Despite bygones, tech leaders and president elect Trump struck a friendly chord at this past Wednesday’s Tech Summit held at the Trump Tower in New York. However, gleaning potential policies from the topics discussed (and Trump’s campaign rhetoric) could spell trouble for several of the Tech Summit attendees, Microsoft in particular.

This article provides a brief review of Microsoft’s evolving business, several valuation metrics worth considering, and an overview of the potential impacts (positive and negative) of new policies that may come out of the Trump Administration such as those that would artificially create more US tech jobs, lower corporate tax rates, pressure interest rates higher, allow overseas cash repatriation, and utilize punitive tariffs with international trading partners.

Overview

Microsoft’s business consists of three segments: Productivity and Business Processes (consists of Office and Dynamics), Intelligent Cloud (consists of public, private and hybrid server products and cloud services, includes Azure), and More Personal Computing (consists of Windows, devices, gaming, search advertising, Bing and eventually LinkedIn). And for reference, the following charts show the revenue and operating margin breakdown and growth trajectory of each segment.

More Personal Computing is the biggest in terms of revenues, but has lower margins and is therefore the laggard in terms of operating income. And with regards to revenue growth, More Personal Computing (-1%) is also the laggard versus the other segments (+8% and +10%) on a year-over-year basis as shown in the following table.

With regards to Cloud, Microsoft seems to be the number two player (behind Amazon Web Services) in an extremely competitive space. Notwithstanding any mistakes, Cloud should provide Microsoft continued growth. Additionally, Microsoft’s Productivity and Business Process Application provide some strong advantages and barriers to entry versus peers, as does the Windows operating system.

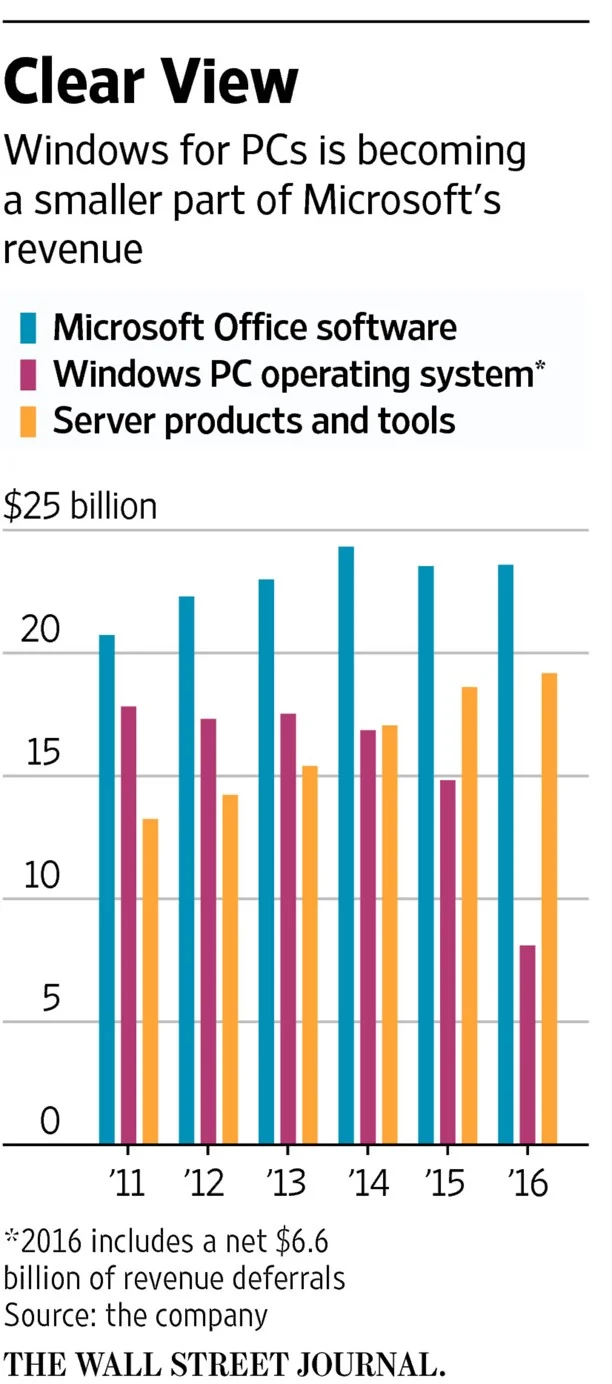

For more perspective, the following graph shows how Microsoft’s Windows for PCs is becoming a smaller part of Microsoft’s revenue, and server products and tools are accelerating.

And from a bottom line standpoint, Microsoft’s net income remains healthy as revenues remain strong, as shown in the following chart.

Additionally, Microsoft has provided a positive outlook whereby revenue in two of its three segments is expected to grow (Productivity and Business Processes plus Intelligent Cloud, but not More Personal Computing).

Valuation Metrics:

From a price-to-earnings standpoint, Microsoft remains reasonably priced as shown in the following chart (taking the tech bubble era with a grain of salt).

Additionally, a basic discounted free cash flow model suggests Microsoft has some price appreciation potential. Specifically, if we discount Microsoft’s 2016 Free Cash Flow of $25 billion, by its 11.85% weighted average cost of capital and assume a 9.1% 5-year annual growth rate (this is the average estimate of the 8 professional analysts surveyed on Yahoo Finance), and a conservative 3-5% growth rate thereafter, then Microsoft is worth $465.0B to $580.4B after adjusting for outstanding long-term debt (-$60.2B) and cash and short-term investments (+$136.9B). On a per share basis, this amounts to a valuation between $59.76 and $74.61, which gives Microsoft current share price roughly 8% upside versus the midpoint of the range.

Worth noting, Microsoft pays a healthy dividend. The dividend yield currently sits at around 2.4% (as shown in the following chart) which is above average for Microsoft and above average for an S&P 500 company, particularly one in the technology sector.

A higher than average dividend yield from a blue chip company like Microsoft can be a signal from management that they believe their stock price should be higher (which would mathematically bring the dividend yield closer to the historical norm, ceteris paribus). Worth noting, Microsoft’s dividend payments are well covered as shown in the following chart.

In essence, Microsoft is a stable company with an above average dividend and the potential for more growth and share price appreciation.

New Administration Policies:

It is worth considering the potential policy changes (and their impact on Microsoft) that might come out of the Trump Administration following this past week’s “Tech Summit” (attended by Alphabet CEO Larry Page, Tesla and SpaceX CEO Elon Musk, Apple CEO Tim Cook, Facebook COO Sheryl Sandberg, Microsoft CEO Satya Nadella, Cisco CEO Chuck Robbins, IBM CEO Ginni Rometty, Intel CEO Brian Krzanich, Oracle CEO Safra Catz, and Amazon CEO Jeff Bezos, to name a few).

Specifically, we consider policies that may artificially create more US tech jobs, lower corporate tax rates, pressure interest rates higher, allow overseas cash repatriation, and utilize punative tariffs.

1. More US Jobs:

For starters, one of Trump’s biggest themes is US jobs creation. However, the types of jobs he’s talking about (middle class manufacturing jobs) aren’t going to help Microsoft, and his views on highly skilled international workers may actually harm Microsoft significantly. For example, Trump has been critical of H1B visas, claiming they take jobs away from Americans. In our view, H1B jobs help Microsoft attract the talent it needs to remain successful. For example…

“Microsoft is an outspoken opponent of the cap on H1B visas, which allow companies in the U.S. to employ certain foreign workers. Bill Gates claims the cap on H1B visas makes it difficult to hire employees for the company, stating "I'd certainly get rid of the H1B cap." Critics of H1B visas argue that relaxing the limits would result in increased unemployment for U.S. citizens due to H1B workers working for lower salaries.”

Additionally, Trump may attempt to force more manufacturing jobs into the US, rather than allowing US companies to trade more freely with international partners (for example, Trump wants to see Apple’s iPhone manufactured in the US, despite daunting economical headwinds). Generally speaking, international trade can increase productivity and efficiency by allowing each partner to focus on what they’re best at, and then allowing trade so each partner can obtain what it needs. Policies restricting international trade could particularly impact Microsoft considering “as of June 30, 2016, Microsoft employed approximately 114,000 people on a full-time basis, 63,000 in the U.S. and 51,000 internationally; and also according to Microsoft “Our international operations provide a significant portion of our total revenue…”) (2016 Microsoft Annual Report). Overall, Trump may be able to create some new US jobs with his pro-growth agenda, but if he restricts free trade and HB1 visas he could significantly hurt Microsoft in particular.

2. Lowering Corporate Tax Rates:

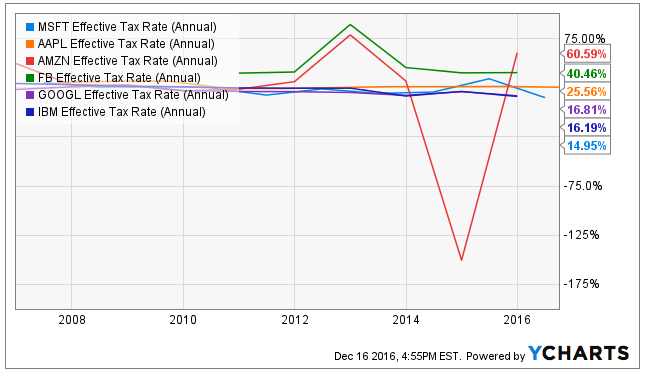

With regards to lowering corporate tax rates (another one of Trump’s consistent themes), this is a no-brainer (in a good way) for US business, but it may help Microsoft less than some of its peers given its already relatively low effective tax rate as shown in the following chart.

The theory is that by lowering taxes on corporations, it will make them more competitive internationally. It will also, in theory, prevent companies from relocating to other countries with lower tax rates and taking away US jobs when they relocate. However, as the above chart shows, Microsoft already has a lower effective tax rate than many of its peers. Lower corporate tax rates could help Microsoft on the margin, but competitively less so than its peers. Arguably, Trump could spur the overall economy by lowering tax rates across all market sectors which would eventually trickle down to Microsoft, but in the immediate term a lower corporate tax policy is likely to help Microsoft less than other companies.

3. Raising Interest Rates:

The Fed sets interest rates, not the President, but Trump’s aggressive growth agenda could speed up the economy resulting in the Fed acting sooner to raise rates faster and this could actually help Microsoft given its large cash balance that currently earns very low interest (i.e. higher interest rates mean Microsoft could earn a higher rate of return on its cash). And granted, much of the $137 billion in cash on Microsoft’s balance sheet is overseas, but in theory the US can lead interest rates around the world higher if it’s successfully able to accelerate growth.

4. Repatriating Non-US Cash:

As the following chart shows, Microsoft has a very large amount of foreign cash. And given the currently high tax rates to repatriate this cash, companies aren’t doing it.

If the Trump Administration were to orchestrate a tax deal whereby companies could pay less tax then they’d likely be willing to bring that cash back to the US. This would be a “win-win” in the sense that the lower tax rate would allow companies to bring the cash back to the US and create more US growth and US profits, while still allowing the government to collect some revenue from the lower taxation rate on the repatriation. This is a potential Trump policy that actually makes sense and could benefit Microsoft.

International Trade:

Donald Trump has expressed a combative attitude towards international trading partners. For example, he is not happy with China, and according to his website, he wants to:

- “...label China a currency manipulator.”

- “…bring trade cases against China, both in this country and at the WTO. China's unfair subsidy behavior is prohibited by the terms of its entrance to the WTO.”

- "Use every lawful presidential power to remedy trade disputes if China does not stop its illegal activities, including its theft of American trade secrets - including the application of tariffs consistent with Section 201 and 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962.”

However, if Trump starts a trade war with China, China has the ability (and a track record) to inflict pain on US companies. For example, during the early 2000s, China openly allowed pirated copies of Microsoft Windows to be sold in most big cities for only around $1 (clearly this was not good for Microsoft). And it would be easy for China to allow similar cases going forward if Trump takes any aggressive actions. As another example, China is already flooding US markets with too much steel and aluminum which is keeping prices artificially low and hurting US producers. As yet another example, China has a reputation for manipulating its currency thereby making its exports very inexpensive.

If Trumps starts a trade war with China (he did threaten a 45% tariff during his campaign), or any other country for that matter, it could end badly for all US companies, especially those with significant non-US business, such as Microsoft (e.g. Microsoft has 51,000 international employees, and international operations provide a significant portion of Microsoft’s total revenue).

Conclusion:

Things could end badly for a lot of tech companies, especially Microsoft, if the new administration follows through on some of its aggressive policy ideas, particularly with regards to international trade. However, despite the policy-related risks, we’ve still ranked Microsoft #7 on our list of Top 7 Tech Stocks Worth Considering because we suspect cooler minds will prevail, thereby making Microsoft attractive because of its strong evolving business, above average dividend yield, and continued upside potential.