Members Mailbag—Mortgage REITs: In this quick note, we share updated data on 40+ big-yield mortgage REITs, plus a response to a member inquiry about how we are currently rating mREITs in our High Income NOW portfolio. For starters, here is the member inquiry we received:

…Need some clarification please. In your Now portfolio ARCC is on Hold. Does that really mean sell? Also AGNC & NLY are under review. Those last two are about 3.6% of my holdings (ARCC is 0.76%). Do these ratings mean that I should start trimming? Thank so much. Dave

First, regarding “HOLD” ratings, that means we believe the shares are worth holding, and we currently own the shares (because we believe the shares are worth owing).

Regarding mREITs, we are generally NOT a big fan of this asset class because of the high risks. Mortgage REITs can vary significantly in strategy, but they tend to use A LOT of leverage (borrowed money), and this creates risks. For example, popular mREIT Annaly Capital recently used 6.0x GAAP leverage at the end of its most recent quarter. To put it bluntly, that is A LOT of leverage that creates A LOT of Risk. Specifically, when the market get volatile (particularly interest rates) mREITs can quickly find themselves over-leveraged, thereby requiring them to liquidate assets at unfavorable prices thereby damaging their book values.

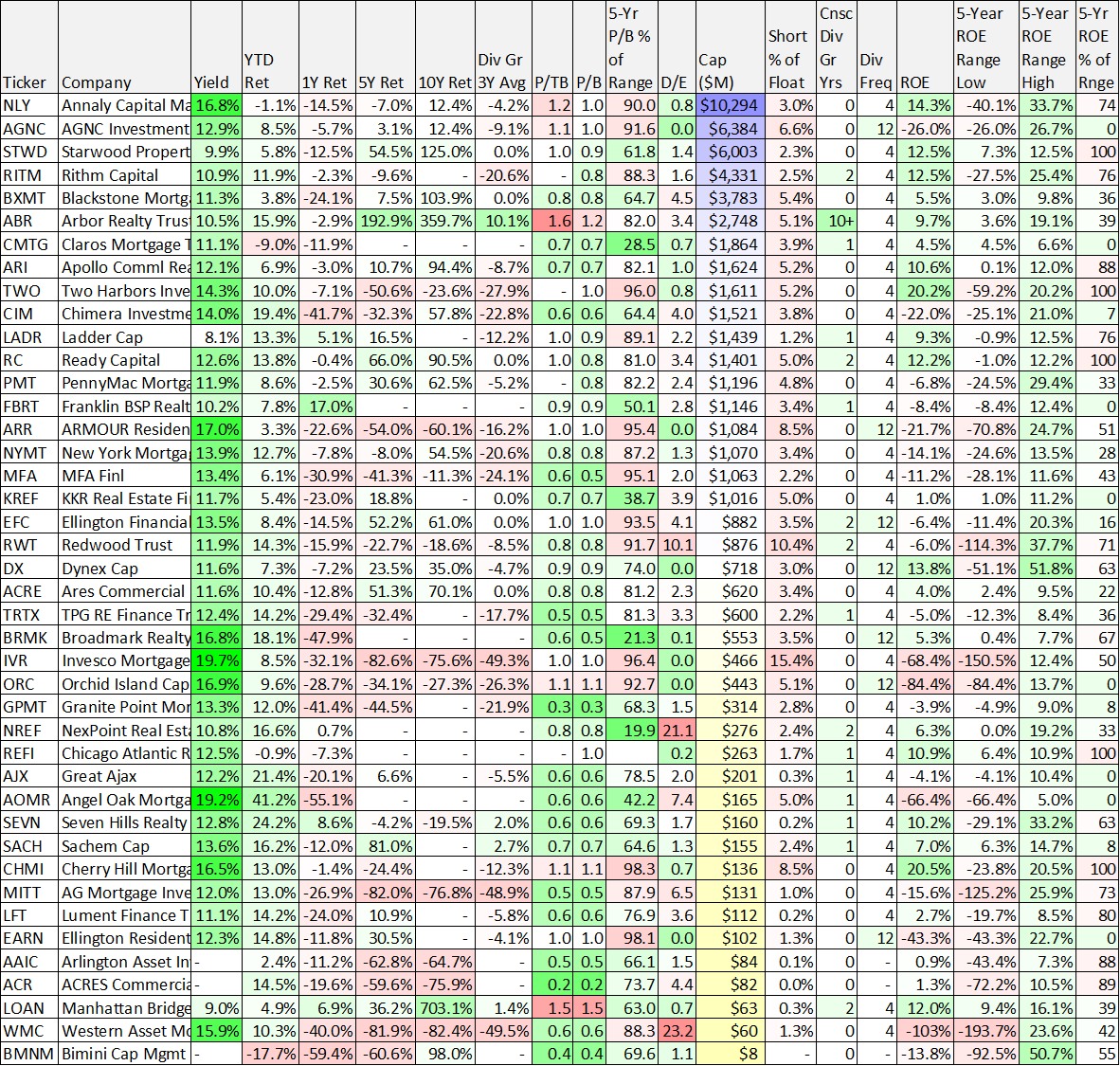

Book value is one of the most basic valuation metrics for mREITs (some investors like to buy mREITs at a discount to book value—i.e. below 1.0x), and you can see the most current book-value data for over 40 mortgage REITs in the following table.

To put the high leverage of mREITs into perspective, BDC ARCC (mentioned in the inquiry above) uses only around 1.25x leverage (which makes them dramatically less risky in this regard).

Generally speaking, we don’t view mREITs as attractive long-term investments. That doesn’t mean they cannot occassionally present very attractive “buy low” opportunities. In fact, mREITs can be quite volatile thereby creating potentially attractive short and mid-term trading opportunities, but in the long-term the group generally remains too risky for our taste. For example, as you can see in the table above, the 5- and 10-year total returns have been very weak, and those are just the ones that haven’t gone out of business or restructured dramatically. For reference, the S&P 500 is up 60.2% over the last five years and up 217.5% over the last 10 years.

The Bottom Line

Our bottom line on mREITs is that although the big yields can be tempting, they also come with big risks. Mortgage REITs can occasionally present attractive short and mid-term trading opportunities, but as long-term investments mortgage REITs are generally too risky for our taste.