In this week's Weekly, we review our top 4 Tech Stocks worth considering. We own shares of all four of the top 4 (we own three in our diversified Blue Harbinger Disciplined Growth strategy, and one in our diversified Blue Harbinger Income Equity strategy). Tech stocks have been beat up since the November election. Without further ado, here is the list...

5. Apple (AAPL)

It’s still not too late to consider Apple as it transitions from an aggressive growth company to a value play (Warren Buffett’s Berkshire Hathaway is a large shareholder now). Apple has so much cash, an attractive dividend, continued growth potential, and an impressive long-term revenue stream. What’s not to like?...

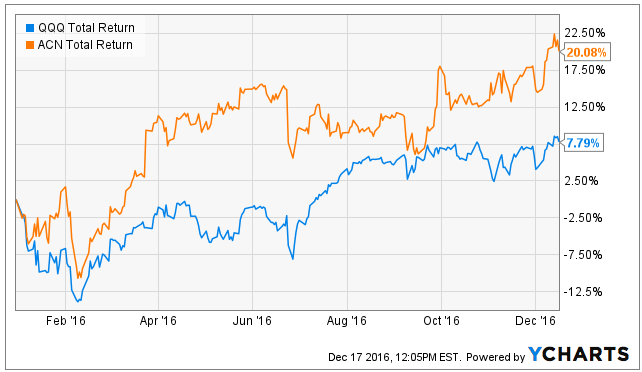

4. Accenture (ACN)

Accenture has more room to run. This is not a company about any particular leader or product. It’s about a persisting culture of innovation and change driven by smart hard-working open-minded people around the world. Accenture has no debt, a decent dividend yield (2%), and a backlog of business and continued long-term growth potential. We own Accenture in our Disciplined Growth portfolio.

3. International Business Machines (IBM)

We know, everyone likes to decry IBM as a dying innovation-less behemoth, but the reality is this company has an amazing competitive advantage with its enormous (albeit slowly shrinking) legacy business that enables it to interact with customers and generate new business. Plus, IBM’s nuanced hybrid cloud and cloud services business is growing. IBM was late to the cloud dock, but certainly did not miss the boat. This stock has a big dividend and it is clearly undervalued in our view. We own IBM in our Blue Harbinger Income Equity portfolio.

2. Paylocity (PCTY)

This incredible revenue growth machine is volatile, and the high volatility is creating a very attractive entry point right now. The company offers cloud-based payroll and human-capital management software services for mid-sized companies. It’s spending very heavily to grow now, but eventually it will get acquired (at a huge premium) or it will reach a point where the heavy spending on growth stops, and Paylocity turns into an amazing cash cow. We own this one in our Blue Harbinger Disciplined Growth portfolio.

1. Facebook (FB)

Facebook has received some bad press lately with regards to fears of slowing growth, fake news, and unfriendly shareholder voting rights which have resulted in lawsuits. In our view, this has created a great buying opportunity (the price is down recently) for a company with unparalleled user information that can be used to customize advertisements in a way that makes advertisers happily open up their pocketbooks and spend heavily. These shares are going way up over the long-term. We own Facebook in our Blue Harbinger Disciplined Growth portfolio.