“Here Comes $20 Oil.” That was the headline in Barron’s this weekend. The article cited the supply side (US fracking and full tilt production from Saudi Arabia and Russia) as the main driver of oil's low price. With that in mind, Tsakos Energy Navigation (TNP) is a seaborne oil transportation and storage company that makes more money when oil prices are low and supply is high.

We believe Tsakos has inappropriately sold off because it’s a Greek company and it gets lumped in with dissimilar shipping stocks as well (we’ll show both of these statistically). Specifically, Tsakos should not have sold off as much with the Greek crisis because the Greek constitution and government exempt it from paying significant taxes on its international profits, and also because its business is unique compared to other shippers. In our view, both of these have contributed to Tsakos being undervalued in the market.

Additionally, Tsakos is increasingly profitable, its price-to-earnings is near historical lows, and its assets alone are worth nearly three times its current market valuation. We believe Tsakos common and preferred shares offer attractive dividend yields, attractive risk-to-reward profiles, and dramatic price appreciation potential.

About Tsakos:

Tsakos Energy Navigation is a Greek company (Athens) that trades on the New York Stock Exchange. It is a provider of international seaborne crude oil and petroleum product transportation services. According to the company’s website, Tsakos:

“…operates a fleet of 45 modern petroleum product tankers and crude oil carriers… [the] fleet also includes one 2007-built Liquefied Natural Gas ("LNG") carrier and two 2013-built DP2 shuttle suezmax tankers, bringing [the] total operating fleet to 48 vessels. [Tsakos has] on order an LNG carrier with expected delivery in 2016… In addition, [Tsakos has] also entered into certain agreements for additional [future] vessels.”

Unlike many other industries and companies, Tsakos profitability tends to increase when oil prices are low. Additionally, Tsakos benefits from the current oversupply of crude oil around the world because it increases demand for the storage capacity on their ships. According to Barron’s, the cost of chartering a crude oil carrier has recently soared as high as $80,000 per day when it was only $20,000 per day in late 2014. Also worth noting, the Greek Constitution of 1967 exempts Greek shipping companies (including Tsakos) from paying taxes on international earnings (this is an important point that we will discuss later).

Correlations:

The following table shows the correlation between the price of Tsakos common stock and a variety of other variables such as oil prices, the S&P 500, stocks of the European Monetary Union, and other shipping companies, to name a few (the data is from the beginning of 2013 through the end of last week).

The first thing to notice in the table is the strong negative correlation between the price of oil and the price of Tsakos. The negative correlation makes sense given the nature of Tsakos’ business (they make more money when oil is cheap ). Also worth noting, there is a strong positive relationship between Tsakos and the S&P 500, the Eurozone, and a global shipping index (more on these important relationships later). And for your reference, we also included a variety of other companies (not surprisingly, there is a strong positive relationship between the price of oil and Transocean (an oil driller), as well as a strong negative relationship between the price of oil and Valero (an oil refiner)).

Regression Analysis:

To dig deeper into the relationships identified in the correlation table above, we ran a linear regression with Tsakos as the dependent variable, and the independent variables included oil, the S&500, the Eurozone and shipping companies. What we found is that these independent variables are statistically significant (t-Stats above two, very low P-values) and they are useful in explaining a large portion of Tsakos stock price (89% R Square).

Tsakos vs. the S&P 500:

As expected, the S&P 500 explains a significant portion of the variability in Tsakos stock price. This is common for most NYSE stocks, especially when governments and central bankers are more involved in the market (when this is the case, stocks tend to move much more on macroeconomic news than on stock specific news). We also believe this has contributed to Tsakos being undervalued by the market because Tsakos has sold off more than its individual fundamentals warrant (more on this later). For reference, the S&P 500 is down nearly 10% this year, and Tsakos (with a beta of around 2) is down significantly more.

Oil and Tsakos:

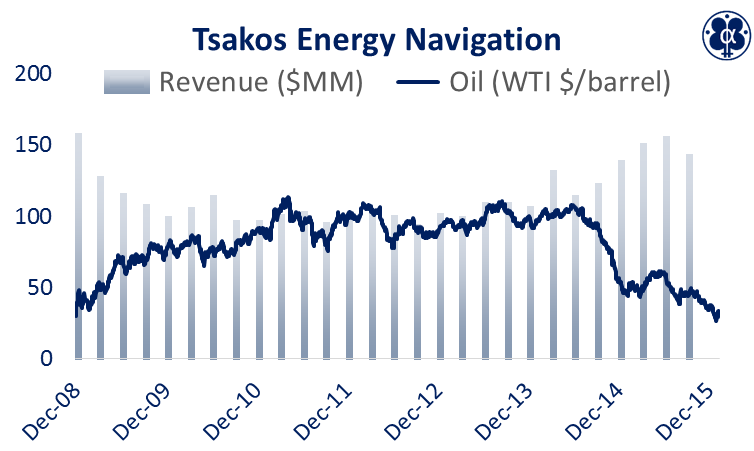

As discussed previously, the inverse relationship between oil and Tsakos makes sense. Tsakos’ profits go up when oil prices go down because more people want to use Tsakos ships for storage (not to mention the cost to operate Tsakos ships goes down). We believe oil prices will stay “low for longer” thanks to technological advances (e.g. fracking, oil sands, deep water drilling). The Barron’s article referenced in our intro suggests oil may fall as low as $20 per barrel in the first half of 2016. But the point is that we believe market forces will keep oil low for longer, and this benefits Tsakos enormously, yet its stock price isn’t yet reflecting this benefit (more on valuation later).

Eurozone and Greek Austerity:

Tsakos also has a strong positive relationship with the Eurozone. To test this we used iShares MSCI EMU Index ETF (EZU) in our correlation table and in our regression model. The relationship between Tsakos and the Eurozone is strongly positive and statistically significant. We believe this is an important consideration because Tsakos sells off when the Eurozone sells off and this should not necessarily be the case. Tsakos’ profitability is not nearly as dependent on Eurozone as other Eurozone companies because of its large global customer base.

Further, Tsakos is exempted from paying significant taxes on international profits by the Greek constitution and government. And if taxes were to increase significantly Tsakos (and other shippers) could easily relocate (something they frequently threaten). To a large extent, this means Greek austerity should not impact Tsakos as much as other Greek/Eurozone companies, and Tsakos should not sell off as much every time the Greek crisis flairs up, but it does. We believe this dynamic causes Tsakos to be undervalued (more on valuation later). For reference, the Eurozone has dramatically underperformed the S&P 500 over the last five years.

Shipping Companies:

There is also a strong, statistically significant, correlation between the price of Tsakos and other shipping companies as measured by the Dow Jones Global Shipping Index (we used ticker SEA to test this). This should not necessarily be the case because of the uniqueness of Tsakos business. Other shipping companies ship a variety of non-petroleum related products. However, because Tsakos gets lumped in with other shippers, it sells off right along with them. We believe this is another contributor to Tsakos being undervalued by the market (i.e. because of Tsakos’ uniqueness it should not have sold off right along with other shippers).

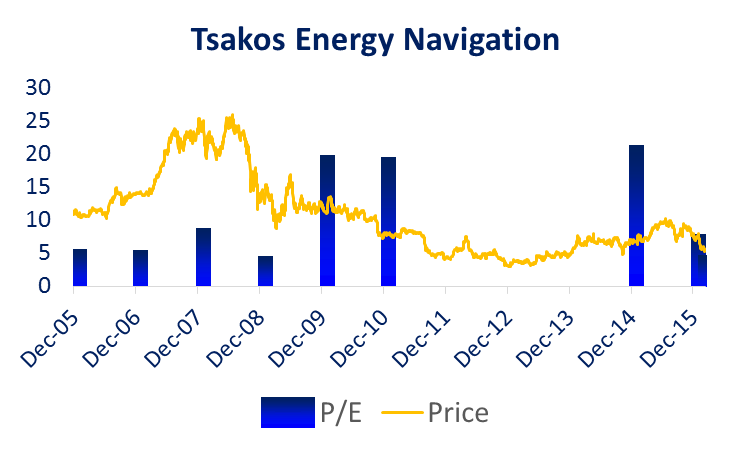

Price-to-Earnings (P/E): On P/E basis, Tsakos is cheap. As of year-end, Tsakos P/E was 6.9 times, and it currently sits around 3.6 times. The following charts shows Tsakos’ historical revenues, net income, price, P/E and the price of oil.

Despite Tsakos’ recent growth in quarterly revenues and net income, the share price and P/E sit near historically low levels (note: the historical prices have been adjusted for dividends and stock splits). Worth noting, Tsakos net income has turned sharply positive over the last year, whereas the net income of some of its peers (i.e. Aegean Marine (ANW) and Nordic American (NAT)) still remain relatively smaller. Additionally, Tsakos’ P/E (3.6x) is more attractive than these same peers (9.8x and 11.9x, respectively).

Price to Net Assets: On a price to net asset basis, Tsakos is very attractive. Its current market value is only one-third of the value of its net assets (assets minus liabilities). Tsakos management acknowledges this apparent mispricing on page 5 of its most recent annual report:

“Yet our stock, despite clearly outperforming its peers in the last twelve months, almost doubling its daily trading liquidity and with a much expanded institutional investor base, still continues to trade at an unjustifiable discount to NAV. It is time that the investor community begins to focus more on the company's unique attributes and fully reflect this in the value of our stock.”

If Tsakos trades at simply the value of its net assets, it would trade at over $15 per share, roughly three times its current stock price.

Regression Valuation: As another method of gauging Tsakos’ relative value, we can simply plug in the current market prices of the variables in our regression model above. The result is just a rough estimate (remember the R-square is 88%), but even by this model, Tsakos has 20% upside versus its current stock price.

High Dividend Yields: Tsakos Common and Preferred Stock:

Worth noting, in addition to common stock, Tsakos offers preferred shares as detailed in the table below. The preferred shares have impressive dividend yields, and potentially may be redeemed at $25 per share within the next 2.5 to 4.5 years.

We believe Tsakos will remain a going concern (it won’t default on its debt or preferred share payments), and its common and preferred shares have dramatic price appreciation potential.

Risks: Tsakos faces a variety of risks. Some of the more significant risks are described below.

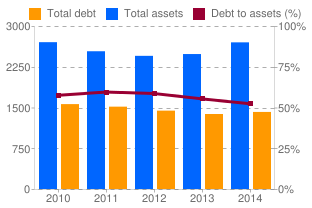

High Debt Levels: High debt levels pose a risk for Tsakos. While the company has worked to bring its debt under control in recent years (by issuing more equity and retiring some debt), the company’s high debt load increases risk.

As mentioned previously, we believe Tsakos will remain a going concern (i.e. it won’t default on its debts). Additionally, the fact that the company has been able to raise additional capital in recent years via equity offers suggests those equity owners have faith in the company’s future earnings power.

Oil Prices: A sharp increase in oil prices would likely result in less demand for Tsakos tankers. For example, speculators using Tsakos ships for storage would likely sell their reserves quickly thus reducing demand for Tsakos ships. Generally, the price of oil can be as unpredictable as it is volatile, but Tsakos has the ability to be strongly profitable even when oil prices average as high as $72 per barrel as they did during the fourth quarter of 2014 (Tsakos had over $13 million in profits during that quarter, and continued to pay its dividends as well).

Tax Law Changes: Tax law changes are another risk faced by Tsakos. For example, Greece could change its constitution to allow for taxation of Tsakos’ international profits. While this seems unlikely, anything is possible given the level of distress in the Greek economy. As another example, the executive branch of the US federal government recently proposed a $10 per barrel tax on oil. While this proposal was promptly rejected by the legislative branch, any future tax changes could have unintended consequences in the market.

Excess Capacity: Tsakos’s new ships under construction pose the risk of excess capacity. Too much transportation and storage capacity (whether from Tsakos or competitors) could reduce profitability in the industry.

Analyst Ratings:

Worth noting, Tsakos tends to be highly rated among brokerage firms. For example, the following table from Tsakos’ most recent investor presentation demonstrates the street’s opinion of the stock.

Also worth noting, Tsakos’ stock price has recently come down significantly since these rating were released, potentially making now an even more attractive entry point from a valuation standpoint.

Conclusion:

We like Tsakos. It makes money when oil prices are low and supply is high (i.e. current market conditions). Its net income has been ramping up in recent quarters, but its stock price has not. We believe oil prices will stay low for longer due to technological advances (e.g. fracking, oil sands, and deep water drilling). However, Tsakos has demonstrated the ability to be profitable at considerably higher oil prices. Additionally, we believe the stock has been unfairly beaten up for being part of the Greek/Eurozone drama and because it gets lumped in (and inappropriately sells off) with other shipping stocks. We believe the common and preferred shares offer attractive dividend yields, attractive risk-to-reward profiles, and dramatic price appreciation potential.