Business Development Companies (“BDCs”) are often an income-investor favorite because of their large dividend yields. And the Oaktree Specialty Lending (OCSL) BDC stands out for its 14.2% yield (which is larger than many peers). However, the higher yield comes with higher risks (for example, net investment income just barely matched the dividend last quarter and the 0.9x price-to-book value suggests the market may be beginning to price in a dividend cut—especially considering 85% of their investments are floating rate while they also have a signifcant amount of fixed rate debts of their own). In this report, we reveiw OCSL and conclude with our opinion on investing.

About Oaktree

Oaktree Specialty Lending provides financing (mainly first, and sometimes second, lien loans) across a variety of industries. OCSL is regulated as a BDC, under the Investment Company Act of 1940. And as a regulated investment company, OCSL is required to pay out over 90% of its profits to shareholders (that’s why BDC dividends are so big).

From a high-level, BDCs lend out the money on their balance sheet at a really high interest rate (in OCSL’s case, they have an 11.9% weighted average yield on debt investments, and they also magnify that a bit higher by using some leverage or borrowed money—their debt-to-equity ratio is 1.1x—so they have a little bit of borrowed money.

For a little more perspective, here is a look at OCSL’s investment portfolio (they currently have provided financing to 158 different companies).

First lien loans are safer than second lien loans, but they’re both secured by business assets (86% of OCSL’s loans are senior secured debt investments). And OCSL is diversified across market industries, with “Application Software” currently the biggest (see above).

For reference, OCSL loans to middle market companies (the average OCSL portfolio company’s EBITDA is $147 million). And also 85% of the loans are floating rate (a great thing in a rising interest rate environment).

The “No Dividend Cuts” Game

Companies that pay big dividends (such as Oaktree) know investors hate dividend cuts and therefore they are loath to reduce the dividend in any way. Not only does it hurt the managment’s pride (it suggests they have poor planning skills) but it also puts selling pressue on the share price as investors sell. For these reasons, management is pressured to play the “no dividend cuts” game whereby they say and do whatever they can to protect the dividend (even when it may not make the most economic sense in terms of protecting and growing long-term book value).

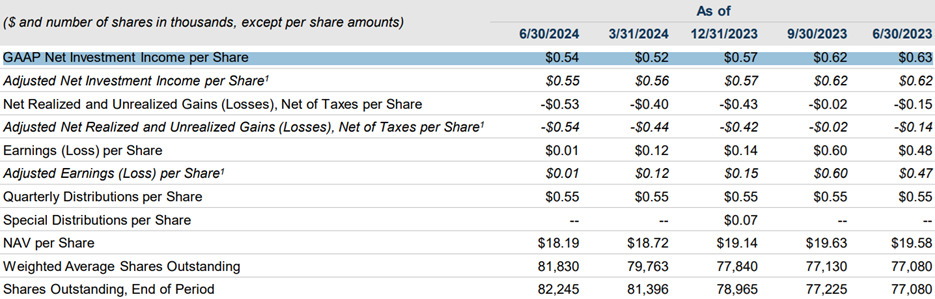

As you can see in the table below, last quarter Oaktee’s adjusted net investment income exactly matched its dividend payout (i.e. there is no dividend payout “cushion”).

And as you can see, NII has been trending lower, which has many investors concerned about dividend safety.

Price to Book Value Declining

Adding to concerns, Oaktree’s book value per share has been declining in recent quarters (see chart below). Book value is a basic valuation metric, and BDCs are sometimes said to be trading at a premium when price to book value is above one and at a discount when it is below one (although different BDCs have different “normal” price to book values). Oaktree’s price to book value has also been in decline.

Book value matters because it is the basis upon which a BDC is able to generate income (to pay dividends). And a declining book value per share is a red flag.

Management and the “No Dividend Cuts” game

Management attempted to assure investors of OCSL’s dividend safety during the last quarterly call. For example, OCSL President, Matt Pendo, explained the decline in NII as a result of:

“we experienced challenges at certain portfolio investments, resulting in a decline in NAV and an increase in non-accruals.”

Non accruals are basically how a BDC accounts for loans that are no longer paying interest per the agreed upon terms. And while this is concerning, management explains it as a one-off “idiosyncratic” event, suggesting it is not an ongoing theme:

“These are unfortunate idiosyncratic situations in a small handful of credits, but unfortunately, were large enough positions to have hurt our NAV in the last couple of quarters.”

OCSL also recently reduced its managment fee in attempt to help cover the dividend, as per Pendo:

So at a high level, we feel very comfortable given the change in the management fee, which was given to 1% as of July 1st and our ability in the future to cover our dividend and feel good about the dividend.

And he went on to explain the thin dividend coverage as follows:

One of the things this quarter that impacted the results were just some inter-quarter timing in terms of repayments than fundings. So there was a little bit -- I wouldn't necessarily take this quarter and just annualize it. So as we think about adjusting for that timing difference as we look at our pipeline and the fundings that we've done this quarter, as well as -- already this quarter but then for the balance of the quarter, the fee waiver et cetera we feel -- you add it all together, we feel very comfortable with covering the dividend.

Further still, management has been shifting to more first lien loans over the last year (a move towards safety, but also an indication that they have been concerned):

“Our first lien investments have increased from just over 76% at June 30, 2023, to approximately 82% today. At the same time, second lien and unsecured debt investments decreased from 14% to below 8% over the same period.”

It seems management may be playing the “no dividend cuts” game, but the question remains if the company’s recent moves will help them avoid a dividend cut, or if they are just kicking the can down the road.

Interest Rate Risk

Another risk BDCs face (inlcuding Oaktree) is the challenge created by volatile interest rates. The fed just recently cut interest rates by 50 basis points (which will continue to trickle through the market) and it will impact Oaktree’s mix of fixed and floating rate loans.

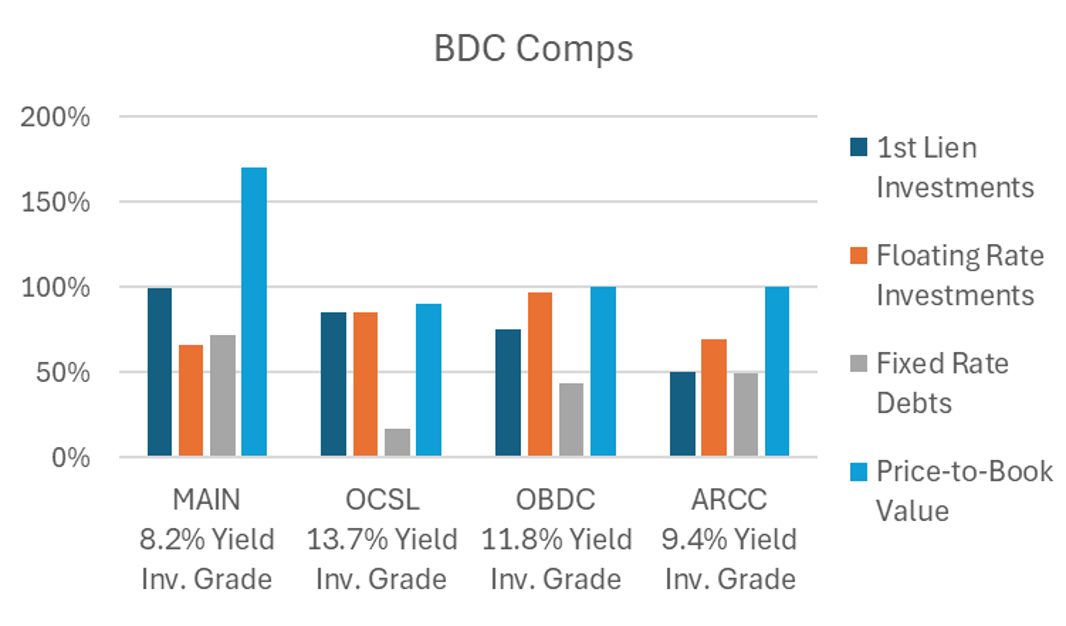

As you can see in the table above, most of Oaktree’s “investment loans” are floating rate (which means the interest income they receive could be pressured lower) while a signifcant portion of Oaktree’s own balance sheet debt is fixed rate (which means they have to keep paying the higher interest rates while they may simulataneously receive less interest income).

Every BDC is different in terms of fixed-versus-floating, as well as in terms of unique rates floors and stipulations. However, Oaktree does face unique risks as compared to other BDCs as you can see in the graph above.

Conclusion

OCSL’s big dividend is barely covered by net investment income, and the recent interest rate cut suggests more challenges ahead (i.e. they have mostly floating-rate investments and a lot of fixed-rate debts).

Management believes the coverage ratio is thin because of idiosyncracies, but the market is already starting to price in the risk (i.e. the shares trade at a discounted 0.88x book value).

If OCSL does reduce its dividend, it will be in a better financial position for it, and it will still pay a big dividend yield.

We currently own four BDCs in our Blue Harbinger “High Income NOW” portfolio, and OCSL is one of them (although it is the highest risk of the four).

Despite the risks, we believe the risk-reward on OCSL is tilted slighly in favor of buying (not selling), but you need to do what is right for you.

Disciplined, goal-focused, long-term investing continues to be a winning strategy.