Technology stocks had been having a great run this year, until Trump won the election. The sector has since underperformed. In particular, Trump had been campaigning on policies that are unfriendly to the sector, such as less H1B visas, the possibility of less friendly international trade agreements, and the likelihood of higher interest rates. However, the two sides struck a conciliatory tone at this last week’s Tech Summit in New York, and the declines and fear in the sector may be overdone. For your consideration, we’ve provided a ranking of 7 tech stocks that we believe are currently trading at attractive prices and are worth considering for long-term investors.

Honorable Mention…

Tesla Motors (TSLA)

Tesla did not make our top 7, but we are giving it an honorable mention because it has the potential to deliver enormous future growth and returns, albeit with a very high amount of risk and uncertainty. And even though the company’s annual net income is still negative, its revenues are growing very rapidly, and it price has come way down.

Tesla CEO Elon Musk was given a special one-on-one session with president-elect Trump after the larger Tech Summit group meeting, and the possibility of this companies long-range electric vehicle technology and solar energy batteries give it truly enormous growth potential for investors with little aversion to volatility and risk

This is also a company that has relied heavily on government subsidies and optimistic environmentalists to fund its unprofitable revenue growth thus far, two things the incoming administration seems less focused on than the outgoing administration. Tesla is too risky and unprofitable for our taste, but we’re giving it an “honorable mention” because of its huge growth potential, greatly reduced share price, and its noble mission (i.e. cheaper, cleaner energy).

7. Microsoft (MSFT)

Things could end badly for Microsoft if the new Trump administration follows through on some of its aggressive policy ideas, particularly with regards to international trade. However, despite the policy-related risks, we’ve still ranked Microsoft #7 because we suspect cooler minds will prevail, thereby making Microsoft attractive because of its strong evolving business, above average dividend yield, and continued upside potential.

You can read our recent full report on Microsoft here...

6. Amazon (AMZN)

The price has come down, but the revenues continue to climb. Amazon Web Services (AWS) has emerged as the clear leader in the cloud space, and AWS gives the company enormous growth and profitability potential. We’d have ranked this one higher if we didn’t believe the company’s penchant for avoiding taxes by minimizing net income with aggressive R&D spending put a target on its back with regards to the Trump administration, especially considering Jeff Bezos’ strong distaste for Trump as shown via his Washington Post (we saw how aggressively Obama went after the big banks, don’t think Trump can’t do the same to Amazon). Regardless, the revenue generation power of Amazon is incredible. And consider the recent price decline, it presents a very compelling buying opportunity right now.

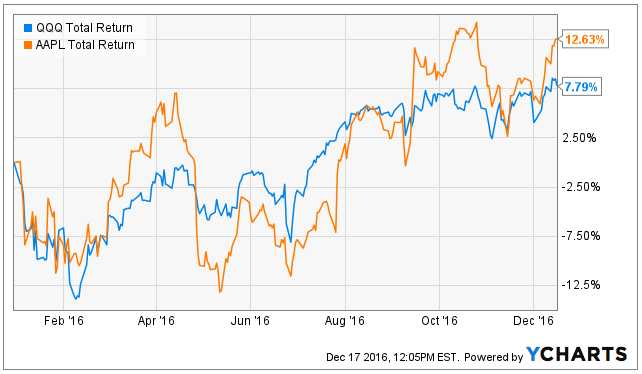

5. Apple (AAPL)

It’s still not too late to consider Apple as it transitions from an aggressive growth company to a value play (Warren Buffett’s Berkshire Hathaway is a large shareholder now). Apple has so much cash, an attractive dividend, continued growth potential, and an impressive long-term revenue stream. What’s not to like?...

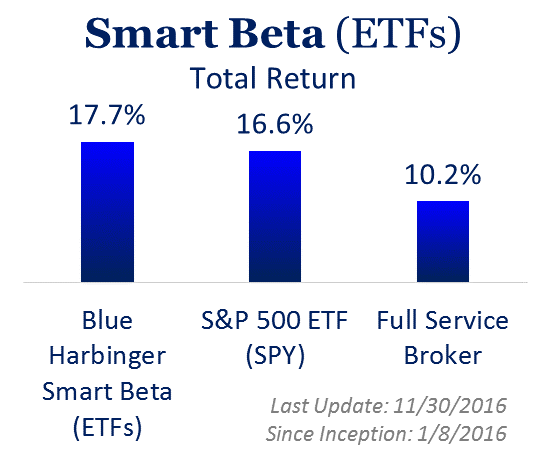

We own shares of all four of the top 4 Tech Stocks Worth Considering (we own three in our Blue Harbinger Disciplined Growth strategy and one in our Blue Harbinger Income Equity strategy).

The top 4 are reserved for members only, and you can access them (including a full report for each) here...

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...