The Artificial intelligence revolution is still just getting started, and some industries are set to benefit more than others. For example, the AI-powered marketing software company we review in this report has a lot of momentum right now, including rapidly rising revnues, a large market opportunity, competitive advantages, a compelling new mobile solution, healthy financials, solid leadership and new tailwinds from lower interest rates. After reviewing the company, including opportunities and risks, we conclude with our strong opinion on investing.

Overview: Zeta Global (ZETA)

Zeta was founded in 2007 by David A. Steinberg and former Apple CEO John Sculley under the name XL Marketing. The company underwent a name change to Zeta Interactive in 2014 and later adopted its current name, Zeta Global in October 2016. The company was founded with the vision that data would revolutionize the interaction between marketers and consumers for achieving successful business outcomes. The company has over 1,000+ customers across verticals including financial services, consumer, telecommunications, etc. It went public in June 2021 and raised over $200M.

The value proposition of Zeta’s platform is that it provides a holistic front office solution, allowing customers to integrate their marketing technology suite seamlessly across various domains. Businesses can execute a comprehensive marketing strategy from a unified platform, engaging customers through both organic and paid channels. Additionally, Zeta provides exclusive data on over 535M individuals, facilitating precise audience targeting - a unique feature not readily available in the market.

The company’s revenue primarily stems from the utilization of its technology platform, involving subscription fees, volume-based utilization fees, and fees for professional services. The platform revenue is categorized into direct platform revenue (revenue generated exclusively through the company’s own platform) and integrated platform revenue (revenue generated by leveraging the platform's integration with third parties).

High Growth Trajectory

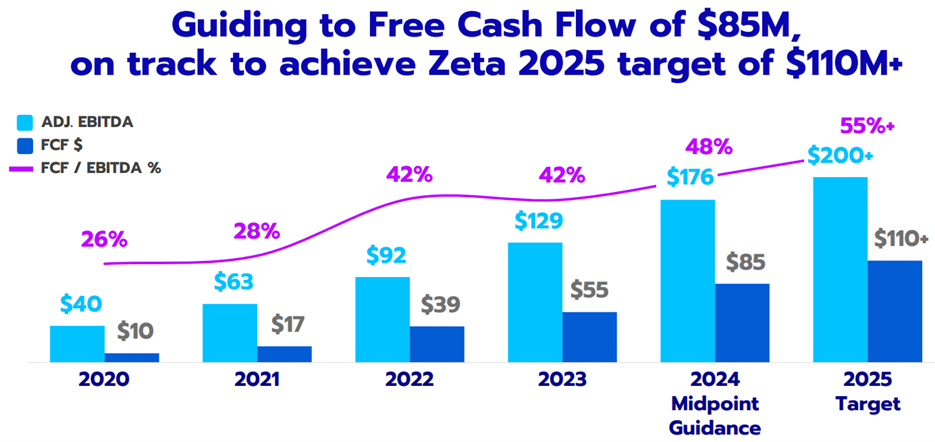

As you can see in the chart below, Zeta has been growing rapidly as free cash flow and adjusted EBITDA have strong momentum.

The growth is being driven by a variety of factors, including healthy “scaled customer expansion,” as you can see in this next chart.

Growing Total Addressable Market (TAM) Fueled by Data and AI Innovation

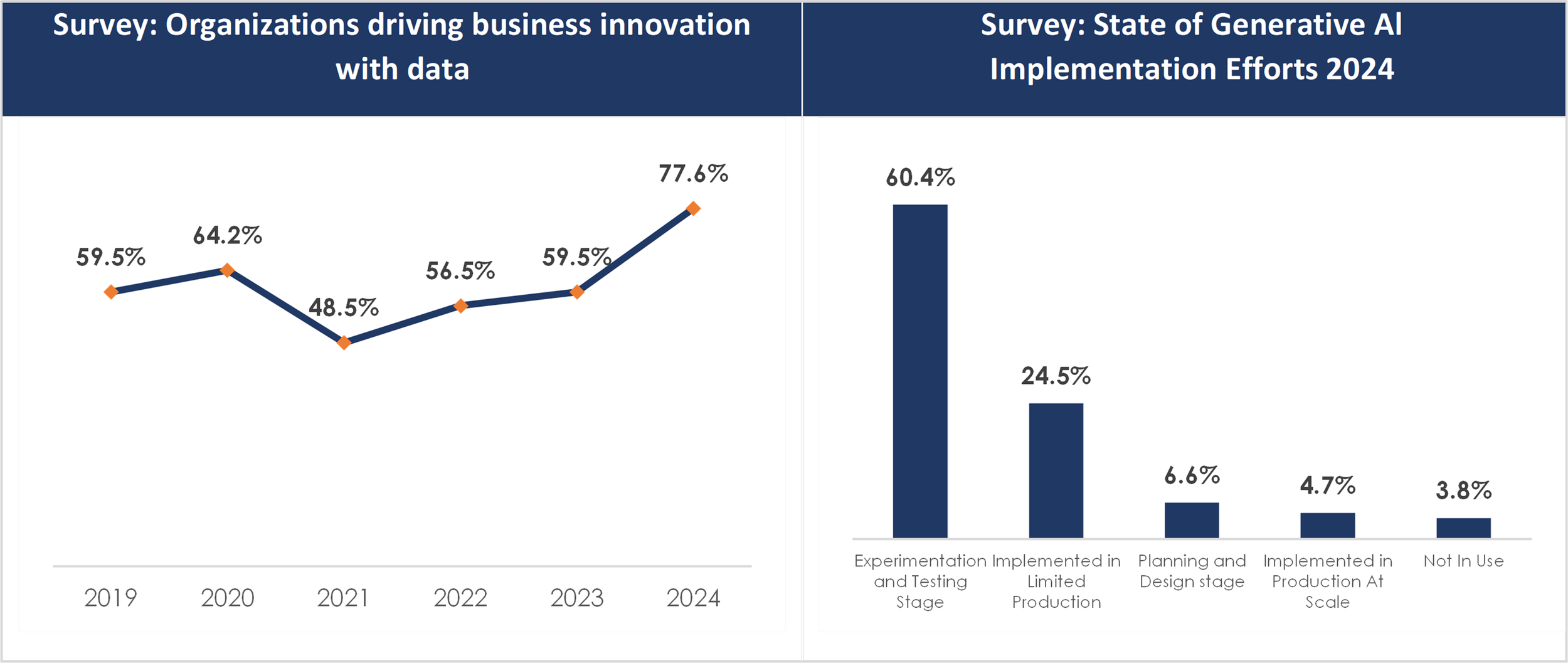

The AI/ML market is undergoing a pivotal shift, with global organizations recognizing the crucial role of integrating data and AI into conventional business processes. According to the 2024 Data and AI Leadership Executive Survey conducted by Wavestone, the percentage of organizations leveraging data for business innovation has shown substantial improvement, rising from 59.5% in 2019 to 77.6% in 2024. Generative AI has emerged as a practical business tool with transformative potential. Despite its potential, the adoption of Generative AI is in its early stages, as evidenced by 60.4% of organizations being in the early experimentation and testing phases. Only a small percentage, 4.7%, have successfully implemented Generative AI at scale in production, indicating significant growth potential for AI implementation.

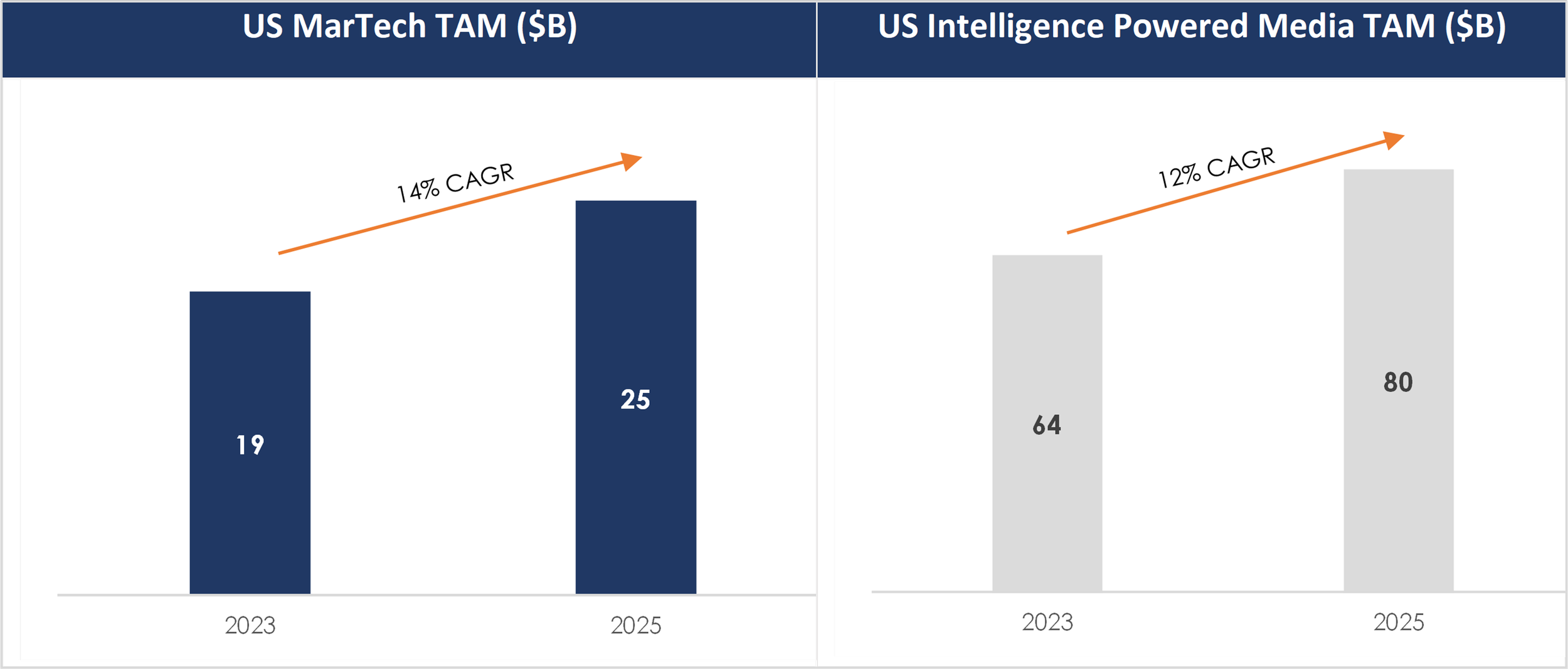

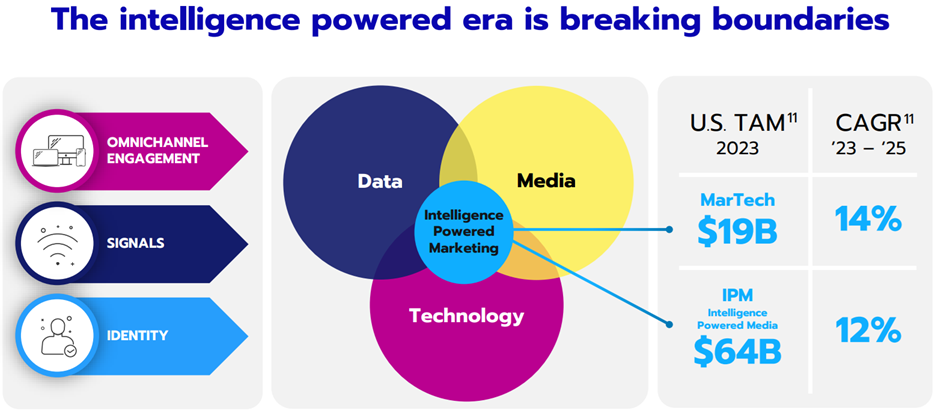

Marketing is one of the areas of business operations where it is widely predicted that AI will drive enormous change. In fact, a McKinsey study found that, along with sales, it is the single business function where it will have the most financial impact. This has significantly broadened the addressable market to $83B and with one-third of media spend expected to shift to intelligence-powered solutions, Zeta has ample opportunity to boost its market share.

Source: Investor Presentation

Competitive Advantages:

The growth is also being driven by the company’s unique solutions and competitive advantages. For example, Zeta is breaking boundaries across previously siloed business functions, and thereby making it easier to implement new artificial intelligence solutions.

More specifically, the company’s “Zeta Marketing Platform” analyzes billions of structured and unstructured data points to predict consumer intent by leveraging sophisticated machine learning algorithms and the industry’s opted-in data set for omnichannel marketing; and the “Consumer Data platform” ingests, analyzes, and distills disparate data points to generate a single view of a consumer, encompassing identity, profile characteristics, behaviors, and purchase intent.

No Third-Party Cookies

Another competitive advantage is Zeta does NOT use third-party cookies (a third-party cookie is placed on a website, by someone other than the owner, to collect user data for the third party). On the last quarterly call, Zeta explained:

There are a lot of companies that have a lot invested in this, Zeta is not one of them. As I pointed out repeatedly, we do not use a third-party cookie for building our models, attribution, or addressing individuals, but at the same time, we do believe that the dissipation of the cookie is going to continue, and we believe that our ability to track without it will continue to be a major competitive advantage.

Land and Expand

Another competitive advantage is the “land and expand” business model, whereby the Zeta is able to retain and expand customer relationships after initially landing them. This provides a high revenue retention rate (recently 111%) which helps support continuing strong momentum for the business. It also helps the company continue to beat and raise its own quarterly earnings guidance.

New Mobile Solution

Furthering Zeta’s competitive advantages, the company is set to ramp the release of its mobile platform through year end, which should further accelerate customer satisfaction and growth. According to the company:

Well, so we said we would debut our mobile product at Zeta Live on September 26 in New York, and we will be there. So, we’re very excited. We’re already beta-testing it with a few clients, and we feel like we’re very well-positioned. To your second question, I think it took us about 3 years to get to $100 million in connected television. CTV, I would think Mobile could be faster than that. I would say again, and I want to be clear, it’s not baked into our numbers for this year. We believe that we will be fully operational this year with Mobile, and we think it’s a business that could scale very, very quickly. There are a few other companies out there that are using Mobile as their primary source of CRM that do a very good job on it. We think we’ve got a competitive advantage with our customer base, having it as a part of the solution, not the entire solution, and the ability to synthesize everything to the Zeta ID and putting our artificial intelligence products at the top of the utilization. So, ZOE will be able to activate into mobile the same way ZOE activate into CTV, online video, social, or any other activation methodology that we operate in.

Healthy Financial Position

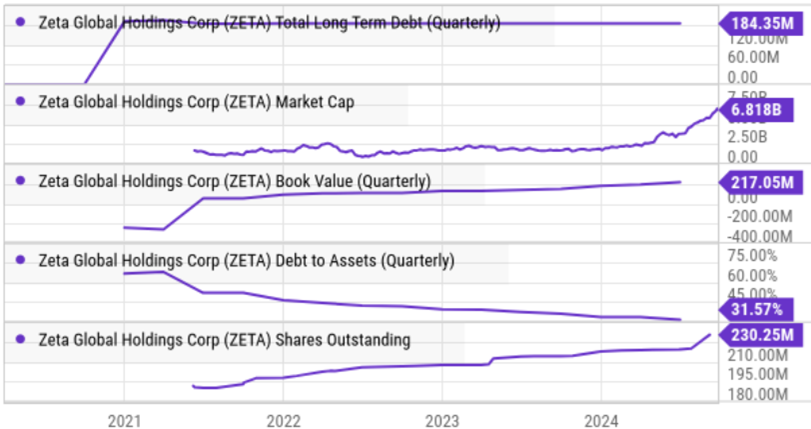

We saw earlier that Zeta’s free cash flow continues to rise as the company moves toward profitability. And as you can see in the chart below, debt is relatively tame.

Further still, the recently rising share price will help the company raise more capital for growth (in the public equity market, at a higher valuation—a good thing), while also being cognizant of dilution to shareholders (dilution has been tame recenty, as you can see the number of shares outstanding above).

Valuation:

Considering the company is not yet profitable (in the most recent quarter, gross margin was a healthy 60%, but net margin was negative 12%, but continuing to show improvement in the right direction towards profitability). You can see the share price and price-to-sales valuation metrics have risen rapidly, but remain reasonable as compared to the levels of many other high-growth application companies.

Risk Factors:

Investors should also be aware of the risk factors Zeta faces. For starters, it operates in a highly competitive industry and competes againsts the likes of Google (GOOGL), Meta (META) and the Trade Desk (TTD), to name a few. However, Zeta is unique in its no-cookie and less-siloed approach.

Additonally, while Google has been claiming for years they intend to stop using cookies, they appear to be dragging their feet, and (as mentioned earlier) Zeta doesn’t believe they will be completely eliminated.

Share-based compensation and dilution in general are also risk factors. As the share price is now higher, the company will have more incentive to issue new shares because they can get more money for them now. So this is actually a good thing (as compared to if they were issuing a higher percentage ownership for lower money when the share price was lower), but a risk factor nonetheless.

Another risk facotr is the company’s dependency on flexible master service agreements. Specifically, Zeta's business model allows customers to adjust spending or terminate services with limited notice. The potential for customers to shift spending or terminate services abruptly could lead to revenue fluctuations and impact the company's ability to maintain stable profit margins.

The Bottom Line

Zeta is a high-growth business, with competitive advantages, and operating in the right place at the right time (marketing technology is growing rapidly and being accelerated by AI. And despite recent share price momentum, the valuation remains relatively reasonable. We do not have a position in Zeta at this time, but may add shares in the near future.