Commerical real estate has performed terribly, and popular retail REIT (Realty Income (O)) has not been spared. With interest rates now sharply higher and shopping habits permanently changed, a lot of investors see more risk than opportunity. In this report, we review Realty Income’s business strategy, valuation, 5.8% dividend yield (paid monthly) and the very big risk factors it is currently facing. We conclude with our strong opinion on investing.

Overview:

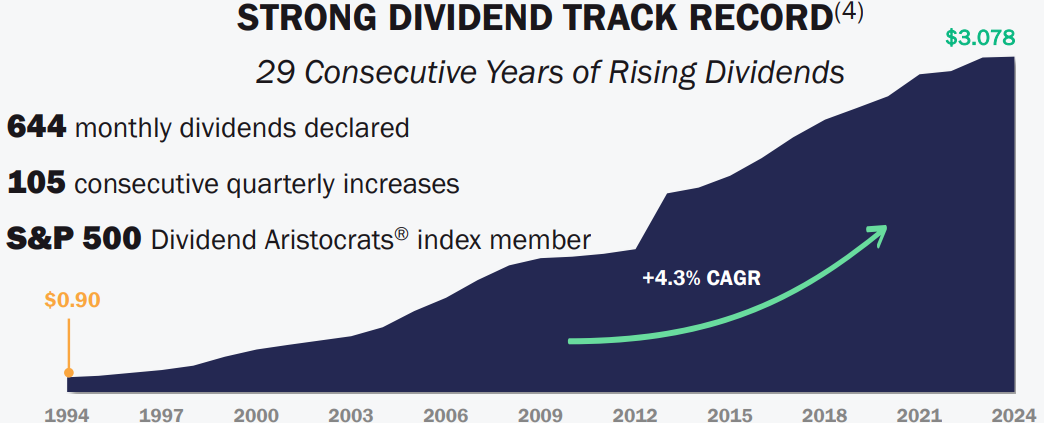

Realty Income (“the monthly dividend company”) is an income-investor favorite for its long history of steady growing dividends (the current yield is 5.8%).

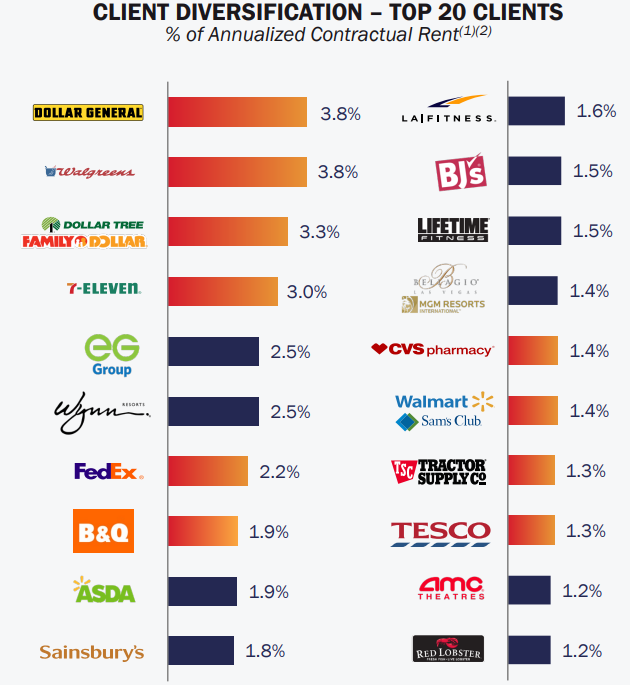

The company is a Real Estate Investment Trust (“REIT”) investing primarily in retail properties diversified across the US and some UK (as you can see in the following graphic).

And you may recognize many of its top tenants, including Dollar General, Walgreens and others.

The company believes the types of properties it owns are “insulated from changing consumer behavior” (more on this later).

Recent Performance:

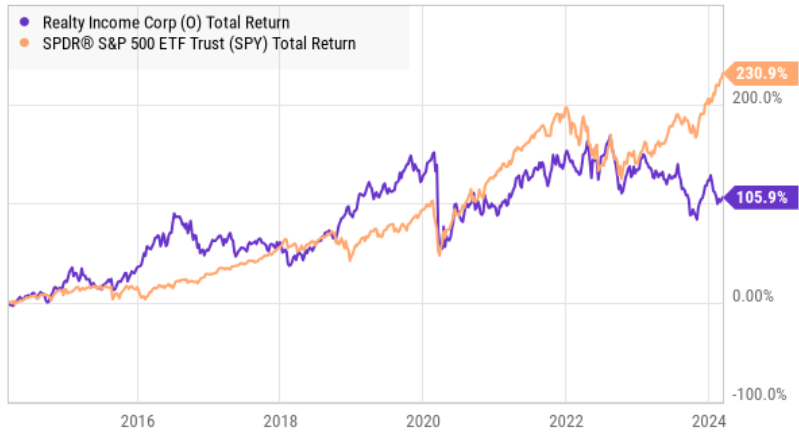

Not surprisingly, the total returns (price appreciation plus dividends as if they were reinvested) of Realty Income have lagged the broader market (e.g. the S&P 500 (SPY)) over the last year as sharply increased interest rates have taken a toll on REITs (which rely on borrowing and share issuance to fund growth).

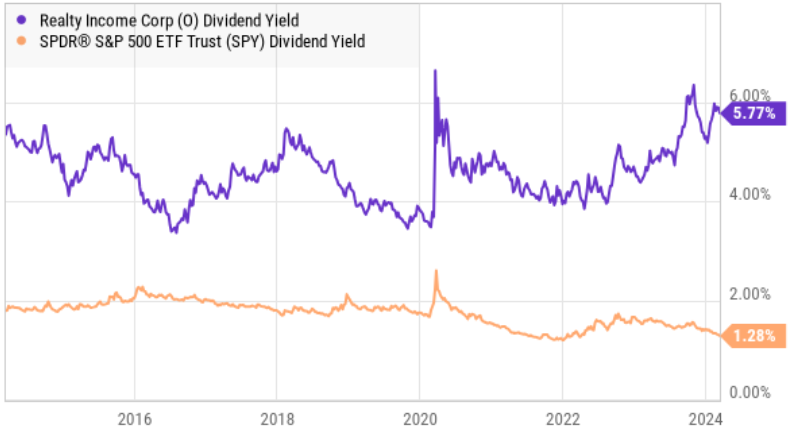

And as a result, the dividend yield is currently high by historical standards (as share price falls, dividend yield mathematically rises, all else equal).

Some investors view the higher-than-normal dividend yield as a buying opportunity, but it’s worth taking a closer look at the business first.

Business Strategy:

Realty Income is special for a few reasons (in addition to its big steady growing dividend). For example:

Triple Net Lease: Realty Income is a triple net lease REIT, which basically means the lessee (not Realty Income) bears all the operational expenses (e.g. property taxes, property insurance and maintenance costs). This helps reduce a lot of the risks for Realty Income (more on risks later).

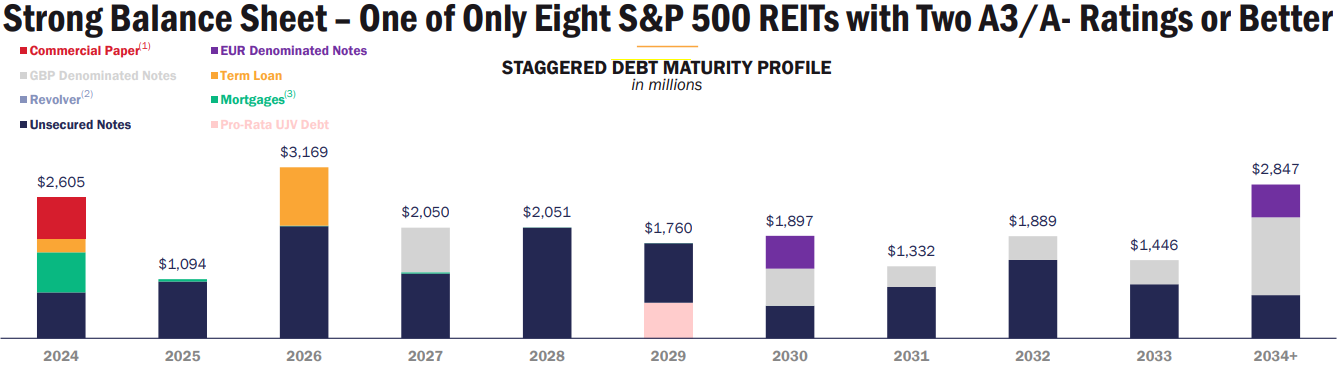

Big and Financially Stable: Realty Income is one of the biggest and most financially stable REITs (especially in the retail industry) and this gives it big advantages in the fragmented net lease space. For example, Realty Income’s investment grade credit ratings (Moody’s and S&P rate it A3/A-) give is a big advantage over many smaller peers.

Acquisition Strategy: Realty Income’s large size and financial strength enable it to pursue a “growth through acquisition” strategy that has served the company well in recent years. For example. Realty Income is able to acquire smaller REIT competitors and then refinance their debts at lower rates thereby allowing them to make more money (better margins) on the properties than their small competitors could.

Valuation:

From a valuation standpoint, some investors view the higher current dividend yield as an indication that the shares may be undervalued (and thereby present an attractive buying opportunity).

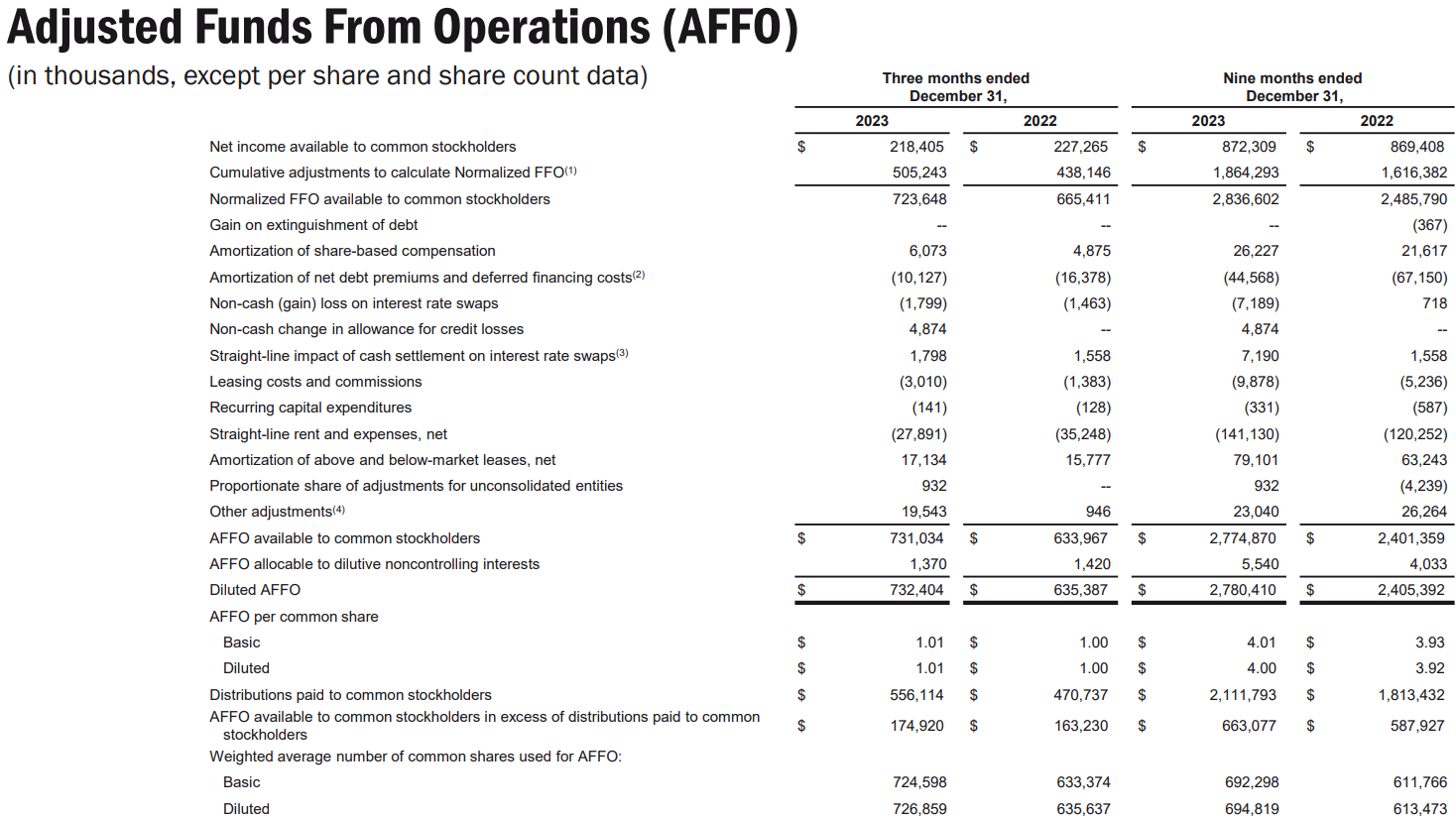

And a look at the company’s share price to Funds From Operations (FFO per share) lend strength to the case that the shares are undervalued. Specifically, you can see in the following chart, Realty Income currently trades at a low (attractive) Price/FFO multiple as compared to its own history.

Furthermore, the company just recently provided 2024 Adjusted FFO/share guidance in the range of $4.13 to $4.21 (i.e. a ~4.3% year-over-year growth rate).

Realty Income also ended the most recent quarter with over $4.0 billion in available liquidity. This provides “dry powder” for growth through acquisitions (without necessarily issuing more shares or taking on more debt) and it also adds strength to the dividend.

Dividend Coverage:

Realty Income’s current monthly dividend payment is $0.26 per share, and this compares favorably to the $4.17 (midpoint) 2024 FFO guidance (0.3475/month) that the company just provided (i.e. the dividend payment is well covered).

The company also appears to have manageable debt loads through 2025 and beyond.

Big Risks:

Realty Income faces a variety of big risk factors that investors should consider.

Slow Organic Growth: Realty Income has been a steady business, but its organic growth (i.e. non-acquisition growth) has been slow. The company has been forced to rely on acquisitions, which are arguably riskier and less preferable.

Higher Rates Make Acquisitions more Expensive: Higher interest rates present another big risk factor considering the company relies heavily on borrowing to fund its growth-through-acquisition strategy. While the company is in a great position to acquire (because of its size and financial stability versus peers) higher rates may slow the acquisition boon in recent past years (when interest rates were so low). Also, a lower share price makes it more expensive to issue shares to fund growth.

Changing Shopping Habits: Realty Income argues its properties are more insulated than others from changing consumer behavior (see graphics below), but the reality is many retail properties are less desirable than years ago (when less people shopped online). Further, the company claims the net lease market opportunities are large because the market is so very fragmented, but the reality is not all retail properties are desirable for acquiring (and roughly half of the company’s own tenants are not investment grade—i.e. riskier).

Weak Moat: Realty Income believes its moat is its large size and financial strength (especially as compared to peers). And while there is some truth to this, the additional reality is there are low barriers to entry in this space (developers can just build more properties to compete) if/when the opportunities become more financially attractive.

The Bottom Line

Despite the big risks, if you like steady income, Realty Income is an attractive leader and a compelling investment opportunity. Not only is the dividend well covered, but the yield is higher than usual (as the price is down) and this creates some additional opportunity for share price appreciation (price/FFO is attractive). Realty Income is not a high volatility disruptive growth stock, but it is a steady high-income opportunity trading at an attractive price. If you are an income-focused investor, Realty Income is absolutely worth considering.