Caterpillar (CAT) stock has fallen 36% since July of 2014, and it has a large 4.3% dividend yield. Additionally, the company has plenty of cash to continue its track record of dividend increases, and the stock also offers significant opportunity for capital appreciation. Despite dramatic declines in Caterpillar’s mining business, significant weakness in energy, a strong US dollar, and a declining outlook from management, CAT is still worth more than its current market price. Further, the company has ample financial wherewithal to weather intermediate-term challenges, and we believe Caterpillar will eventually revert to moderate growth making now an exceptional buying opportunity for long-term dividend investors as well as those seeking capital appreciation.

Why has Caterpillar’s stock price declined?

CAT’s stock price has declined because of sharp declines in revenues and future revenue forecasts. Specifically, CAT management expects total sales and revenues for 2015 to be $48 billion. This is down from $55 billion in 2014 and $66 billion in 2012. Further, management expects sales and revenues to decline another 5% in 2016 (Q3 Earnings Release).

The following chart and table estimates the breakdown of the full-year 2015 $48 billion guidance from management based on trending sales volumes across business segments and regions. For reference, we’ve also included 2014 actuals.

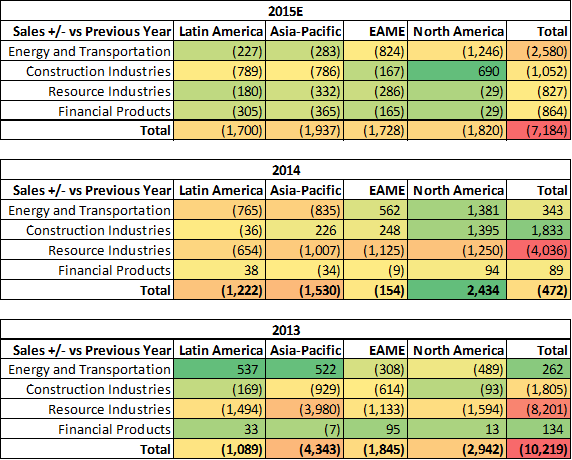

As the above table shows, “Energy and Transportation” and “Construction Industries” are the two largest business segments (by revenue) for CAT. However, as recently as 2012, “Resource Industries” contributed over $21 billion in annual sales and revenues. For further context, the following tables show the increase/decrease (sales in dollars) for each business segment and region since 2012.

CAT Annual Reports, 2012-2014

The table shows the dramatic decline in “Resource Industries” since 2012. This is the segment of CAT’s business that builds and supports machinery for the mining industry. The mining industry has been decimated in recent years as demand and prices have significantly declined. For example, the SPDR S&P Metals and Mining ETF (XME) has declined over 70% in the last five years.

Caterpillar’s “Energy and Transportation” business segment has also declined in 2015 and is expected to decline further in 2016. According to the company’s third quarter earnings release: “Energy & Transportation’s sales are expected to be down 5 to 10 percent [in 2016] as a result of continuing weakness in oil and gas coupled with a weaker order backlog than in 2015.” For reference, Energy & Transportation supports customers in oil & gas, power generation, marine, rail and industrial applications.

In addition to challenges across business segments, CAT has also been negatively impacted by the strong US dollar. For example, in the most recent third quarter 2015, currency detracted $466 million from sales versus the third quarter of 2014. (Q3 Earnings Release, p.5) This is significant considering net income for Q3 2015 was only $368 million.

What is Caterpillar Worth? (Bear Case Valuation):

Our bear case valuation uses a discounted cash flow (DCF) model and forward price-to-earnings (PE) estimates. Our DCF model assumes cash from operations shrinks by 25% in 2015 (versus 2014), and then shrinks by another 5% in 2016, and then finally remains flat thereafter. The 25% decline in 2015 is based on current market conditions and declines through the first nine months of the year. We assume capital expenditures decline by 5% this year and next year, and then remain flat thereafter. We also assume a weighted average cost of capital (WACC) of 5.98% and we assume a zero percent growth rate after 2016. In this scenario, Caterpillar is worth around $77 per share (more than its current stock price):

Using PE multiples as a second check, Caterpillar’s stock currently trades at about 15.54 times management’s 2015 earnings guidance (excluding restructuring costs). This is consistent with year-end 2014 when the ratio was 15.58. For reference, the following chart provides recent history of CAT’s price-to-earnings ratio, and 15.54 is not dissimilar from the recent past.

We exclude restructuring costs (because they are not permanent) but we also exclude the eventual benefits of restructuring (which management expects will be around $1.5 billion per year when restructuring is complete in 2018, Q3 earnings release, p.1).

For 2016, management hasn’t yet provided earnings guidance, but they expect sales to decline another 5%. Assuming the same 5.6% profit margin that management provides for 2015 implies earnings of $4.47 per share (excluding restructuring costs) in 2016. And applying the same 15.54 multiple gives us a price per share value of $69 (which is not dissimilar to the current stock price). However, this methodology ignores the full benefits the company will achieve when restructuring is complete. If we apply the full $1.5 billion in expected future savings, then EPS rises to $4.61 per share, and the stock is worth $72 per share (slightly above its current market price). However, this valuation still ignores the likelihood that Caterpillar will eventually return to growth at some point in the future. Averaging our DCF and PE valuations gives CAT an overall a bear case valuation of around $74 per share, which is slightly above its current market price. And remember, this bear valuation assume CAT declines significantly through 2016, and then never grows again thereafter.

What is Caterpillar Worth? (Bull Case Valuation):

Our bull case scenario DCF model makes the same assumptions as the bear case, except we assume a 2% growth rate after 2016. Two percent is not unreasonable considering the company may stabilize after the large business declines in 2013 – 2016, and begin to grow at a rate consistent with the overall economy. Said differently, there is likely a floor to CAT’s sales declines which we expect the company to approach in 2016. Using these assumptions gives CAT a value of around $116 per share. And realistically, we may see growth higher than 2% for a variety of economic reasons that would result in a value for CAT that is even higher than $116 per share.

Our bull case price-to-earnings assumes the company eventually completes its restructuring and market conditions result in profit margins returning to historically higher levels of around 7%. A 7% profit margin applied to $45.6 billion in sales equals $5.48 in earnings per share. Applying a 15.5 multiple gives CAT a value of around $85 per share. Realistically, sales could be dramatically higher than $45.6 billion if the international resources business picks back up or if US Energy and Transportation increases. As recently as 2012, CAT had revenues of $66 billion, and applying a 7% profit margin and a 15.5 multiple gives the stock a value of over $122 per share. Averaging our DCF and PE valuations gives CAT a bull case value in excess of $100 per share with the potential to climb even more significantly higher.

Is Caterpillar’s Dividend Safe?

Even in our bear case scenario, Caterpillar’s dividend is very safe. CAT generates an enormous amount of free cash flow, and it has over $6 billion of cash and short term investments on its balance sheet. For perspective, CAT paid $1.3 billion in dividends through the first nine months of this year, and has generated $2.7 billion of free cash flow. This means CAT generates plenty of cash to cover the dividend, and they have ample cushion to keep paying (and increasing) the dividend in the future. Worth noting, CAT has increased its dividend 83% since 2009 (Q3 Earnings Release, p.1), and we believe the company has the wherewithal to continue this trend.

Are Caterpillar’s Share Repurchases Prudent?

Given its extra cash, Caterpillar has accelerated the repurchase of its own shares in 2013-2015. For example, the company’s net issuance of shares was positive in 2011 and 2012 ($123 million and $52 million, respectively), but in 2013 they retired (bought back) nearly $1.9 billion, in 2014 they bought back nearly $4 billion, and through the first nine months of 2015 they’ve bought back almost $2 billion. As we’ve written before, public companies have accelerated share repurchases in recent years, and the value of the repurchases is hotly debated by investors. In the case of Caterpillar, we believe the shares are currently undervalued (based on our valuation above), and the share repurchases are prudent and value adding.

Is Caterpillar’s Debt Appropriate?

Caterpillar’s debt load is reasonable, and it is unlikely to hamper the company in the future. For example, the company’s debt-to-assets ratio is a manageable 47.5%. This allows Caterpillar to lever returns for shareholders, and realize tax advantages based on its estimated annual tax rate of 27%, without unnecessarily increasing its risk. For reference, CAT’s debt ratio is lower than its competitor, Deere (Deere has a high 63.6% debt ratio, which may create higher capital costs and increase risk for that company). Additionally, Caterpillar has the ability to retire debt if needed based on its strong cash position.

Is now a good time to buy value stocks with high dividends?

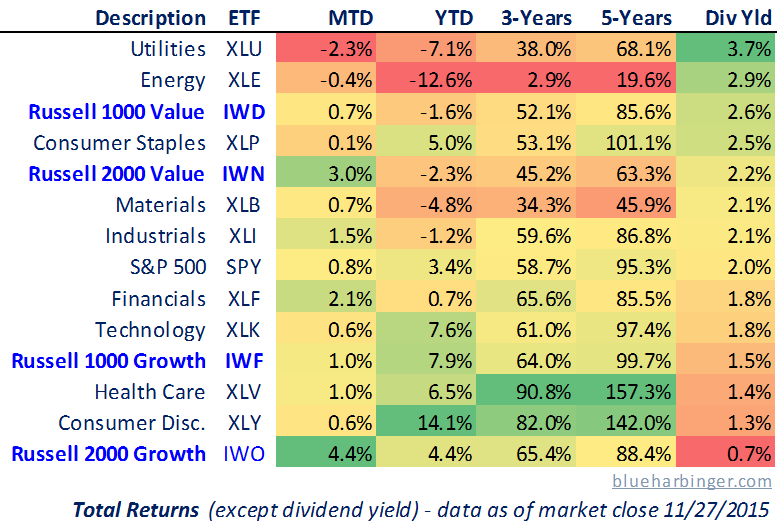

Some investors make the case that it is always a good time to buy value stocks with high dividends. However, given current market conditions, we believe now is a particularly good time to buy value stocks with high dividends (such as Caterpillar). There is a long history of mean reversion in the stock market (recent examples include REITs under-performing by a lot in 2013 and then out-performing by a lot in 2014, and aggressive growth stock Amazon under-performing by a lot in 2014 and now outperforming by a lot in 2015). And recent performance suggests high dividend value stocks are increasingly due for better relative performance. The following chart shows the recent returns of various equity styles and allocations.

Large cap value stocks (such as Caterpillar) as represented by the Russell 1000 Value index have underperformed in recent periods. This is largely due to the accommodative monetary policies of the US Federal Reserve which have favored growth stocks. However, the Fed is widely expected to turn more hawkish in the near future, and this may favor value stocks on a relative basis. Of course predicting the exact timing and speed of the Fed’s policy shift is impossible, but the odds are increasingly favoring value stocks. Additionally, the above chart also suggests dividend stocks are due for better relative performance. For example, the highest dividend yield sectors in the above chart have been the worst performers. And even if the Fed does begin slowly raising interest rates (which is bad for bond prices in general) it will still take years before US treasury yields can compete with attractive dividend yields, especially considering the capital appreciation opportunities of high dividend yield stocks like Caterpillar.

Conclusion:

We like Caterpillar. Its dividend is big, safe and growing. Management is appropriately allocating the company’s ample free cash flow and maintaining an appropriate level of debt. Additionally, Caterpillar’s stock offers considerable opportunity for capital appreciation. Even if Caterpillar’s business shrinks significantly over the next two years and then never grows again, it is still worth more than its current stock price. However, we believe the market is too bearish and too shortsighted in its view of Caterpillar. Rather than never growing again, we believe the company will eventually revert to moderate growth and the stock will be worth dramatically more than its current market price.