This week’s members-only investment idea is a small cap Software as a Service (SaaS) company with very significant price appreciation potential. The stock fell after the November election, but for all the wrong reasons. The stock price still hasn’t recovered yet, and we believe it has big upside potential in 2017 and beyond because it offers a better product with little competition and a very big total addressable market. This stock has room to run!

Thesis:

The stock we are talking about is Ellie Mae (ELLI). Ellie Mae is a provider of on-demand software solutions and services for the residential mortgage industry in the United States. Ellie Mae has been growing rapidly, and is projected to continue to rapidly grow per analyst earnings and growth estimates. The shares declined sharply in the days following the November election, and they have not rebounded. The declines were likely due to fears of more rapidly increasing interest rates slowing the retail mortgage industry. However, the business is not likely to experience another housing crisis (or anything like it) for the next generation. Further, less regulation from the new administration may actually create more opportunities and profits for Ellie Mae. Additionally, Ellie Mae may be an attractive buyout target because of its rapid growth trajectory, small market capitalization, and zero debt (if it gets acquired it would likely be at a big healthy premium for shareholders). Ellie May has experienced recent volatility (thus the buying opportunity), and it has room for multiple expansion relative to its own recent history. Its price could also go much higher, especially after the recent pullback.

About Ellie Mae:

Ellie Mae is a provider of on-demand software solutions and services for the residential mortgage industry in the United States. The Company's Encompass all-in-one mortgage management solution provides one system of record that allows banks, credit unions, and mortgage lenders to originate and fund mortgages and improve compliance, loan quality, and efficiency.

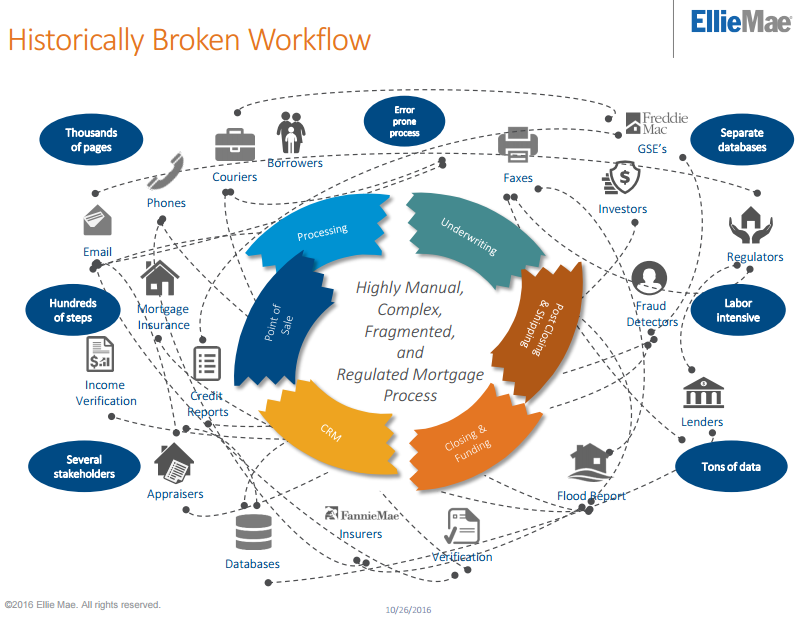

Its Encompass software is an enterprise solution that handles functions involved in running the business of originating mortgages, including customer relationship management; loan processing; underwriting; preparation of application, disclosure and closing documents; funding and closing the loan for the borrower; compliance with regulatory and investor requirements, and overall enterprise management that provides one system of record. It delivers Encompass software in an on-demand Software-as-a-Service (SaaS).

Large Addressable Market:

There is a large addressable market, and Ellie Mae is only 25% of it, but growing. Ellie Mae’s vision is that the mortgage origination process will be completely automated and Ellie Mae will be the automation infrastructure for the entire industry. The industry is highly fragmented (the competition is mostly banks), and Ellie Mae is the largest player and offers a better “Software as a Service” solution.

Residential Mortgage Market Cycle:

The residential mortgage market has continued to recover since the financial crisis, and Ellie Mae has benefited. The company IPO’d in 2011, and has climbed in price significantly since that time as it has benefited from the market cycle rebound. There are concerns the market may be slowing after its long rebound and after the November election whereby interest rates may rise faster than previously expected thereby making loans on residential properties more expensive. However, we believe the market won’t experience anything remotely similar to the housing crisis for at least a generation (let’s hope) and that bodes well for Ellie Mae’s business. In particular, Ellie Mae has built a “sticky” business that should continue to retain customers and grow market share regardless of the residential mortgage market cycle. And further, we expect the residential mortgage market to continue to growth at a normal healthy rate which will benefit Ellie Mae.

Capital Allocation:

Ellie Mae has been issuing some equity to fund its growth (Ellie Mae has zero long-term debt). Ellie Mae does not pay a dividend. Ellie Mae currently has a large amount of cash on its balance sheet ($388 million). According to the company’s Q3 earnings call transcript: “our cash and investments finished the quarter at $432 million, up $299 million from the prior quarter and includes net proceeds of approximately $271 million from the August follow-on offering.”

Long-Term Competitive Advantages:

For starters, Ellie Mae is the large player in a highly fragmented market as shown in the following chart.

This gives the company scale and brand recognition. Ellie Mae also offers a better, more-organized, solution (Encompass) in a highly fragmented market as shown in the next two charts.

Ellie Mae’s better solution also gives the company some pricing-power, and they have room to increase revenues per loan as shown in the following graphic.

Additionally, there is a large addressable market which gives Ellie Mae room for continued significant growth as shown in the following graphic.

Further, if the incoming administration reduces regulations (as promised during the campaign) then this increases Ellie Mae’s opportunities and profit potential considering regulations are currently very onerous ad expensive.

Additionally, Ellie Mae’s better solution is “sticky” (i.e. it helps retain customers). Specifically, the industry is complex (particularly with regards to evolving regulation), and Ellie Mae offers expertise that competitors do not.

Earnings Growth:

Ellie Mae is expected to experience continued strong growth. For reference, third quarter 2016 growth highlights include:

• Revenue of $100.4 million, up 46% from $68.9 million in Q3 2015

• Net income of $13.8 million, up 121% from $6.2 million in Q3 2015

• Adjusted EBITDA of $37.1 million, up 83% from $20.3 million in Q3 2015

• 12,800 Encompass seats booked

• Revenue per average active Encompass® user of $640, up 23% from $520 in Q3 2015

Also, the 10 analysts surveyed on Yahoo Finance expect earnings to grow at 24.5% annual for the next 5 years.

Additionally, Ellie Mae has been able to grow with acquisitions, and expect to continue to do so. Specificially,t he industry is highly fragmented, and ELLI believes there are strategic opportunities available to acquire software companies that offer mortgage origination functionality that will complement and increase the attractiveness of existing solutions. For example, in October 2015, ELLI acquired substantially all the assets of Mortgage Returns, LLC, or Mortgage Returns, a provider of on-demand customer relationship management and marketing automation solutions for mortgage lenders. In October 2014, ELLI acquired substantially all the assets of Mortgage Resource Center, Inc., dba AllRegs, a provider of research and reference, education, documentation, and data and analytics products relating to the mortgage industry. The assets that ELLI acquired from AllRegs allow the company to strengthen its products through product integration and introduce new products related to training, compliance management systems, and loan product eligibility.

And according to the Q3 earnings call:

“We also get to see a lot of the opportunities, the potential assets that are available out there. And so we raise the money [the large balance sheet cash value from the recent equity offering] so that we can be opportunistic."

"At the same time, we've been very disciplined in doing acquisitions over the last six or seven years as we've done six or seven acquisitions. And we're going to have that same level of discipline. So although we have the money ready to act, we're not going to do anything foolishly and let it burn a hole in our pockets. There's a lot of activity in our pipeline. Ultimately, it's finding the right asset with the right team at the right price and making something happen.”

Continued growth via acquisitions is feasible given the large total addressable market size ($6.25 billion according to Ellie Mae’s Q3 earnings presentation), and the fact that the market is currently highly fragmented.

Buyout Target:

Also worth considering, Ellie Mae may eventually become a buyout target whereby a larger company would purchase all outstanding shares, and existing shareholders would likely be rewarded with a very healthy premium price. Specifically, Ellie Mae is an attractive buyout target because of its rapid growth trajectory, small market capitalization, and zero debt. Plus less industry regulations under the new administration could result in increased mergers and acquisitions, particularly from large financial organization which have been under the microscope and heavy regulations from the current

Price-to-Earnings Considerations:

Per the following chart, Ellie Mae’s P/E has declined recently. Its forward P/E has also come down. Both are still very high as analysts expect continued growth, however they can both still expand.

Risks:

Ellie Mae also faces risks that are worth considering. For example, industry regulation is a constant challenge. Even though we expect regulations may be reduced under the incoming administration, there are still risks. Any unexpected regulation changes can be costly. In fact, it is challenging regulation that have lead many customers to Ellie Mae (they need Ellie Mae’s help in navigating the regulatory risks) but Ellie Mae itself is not immune from significant risks and new challenges from changing regulations.

New competition is another risk for Ellie Mae, and it could come from new or existing sources. For example, if the regulatory environment becomes more friendly then this could encourage banks to compete more head on with Ellie Mae, and banks are much bigger and have much more financial wherewithal. Additionally, new entrants altogether could enter the marketplace if regulations are reduced enough to make entry more attractive.

Higher Interests rates are another risk. Specifically, if the new administration pressures interest rates higher faster with its pro-growth agenda, then this could slow the residential mortgage industry (because it would be more expensive to finance mortgage loans) and this could this could slow Ellie Mae’s rate of growth.

Another risk is Ellie Mae’s current large cash balance. Elli Mae raised significant cash recently though an equity offering, and if they are unable to find attractive acquisition targets to spend that cash on, then the cash could just sit on the balance sheet, and become a drag on earnings.

Conclusion:

Ellie Mae is worth considering for long-term growth investors. Its price has recently fallen somewhat dramatically, and we believe it fell for the wrong reasons. We believe the company continues to have large growth potential ahead, and the shares could rise dramatically over the next year. We don’t currently own shares of Ellie Mae, but it is on our radar and our watch list.