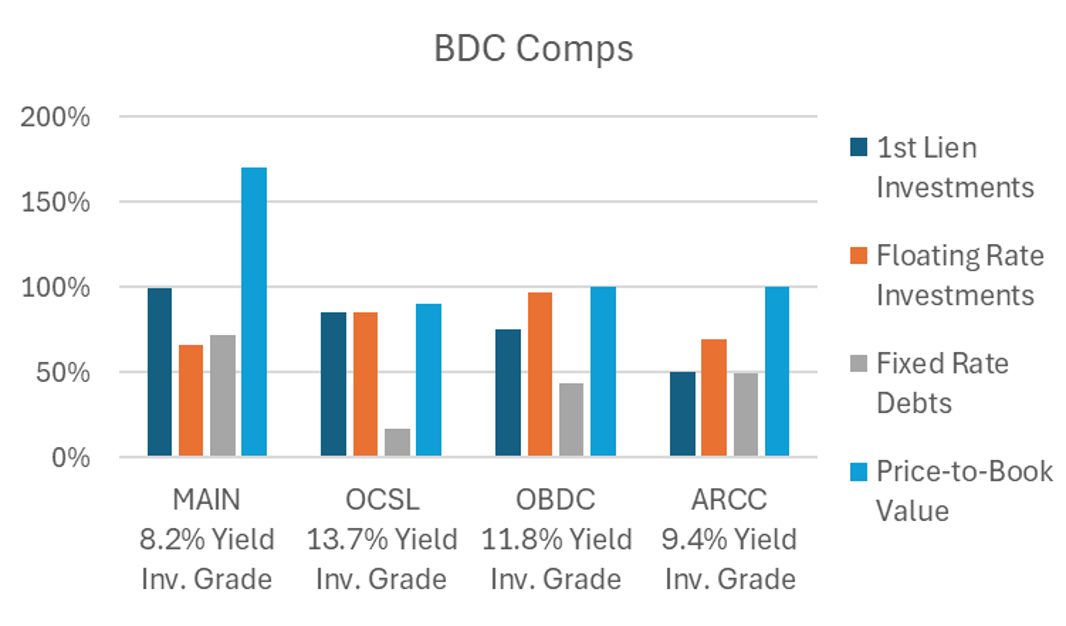

A lot of income-focused investors are attracted to BDCs for their large dividend yields. However, not all BDCs are created equally. In the following table you will see comparative data for top BDCs, including the percent of investments that have fixed-versus-floating rates, the percent of debt they have that is fixed-versus-floating rate, price-to-book value, current dividend yields and the percent of first lien loans they have made as investments.

The BDCs also differ in terms of market cap (ARCC and OBDC are the biggest), and types of loans (MAIN’s niche is lower middle market loans).

We curently own all four of these BDCs in our Blue Harbinger High Income NOW portfolio and have no intention off selling because we like the mix and the exposure to the space as part of our prudently diversified high-income portfolio.