In part one of this report, we explained why the Schwab US Dividend Equity ETF (SCHD) is for winners (including its growing dividend, low volatility and more). In this part two, we explain how SCHD can easily add big alpha to investor returns (in four very specific ways). In the conclusion of this report, we explain why many “SCHD haters” are usually barking up the wrong tree (they’re typically earning no alpha anyway) as well as our strong opinion on who should consider investing.

SCHD Overview:

As we explained in part one, SCHD is a low-cost (0.06% annual fee) exchange-traded fund (“ETF”) with ~100 positions diversified across market sectors, but with a tilt towards value stocks instead of growth.

The fund also offers a relatively large dividend yield (3.6%), and the income (paid quarterly) is focused on qualified dividends (i.e., they’re eligible for the lower qualified dividend tax rate, instead of your ordinary income tax rate).

SCHD recently had over $54.6 billion in total assets, which basically equates to “cult status” in the ETF world (it’s the 26th largest ETF), and this also helps keep the fund’s total expense ratio down (economies of scale).

So with that backdrop in mind, let’s get into part two, starting with the concept of “alpha.”

What is Alpha?

According to Investopedia:

“Alpha (α) is a term used in investing to describe an investment strategy's ability to beat the market, or its “edge.” Alpha is thus also often referred to as excess return or the abnormal rate of return in relation to a benchmark, when adjusted for risk.

And SCHD gives investors an "edge" in four specific ways (that allow them to easily outperform peers by a wide margin). We run through each of these easy alpha sources below.

Alpha Source 1: SCHD Helps Reduce Emotional Mistakes

If you look at each of your stocks individually, they can be dramatically more volatile than if you look at them as an aggregate portfolio (i.e. the diversified portfolio is dramatically less volatile than your individual stocks).

(image: Fisher and Lorie, see How Many Stocks Should I Own)

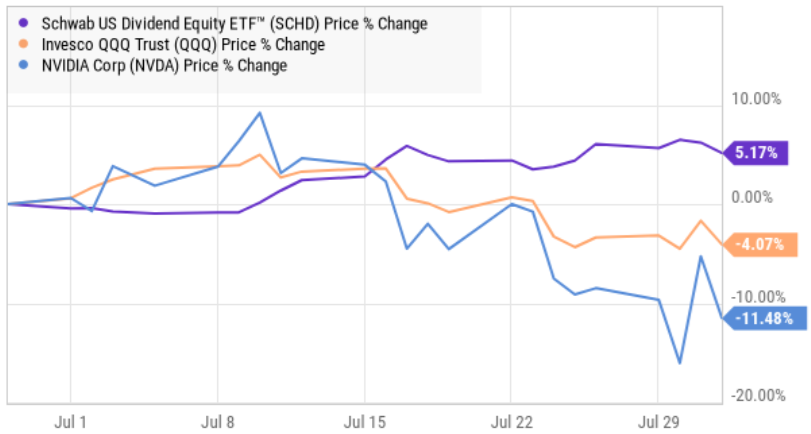

And in the case of SCHD, it’s constructed in a way that is even less volatile than the overall market (such as the S&P 500 and or Nasdaq), and this can help reduce emotional mistake (i.e. it can be a source of alpha). For example, you can see in the chart below how much less volatile SCHD has been over the last month versus the tech-heavy Nasdaq 100 (QQQ) and individual stocks like Nvidia (NVDA).

And it is this “SCHD stability” that can help investors avoid fear-driven emotional mistakes.

For more detail, according to a study by leading ETF investor, Vanguard, avoiding emotional mistakes (i.e. a little “behavior coaching”) can help investors add up 200 basis points of “alpha” (2% per year) to their total returns.

By investing in SCHD, investors can reduce their chances of making emotional mistakes, and this can be an important source of “alpha.” It’s also why it’s so important to get your “asset allocation” right, as we discuss in the next section.

Alpha Source 2: SCHD Helps Avoid Asset Allocation Mistakes

Asset allocation (how much of your investment portfolio is in stocks, bonds and/or cash, for example) can be closely related to avoiding emotional mistakes, and it can be another major source of alpha.

For example, loss aversion means investors psychological reaction to losses is typically much greater than their reaction to gains. And unfortunately this can lead to bad asset allocation decisions (and negative alpha). For instance, some people move to “all cash” out of fear when the market gets volatile (like it has been recently), which can cause them to ultimately miss out on healhy market gains (when it rebounds). But a fund like SCHD (i.e. a strategy with signficantly less volatility than the overall stock market) can help investors arrive at better asset allocation decisions, and this can be a major source of better returns (i.e. alpha). Said differently, if the S&P 500 is too volatile for you, consider owning some SCHD instead of hiding your cash under the mattress.

As another example, some people end up buying aggressive growth stocks, only to panic when the market sells off (like it has been recently) and then they forget to get back in the market again before the rebound arrives. It’s another source of “negative alpha” from asset allocation that SCHD can help many investors avoid.

Alpha Source 3: SCHD Helps Avoid Tax Mistakes

According to the Vanguard table we shared earlier, avoiding tax mistakes can help investors add up to 180 basis points of alpha (i.e. an additional 1.8% return each year), and SCHD is a great tool for accomplishing this for multiple reasons.

For starters, SCHD is focused on qualied dividends which are generally taxed at a lower rate than your ordinary income (depending on your personal income situation). So by owning SCHD in a taxable account, you can earn higher after-tax bottom line returns (i.e. alpha) than if you invest in income investments with dividends taxed as ordinary income, such as most REITs (a category that SCHD does not own) and many high-yield closed-end funds (where distributions are often taxed at the higher ordinary income rate).

Secondly, SCHD is generally considered a long-term investment tool. And as the value of your SCHD shares appreciate over time, they are taxed at the lower long-term capital gains tax rate if/when you do sell (after owning for over 1 year). Investing in long-term income strategies like SCHD can save you on taxes as compared to shorter-term income strategies (such as covered call strategies, which can result in more income being taxed at your higher ordinary income tax rate, for example).

Also, depeding on your situation, you may own SCHD in a tax-advantaged individual retirement account (“IRA”) so you never pay tax on the income or gains (if you own it in a Roth IRA) and you only pay taxes when you withdraw money from a traditional IRA. Once scenario this might especially make sense is if you have a lot tax-free municipal bonds in your taxable account thereby potentially making SCHD a better fit for an IRA.

Alternatively, depending on your individual situation, you can even use the SCHD dividends as a source of cash for your required minimum distributions (“RMDs”), if you’ve reached that stage in life and it makes sense depending on your personal situation (especially, how SCHD compares to the other types of investments you own).

Overall, depending on your situation, SCHD can be a great tool to add alpha by reducing your tax liabilities.

Alpha Source 4: SCHD Helps Avoid Overconfidence Mistakes

SCHD can help investors add alpha by avoiding multiple forms of overconfidence mistakes. Firstly, SCHD has a low management fee, which is a source of alpha versus funds with very high fees (that usually underperform similar strategies with lower fees anyway). Don’t be overconfident in a lower volatility dividend strategy like SCHD just because the alternative strategy may charge a higher fee. SCHD’s low expense ratio is a source of alpha (as compared to high-fee strategies).

Time is priceless, and you may also be overconfident in what you can accomplish in a limited amount of time. For example, rather than trying to trade in-and-out of stocks everyday, you can do very well, and save a lot of time, by investing in SCHD (if it is consistent with your goals), and this can be a signficant source of “time alpha.”

The Bottom Line

SCHD is a master class in the uncommon sources of alpha many investors unfortunately leave on the table. And depending on your personal disposition and skill set, all of these alpha sources can also be implemented in non-ETF portfolios too (for example, we have included SCHD as an “honorable mention” in our new report: Top 10 Big Yields).

And while many of the “SCHD haters” proclaim the strategy inferior to long-term growth portfolios, they’re generally barking up the wrong tree. Specifically, they’re often oblivious to the alpha available from reducing emotional mistakes, getting your asset allocation right (to meet your personal goals), being very aware of the tax consequences, and by not falling victim to costly overconfidence mistakes. Overall, disciplined, goal-focused, long-term investing continues to be a winning strategy.