The recently announced merger between Blue Owl’s two publicly-traded BDCs (OBDC) and (OBDE) is a warning sign that investors should heed. In particular, the combination between OBDC (flagship) with OBDE (slightly-more-conservative) is a precautionary step. Here is how we expect it to play out for Blue Owl and for the BDC industry in general.

BDC Industry Overview & Current Challenges

BDCs basically lend capital to small (middle-market-sized) companies. And to over-simplify things, BDCs earn profits on the spread between their cost of capital and the rate they earn on the loans they make (minus operating expenses and defaults by loan recipients).

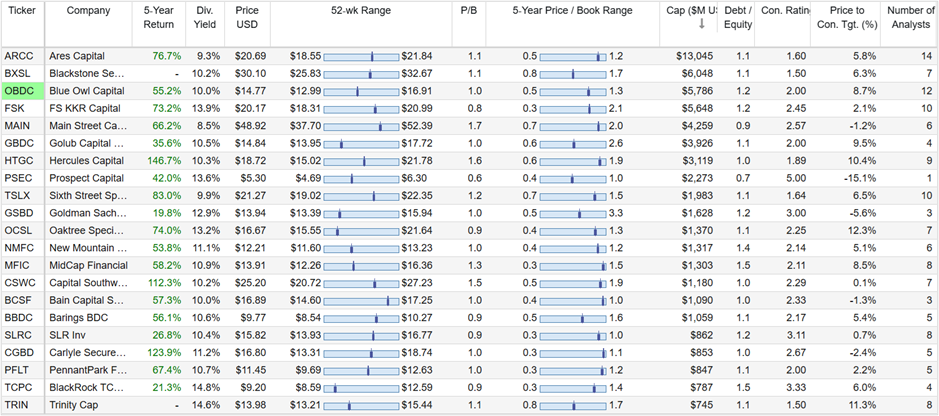

Most BDC returns have been strong in recent years as interest rates rose rapidly (especially BDCs that made a lot of floating-rate loans). However, now that rates appear set to fall (at least that was Blue Owl’s view on its last quarterly call) that could put a lot of pressure on BDC earnings (i.e. spreads could narrow).

Note: OBDC currently yields 11.9% if you count the additional supplemental dividends.

Another challenge the industry is facing is competition. Specifically, the BDC industry has grown rapidly following new restrictions placed on traditional bank lending following the Great Financial Crisis in 2009. As a result, there are now more BDCs chasing after every new lending opportunity).

Blue Owl’s Strategy Benefits

Blue Owl is well-suited to deal with the two challenges above (i.e. more competition and the threat of lower interest rates) because of its increasingly large size (it claims it will be the second-largest publicly-traded BDC if the merger goes through, as expected in January of 2025) and because of its increasingly healthy operating model (i.e. Owl Rock is pursuing more first lien and less second lien loans, and the merger will strengthen its balance sheet and competitiveness due to increasing economies of scale and a slightly lower post-merger risk profile—again OBDE is slightly more conservative than OBDC).

Blue Owl Strategy Risks

Blue Owl CEO, Craig Packer, noted on the most recent quarterly conference call that:

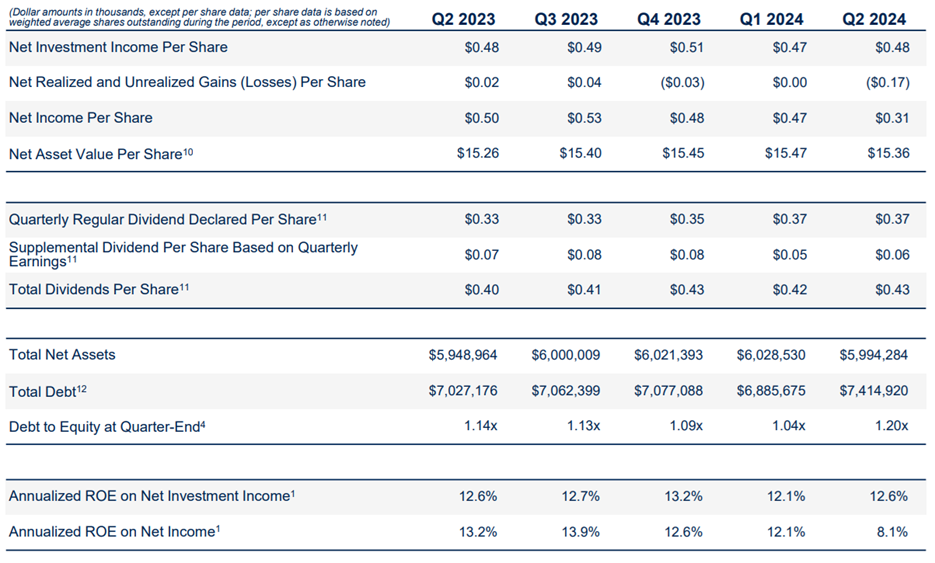

I hope that we can take OBDC on a proforma basis north of 10 [10% in terms of Return on Equity or ROE]. Today, we're in the 12s. Obviously, rates are a bigger driver than any of that.

I'd like to think we're going to do a great job to optimize the mix, but obviously, the rate picture will drive where we land ultimately. And we're looking at what's going on with rates. And like most market participants, we expect rates to come down. We still think we can generate a low double-digit rate of return even if the rate curve plays out the way it's expected. If it stays the way rates are now, then we should be able to generate a 12% rate of return in short order. So I guess we'll optimize and we'll optimize for whatever rate environment we live with.

The above comment is an acknowledgement of the lower returns OBDE is producing (compared to OBDC) and the drag it will have on the combined-OBDC entity post-merger.

To look at it another way, lower returns and pressure on dividend coverage is a real risk that Owl Rock is facing, but at the same time the merger will financially strengthen OBDC through less risky loans (potentially a good think if the industry is about to head into bumpy roads ahead).

Robust Financial Wherewithal

Despite the challenges the industry faces (e.g. interest rate volatility and increasing BDC competition), Blue Owl remains in a healthy financial position. For example, you can see in the table below that net investment income per share continues to cover the ordinary and supplemental dividends. And the net asset value (“NAV”) per share has remained somewhat steady as well.

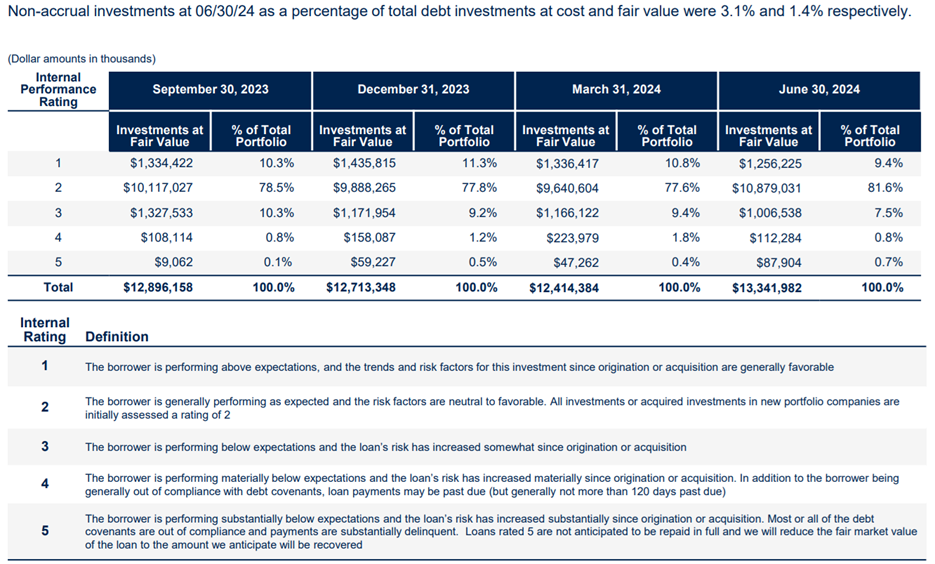

Also, the non-accrual rate (i.e. loans that are not making interest rates per the agreed upon terms) is very low. Specifically, OBDC’s non-accrual rate was only 1.4% of the fair value of the debt portfolio (this number reflects the addition of Pluralsight in the most recent quarter, which is a small 37 basis point position).

The Bottom Line

The BDC industry has been relatively healthy in recent years, but may face storm clouds ahead as interest rates revert lower and as industry competition has more BDCs competing for the same loans.

However, we view OBDC as particularly well-suited to deal with the challenges due to its increasing economies of scale (to help it win more business) and its healthy financial wherewithal (to deal with any increasing non-accruals that may arise).

Also noteworthy, OBDC trades below book value (recently 0.97x) after the announcement of the merger has put selling pressure on the shares.

If you are looking for a big-yield opportunity in the BDC space, Owl Rock is absolutely worth considering. In fact, we have ranked it in our latest Top 10 “High Income NOW” opportunities report here.