If you are an income-focused investor, Arbor Realty Trust (ABR) may be extremely tempting because of its massive dividend yield (currently 13.3%) and long-term track record of success. However, this mortgage REIT checks all the boxes for a “sucker yield,” and there are far better investment opportunities if you like to generate high income. In this report, we share 10 reasons why Arbor Realty Trust may be a sucker yield (i.e. a dividend that is “too good to be true”), and then conclude with three superior big-dividend strategies for you to consider.

About:

Arbor Realty Trust is a mortgage REIT. Specifically, it is a real estate investment trust (REIT) and direct lender providing loan origination and servicing for multifamily, single-family rental portfolios and other diverse commercial real estate assets.

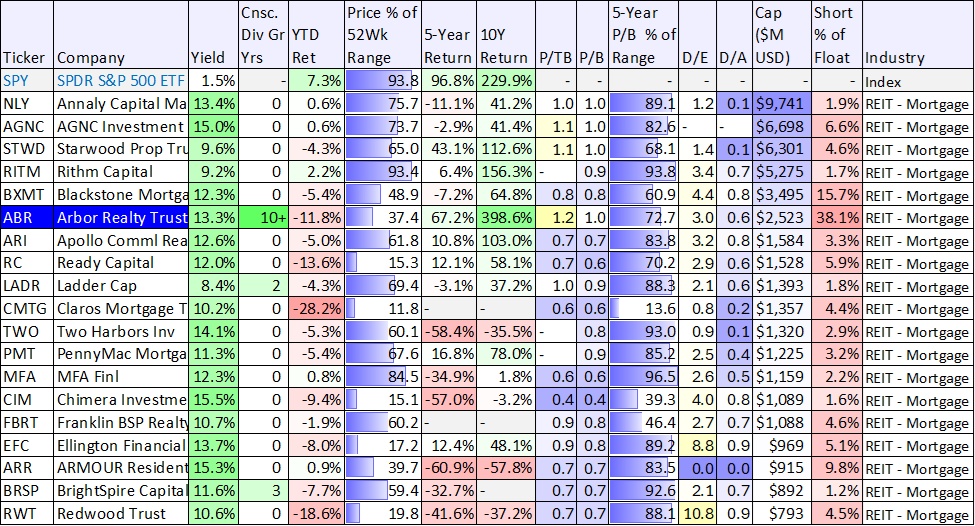

Mortgage REITs are often extremely tempting to income-focused investors because of their very high dividend yields, as you can see in the following table (i.e. mortgage REITs, sorted by market cap).

(data as of market close, Fri 3/15/24, source: StockRover)

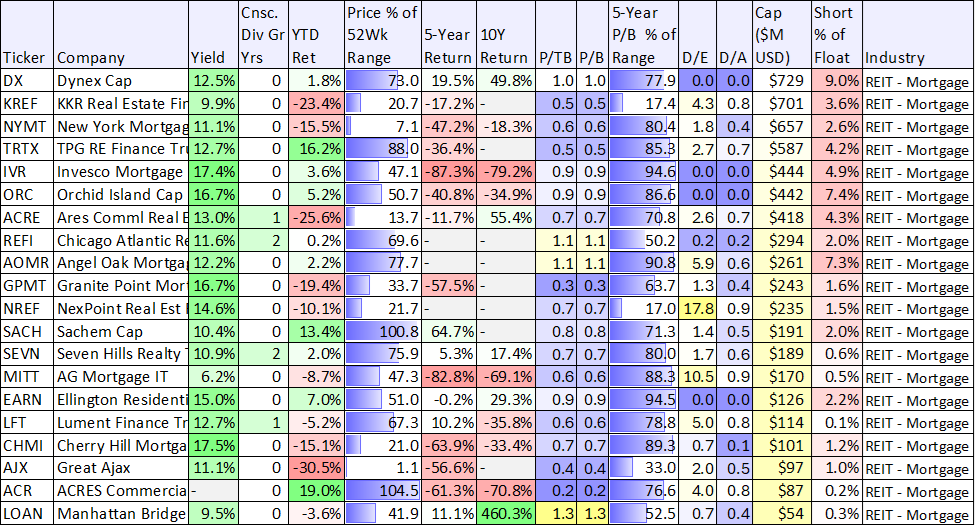

(data as of market close, Fri 3/15/24, source: StockRover)

However, before you start investing your hard-earned dollars into this gigantic yield opportunity, there are a few things you should consider, as we describe in the following section:

Sucker Yield: Checks All 10 Boxes

Arbor Realty checks all 10 of the “suckers’ yield” boxes, as we describe below.

(1) Is the Yield Big? Like moths to a flame, there is an entire cohort of investors that sadly believe the bigger the yield, the better the investment. Obviously, this is wrong because it does not take into consideration the risks (as we will cover for ABR throughout this report). However, in terms of a “sucker yield,” Arbor Realty absolutely checks the “Big Yield” box.

(2) Is the Dividend History Strong? Many investors will point to ABR’s incredible history of 10+ years of dividend growth. And as you can see in our earlier table, not a lot of mREITs can match this. However, as is disclosed everywhere in the investments world, past performance does guarantee future success. We will show momentarily why dividend history is misleading for ABR. Nonetheless, many investors still point to its history of dividend growth (without considering the future), and this is another “sucker yield” checkbox checked.

(3) Is the Dividend Well Covered? Sticking with our theme of wrongfully believing past performance indicates future success, ABR’s dividend was very well covered by recent earnings. As per management on the most recent earnings call:

“We generated GAAP earnings in excess of our dividend in 2023 despite recording approximately 90 million in reserves and our distributable earnings were also well in excess of our dividend, providing one of the best dividend coverages ratios in the industry.”

We’ll see momentarily why this is likely about to change in a major way, but for the time being, ABR checks the “sucker yield” box of well-covered past dividends.

(4) Is ABR Internally Managed? There is a belief among many investors that if a company is “internally managed” then that is a good thing because it eliminates a major conflict of interest. And while this may be somewhat true, it also can be very misleading. Just because something is internally managed doesn’t mean its future performance will be better. Internally managed “sucker yield” box checked.

(5) Is the Dividend Qualified? Before investing in a dividend stock, you might first want to consider whether the dividend is ordinary (taxed at your ordinary income rate) or qualified (taxed at the lower capital gains rate). Many investors mistakenly buy stocks simply because they offer higher yields without realizing those higher yields can also be taxed at higher rates (thereby nullifying some of the value you thought you were receiving). You likely already know your personal income tax rate, but here is a look at the lower qualified dividend tax rates for 2024, and here is a look at what percent of ABR’s dividends are qualified (i.e. 0% qualified, 100% non-qualified):

(6) Past Price Performance: We already reviewed dividend history, but it’s also worth considering total returns (i.e. price gains plus dividends as if they were reinvested). As you can see in our earlier table, ABR has performed much better than peers, which is more an artifact of being in “the right place at the right time” than it is an indication of future performance, especially considering there are dark storm clouds ahead. Management overplays the “past performance” card on the earning call, saying:

“We managed to increase our dividend twice while maintaining one of the lowest payout dividend ratios in the industry and generated a total shareholder return of 28% outperforming our peers. Additionally and very significantly, we're able to maintain our book value of our recording reserves for potential future losses, which clearly differentiates us from everyone in this space.”

(7) Storm Clouds Ahead: Looking at current market conditions and underlying fundamentals is a much better indication of what is to come than looking in the rear-view mirror (like the previous six “lazy man” investment analysis metrics). And in the case of ABR, management admits clearly in the latest earnings call that there are dark storm clouds ahead, as CEO Ivan Kaufman described:

“We are in a period of peak stress and expect the next two quarters to be challenging, if not more challenging than the fourth quarter. As a result of this environment, we are experiencing elevated delinquencies. One of the many reasons this is occurring is certain borrowers are taking the position that they will default first and negotiate second which is not a strategy that works well with us.”

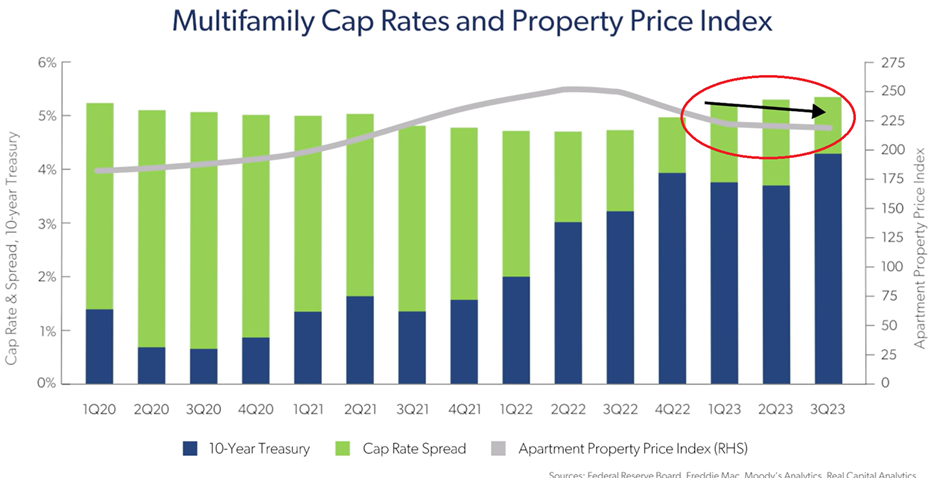

However, the challenges are much more dangerous than management lets on. For starters, many of ABR’s loans originated in 2021 when rates were lower while valuations have subsequently fallen.

The danger of higher rates and lower valuations is compounded by the fact ABR underwrites its collateralized loan obligations in a way where the lower-risk top tranches of debt are given to large institutional investors and the company itself is left holding a significant amount of subordinated high-risk tranches which will experience an avalanche of pain as defaults rise (as management explained in the earlier quote above, they do expect delinquencies to spike in the first half of this year). According to a recent short-seller report from Viceroy Research, who recently examined some of ABR’s loans:

In one $759 million CLO pool, according to Viceroy, almost 70 percent of the loans have a debt service coverage ratio below 1, meaning the properties backing them are not generating enough cash flow to cover the debt payments. Seven in the pool are delinquent.

Investors in CLO securities are usually banks, mutual funds, pension funds, insurance firms and hedge funds, according to the Federal Reserve. Institutional investors generally only buy in the top-rated tranches.

But with CLOs, the original lender keeps a significant portion of the lower-tier tranches, a more junior stake.

“It can get paid the most if borrowers are non-delinquent, or nothing at all if delinquencies are high,” Viceroy said in its report.

According to Viceroy, “there is no rate cut large enough, no rate caps cheap enough, and no investors dumb enough to save Arbor” as their CLO interest coverage rate continues to deteriorate.

And as you can see in our earlier table, short interest (people betting against ABR) is increasingly high.

The storm clouds ahead are a red flag for ABR that suggest the big dividend may be a “sucker yield.”

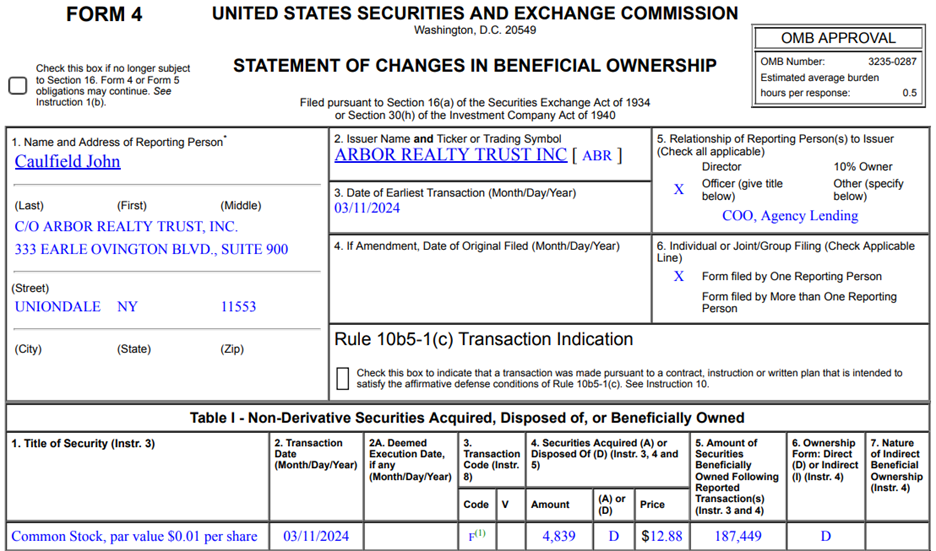

(8) Insider Sales: And per the company’s latest statements of beneficial ownership (to the SEC), many insiders were heavily selling their shares on March 11th (including the highly compensated COO).

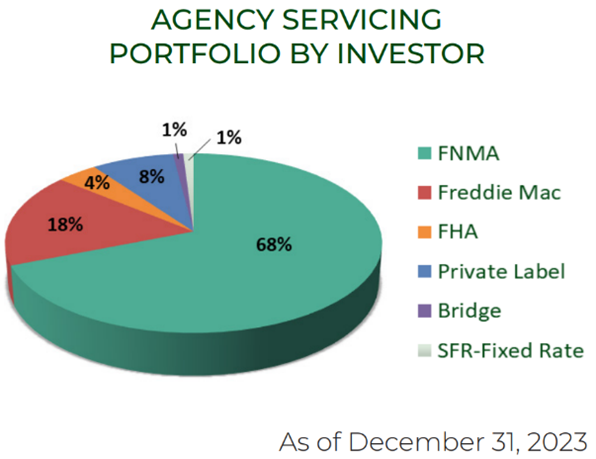

(9) Government Conflict of Interest: There is a huge conflict of interest between mortgage REIT investors and US government agencies. And a strong case can be made that the main reason the government allow so many mortgage REITs to even exists is because they transfer risk off government agencies (that underwrite bad loans for political reasons) and onto suckers investing in the likes of Arbor Realty Trust.

Management acknowledges this on the call by saying:

“As we all know, Fannie Mae and Freddie Mac have had a specific mandate to address the workforce/affordable housing needs, which is a major issue in the United States, making Arbor a great partner.”

(10) A New Batch of Suckers Every Market Cycle: Generally speaking, mortgage REITs are garbage long-term investments because every market cycle many of them get over-stressed and washed out. You can see the terrible 10 year returns for the group in our earlier table, and that’s just the ones that still exist.

For example, we took a lot of heat for writing about the dangers of “then popular” mortgage REIT New Residential (now re-named Rithm Capital) in late 2019 right before its share price was decimated and the dividend was reduced by 90%, as we correctly predicted.

3 Better Big Dividend Strategies:

If you are an income-focused investor, there are far better big-yield opportunities right now than mortgage REITs in general (and better than Arbor Realty in particular). For example:

(1) Select Property REITs: Unlike mortgage REITs (which basically end up owning a bunch of risky leveraged financial assets related to real estate) property REITs actually own underlying physical properties. Property REITs are a diverse group, that has suffered a lot of pain in recent years from changing market dynamics (such as online shopping, the pandemic, work-from home and sharply increased interest rates). However, select attractive opportunities are starting to emerge. Property REITs can be much better long-term investments than mortgage REITs.

(2) Top Bond Closed-End Funds: Another beat up high-income group that currently offers some very attractive high-income opportunities is bond closed-end funds (“CEFs”). This group experienced significant pain as interest rates increased over the last two years (as rates rise, bond prices fall), but with rates now dramatically more stable, the group offers some highly compelling industry-leading opportunities for high income. We have been investing heavily in select bond CEFs recently.

(3) Qualified Blue-Chip Dividends: Unlike the ordinary (non-qualified) dividends paid by many mortgage REITs, there are a lot of steady dividend growth stocks that pay qualified dividends (i.e. taxed at a lower rate) and also offer compelling long-term price appreciation. Steady dividend growth (taxed at a low rate) and long-term price appreciation (that can generate even more spending cash) is a powerful (and often underappreciated) opportunity, especially for those that want to avoid the dramatic market cycle pain that often goes unnoticed for mortgage REITs—until it’s too late.

Bottom Line:

By looking only at past performance, you are being lazy, and could fall into the “sucker yield” trap, especially for mortgage REITs like Arbor Realty Trust. Instead, considering also the fundamentals and current market environment is critically important (and they are NOT looking good for Arbor Realty Trust).

We currently own zero mortgage REITs in our “High Income NOW” Portfolio, and we’re still able to generate a 9.6% aggregate yield across 28 individual holdings and top ideas. We happen to be heavily weighted in select bond CEFs at the moment, but have also been seeing specific property REIT opportunities starting to pop up too at this point in the market cycle.

In fact, now is an incredible time to be a high-income investor (if you know where to look). Disciplined, goal-focused long-term investing continues to be a winning strategy.

*Note: Members can view all of our current holdings here.