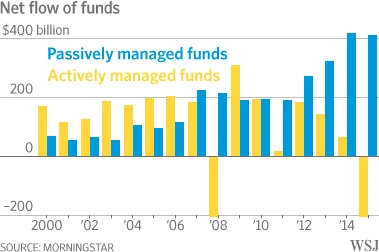

As this chart shows, investors continue to flee expensive actively-managed investment strategies in favor of low-cost passive strategies, such as ETF’s. This makes perfect sense for a variety of reasons. However, there are smart ways and not-so-smart ways to invest in passive ETF strategies.

According to this article in yesterday's Wall Street Journal, the great migration from active to passive continued in 2015 even though that was the first year since 2012 that active strategies outperformed passive. The article highlights the some of the benefits of passive ETF investing (low costs), but it also notes some of the risks such as companies luring in customers with low-cost ETFs, and then selling them a variety of more expensive and riskier products.

We have previously highlighted some of the benefits of low-cost investing here, here and here as well as the Top 10 ETF investing mistakes we often come across. We also believe our Blue Harbinger “Smart Beta” ETF strategy is a truly exceptional approach for long-term investors that want to grow and protect their nest egg.

Worth noting, there are also smart low-cost ways to construct an investment portfolio of individual stocks instead of ETFs. And if you are truly a long-term investor, the fees of a self-managed individual stock portfolio will be lower than any ETF (because you’re managing it yourself). Plus you can construct it to meet your own personal needs (risk tolerance, income, growth) with minimal effort. For example, check out Blue Harbinger Stocks.

The great value investor, and Warren Buffett’s mentor, Benjamin Graham described passive investing differently than simply buying ETF’s (especially since ETFs didn't exist back then). To Graham, “the passive investor, often referred to as a defensive investor, invests cautiously, looks for value stocks, and buys for the long term.” Our Blue Harbinger “Income Equity” and “Disciplined Growth” strategies are two example of low-cost, long-term, individual stock portfolios that we believe are truly exceptional long-term investments.