If you like your investments to pay you high income now—this report may be right for you. We countdown our top 25 big-yield Exchange Traded Funds (“ETFs”) and Closed-End Funds (“CEFs”) with yields of 6.0% to over 12.0%, and carefully highlighting the important nuances of these two distinct investment vehicles, while also avoiding the gimmicky yield traps that sadly dupe so many unsuspecting investors. We start with some high-level advantages and disadvantages of ETFs versus CEFs, then rank our top big-yield funds, starting with #25 and counting down to our top ideas.

ETFs Versus CEFs: Strengths and Weaknesses

Starting with ETFs, they are increasingly popular for good reasons, and for bad. Initially, many ETFs were positioned as passive index funds designed to give you diversified market exposure at a very low cost. For example, rather than painstakingly trying to select individual stocks, and rather than paying the very high fees of traditional mutual funds (which are often tax inefficient and struggle mightily to beat an index), an ETF could quickly get you the diversified market exposure you want and at a very low cost.

However, ETFs also have a couple big weaknesses that you need to look out for. First, an increasing number active and exotic ETFs have been released over the years. Active ETFs try to beat a specific benchmark (which is hard to do) and often charge dramatically higher fees. And exotic ETFs can have goofy and misleading strategies (we’ll review one popular example later in this report) and also can charge very high fees without actually delivering the results you’re looking for.

The other big ETF weakness you need to look out for is their distinct disadvantages versus CEFs, particularly in the big-yield space (i.e. the focus of this article). Specifically, ETF’s that try to produce big-yields often take on risks that can be avoided through a CEF vehicle. For instance:

Leverage (i.e. borrowing money) is dramatically LESS risky for most CEFs than it is for most ETFs because of the fund flows. Specifically, it’s a lot riskier for an ETF to use leverage (which can magnify income and returns) because uncontrollable fund outflows (from investors selling shares) can force an ETF management team to sell things when they don’t want to (and at “fire sale” prices) just to meet immediate liquidity needs and to stay within mandatory leverage limits. On the other hand, CEFs are closed-end, so they don’t have to worry about money flowing out of their fund (at exactly the wrong time) and messing up their liquidity and leverage levels. It’s a lot less risky to use leverage in a CEF than in an ETF, and this is a distinct advantage for a CEF versus an ETF (especially in the “big-yield” space, as we will review with specific examples later in this report).

Holdings Flexibility is another advantage CEFs have over ETFs. For example, it’s a lot less risky (again from a liquidity standpoint) for a CEF to own less liquid assets (for example, higher-yield bank loans—which don’t necessarily trade in the public markets) than it is for an ETF. This is because CEFs (i.e. “closed-end” funds) generally don’t have the same liquidity demands as ETFs (i.e. “open-end” funds) in terms of fund inflows and outflows, and this allows CEFs to own some attractive asset classes that are generally a lot harder (and riskier operationally) to own in the ETF structure. This is another distinct advantage for CEFs over ETFs in the big-yield space.

Discounts/Premiums versus NAV are another unique characteristic of CEFs versus ETFs, and this creates some important risks and opportunities. Specifically, because CEFs are “closed-end,” they trade based on supply and demand (sellers versus buyers) and there is no immediate mechanism in place to ensure CEF market prices stay tightly aligned with the value of their underlying holdings (i.e. net asset value or NAV). As such, CEF’s can trade a wide discounts or premiums to NAV (we’ll discuss specific examples later in this report), and this creates distinct opportunities and risks for CEFs versus ETFs (which typically trade at market prices extremely close to NAV due to “open-end” market mechanisms in place).

There are a lot more nuances to ETFs versus CEFs (that we’ll get into later in this report), but the ones listed above are very important as we get into our top 25 big-yield ETFs and CEFs in the next section of this report.

Top 25 Big-Yield ETFs, CEFs, Ranked

You’ll notice there are a lot more CEFs than ETFs in our top 25 (for the reasons described above). Nonetheless, several big-yield ETFs did make the list. But before getting into the top 25, we’re starting with an also-ran (e.g. a big-yield ETF that is extremely popular, but wasn’t good enough to make it into our top 25).

*JP Morgan Equity Premium ETF (JEPI), Yield: 11.7%

JEPI is an extremely popular big-yield ETF, but it’s not good enough to make it into our top 25. From a “sales and marketing” standpoint, JEPI is a dream; it has a huge yield (paid monthly) and it’s beaten the S&P 500 over the last year (and with less volatility).

However, a look under the hood reveals that its yield is set to fall (as the income it generates from its ELN covered call strategy will fall as volatility passes) and it will likely underperform the S&P 500 dramatically in the years ahead (as that same ELN covered call strategy will cause investors to miss out on long-term market gains at an astounding (costly) compounding rate).

We recently wrote up JEPI in more detail for our members (you can access that report here), but if you are a long-term income-focused investor, JEPI simply isn’t good enough. There are other funds (and combinations of funds) that will deliver dramatically superior high-income results over the next decade.

25. Reaves Utility Income Fund (UTG), Yield: 7.7%

The Reaves Utility Income Fund is a closed-end fund ("CEF") that invests in securities (mostly stocks) operating mainly in the Utilities sector (a sector known for lower volatility and higher dividend income). And despite its higher management fees and expense ratio, it will likely handily outperform JEPI (mentioned above) over the next decade (higher returns and comparable monthly income payments) for the reasons described below.

First, UTG's holdings naturally have lower volatility than the typical S&P 500 stock (this is a general characteristic of Utilities stocks), but unlike JEPI, UTG will benefit more fully from the stock market's long-term gains. Specifically, JEPI limits its upside by only participating in around 65% of the market’s long-term gains (due to its covered call ELN strategy), whereas UTG uses a prudent amount of leverage (i.e. borrowed money) to more fully participate in the market's long-term gains (UTG recently employed ~19.3% leverage). Said differently, JEPI's long-term gains are hamstrung whereas UTG's long-term gains are prudently enhanced. Not only does the UTG leverage improve long-term returns, but it does so enough to offset the strategy's higher management fee and expense ratio, especially as compared to JEPI.

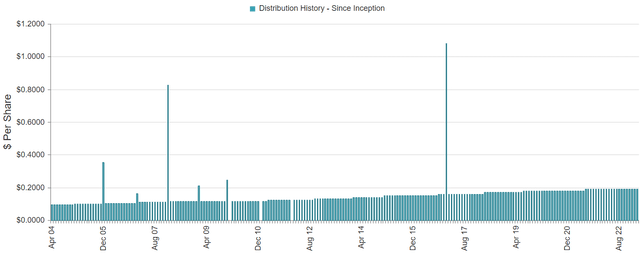

Further, both fund's pay monthly income, but JEPI's yield is set to fall, whereas UTG's yield is set to remain strong (see UTG's since-inception distribution payments in the chart below).

If you are seeking a high-monthly-income fund and strong returns, UTG's total returns will likely beat JEPI's very significantly over the next decade and beyond. Especially considering we like the Utility Sector right now (it's been relatively weak year-to-date in a bit of short-term mean reversion as compared to growthier sectors which have been whipsawed by unusually strong year-end tax loss selling followed by early 2023 strong gains).

24. PIMCO High Income (PHK), Yield: 11.2%

As the name suggests, the primary investment objective of the PIMCO High Income fund (a CEF) is to seek high current income. The secondary objective is capital appreciation. And with an 11.2% yield, paid monthly, there is a lot to like about this fund. For starters, it’s managed by PIMCO—a firm considered by many to be the clear leader in the fixed income space (and it has massive resources and expertise to support its leadership position).

PHK’s income has recently been entirely from income on the underlying holdings, and not from capital gains or return of capital. The income payments have had some downward volatility in recent years, but have always remained large and could also be set to rise as interest rates are up and the fund’s duration (interest rare risk) was recently around 3.8 years. PHK also has a healthy distribution coverage ratio as compared to other PIMCO Funds. Further, PHK holds a high dose of high yield credit, which could be positioned for gains as somewhat elevated credit spreads could soon narrow as the economic risks of high inflation fade.

Further, this fund trades at a 9.8% premium to NAV, which is not too large for a PIMCO fund, and low by the fund’s own historical standards. Further, it recently had 31.2% leverage (or borrowed money) to magnify income and returns, and we view this as prudent (and even slightly conservative for a PIMCO bond fund). If you are looking for a well-positioned high-income fund that pays monthly and is managed by an industry leader, the PIMCO High Income Fund is worth considering.

23. iShares Preferred & Income ETF (PFF), Yield: 5.7%

Owning preferred stocks can be an important part of an income-focused investment portfolio because the asset class adds volatility-reducing diversification while keeping income strong. And the iShares preferred stock ETF (PFF) is an efficient and effective way to do this. Specifically, PFF seeks to track the investment results of an index composed of U.S. dollar-denominated preferred and hybrid securities.

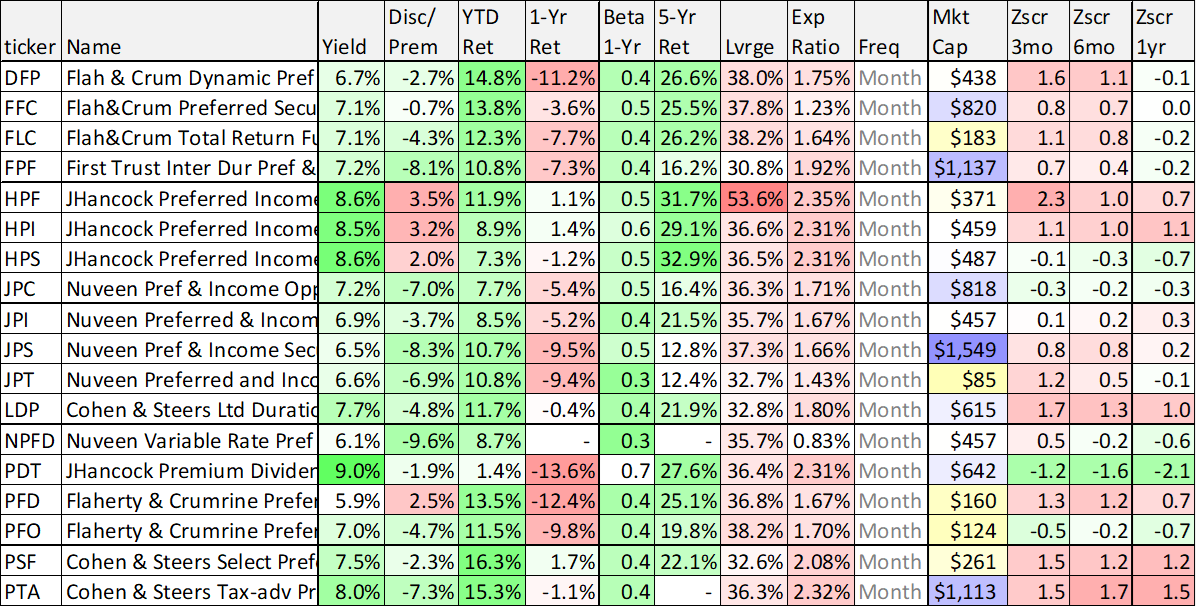

Rather than trying to pick individual preferred stocks, a lot of investors prefer to own preferred stocks funds. And for some perspective, here is some recent data on preferred stock ETFs (including PFF) and preferred stock CEFs, in the following two tables, respectively.

We like PFF in particular for its relatively low expense ratio, its big yield and its low-turnover passive approach. It also doesn’t use any leverage (which is common among CEFs). We’ll have more to say about a particular preferred stock CEF later in this report. However overall, PFF is an efficient and effective way to get broad exposure to high-income preferred stocks. We recently wrote up PFF in great detail, and you can view that report here.

*Honorable Mention:

*Schwab US Dividend Equity ETF (SCHD), Yield: 3.3%

SCHD is an okay fund, and frankly we have no huge problems with it, except for the fact that its yield isn’t big enough to make it onto this list and there are significantly better ways to achieve the goals it has set out to accomplish. For example, SCHD is biased in the types of stocks it buys, it omits REITs altogether, and we believe some of its holdings are much more attractive than others. We recently wrote up SCHD in detail here, and we shared better dividend-growth ideas in this report: Top 20 Dividend-Growth Stocks, Ranked.

22. Global X MLP ETF (MLPA), Yield: 7.1%

Master Limited Partnerships (or “MLPs”), especially those in the midstream energy sector, are often an income-focused investor favorite because of their big distribution yields (which are often supported by steady fee-based income generated by the underlying business). For example, midstream energy MLPs like Energy Transfer (ET) and Enterprise Products Partners (EPD) are frequently revered (we actually like them both). However, the problem with MLPs is they send out K-1 statement at tax time (instead of the typical 1099’s that investors are used to). And the K-1s are not only often a pain for investors, they are simply not allowed by some brokers in non-taxable accounts (such as IRAs). For this reason, many investors that want to invest in MLP’s simply cannot.

However, MLPA offers an attractive mix of 21 different individual MLPs in one ETF (Energy Transfer and Enterprise Products Partners are top holdings). And very importantly, MLPA doesn’t generate a K-1, rather it sends investors a 1099 at tax time. This makes it possible for many investors to invest in MLPs in situations where they otherwise would not be able to. And if you’re trying to get exposure to this attractive segment of the market MLPA is a great way to do it. MLPA is one of the few ETFs that actually cracked our top 25 list, and it’s worth noting that MLPA has a lower expense ratio than more popular MLP ETF (AMLP) (0.45% versus 0.87%). MLPA is absolutely worth considering for investors that want this unique MLP exposure (and high income) without the annual K-1 statement.

21. Guggenheim Strategic Opps (GOF), Yield: 12.9%

This largely fixed-income (bond) CEF is widely popular among income-focused investors because its big monthly distributions (it currently yields 12.9%) have never been reduced, only increased. And while its big premium to NAV (+30.4%) is a turnoff to some investors, it’s not as unattractive as some investors think (because of its ongoing “at-the-market” offerings and its well executed DRIP program). It recently had 24.4% leverage (which we view as prudent for the assets it owns) and its expense ratio (including leverage) is reasonable (recently at 1.83%). The fund’s investment objective is to maximize total return through a combination of current income and capital appreciation, and it has a long history of achieving that goal. We view GOF as attractive, and we previously wrote it up in extensive detail here.

20. Cohen & Steers Quality Realty (RQI), Yield: 7.2%

If you want exposure to the real estate sector (which is a bit of a contrarian play that we like right now), RQI is a great way to play it. The fund offers a big yield, a discount to NAV (recently -1.7%), monthly payments, and attractive z-scores (an indication of an attractive price relative to recent history). It’s also been successfully paying distributions for over 20 years. The strategy uses a healthy dose of leverage (to help magnify income and returns) currently around 27.9%.

According to the RQI website: “the primary investment objective of the Fund is high current income through investment in real estate securities. The secondary investment objective is capital appreciation.”

This one holds a lot of REITs that you are likely familiar with (recently Prologis (PLD), Welltower (WELL) and Realty Income (O) were all in the top 10 holdings). The management fee and total expense ratio (recently 1.91%) are a bit on the high side, but reasonable depending on your goals (i.e. if you want instant diversification and a large monthly distribution trading at a discount to NAV—it’s worth it).

19. Tekla Life Sciences Investors (HQL), Yield: 9.3%

If we are headed into a recession (as many experts predict) healthcare stocks can continue to hold up well, especially pharmaceutical companies and those that benefit from the healthcare procedures that were postponed during the pandemic lockdowns (as demand continues to resume). HQL trades at a healthy discount (-12.3%) has compelling z-scores and an attractive yield (paid quarterly). Some investors avoid this one considering the distribution payout bounces around a bit (it has consistently remained high however) and has recently included some return of capital. The total expense ratio is reasonable (recently ~1.4%). Overall, if you are looking for attractive high-income opportunity trading at a significantly discounted price (as compared to NAV and z-scores) this one is worth considering.

18. Tekla Healthcare Opportunities (THQ), Yield: 6.8%

If you are looking for big monthly distribution payments (that have never been reduced in its nearly nine year operating history), THQ is worth considering. It recently held 127 positions concentrated mainly in healthcare stocks (such as Eli Lilly (LLY), Cigna (CI) and Humana (HUM)), and trades at a wide ~10% discount to NAV. Interestingly, this fund may invest up to 20 percent of its assets in the debt of healthcare companies, up to 25 percent of its assets in healthcare REITs, and up to 30 percent of its assets in convertible securities. Recently, THQ owned roughly 85% stocks and 15% bonds.

This fund also recently had ~20% leverage (or borrowed money), which can magnify income, but also magnify volatility. The management fee was recently 1.24% (reasonable for this type of fund) and its total expense ratio was around 1.87% (after you factor in the interest expense, i.e. cost of borrowing).

The distributions have recently included a significant dose of return of capital (“ROC”), which is fine for now, but should be monitored (considering ROC can reduce your cost basis, thereby increasing your potential capital gains taxes if/when you sell, assuming you own it in a taxable account). Overall, we view this as an attractive big yield opportunity to gain exposure to the healthcare sector. We recently wrote up THQ in detail, and you can review that report here.

17. Tekla Healthcare Investors (HQH), Yield: 9.1%

The Tekla Healthcare Investors Fund is currently attractive for a variety of reasons. For starters, it offers exposure to a wide variety of healthcare sector companies (it recently had around 150 holdings, including stocks like Amgen (AMGN), Gilead (GILD) and UnitedHealth Group (UNH)), thereby giving investors some instant healthcare sector diversification.

HQH currently trades at a ~10% discount to the value of its underlying holdings, or Net Asset Value ("NAV"), a wide discount by historical standards (the 1-year z-score was recently -1.5, arguably a good sign). Large discounts and premiums to NAV are a unique characteristic of CEFs (as compared to other mutual funds and exchange traded funds) and they can create unique risks and opportunities (we generally greatly prefer to buy attractive CEFs at large discounts).

As a matter of policy, the fund has a managed distribution policy:

The Fund has a managed distribution policy (the Policy) which permits the Fund to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends, to the extent possible, to use net realized capital gains when making quarterly distributions. However, implementation of the policy could result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains.

Another important consideration is the source of HQH distributions. As you may have guessed, not all of the distributions are sourced from income on the underlying holdings, but rather a portion can come from capital gains and/or return of capital. A portion from capital gains is expected over time, and a portion from return of capital ("ROC") is also acceptable but should be monitored. Specifically, ROC can reduce your cost basis, thereby generating an unexpected capital gains tax if/when you do sell your shares.

Management fees are another metric that should be monitored for reasonableness. The management fee on HQH was recently 0.99% (reasonable) plus 0.20% in other expenses. This fund has recently been using close to 0% leverage (or borrowed money) which we view as a good thing (leverage can magnify income, but also magnify risks when the market gets volatile--like it has this year). Leverage is also expensive (especially with rates rising) and can add to a fund's total expense ratio. The total expense ratio on HQH was recently 1.19%, which we view as acceptable for an actively managed CEF (view the fund's management team here).

Overall, if you are an income-focused investor, we view HQH as attractive for its large price discount (versus NAV), its very low use of leverage (recently 0.85%), reasonable expense ratio (recently 1.19%), attractive exposure to the healthcare sector, and big distribution yield (paid quarterly).

16. BlackRock Health Sciences II (BMEZ), Yield: 10.6%

If you like big income, trading at a significantly discounted price, essentially zero use of leverage, a relatively low management fee and distributions based almost entirely on income and gains (virtually no return of your own capital), this BlackRock CEF is hard to ignore. So far, it’s never reduced its big monthly distribution (only increased it) and it has a history of paying additional special distributions too.

The fund recently held 187 positions concentrated mainly in US healthcare stocks, and it is backed by the resources of BlackRock, a vast industry leader. The fund was launched in January 2020, but already has over $2 billion in assets. BMEZ basically trades near its widest discount to NAV since inception, and if you are looking for exposure to healthcare stocks, BMEZ is attractive and hard to ignore.

15. John Hancock Prem Div. CEF (PDT), Yield: 9.0%

PDT is a CEF focused primarily on preferred stocks. And as an asset class, preferred stocks can be an important complement (and risk-reducing portfolio diversifier) as compared to common stocks and bonds.

PDT seeks to invest in companies operating across diversified sectors, with an emphasis on the utilities sector. It benchmarks the performance of its portfolio against a composite benchmark comprised of 70% Bank of America Merrill Lynch Preferred Stock DRD Eligible Index and 30% S&P 500 Utilities Index.

The fund recently had 36.4% leverage to help magnify returns (a level we believe is prudent based on its allocation to less volatile preferred stocks and utilities sector stocks). It also pays dividends monthly, trades at a discount to NAV (-1.6%) and has attractive z-scores. If you are looking for exposure to preferred stocks and a big monthly distribution, PDT is absolutely worth considering (see our earlier preferred stock CEF table for more PDT data).

15. BlackRock Energy & Resources (BGR), Yield: 5.4%

There is a lot to like about this stock CEF focused on the energy sector. For starters, it trades at a wider-than normal discount to NAV (recently -9.7%), which means you get access to the underlying holdings (and dividends) at a discounted price. The CEF has only around 34 holdings (the largest positions were recently Exxon Mobil at 13% followed by Chevron at 11%) so there is clearly some concentration to the strategy. It also uses close to 0.0% leverage, so that offsets some of the volatility risks of the energy sector (it would be a lot riskier if BGR used a lot of leverage).

We also appreciate the vast resources and competencies of BlackRock, which is a leader in the CEF space but not revered on the same level as PIMCO (that helps keep the price low versus NAV—a good thing). As such, BlackRock funds generally offer lower management fees, and BGR is no exception with a recent total expense ratio 1.1% (significant, but also significantly lower than many other CEFs, and not so bad considering the current wide price discount versus NAV).

14. BlackRock Innovation & Growth (BIGZ), Yield: 12.3%

BIGZ is another BlackRock stock CEF, but this one is focused on growth and innovation sectors, including a large allocation to technology stocks (something many income-focused investors unfortunately miss out on because technology stocks aren’t known for paying big dividends). As such, this fund sources its distributions from gains, something there has not been a lot of over the last year as tech stocks sold off particularly hard. We view this as an attractive contrarian opportunity, especially considering the fund trades at a very large 21.4% discount to NAV (which means you get to own the underlying holdings at a very large discount).

Interestingly, this fund also has a focus on small and mid-cap stocks, another allocation that has underperformed over the last year in particular and represents a particularly attractive long-term contrarian opportunity, in our view.

It may seem odd for an income-investor to invest in small and mid-cap growth stocks, especially considering the total expense ratio on this fund (1.35%), but considering the contrarian nature of the opportunity, the diversification benefits (especially for income-focused investors), the strength and resources of BlackRock, the high monthly income payments and the truly massive discount to NAV, BIGZ is hard to ignore.

12. BlackRock Corp High Yield, (HYT), Yield: 10.4%

Some investors prefer PIMCO over BlackRock when it comes to bond CEFs, but BlackRock has incredible resources that put it head and shoulders above most other CEF providers. Further, BlackRock’s management fees are generally much more reasonable (for example, the management fee on this fund was recently 1.3%, which is very low considering that includes the cost of borrowing on this fund that is levered at around 29.4%). Further, high-yield bonds are particularly attractive now as credit spreads remain elevated (an indication that the market is already pricing a lot of risk). If/when credit spread return to normal, the value of this fund will rise. And the recent share price declines of almost all bonds (as interest rates have risen) appear to be approaching an end (as interest rate hikes are set to end this year—hopefully sooner than later). HYT also trades at an attractive discount to NAV (-4.1%) and its 20-year distribution history has been very solid. If you are looking for high income (paid monthly) trading at an attractive price—this one is worth considering.

11. Royce Micro-Cap Trust (RMT), Yield: 11.6%

We especially like CEFs that offer unique manager skills, investment opportunity sets and leverage that is not easily achieved and managed by individual investors) and/or that trade at attractive discounts to net asset value (“NAV”), such as RMT.

Led by lead portfolio manager (and his team), Chuck Royce, Royce Investment Partners has been a small cap specialist since 1972. And the Royce Micro-Cap Trust has outperformed its benchmark for the 1-, 3-, 5-, 10-, 15-, 20-, 25-year, and since inception (12/14/93). The fund actively invest in small and micro-cap stocks (the average market cap is only around 590 million versus roughly $2 billion for the Russell 2000 small cap index). Navigating small and micro-cap stocks requires specials skills (due to liquidity constraints and the risks and opportunities of the CEF structure) and the Royce team has a long-track record of success. RMT has delivered strong performance net of fees (the total expense ratio was recently 1.35%, an acceptable level for active micro-cap) and the strategy appears positioned to perform well going forward.

Specifically, small and micro-cap stocks currently present a compelling contrarian opportunity right now as the market paradigm shifts. For example, the Russell 2000 small cap index (and the Russell microcap index) have significantly underperformed the S&P 500 in recent years, and that has historically been an exceptional time to buy, as argued by this Royce article.

Also important, RMT currently trades at a wide discount (~10.5%) to its NAV (i.e. the market value of all the underlying holdings in the fund). And like other CEFs, the reason this fund offers such a big yield is NOT because the underlying holdings pay such big dividends. Rather, it generate a significant portion of its distribution from capital gains (and in some cases from a return of capital). The big distribution yield can be helpful to investors that really appreciate steady income payments, but the performance described above includes a reinvestment of the distributions, and if you are a long-term investor—simply reinvesting the distributions automatically can make a lot of sense.

Overall, if you are looking for an attractive contrarian opportunity, the Royce Micro-Cap Trust is attractive and worth considering.

10. Royce Value Trust (RVT), Yield: 8.9%

We currently own both of these two Royce funds (RVT and RMT) and we view this as not only a high income opportunity (paid quarterly), but also as an attractive price appreciation opportunity as we take a contrarian view on small and micro cap stocks—we expect them to rebound hard (ahead of large caps) as the market stabilizes and eventually rebounds. Statistically speaking, now is an attractive time to invest in small caps as a contrarian opportunity, as we explained in our previous Royce articles.

Further, both funds trade at big discounts to NAV (~10.0%), they both offer very reasonable management fees (1.15% and 1.20%, respectively), they have compelling z-scores, and Royce is a small cap specialist with a long track record of success (i.e. beating their benchmarks consistently and handily, net of all fees and expenses).

9. Adams Diversified Equity Fund (ADX), Yield: 6.3%

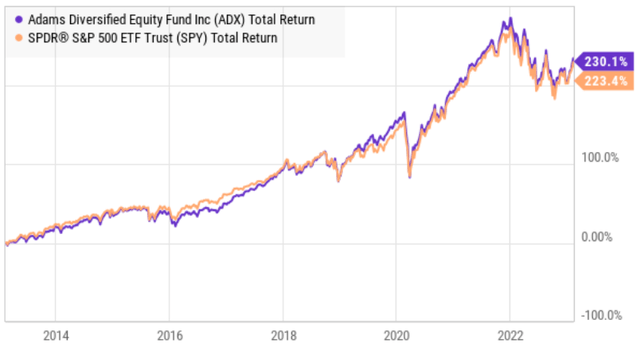

If you are a long-term income-focused investor, the Adams Diversified Equity Fund is attractive. For starters, ADX is a closed-end fund that has been paying big dividends to investor for over 80 years straight. It guarantees at least a 6% distribution each year, and it is usually significantly higher. Further, ADX currently trades at ~14.9% discount to its net asset value (i.e. "NAV" or the aggregate value of its underlying portfolio holdings). This type of large discount is a unique characteristic of closed-end funds (it's generally not allowed on ETFs, and there are mechanisms and arbitrageurs in place to make sure it essentially never happens for ETFs). And this discount helps more than offset ADX's 0.56% annual expense ratio (which is very reasonable for a CEF).

ADX invests actively in US equities across market sectors, and it has historically delivered net returns that are comparable (usually better) than the S&P 500. What's more, ADX can be a great compliment to income-investor portfolios because it invests across sectors, including sectors that many income-focused investors significantly miss out on (such as technology and discretionary).

One common complaint with ADX is that is pays dividends quarterly. Specifically, it pays a smaller dividend in quarters one, two and three, followed by a larger fourth quarter dividend to bring the annual yield significantly higher. Here is a look at its recent dividend history.

Investment websites notoriously misreport the ADX dividend because their yield calculation methodologies simply cannot handle the annual ADX small-small-small-big distribution cadence. But if you can handle that pattern--you will likely do very well with ADX over the long term.

Honorable Mention:

Liberty All-Star Equity (USA), Yield: 9.7%

If you can’t handle the lumpy distribution payments of ADX, try USA instead. It pays monthly (not quarterly), it yields more and distributions are at a steadier rate. USA also invests in US public equities (financials are its largest current sector exposure, followed by technology) and it also trades at a discount to NAV (though not as big). Both funds use essentially zero leverage. Both (ADX and USA) are attractive in our view, depending on your goals.

8. DoubleLine Income Solutions (DSL), Yield: 10.9%

DSL offers a big yield (paid monthly) and still trades at a small discount to NAV (a good thing). The strategy is managed by famous bond investor, Jeffrey Gundlach, and the strategy’s primary objective is to seek high current income and its secondary objective is to seek capital appreciation. DSL invests in lower rated bonds (which offer higher yields) in the US (40% of the fund) and internationally (including 40% in emerging markets), and the strategy will likely do better as credit spreads narrow as the markets continues to recover from the inflation shock caused by pandemic stimulus. The duration (interest rate risk) was recently 4.7 years, so interest rates matter (an end to rate hikes would be good), but narrowing credit spreads will also help this high yield CEF’s price significantly too.

7. DoubleLine Yield Opportunities (DLY), Yield: 9.8%

DLY is a “go anywhere” bond strategy (managed by famous bond investor, Jeffrey Gundlach) that has never reduced the distribution, and it has not been sourcing the distribution from capital gains or ROC (return of capital). It also uses conservative leverage (~23.3%) compared to others, and it trades at a wide 7.7% discount to NAV. The Fund’s investment objective is to seek a high level of total return, with an emphasis on current income. It invests around 69.5% of its assets in the US, it has a heathy dose of high-yield bonds, and its duration (interest rate risk) was recently only around 2.6 years.

Portfolio manager, Jeff Gundlach, recently noted in a P&I article that now is the time to get back into bond investing. Bonds suffered sharp declines in 2022, however DLY is positioned to benefit from the rebound (as the Fed rate hike cycle approaches its end in the months ahead, as per CME Fed Funds Futures).

6. PIMCO Corp & Inc Opp. Fund (PTY), Yield: 10.2%

PTY is a popular PIMCO bond fund, and for good reason. For starters, it's managed by PIMCO, generally considered the top bond CEF manager (thanks to the company's track record of delivering the goods). For example, PTY has a long history of paying big monthly income to investors, plus an occasional special dividend to boot.

PTY's objective is maximum total return through a combination of current income and capital appreciation. Specifically, PTY seeks to achieve its investment objective by utilizing a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

PTY trades at a relatively large premium to NAV (recently ~21.7%), but a lot of investors don’t mind considering its relatively shorter duration than some other PIMCO funds (i.e. less interest rate risk), and the fact that it hasn’t been sourcing the distribution from return of capital or capital gains lately. It recently had just under 40% leverage. If you can get comfortable with the large price premium (which is frequently the case for PIMCO funds), this one is attractive and worth considering.

5. PIMCO Dynamic Income Opps. (PDO), Yield: 11.0%

PIMCO's popular bond fund, PDO, gives you big steady monthly distribution payments by investing opportunistically across the bond markets, including corporate bonds, bank loans and asset-backed securities, to name a few. It has never decreased its distribution (only increased it), and it has a history of occasionally paying additional special dividends. Further, it trades at only a 4.1% premium to NAV, which is relatively quite small for a PIMCO bond fund (PIMCO is the market leader in bond funds).

PDO currently uses ~50% leverage to magnify returns and income (this is a healthy "full" dose of borrowing that we're comfortable with considering the competencies and resources of PIMCO). And the total expense ratio was recently around 2.79% (that includes the cost of borrowing). If you are looking for big monthly income, PDO is attractive and worth considering.

4. PIMCO Dynamic Income Fund (PDI), Yield: 12.8%

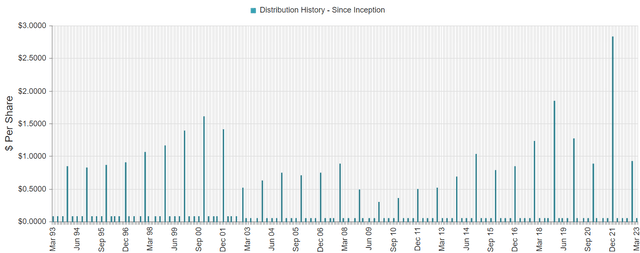

PDI is the grand daddy of them all with total assets of around $5 billion (it grew from popularity and from its consolidation with 2 other large PIMCO funds just over a year ago). This one pays a huge monthly dividend (and has a history of paying special dividends too). Plus, It has never reduced its distribution (only increased it) since it was launched over 10 years ago.

PDI also trades at a significant premium to NAV (+12.3%) and has a somewhat ugly z-score, but inevitably many income-focused investors don’t mind the potential short-term price volatility as long as it keeps paying those big monthly distributions.

The primary investment objective of PDI is to seek current income, and capital appreciation is a secondary objective. The Fund seeks to achieve its investment objectives by utilizing a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

PDI uses a healthy dose of leverage (48%), and it has a hefty total expense ratio (recently ~2.64%), but as long as it keeps delivering the goods (high monthly income) investors love it. We are not crazy about the premium price, but we do like the fund and the income.

3. BlackRock Credit Alloc. Inc IV (BTZ), Yield: 9.3%

BTZ seeks current income, current gains and capital appreciation. Normally, it will invest at least 80% of its total assets in credit-related securities, including, but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these credit-related securities.

Unlike many PIMCO funds, BTZ actually trades at a discount to NAV (currently -5.4%) and remains well positioned to benefit from the end to interest rate hikes. With a duration of over 6 years it has some interest rate risk, but it also uses only around 33% leverage which gives it more flexibility to take advantage of the dynamic environment. BTZ also has a significantly lower total expense ratio of around only 1.12% (much more reasonable). If you are looking for a big monthly distribution payment (and you prefer discounts instead of premiums), BTZ is attractive and worth considering.

2. BlackRock Multi-Sector Income (BIT), Yield: 9.9%

If you are looking for big, steady, monthly income payments, BIT is absolutely worth considering. It is prudently managed by well-respected BlackRock, it uses less leverage than many popular PIMCO funds (such as PDI and PDO) thereby reducing risks in that regard, and BIT has very little interest rate risk (its duration is close to zero), so it is not as negatively impacted by rising interest rates to the same extent as most other bond funds.

For reference, BIT’s primary investment objective is to seek high current income, with a secondary objective of capital appreciation. BIT seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. And considering it still trades at a small discount to NAV, offers nearly a 10% yield and holds a significant dose of investment grade bonds, we like it.

1. PIMCO Access Income Fund (PAXS), Yield: 10.4%

We like PIMCO, we like high income (paid monthly), we like discounted prices and we like price appreciation potential. The PIMCO Access Income Fund has all of these. It’s a new fund launched about one year ago (on January 31, 2022), and we believe its worth considering for investment now before the discount turns into a premium (as is the case with so many other PIMCO funds).

PAXS seeks current income as a primary objective and capital appreciation as a secondary objective. The Fund seeks to achieve its investment objectives by utilizing a dynamic asset allocation strategy among multiple sectors in the global public and private credit markets, including corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers and real estate-related investments.

Further, PAXS already established itself as a special dividend payor (it paid a big special dividend in December of its first year in existence), and it continues to maintain healthy distribution coverage as per its net investment income report. If you are looking for big steady income with share price appreciation potential, and from a top-notch manager, we like PAXS.

Conclusion:

ETFs and CEFs provide a wide variety of opportunities for high-income investors, but they also offer risky pitfalls (i.e. opportunities that look good, but are actually quite gimmicky and weak in the long-term). Also important, big-yield funds offer opportunities to diversify away some of the risks by constructing a portfolio that works to meet your specific needs. At the end of the day, you need to determine a strategy that is right for you. We believe disciplined goal-focused long-term investing will continue to be a winning strategy.

*For more high-income ideas, check out our new High Income Now Portfolio.