Quick Note: Mercado Libre (MELI) is the leading ecommerce and financial services platform in Latin America, and the shares are up +10% on earnings (on an otherwise terrbile day with broad market indexes down significantly). The company beat earnings and revenue expectations (GAAP EPS of $10.48 beats by $2.00, revenue of $5.07B beats by $390M).

Here is how the company explained its own Q2 results:

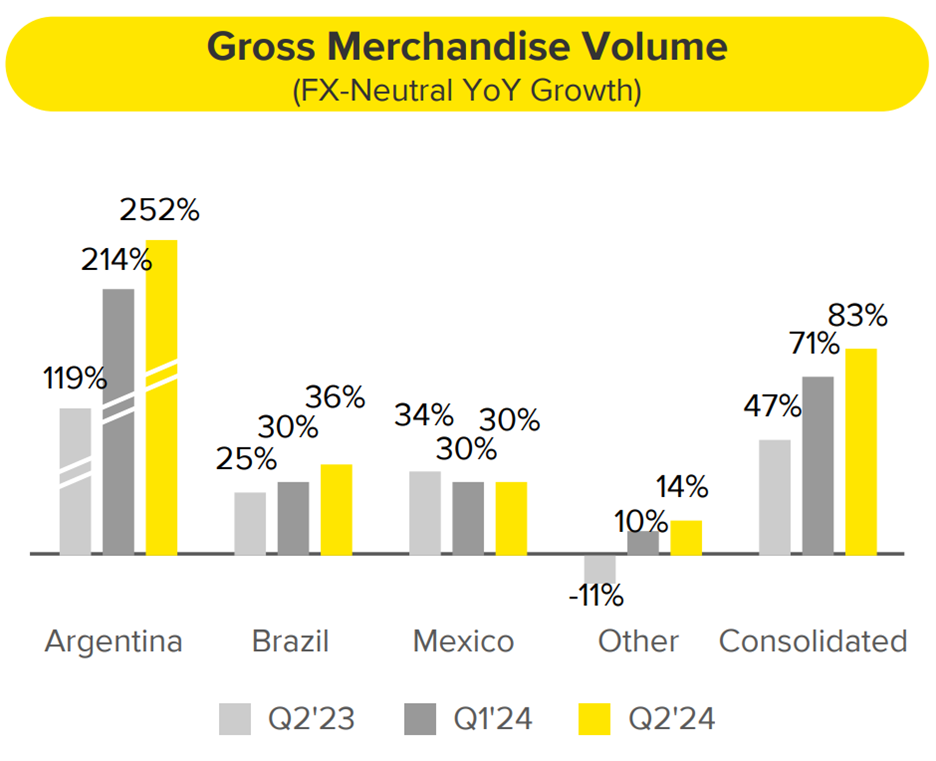

“We delivered a great financial and operational performance in Q2'24, with growth in GMV, Acquiring TPV and the Credits portfolio accelerating in all three major geographies on a YoY FX-neutral basis. Unique buyer growth also accelerated and Fintech MAU surpassed 50mn for the first time. Our ecosystem is gaining more traction, and our investments in product, technology and service levels are extending our position as the region's leading ecommerce and fintech platform.

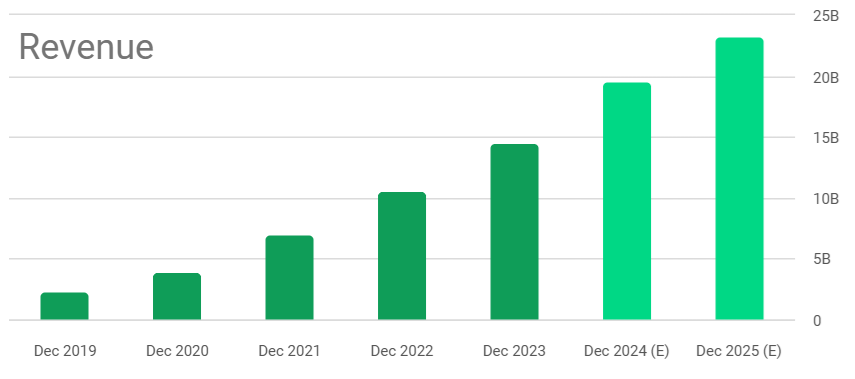

At the same time, we are delivering strong financial results both at the top line - with Q2'24 revenue growth of 42% YoY (of which 14ppts relates to the shipping reporting updates outlined in Q1'24) - and at the bottom line, with net income rising 103% YoY to $531mn. Our net income margin reached 10.5% in Q2'24, up 3ppts YoY and at the highest level since Q1'17.”

Mercado Libre is one of the largest holdings in our Blue Harbinger Disciplined Growth Portfolio, and we like it because of the rapid revenue growth (42% YoY), high margins (>46% gross, >10% net), leadership position and large total addressable market (to continue growing fast and profitably). Long MELI.