We have added back shares of this “fallen angel” AI stock mainly because the risk-reward and valuation metrics appear very compelling, despite high uncertainty and high short sales.

SuperMicro Computer (SMCI) manufactures servers and other related hardware. The shares had been on fire over the last year because of its strong tie in with chip leader Nvidia and the craze over AI.

However, when the shares started to sell off, the sell off accelerated on a short-seller report (that got a lot of attention) and a delay to the release of the company’s financial statements.

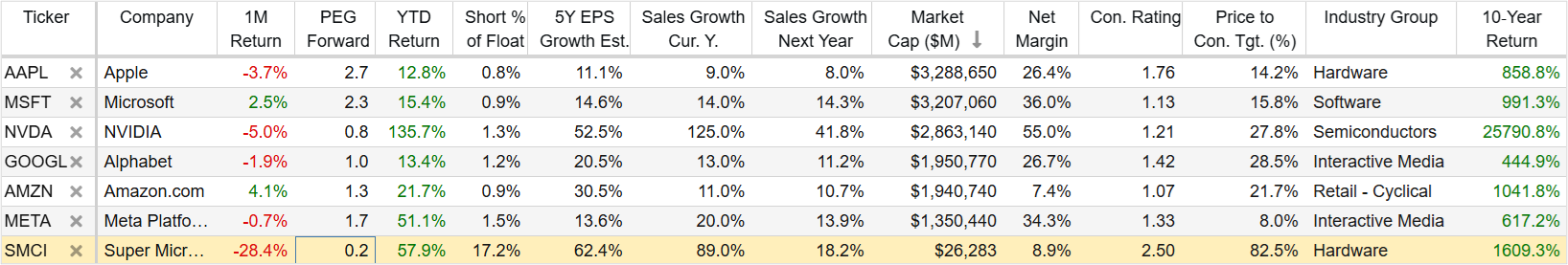

With a P/E ratio of 22.4x, and a forward P/E of only 10.2x, the shares are very compelling (especially considering the forward PEG is now only 0.2x).

This company is profitable and growing fast. Super Micro Computer is now ~1.81% of the Blue Harbinger Disciplined Growth Portfolio (and the tracker sheet will be updated soon to reflect the trade).

If you like to buy profitable high-growth businesses with a long runway for growth, SuperMicro is very attractive here. The share price could get worse before it gets better, but long term these shares appear poised to go MUCH higher. Long SMCI.