Quick Note: Oaktree Specialty Lending Corp (OCSL) is a big-yield (+13.8%) BDC that has been declining in price, particularly following its latest earnings announcement this past week whereby its adjusted net investment income (“NII”) came in at $0.55 per share (a penny lower than estimates) and just matches its quarterly dividend of the same amount.

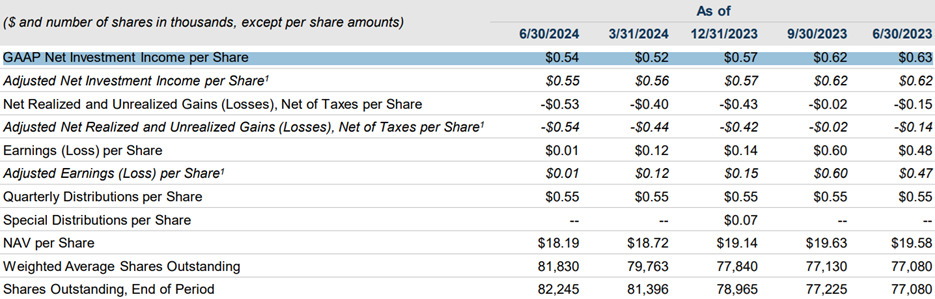

And as you can see in the table below, NII has been trending lower, which has some investors concerned about the safety of the dividend and the shares overall.

OCSL President, Matt Pendo, explained the decline (on the earnings call) as a result of:

“we experienced challenges at certain portfolio investments, resulting in a decline in NAV and an increase in non-accruals.”

While this is concerning, management explains them as “idiosyncratic” implying they are not an ongoing theme:

“These are unfortunate idiosyncratic situations in a small handful of credits, but unfortunately, we're large enough positions to have hurt our NAV in the last couple of quarters.”

Additionally, the company has been shifting to more first lien loans over the last year (a move towards safety, but an indication that they have been concerned):

“Our first lien investments have increased from just over 76% at June 30, 2023, to approximately 82% today. At the same time, second lien and unsecured debt investments decreased from 14% to below 8% over the same period.”

President Matt Pendo didn’t seem overly concerned about dividend safety when asked about it directly on the quarterly call:

Brian McKenna

Okay. Great. Thanks. Good morning all. So a question on the dividend and the management fee reduction. So if I annualize second quarter results and then add the $0.15 to that, so the fee change, dividend coverage is still less than 110%, and that's before any reduction in interest rates and then any other changes in underlying credit across the portfolio. So what makes you confident you'll be able to fully earn the dividend looking out over the next 12 to 18 months, assuming the forward curve plays out? And then can you remind us what your earnings sensitivity is to every 100 basis point move in rates?

Matt Pendo

Sure, Brian. Thanks for the question. So at a high level, we feel very comfortable given the change in the management fee, which was given to 1% as of July 1st and our ability in the future to cover our dividend and feel good about the dividend.

One of the things this quarter that impacted the results were just some inter-quarter timing in terms of repayments than fundings. So there was a little bit -- I wouldn't necessarily take this quarter and just annualize it. So as we think about adjusting for that timing difference as we look at our pipeline and the fundings that we've done this quarter, as well as -- already this quarter but then for the balance of the quarter, the fee waiver et cetera we feel -- you add it all together, we feel very comfortable with covering the dividend.

So I think the one thing is just focus on the timing of the quarter, and then just our pipeline as we see it.

Our Bottom Line Take

Oaktree specializes in “riskier loans,” and considering the diversification of their portfolio (combined with management actions and comments) we are not overly concerned with this position (we own the shares in our High Income NOW Portfolio). In fact, we like shares like this more when the price goes down (like it recently has).

However, if you are overly nervous about a dividend reduction (we don’t think one is coming), you may consider shifting out of OCSL and into something else. As for us, we are continuing to own our shares of the BDC. Long OCSL.