Who really benefits when companies buy back their own shares? Contrary to popular narratives, it's not usually the shareholders or the highly incentivized C-suite executives. It's the Wall Street bankers that orchestrate them.

Source: WSJ

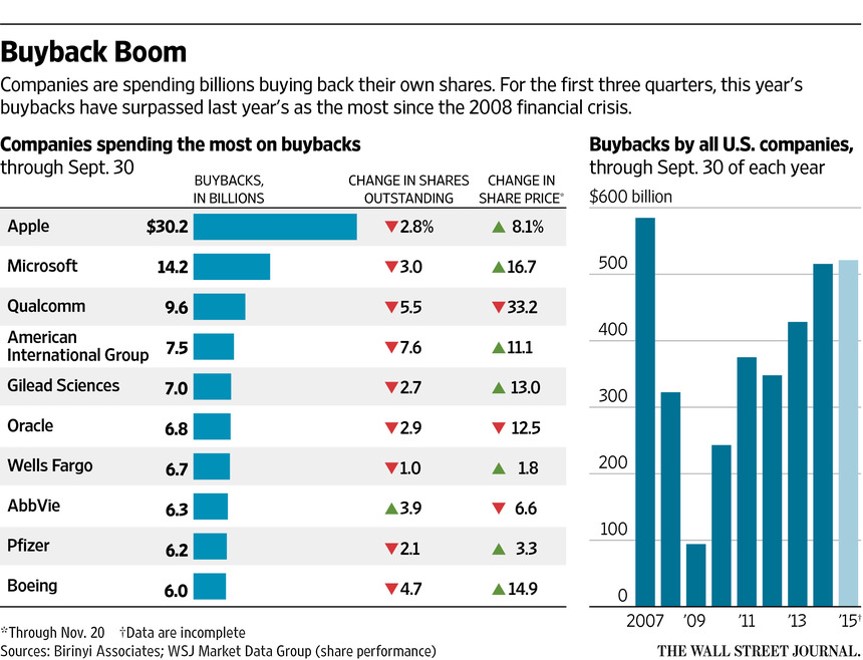

The companies on the left side of this chart will tell you that they're buying back shares because their stock price is too low, and they're doing shareholders a favor. However, the right side of the chart tells a quite different story. It shows that when the market was peaking in 2007 (before the financial crisis) companies were buying back lots of shares. But these companies were essentially proven wrong as the stock market crashed in 2008 and 2009. And were they buying back shares in 2009 and 2010 when the market really was cheap?... Nope. They were not. Precisely when they should have been buying back shares they were not, and when they should NOT have been buying back shares they were.

Don't worry though. You know who profits from these buybacks with essentially no risk. The Wall Street bankers that orchestrate them. Whether it's a penny for each share bough back or a big fee for "helping" these companies- Wall Street is making money. And don't worry because when share buybacks are no longer en vogue, Wall Street will find another way to make a lot of money.

We're not even going to get into the perverse incentives some corporate management teams have to engage in share buybacks (e.g. sometimes they have big bonuses tied to hitting short-term EPS numbers which can be easily manipulated (in the short-run) with some "well-timed" share buybacks).

In our view, most of the time share buybacks are just another fee that is ultimately paid by the investor. After companies spend cash on the share repurchase programs they have less cash left over for the stock holders. In reality, most share repurchase programs are just another expensive Wall Street fee similar to broker sales commissions, 12b-1 fees, unnecessary FX hedging programs, and those ridiculous mutual fund management fees. However, unlike all those other fees, it's a lot harder for you to avoid them because it's up to the corporate executives to wise up.