With interest rates near all-time lows, alternative income strategies such as covered call writing may seem increasingly attractive. However, before engaging in such a strategy, it’s important for investors to consider the potential risks and rewards. In this article, we provide some important considerations, and also highlight five specific opportunities for generating big income by writing covered calls.

What is a covered call strategy?

A covered call strategy involves collecting extra income by selling a call option on a stock you already own. If the price of the stock climbs above the call price it will be taken off your hands (called) at the predetermined call price (you keep the premium and get the cash from the sale). If the call option expires unexecuted, then you keep the stock as well as the premium you received for selling the call. And if income generation is your investment focus, this strategy may seem attractive.

When does it make sense to implement a covered call strategy?

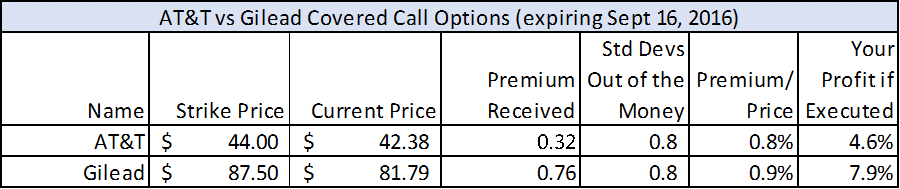

Aside from anytime you want to generate extra income, a covered call strategy may make sense if you believe a particular stock is getting ahead of itself. For example, AT&T’s price has rallied more than 25% this year, while the overall market (S&P 500) is up barely 3%. Some investors believe AT&T’s price may be getting ahead of itself, and rather than selling AT&T they instead choose to sell covered calls on AT&T. They believe it’s unlikely the stock will appreciate enough to get called before the call expires, and they’ll be left with the stock, the dividend, and the additional premium for selling the call.

To some investors, it makes sense to implement covered call strategies when interest rates are low. They believe since they cannot earn much income on traditional fixed income investments, they instead choose to earn additional income by selling calls on stocks they already own. Additionally, many investors are willing to forgo some upside potential (i.e. if the stock gets called then you would miss out on any additional upside price appreciation potential) in exchange for more income.

As we just described above, one risk of investing in a covered call strategy is that you may miss out on some potential upside price appreciation potential. Worth considering, this article recent article from the CFA Institute describes what happens when you are Missing the Best Weeks: A Mistake Investors Should Avoid.

In addition to the risk of missing out on some potential upside price appreciation, you may also miss out on other investment opportunities because you’re stuck holding a stock that may have less price appreciation potential than other investment opportunities. For example, how worthwhile is it to collect a few extra percentage point by employing a covered call strategy, when the stock upon which you’re writing the call underperforms the market by 10-15%?

Also worth considering, covered call strategies require more time and effort than simply buying and holding. If you’re stock gets called, and you are not available to reinvest the proceeds right away then you could miss out on some of the best days and weeks of market performance as we described above.

How should you implement a covered call strategy?

Only you (perhaps with the help of your financial adviser) know how to best implement a covered call strategy that meets your needs. However, generally speaking, it may make sense to only employ the strategy on only some of your holdings. This way you’ll have a diversified income stream, and you won’t be entirely exposed to all of the same risks as described above. Also, as general rules, stocks with more options volatility tend to have tighter bid ask spreads (this works in your favor), and stocks that are more volatile tend to offer higher option premiums. For your consideration, we have described (below) five covered call stocks that we believe currently offer attractive opportunities to generate additional big income.

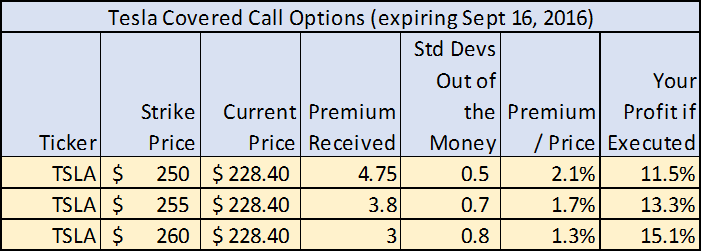

Tesla (TSLA): Tesla is our first example because it has lots of trading volume (lower bid ask spreads) and it has been enormously volatile (it offers big premiums/income). If you are a long-term believer in Tesla’s sustainable strategies (automobiles, energy, driverless ride-sharing) then now is an attractive time to own the stock and write covered calls because it’s still roughly 14% lower than its 52-week high, and the call option premiums are enormous (even on a risk-adjusted basis).

For example, you can write a covered call that won’t be in-the-money unless Tesla rises 13.8% in the next 50-days, and it pays a large $3 premium ($3 amounts to a 1.3% return over the next 50 days, or a 9.4% return annualized). Part of the reason the premium is so high is because uncertainty is high leading into next Wednesday’s earnings announcement, but if you are a long-term owner of the stock, then the short-term volatility is trivial to you, and writing covered calls is an opportunity for big income. And if this particular option does get called, you will have earned a 15.1% return in just 50 days.

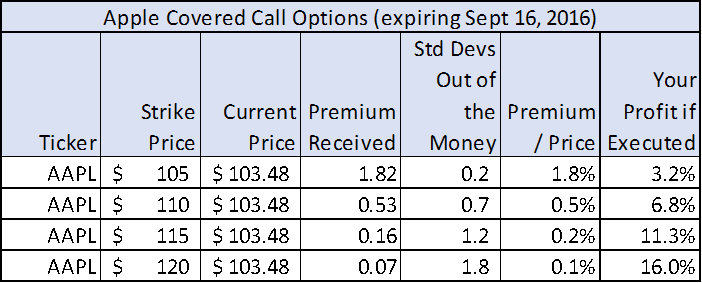

Apple (AAPL): Our next example is not as volatile as Tesla, but Apple is a popular high-volume stock, and in this case (unlike Tesla) it actually pays a dividend (2.2% yield). Apple’s valuation is very low (it trades at less than 12.2 times earnings), and the premium on Apple calls is high on an absolute and risk adjusted basis. For example, as the following table shows, you can collect a $0.16 premium (0.2% upfront return, 1.5% annualized) by selling calls on your Apple shares. And if they get called your return (premium plus price appreciation) is 11.3%.

If you are a long-term owner of Apple, covered calls are a decent way to increase your income.

Gilead (GILD): Our next example is large-cap pharmaceutical company. Gilead covered calls offer an attractive absolute and risk-adjusted call premiums as shown in the following table.

Plus Gilead’s price is very inexpensive on a price-to-earnings basis.

In our view, the market is overly pessimistic about Gilead’s future. In particular, the outlook for its HIV and Hepatitis drugs is not so bleak, and it has a proven ability to innovate. Plus it’s 2.3% dividend yield is attractive. You can read our recent report on Gilead here.

Energy Sector ETF (XLE): The energy sector exchange traded fund presents another relatively attractive opportunity to write covered calls. Given this ETF’s low idiosyncratic risks (it diversifies away stock specific risks within the energy sector), its big dividend payments (3.6% yield), its recent relative performance, and its call premiums, we believe it is worth considering. For example, the following table show the recent call premiums available for XLE versus its ETF peers sorted by “standard deviations out of the money.”

And as the table shows, XLE stands out for its high risk-adjusted premiums. Certainly, the energy sector has been volatile and faces unique challenges, but even after adjusting for volatility we believe XLE covered calls are a compelling opportunity to collect attractive income payments. If you are going to have exposure to the energy sector, the diversified XLE ETF (along with covered calls) is a decent way to do it.

S&P 500 ETF (SPY): Our final covered call example is simply an S&P 500 ETF. If you believe we’re at a point where the potential upside and downside in the overall market is limited (volatility is low with the VIX currently sitting at only 11.9), then why not sell covered calls on the S&P 500 to collect additional income.

For example, you can collect an additional 0.2% return every 50 days (1.46% annualized) by selling the $225 calls, and if they do get called you’re profit is 4.1% (nearly 30% annualized). In this scenario, you maintain some exposure to the market, but increase your income.

Conclusion:

Covered call strategies (such as the ones highlighted in this article) are an opportunity to earn additional income, but they also come with additional risks. For example, collecting an additional 2% in income per year may not be worth it if the stocks upon which you are writing the calls end up declining in value by 10-15%. Only you (perhaps with the help of your adviser) know if a covered call strategy is right for you. A covered call strategy takes more time than simply buying and holding stocks, but it can also generate an important diversified stream of cash flow for your income-focused investment portfolio.