Stag Industrial (STAG) is a highly-diversified, well-managed, Real Estate Investment Trust (REIT) with a high 7.6% dividend yield. However, it is still a higher risk than many of its industrial REIT peers because of its secondary and tertiary properties, its high growth goals, and its high dividend payout ratio. We believe the company’s biggest risk is macroeconomic in nature, as a significant economic downturn would likely impact Stag more severely than its peers. Additionally, REITs in general face risk from rising interest rates, but they can also add important diversification to a nest egg. Barring a severe economic downturn, we believe Stag’s growing dividend is safe, and we expect the stock to deliver superior total returns.

About Stag:

Stag Industrial is a well-diversified REIT focused on the acquisition and operation of single-tenant industrial properties throughout the United States. The Company owns 281 buildings in 37 states with approximately 52 million rentable square feet, consisting of mostly warehouse/distribution buildings, a variety of light manufacturing buildings and some flex/office buildings (Investor Presentation, p.5). Stag is more geographically diversified than many of its industrial REIT peers.

Stag’s business model and investment thesis is basically that single tenant properties are often priced too low because of the binary risk of cash flows. Stag believes they can acquire single tenant properties for low prices and then greatly improve the risk profile by holding a diversified portfolio of them (2014 Annual Report, p.5).

Recent Market Performance and Outlook:

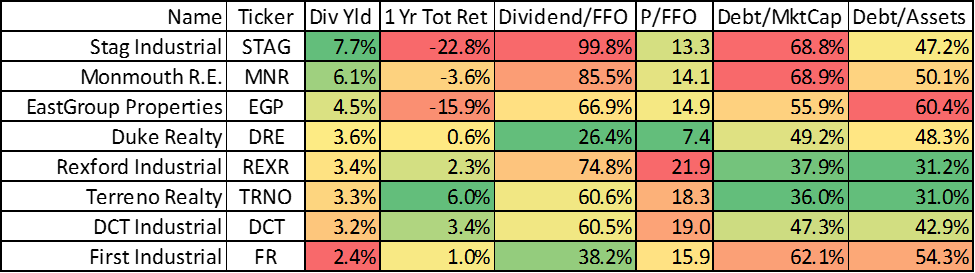

Stag’s dividend yield has recently climbed to an impressive 7.6% as the stock has fallen nearly 30% over the last year. For some perspective, the following table shows the dividend yield and 1-year performance of several of Stag’s Industrial REIT peers:

For additional perspective, the following table shows the recent performance of various REIT subsectors:

As the table shows, industrial REITs (such as Stag) have lagged other sub-classes significantly such as residential and self-storage over the last year. However, many real estate professionals believe industrial REITs present an attractive investment opportunity right now. Supporting this notion, is the most recent SIOR Commercial Real Estate Index reading (the SIOR Commercial Real Estate Index (CREI) is an attitudinal survey of local markets completed by commercial real estate market experts (SIOR members)) The survey is conducted quarterly and helps measure the state of the commercial real estate market for the United States). According to the index, market conditions are currently very strong for industrial real estate (values significantly higher than 100 indicate strong market conditions):

source: SIOR

A variety of factors have contributed to Stag’s recent underperformance including its negative net income (even though FFO is still positive, more on this later) as well as a slowing overall US economy. Stag’s business model is based on aggressive growth, and the company’s ability to achieve that growth is being questioned by some investors as the US economy has slowed. Specifically, Stag’s performance is highly correlated with the US market, and it may be more impacted by the Fed’s less stimulative monetary policy than other industrial REITS (more on this later).

Additionally, Stag’s focus on secondary and tertiary markets makes it more susceptible to macroeconomic headwinds than some of its peers that are focused on primary markets. For reference, here is a breakdown of Stag’s portfolio:

Based on a variety of valuation metrics (see below) it is unlikely that Stag will run into a situation where they’d need to cut their dividend (cutting the dividend is horrible for the stock price and for income investors that rely on Stag’s dividend checks). However, in highly stressed market situations, Stag may be more susceptible to the risk of a dividend cut than many of its industrial REIT peers. Specifically, a severe economic downturn could cause Stag’s occupancy rates to fall (Stag’s 4.1 year weighted average lease term is shorter than peers) (Investor Presentation, p.5), this could cause the value of Stag’s properties to decline (secondary and tertiary markets can be riskier), Stag would likely not achieve its growth goals (remember Stag is counting on more growth than many of its peers), and ultimately may run into a cash crunch requiring a dividend cut (Stag’s above average dividend payout ratio adds risk relative to peers). We view the likelihood of a Stag dividend cut to be remote, but it is still more likely for Stag than many of its peers. Below, we highlight a variety of valuation and risk metrics to lend support to our views.

Valuation and Risk Metrics:

The following table highlights a variety of valuation and risk metrics for Stag relative to its peers:

source: Google Finance

Dividend-to-FFO Ratio:

One thing that stands out upon looking at this table (beside the fact that the REITs with the highest dividend yields also performed the worst over the last year) is the high “Dividend to FFO” ratio for Stag. FFO stands for “Funds from Operations” and it is a common measure for analyzing REITs. Traditional valuation metrics such as price-to-earnings can be misleading for REITs because of REIT’s very high depreciation expense as well as any gains on sales of properties. FFO generally makes more sense for analyzing REITs, and it is calculated by adding depreciation/amortization back to net income and subtracting any gains on sales of assets. FFO is a more pure way to look at a REIT’s operations.

In the case of Stag’s high Dividend-to-FFO ratio, it suggests the company is paying out a very high portion of its funds from operations as dividends. At first glance this may seem alarming (because theoretically they’re generating just enough funds from operations to pay the dividend), but the ratio isn’t as worrisome when you consider the firm’s growth. Stag has been growing Core FFO at a rate of 9% per year since its IPO in 2011 (per share Core FFO grew 8.3% in the most recent quarter, and the firm believes it can continue to grow in the future. As an example of growth opportunity, the company cites their less than 1% market share of what they believe to be a $250 billion target market (i.e. they believe they still have lots of room to grow). Additionally, the firm’s AFFO (Adjusted Funds from Operations) dividend payout ratio is only 86.3% (AFFO excludes property acquisition costs, lease termination income, intangible amortization in rental income, consulting services fees and non-recurring other expenses. AFFO also excludes non-rental property depreciation and amortization, straight-line rent adjustments, non-cash portion of interest expense, non-cash compensation expense and deducts recurring capital expenditures and lease renewal commissions and tenant improvements) (third quarter results). And for reference, Stag’s AFFO is down from over 90% in previous quarters. Further, Stag has sufficient liquidity and cash flow coverage.

Price-to-FFO Ratio:

On a price-to-FFO basis, Stag looks relatively inexpensive to peers as the ratio has been pressured downward by Stag’s declining stock price. However, this “buy low” opportunity does not come without risk. The decline also represents increased risk of the “bad case scenario” whereby a dramatic slowdown in the economy could stifle growth and potentially cause Stag to lack the cash to maintain its dividend. However, we believe Stag is a well-run business, and the likelihood of a severe economic downturn is remote. And as mentioned previously, we have additional comfort from the positive outlook for industrial real estate in general, per the recent SIOR commercial real estate index reading.

Debt Ratios and Ratings:

When compared to peers, Stag’s debt ratios are not overly alarming. For example, Stag has a lower debt-to-assets ratio (47.2%) than many of its peers. Stag’s debt-to-market cap ratio (68.8%) is less compelling than many of its peers, however this is largely the result of the stock’s declining market price and not an increase in debt. Worth remembering, the value of Stag’s assets could change dramatically in high-stress market conditions such as those of the 2007-2009 financial crisisFor example, the value of Stag’s properties could decrease dramatically and quickly creating problems for cash flows and debt ratios. However (as noted in the table above), Stag’s credit rating is investment grade, BBB, with a stable outlook. And this is a similar rating to several of its peers, and suggests an “investment grade” level of confidence from the rating agency.

Cap Rate:

In a recent investor presentation, Stag makes the argument for long-term cap rate compression, suggesting they believe their share price is undervalued (see table below).

Cap rate (Net operating income / current market value (sales price)) is a commonly used real estate valuation metric. And while we agree Stag’s cap rate could easily come down if the value of the properties increase, it could also easily go up in a distressed market thus creating problems for the company. Worth noting, Stag’s cap rate is higher than industry peers largely because Stag’s secondary and tertiary property portfolio is higher risk. Barring an extreme economic downturn, Stag should experience higher returns than its peers.

REITs and Interest Rates:

Stag has benefitted from low interest rates since its initial public offering in 2011. Low interest rates have allowed Stag to access capital and deploy it on an attractive “spread investing” basis (annual report, p.45). Additionally, low interest rates have driven many “yield hungry” investors away from traditional fixed income investments (because rates have been so low) and into high dividend stocks (such as REITs). And while it is likely the US Federal Reserve will continue to raise rates in the future, they will likely raise them at a slow pace, and rates will remain relatively low for years. And as we mentioned earlier, real estate professionals have a particularly strong outlook for the future of industrial REITs in general.

Additionally, REITs add important diversification to an investment portfolio. REIT tend to be less correlated with the rest of the stock market, and the dividend payments help reduce volatility. As the following chart shows, these characteristics make REITs an important diversifier and risk reducer within the context of a larger investment portfolio.

Conclusion:

Barring a significant economic downturn (whereby Stag would likely be negatively impacted more so than its peers), we believe Stag Industrial will deliver superior returns. Not only is Stag’s large dividend safe, but its price appreciation opportunity is higher than peers due to its growth oriented strategy and the positive outlook for industrial real estate. Further, the stock’s recent price decline provides some margin of safety for investors willing to tolerate Stag’s single-tenant, secondary-tertiary, high-growth, investment strategy.