As a follow up to our public post titled Covered Calls Roadmap: 5 Big Income Opportunities, this members-only post highlights our Top 3 covered call stocks. All three are attractive long-term investments, with particularly attractive premiums for selling their call options. Essentially, we believe writing covered calls on these three stocks is a "win-win" opportunity for income investors because if they get called you will collect the proceeds from the sale (plus the premium you will have already received), and if they don't get called then you're left holding a very attractive long-term investment that pays a big dividend. Without further ado, here is the list...

AstraZeneca (AZN)

AZN is a very attractive covered call stock right now. It pays a big dividend (4.1% yield), but it also has just rallied 10% in the last two days following earnings. In our view, this limits the short-term upside as profit-takers may well put some small downward pressure on the stock. Plus, with earnings out of the way, that reduces the chance for big volatility during the life of the call options. Currently, the September 16, 2016 calls with a strike price of $37.50 offer a $0.25 premium. If they get called over the next 50 days you get a 0.73% return from the premium, plus a 9.84% return from the sale price (AZN currently trades at $34.14). A 10.57% return in 50 days or less isn’t bad, and if it’s not called, we still like AZN over the long-term. You can read our recent AZN write-up here.

Caterpillar (CAT)

We own Caterpillar in our Blue Harbinger Income Equity strategy. It’s been a great performer year-to-date as its price is up more than 20%, and it offers a big 3.7% dividend yield. We continue to believe in the long-term value of this company, but we consider now an opportune time to sell covered calls.

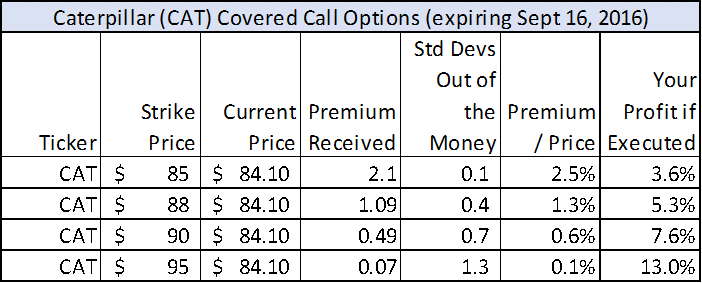

For example, the above table shows you can receive a $0.49 premium for selling covered calls on your CAT position with a $90 strike price expiring on September 16, 2016. This means if the stock does get called you will profit by 7.6% within the next 50 days (that’s over 55% on an annualized basis). And if the stock does not get called, then you keep the $0.49 premium, and you’re left owning a big dividend stock that we believe will perform very well over the long-term.

CenturyLink (CTL)

CenturyLink is another stock that has an attractive premium on its call options. For example, you can earn a $0.30 premium on the September 16, 2016 calls with a strike price of $33. CenturyLink currently trades at $31.44, which means if the stock gets called you earn the roughly 1% call premium plus an additional 5% on the sale (that’s almost 44% on an annualized basis). And if the stock doesn’t get called, we still believe it’s an attractive long-term stock to own. It pays a big 6.9% dividend, and you can read full recent write-up on CenturyLink here.