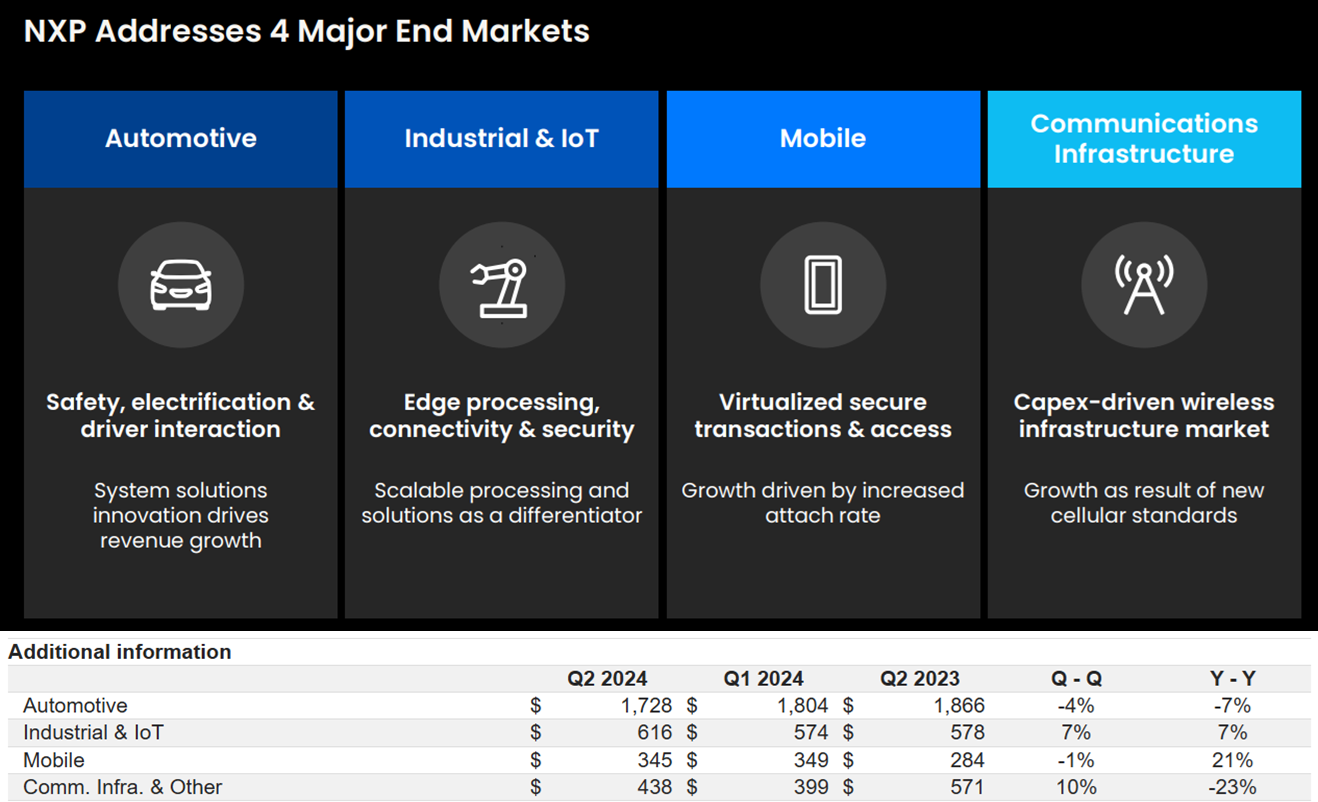

Quick Note: Netherlands-based chip stock (NXP Semiconductors (NXPI)) reported healthy earnings, but provided guidance below expectations. The shares sold of in afterhours, but the stock looks like an attractive “wide moat” “value play” at this point (especially as compared to other more cyclical chip stocks). NXP has high margins, generates tons of free cash flow and trades at a reasonable valuation, especially considering its leadership position across multiple industries (auto, industrial IoT, mobile and communications infrastructure).

We have no position in this one, but view it as attractive if you are looking to maintain exposure to the growing semiconductor industry (big long-term growth from expanding market size) but are nervous about more volatile chip stocks.

We’re keeping NXP high on our watchlist for now.