition of Yahoo. Verizon shares have recently taken a double hit: one from uneasiness about the Yahoo acquisition, and two because lower-volatility safe-haven stocks in general are out of favor. If you’re a contrarian income-focused investor, now is a decent time to consider purchasing shares of Verizon. We’ve written more about this opportunity here…

5. Under Armour (UAA)

As we wrote about briefly in December, investors have set the growth bar extremely high for Under Armour. Since contributing to that article, Under Armour announced lower future earnings expectations, and the shares fell dramatically.

In our view, Under Armour shares are still not attractive, but the debt may be a different story. S&P Global recently downgraded Under Armor debt to junk status, and subsequently the yield is increasingly attractive. The CEO of the company has recently been very vocal about not betting against Under Armour, and we believe the debt (bonds) are still very likely money good. If your are into debt investments, and you're searching for slightly higher yield, then Under Armour's 3.25% coupon 2026 bonds are trading at 91 cents on the dollar, and may be worth considering.

4. Puts on High Volatility Stocks

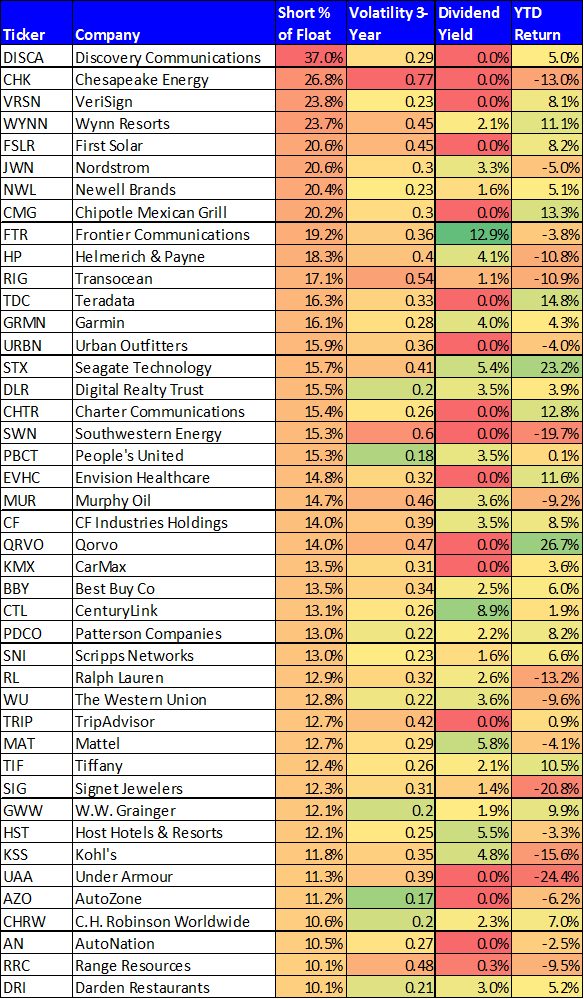

If debt investments are too safe and not interesting enough for you, then you might consider moving further out on the risk spectrum to consider selling uncovered puts on stocks you’d like to own, just not at their current price. For example, the following table lists some of the stocks in the S&P 500 with the highest level of short-interest (note: Under Armour is at 11.3%)...

Stocks with high short-interst, are usually stocks wth a lot of uncertainty and volatility. And when uncertainty and volatility are high, the premium on options is usually high too. If there are are stocks on this list that you’d like to own, then consider selling puts on them because you’ll likely collect a very healthy premium now, and you may even get to own the stock later at a much more attractive price. For example, we wrote about this strategy on a certain Healthcare REIT in this recent members-only post.

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...