Liberty Property Trust (LPT) is a real estate investment trust (REIT) with a big 6.5% dividend yield. However, because the company cut its dividend during the financial crisis (like many other REITs did), and it has not increased its dividend since that cut, Liberty Property receives very little love. We believe this is a REIT worth loving because its dividend is relatively safe, its long-term strategy (to shift out of suburban office properties and into industrial properties) is smart, and it offers a better total return opportunity than many of its peers. Further, we expect LPT may resume dividend increases within the next 12 to 18 months.

History:

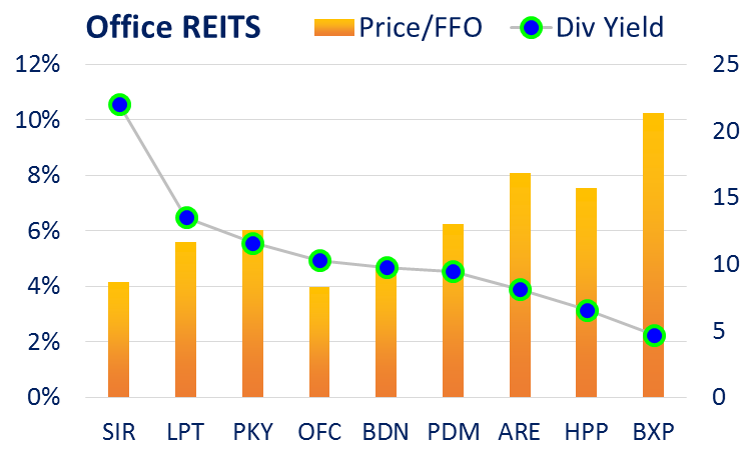

Liberty Property has been developing and managing office and industrial properties since 1972. It became publicly traded in 1994. It currently has 728 industrial and office properties totaling 106 million square feet located mainly throughout the United States. The following chart shows Liberty Property’s high dividend yield relative to some of its peers (the chart also shows price-to-funds-from-operations, more on this later).

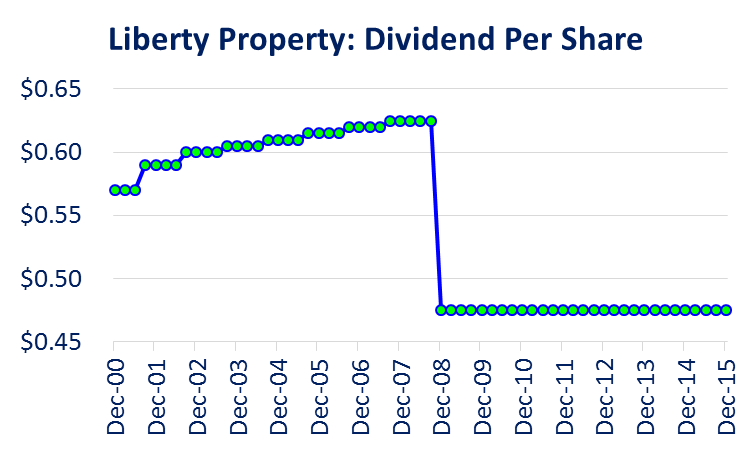

Despite Liberty Property’s high dividend yield (as shown in the chart above) it is still unloved by many income investors because it cut its dividend during the financial crisis (like many of its REIT peers) and it has never raised the dividend since then. The following table shows Liberty Property’s historical dividend payments per share.

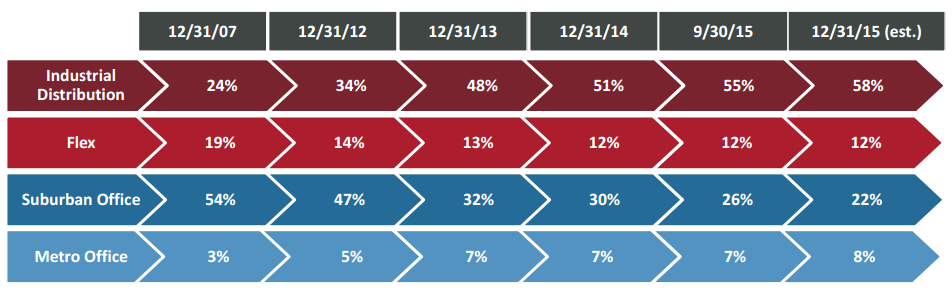

As the chart shows, Liberty had a nice history of increasing the dividend payment, but that all stopped after it cut its dividend during the financial crisis. The reason Liberty has not increased its dividend in recent years is because of its strategy to change its focus within commercial real estate from suburban office to industrial (and some metro office).

Strategy:

The following graphic shows Liberty’s changing investment strategy in recent years. The company’s focus continues to shift away from less attractive “Suburban Office” properties, to more attractive “Industrial Distribution” properties.

The firm is shifting out of suburban offices because they believe they are less attractive properties in the long-term. They’re not the only ones to believe this as the following table shows recent performance of office versus industrial real estate (as well as a few other categories):

As the table shows, office properties underperformed industrial properties in 2015. Further, many real estate professionals believe industrial real estate presents a more attractive opportunity than office real estate right now. Supporting this notion, is the most recent SIOR Commercial Real Estate Index reading (the SIOR Commercial Real Estate Index (CREI) is an attitudinal survey of local markets completed by commercial real estate market experts (SIOR members)) The survey is conducted quarterly and helps measure the state of the commercial real estate market for the United States). According to the index, market conditions are currently very strong for industrial real estate (values significantly higher than 100 indicate strong market conditions):

As noted in the company’s 2014 Annual Report:

“we undertook several significant transactions in 2013 and 2014, and may undertake additional transactions in 2015, consistent with our strategy to favor industrial and metro-office properties and markets with strong demographic and economic fundamentals.”

And more recently, during the company’s third quarter conference call, management noted they continue to exit less attractive properties in favor of their strategic preference for industrial and metro office properties. According to chairman and chief executive officer, Bill Hankowsky:

“Liberty’s third quarter results reflect the increasing quality of our portfolio and the outstanding real estate environment we are operating in… The industrial market is firing on all cylinders and the office market is firming.”

Remember, Liberty still has a significant amount of office properties on their balance sheet even though they are transitioning out of them. In fact, the transition has been going well as the company noted during the call:

“We are focused on increasing rents and executing on our portfolio-transforming disposition strategy. We now believe our dispositions for 2015 will be in the range of $600-$700 million, exceeding our previous guidance of $525-$625 million.”

For additional color, during the previous Q2 conference call management explained they are nearing the end of the company’s transition:

"So we are increasing our disposition guidance this year. We are the vast amount of work that has to get done in terms of moving this portfolio has been accomplished. We are in the last inning, the last leg whatever analogy you would like to use, that is going to have an impact in ’16 but I think then you’re done. I mean you’re done in the sense of now you are moving forward but that is what we are doing."

This is an indication that once the transition is complete, the company’s focus may shift to something else such as growing the industrial business further (through acquisitions or development) or perhaps considering a dividend increase. Management was repeatedly furtive when asked about the possibility of a dividend increase or special dividend during the Q2 and Q3 conference calls, which suggests the desire and financial wherewithal for a dividend increase is strengthening.

Liberty announces full year 2015 earnings on February 9th, and this should give us more insight into the potential for significant price and dividend increases in the future.

Valuation:

The following table provides a comparison of valuation and risk metrics for Liberty Property and some of its peers, both office REITS and industrial REITS.

Dividend Yields and 1-Year Performance:

The first thing that stands out about this table (aside from a few very high dividend yields) is the recent underperformance of office REITS versus industrial REITS. We believe this is an indication of the relative strength in industrial real estate. Further, considering Liberty’s properties are now more than 50% industrial, perhaps the market is not giving it enough credit for its changing business strategy. And for more information on the industrial REIT in this table with the highest dividend yield (STAG) check out our recent analysis/report on STAG Industrials here.

Funds from Operations:

Liberty’s FFO is compelling. FFO stands for “Funds from Operations” and it is a common measure for analyzing REITs. Traditional valuation metrics such as price-to-earnings can be misleading for REITs because of REIT’s very high depreciation expense as well as any gains on sales of properties. FFO generally makes more sense for analyzing REITs, and it is calculated by adding depreciation/amortization back to net income and subtracting any gains on sales of assets. FFO is a more pure way to look at a REIT’s operations.

Liberty’s Price to FFO ratio is not unreasonable given its property mix and in comparison to its office and industrial REIT peers. Additionally, Liberty’s Dividend to FFO ratio is compelling because it suggests the company is not over-extending itself to make the dividend payments. In fact, the relatively low Dividend to FFO ratio suggest Liberty may have the ability to increase its dividend in the future. Especially considering the company’s healthy debt ratios (i.e. Debt/Assets and Debt/Market Cap, relative to its peers).

Debt Levels:

Liberty’s debt levels are not unreasonable compared to office and industrial REITs. In fact, it’s debt to market cap ratio suggests the market may be giving it some credit for its transition strategy as the ratio is more in line with industrial REITS than with Office REITS. Further, Liberty maintains an investment grade credit rating from all three of the major credit ratings agencies. The company is rated Baa1 by Moody’s, BBB by S&P and BBB by Fitch.

Risks:

There are a variety of risks for Liberty Property Investors to consider. For example, the company may not be able to successfully complete its strategy to transition into industrial properties. Specifically, the company may get stuck with highly undesirable suburban office properties that it simply cannot sell or may sell at extremely discounted prices. This could cause Lierty’s stock price to decline even further than it already has.

Rising interest rates is another risk factor for Liberty and REITS in general. For example, if interest rates increase significantly it could make REITS less attractive compared to other income generating securities. Additionally, rising rates could harm REITS more than other industries because REITS generally maintain higher levels of debt on their balance sheets than many other market sectors and industries. Rising rates could make it more expensive to refinance maturing debt, and more difficult for REITS to operate as profitably.

A severe economic downturn is another risk factor for Liberty. Remembering back to the financial crisis of 2008-2009, many REITS (including Liberty) were forced to cut their dividend payments. And while the dividend cut wasn’t the death of Liberty, the stock price certainly took a short-term hit.

Conclusion:

As mentioned previously, we believe Liberty Property deserves more love. Investors have shunned this high dividend yield REIT because it cut its dividend during the financial crisis (like many other REITS) and it hasn’t increased its dividend since. We believe the company has a good reason for not increasing its dividend (i.e. they are prudently transitioning from suburban office to industrial and metro office properties). We also believe the company offers above average price appreciation opportunities, and it may resume dividend increases within the next 12-18 months.