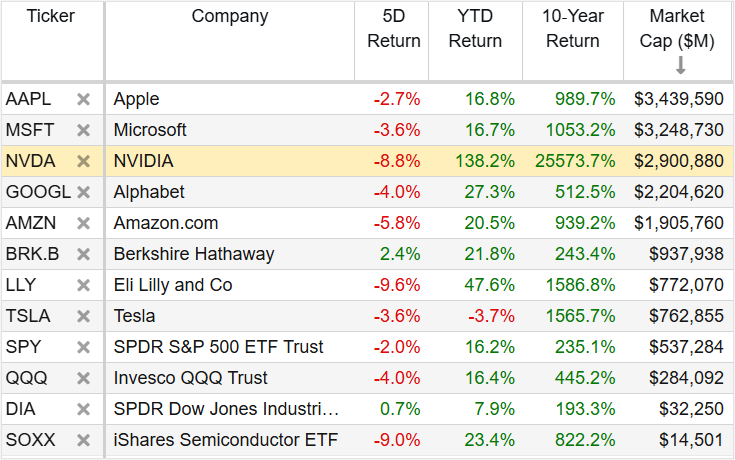

In a major market reversal, leading mega-cap and semiconductor stocks have sold off hard over the last week (see table), and a lot of investors are concerned this may be the beginning of something much worse. We’ve been hearing for months, even years, these names were over-extended, and some investors are flummoxed about what to do (i.e. is it time to dump growth and tech stocks, and dive headfirst into value stocks—or even bonds?). In this quick market snapshot report, we share our strong opinion about what investors should be doing right now.

1. Take a Deep Breath

Despite the steep 5-day sell off for leading megacaps and semiconductors, we’re still in the middle of a very strong year and market sell offs are normal and healthy.

2. Check Your Asset Allocation

If a 5-day selloff has you overly stressed—that could be a good indication that you have too much risk in your investment portfolio and it may be time to re-adjust your asset allocation. This can be as simple as reducing your growth and tech stock holdings, to as significant as moving into more bonds and income-producing investments.

3. Stick to Your Long-Term Goals

However, if you are still a long-term investor—then the most likely thing you should be doing right now is absolutely nothing! Again, selloffs are normal.

4. Don’t Make Psychological Mistakes

When the market gets volatile, investors often make psychological mistakes that they end up regretting later.

For example, what you should NOT be doing right now is panicking and making rash decisions. It’s okay to do a little portfolio rebalancing around the edges (to bing your target asset allocations back in range for your goals), but do NOT sell everything and hide the cash under your mattress.

If you are a long-term investor, the megacap stocks are still great businesses that are profitable and positioned to keep growing for many years (especially thanks to megatrends like the cloud and AI).

The Bottom Line

We don’t know if this selloff is over or just beginning. But we do know that years down the road the market will likely be trading much higher than it is now. And we also know making panicked decisions can be a terrible idea (because rash buying and selling can take you off track for meeting your long-term goals).

Make sure your asset allocation is correct (do you have the right amount of growth/value stocks? Dividend stocks and bonds?). It’s okay to do a little rebalancing now, but most likely—the best thing for most long-term investors to do right now is absolutely nothing!

Disciplined, goal-focused, long-term investing continues to be a winning strategy.