If you are an income-focused investor, attractive yield can be hard to find. Especially, considering chronically low interest rates, the constant threat of stock market declines, and the uncertainty of the soon-to-be aligned White House and Congress. For your consideration, we have compiled a list (and provided details) for ten high-income opportunities that we consider attractive. Without further ado, here is the list...

10. W.P. Carey REIT

(Ticker: WPC, Yield 6.5%)

W.P. Carey REIT is a big-dividend payer, and it is increasingly attractive from a contrarian standpoint. We first added WPC to our watch list back in October, and since then its price has fallen further while the overall market (as measured by the S&P 500) has increased. In our view, the market has become overly pessimistic and fearful with regards to rising interest rates and the REIT sector in general. From a fundamentals standpoint, WPC boasts a growing dividend (it's a dividend achiever), a healthy dividend coverage ratio, and a positive AFFO outlook. We also like its European exposure as a diversifier and a contrarian opportunity (roughly 1/3 of its contractual minimum annualized base rent is in Europe). We consider WPC even more attractive now than when we first added it to our watch list back in October, and you can read our write-up that landed it on our watch list here...

9. Verizon Communications

(Ticker: VZ, Yield 4.4%)

We consider Verizon an attractive investment for income-focused investors. In fact, we’ve ranked Verizon #9 on the list because of its valuation and because we believe it will be successful in generating the cash flows it needs to support its big, growing, dividend payments. Ideally, we’d like to see Verizon add to its cash flows via strategic initiatives (such as digital marketing revenues through a successful Yahoo integration). However, the company also has the ability to keep raising cash by selling off assets, if need be (i.e. Verizon does have the best wireless network in the US). Overall, if you are a long-term, income-focused investor, we believe Verizon is worth considering for an allocation within your diversified investment portfolio. You can read our full write-up on Verizon here...

8. Nuveen Real Estate Income Fund

(Ticker: JRS, Yield 9.0%)

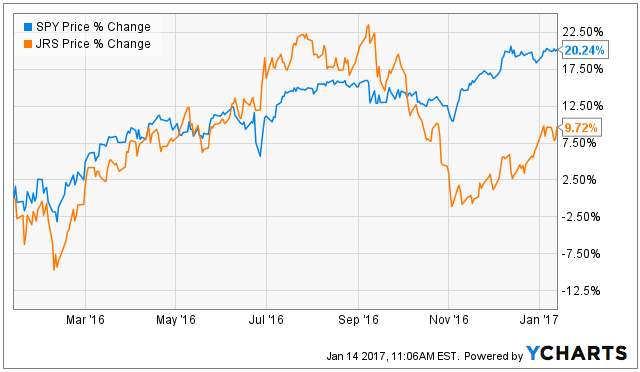

Income investors are often attracted to real estate securities because they offer big steady yields. For example, the real estate sector ETF (XLRE) offers an attractive 4.1% dividend yield. And considering the sector had a relatively poor 2016 (XLRE was up only 4.9% versus up 13.4% for the S&P 500 ETF), it’s even more attractive in 2017 from a contrarian standpoint. However, if you are a mature income-focused investor there are other attractive ways to play the sector. For example, JRS currently offers a big 9.0% yield (paid quarterly), it will benefit handsomely as the sector rebounds, and it currently trades at an attractive discount to its net asset value (NAV). You can read our full report on the Nuveen Real Estate Income Fund here...

7. Diversified Real Asset Income Fund

(Ticker: DRA, Yield 8.3%)

If you are an income-focused investor, and you believe in the power and safety of real assets, then this particular closed-end fund (CEF) may be worth considering. Especially from a contrarian standpoint because its two largest sector exposures (equity REITs and Utilities) have recently underperformed the rest of the market. DRA invests across the capital structure (mainly common stocks, preferred stocks and corporate bonds), and it currently trades at an attractive discount to its net asset value. You can read our full report on the Diversified Real Asset Income Fund here...

6. Omega Healthcare Investors

(Ticker: OHI, Yield 7.6%)

Omega Healthcare Investors (OHI) is a big-dividend REIT that has delivered particularly poor performance in recent months because of macroeconomic headwinds, heightened Affordable Care Act uncertainty, and an overly pessimistic market narrative for skilled nursing facilities. However, we believe these conditions have created an attractive contrarian opportunity. We own OHI in our Blue Harbinger Income Equity portfolio, and you can read our full report here...

Our Top 5 are reserved for members-only...

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...