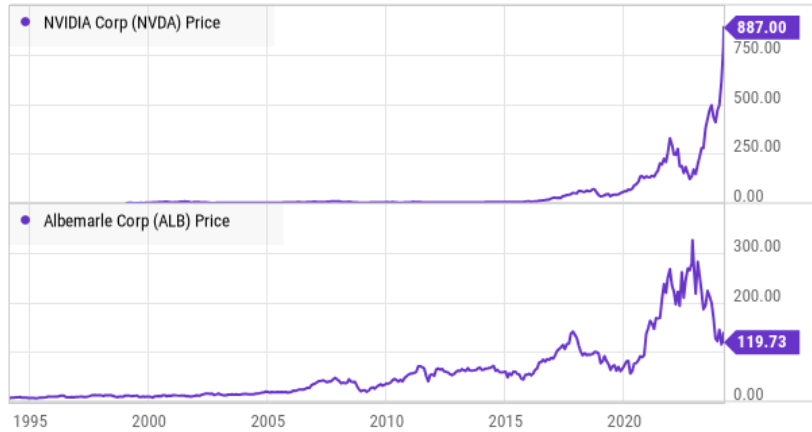

Chip stocks (such as Nvidia) are notoriously cyclical (50% to 80% declines are not uncommon). Somewhat similarly, the materials stock (lithium) we review in this report is likely near the bottom of an epic cyclical decline of its own (shares are down 66%). And like Nvidia, this materials stock is a leading beneficiary of another big secular trend (rather than AI, it benefits from technological advances in batteries). In this report, we review the materials stock (including it business, market opportunity, valuation and risks) and then conclude with a comparison of its massive price appreciation potential as compared to Nvidia’s with regards to where each one sits in its own massive secular market trend.

Albemarle (ALB)

You may want to puke at the mention of a name like Albemarle. It’s been touted by pundits for years as the golden child beneficiary of the massive global migration from gas-powered to electric vehicles. Unfortunately, the stock price has plummeted.

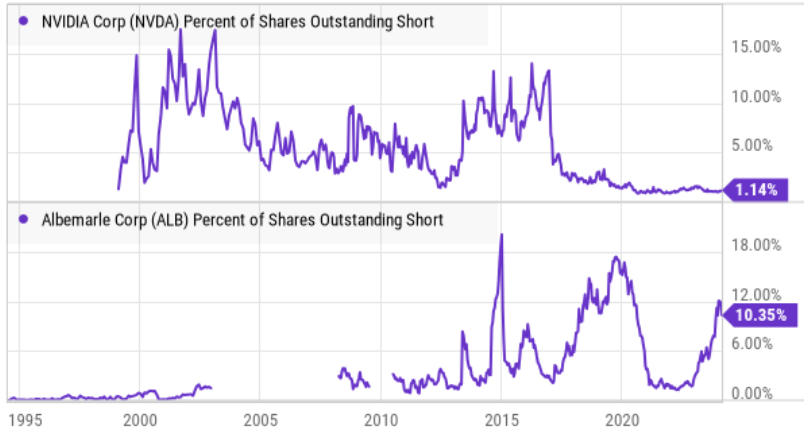

The story behind Albemarle’s epic fall from grace is that it was overhyped, the transition to EVs will be slower and less expansive than previously expected and the supply of lithium has been greater than demand (thereby putting downward pressure on lithium prices and hurting Albemarle’s share price). For a little more perspective, you can see the relatively high short interest (people betting against the shares) for Albemarle (below).

Before getting into the details on why the above “negative narrative” is wrong, too short-sighted, and potentially about to reverse (in a major way), let’s first review what Albemarle does.

Overview:

Albemarle is a materials company (founded in 1887, and headquartered in Charlotte, North Carolina). In recent years, the company has dramatically shifted its focus to lithium (because of its growing importance in electric vehicle batteries—a huge new market).

Albemarle operates through three segments:

Energy Storage: Offers lithium compounds.

Specialties: The Specialties segment provides bromine-based specialty chemicals used in a variety of industries.

Ketjen: offers clean fuels technologies.

And as you can see below, lithium (energy storage) is the biggest segment by far.

Contrarian Value:

Adding insult to injury (for underwater shareholders), Albemarle just issued over $2 billion of highly dilutive convertible preferred shares this month (bad for existing shareholders, but good to have it out of the way).

The company already had a healthy balance sheet, but this new issuance will help the company maintain its investment grade credit rating (a stated goal in the last earnings call) because equity is subordinate to debt. The proceeds of the issuance are intended for “general corporate purposes,” including:

“funding growth capital expenditures, such as the construction and expansion of lithium operations in Australia and China that are significantly progressed or near completion, and repaying the company’s outstanding commercial paper.”

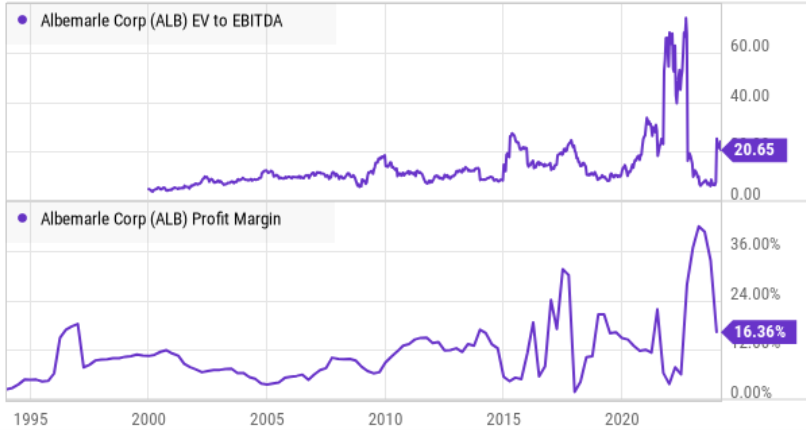

Albemarle continues to be a very profitable company (despite recent price declines) and currently trades at a reasonable valuation (EV/EBITDA) especially considering the expected secular growth in the decade ahead.

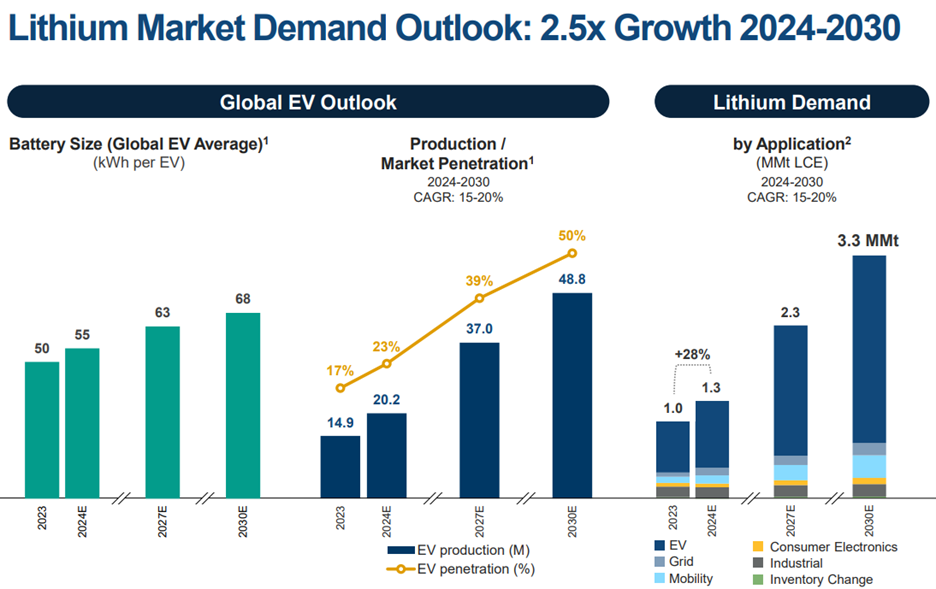

In particular, growing demand for lithium should provide strong support for the business and the shares going forward.

Strong Demand Growth

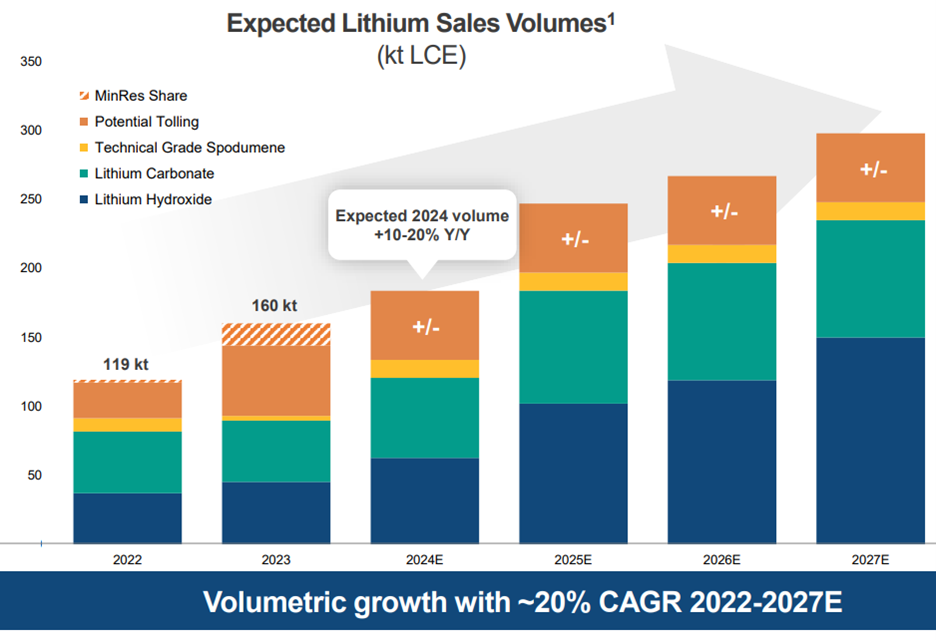

In addition to the strong market wide demand growth, Albemarle in particular is expecting strong growth as you can see in the following graphic.

Supply Destocking

Of course, supply in the counterbalance to demand, and the industry has been overstocked with lithium thereby putting downward demand on the commodity and on the price (and this is the major reason for Albemarle’s steep share price declines.

However, according to Morningstar analyst, Seth Goldstein, destocking should reduce supply and benefit Albemarle. Specifically:

“As inventory destocking eventually ends, we expect lithium sales volumes will move closer to end-market demand, which we expect will see double-digit growth in 2024,” Goldstein says. “As supply growth has slowed and some higher-cost supply exited the market, we expect the lithium market will revert to undersupply by the end of 2024, sending prices rising, particularly in the second half of the year. For lithium producers, including Albemarle, higher prices should provide a strong catalyst for shares to rise.”

Goldstein has a “strong buy” rating on Albemarle, as he expects lithium prices to rise in the second half of 2024 (a very good thing the business and likely the shares too).

Also important, Albemarle has a distinct advantage over competitors considering its high quality assets allow for lower cost production. Albemarle is in a great position as supply comes down and demand increases.

Risks:

Of course, Albemarle faces a variety of risks. For example, EV demand may be overstated and the expected demand for lithium may not emerge. Additionally, supply may still be over-extended as demand continues to ramp. Further still the company faces government and regulatory risks, such as for its “very high quality” assets in Chile which may could face increasing government taxation and even “nationalization of assets,” despite Albemarle’s least through 2043.

Conclusion:

Nvidia is benefiting from a massive secular trend (AI), while Albemarle (as difficult as it may be to see right now) is benefitting from a massive secular trend in Electric Vehicles. These two megatrends are not apples-to-apples (AI is a much bigger deal than EVs) but considering where each stock is in its own industry-specific market cycle (Nvidia has just had a rally for the ages, whereas Albemarle has experienced an epic fall), investors may want to consider an allocation to both in their investment portfolios.

To be fair, we own shares of Nvidia and believe the shares are still going much higher in the decade ahead. However, we won’t be surprised to see a 50% decline in Nvidia’s share price in the near future (we just don’t know when), and we’re okay with said decline (volatility is par for the course for Nvidia, as long-term investors we don’t care about maximizing short-term Sharpe ratios, and we’re comfortable with our allocation/weight within our investment portfolio).

The Albemarle opportunity is different. Nvidia is a growth stock, whereas Albemarle is a value play. The pendulum has swung too far to the downside on Albemarle due to the lithium supply/demand dynamics, the rate of EV expansion and simply very negative investor sentiment.

Some investors are okay putting a HUGE percent of their investment dollars into a single stock such as Nvidia (and when times are good they say things like “why trim the flowers and water the weeds”). We are not doing that. Rather, we believe in prudently concentrated, long-term investing. We currently own shares of both Nvidia and Albemarle, and look forward to the potential for large gains and big upside ahead.