Preferred Stocks are often misunderstood. They can grab the attention of income-focused investors because of their big yields, but beyond that—many investors just don’t understand how they work. In this report, we review the nuances of preferred stocks (that investors absolutely need to know), and then share data on 40 big-yield preferred stock funds, with a special focus on PFF, plus a few more in particular that are worth considering. We conclude with our opinion on who might want to invest, and how best to go about doing that.

Preferred Stock Overview:

Although referred to as preferred “stocks,” they’re really a lot more like “bonds” in the sense that they typically have a stated face (or par) value (usually $25 per share) and they have a contractual interest rate. However, unlike bonds, preferred stocks typically don’t have a set maturity date, and with regards to the capital structure, preferred stocks rank junior to all other bonds (which means in a bankruptcy situation—the bond holders may get some of their money back, whereas the preferred stock holders often get nothing). Further, like bonds, when interest rates rise, preferred stock values fall (and vice versa), and when market volatility (i.e. fear) rises—preferred stock values also typically fall.

Further, every preferred stocks has its own unique details in terms of interest rates, possible (but not mandatory) redemption dates and more. One good resource to look up the details on an individual preferred stock is quantum online. For example, Well Fargo Company (WFC) has a lot of different series of preferred shares and you can review the details here.

Preferred Stock Funds:

Some investors like to sort through the many thousands of series of preferred stocks currently outstanding in the market. However, others view preferred stocks as a group (or an asset class) and simply want exposure to the group, instead of trying to sort through the individual issues to pick out the good ones. Exchanged Traded Funds (“ETFs”) and Closed-End Funds (“CEFs”) are two important ways to get exposure to the preferred stock asset class, so let’s review some examples and data.

40 Big-Yield Preferred Stock Funds:

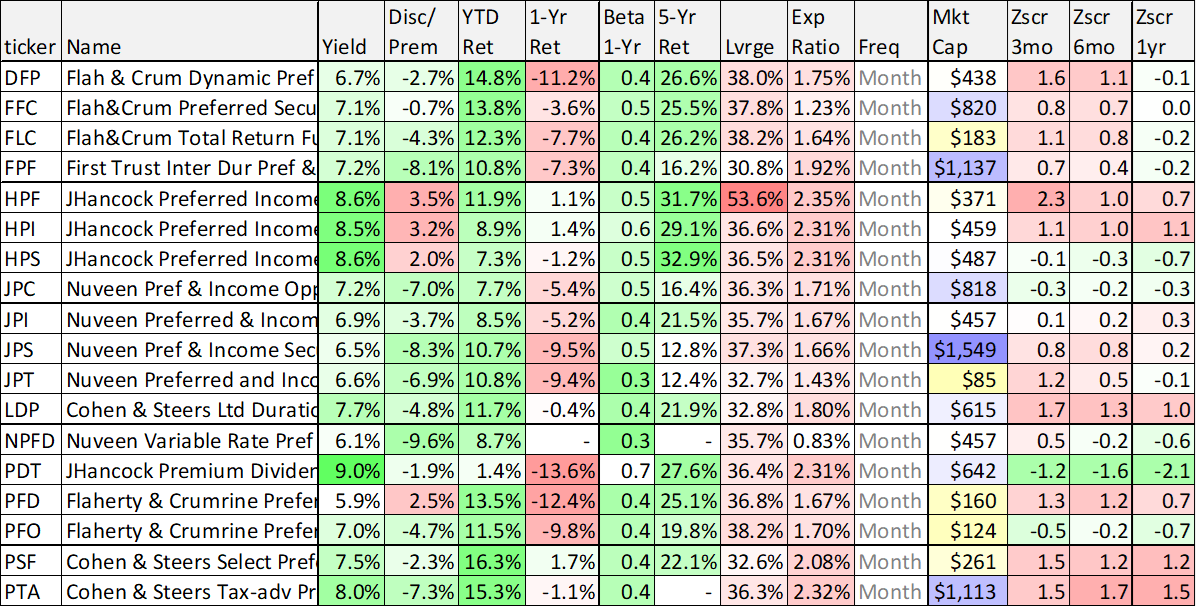

The following tables include important data on a variety of preferred stock funds, both ETFs and CEFs, including yields, performance, fees and more.

ETFs (Preferreds):

data as of mid-day 14-Feb-23

CEFs (Preferreds):

data as of mid-day 14-Feb-23

iShares Preferred ETF (PFF), Yield: 5.8%

According to BlackRock (i.e. the company behind iShares), the iShares Preferred and Income Securities ETF seeks to track the investment results of an index composed of U.S. dollar-denominated preferred and hybrid securities. It gives investors exposure to U.S. preferred stocks, which have characteristics of bonds (pay a fixed dividend) and stocks (represent ownership in a company). It gives investors access to the domestic preferred stock market in a single fund, and it can be used to pursue income that can be competitive with high yield bonds.

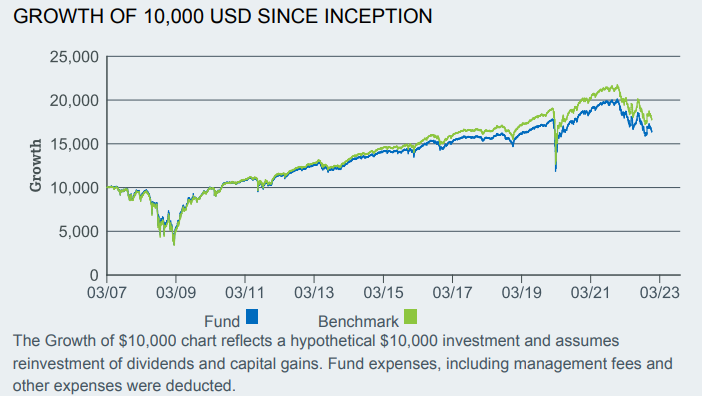

Since inception, PFF’s total return has mostly kept pace with its index, as you would expect (see chart below).

And over the last 10 years, PFF’s total return has significantly lagged the S&P 500 (SPY) and performed slightly better than a high yield bond ETF (HYG), as you also might expect.

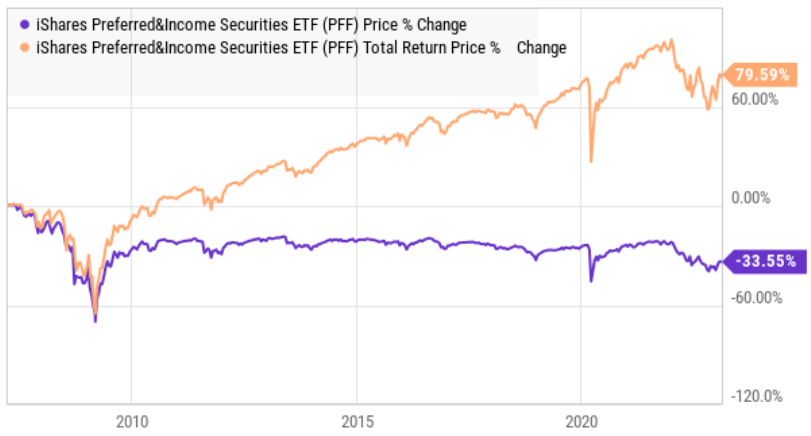

Basically, PFF is a decent way to get passive exposure to the high-dividend payments of the preferred stock asset class. Just be aware that the above returns assume all dividends are reinvested, and here is a look at the historical price returns versus total returns—an important distinction to keep in mind.

Also note, there are other preferred stock ETFs (besides PFF) as you can see in our earlier table, and they differ slightly in terms of expense ratios (a lower expense ratio saves you money), but they are similar in terms of current yields and longer-term total returns.

Leveraged US Preferred Stock ETF (PFFA), Yield: 9.4%

Another way some investors choose to get exposure to the preferred stock asset class is through a levered ETF, such as PFFA. This ETF basically invests in a similar group of preferred stocks as PFF, but it does so using leverage (or borrowed money) to magnify the returns. According to the fund:

“Modest leverage (typically 20-30%) is utilized to enhance portfolio beta, and options strategies are used in an effort to enhance current income.”

According to the PFFA manager, the Fund seeks current income and, secondarily, capital appreciation through a portfolio of preferred securities issued by U.S. companies with market capitalizations of over $100 million.

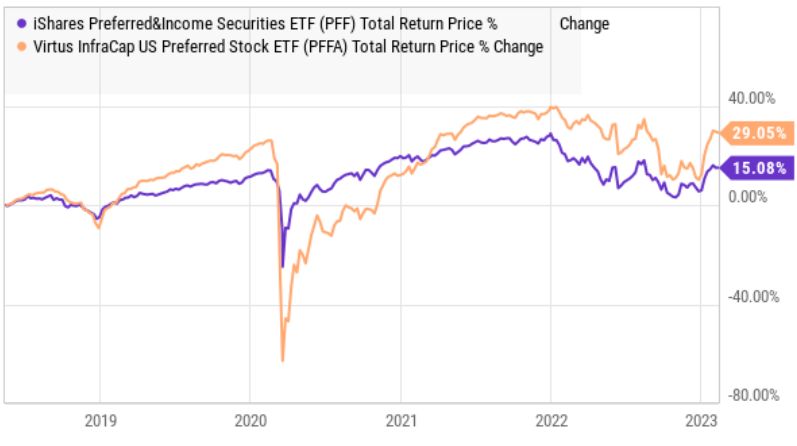

Here is a look at the performance of PFF versus PFFA (below).

PFFA can be tempting in terms of offering higher income, but that higher income also comes with more risks. For example, when the market get volatile and sells off—PFFA sells off harder than PFF (as you can see in the chart above).

Complicating and compounding the challenges of a market wide sell off for PFFA is the fact that it does NOT have total control over fund flows (i.e. investors buying or selling shares, potentially requiring PFFA to raise cash to redeem shares at precisely the most dangerous and costly time (i.e. when the market is down). In such a scenario, PFFA can be forced to sell things at less than ideal prices to maintain their target leverage level and this can ultimately cause a big drag on performance. Not a good situation.

Complicating matters further, PFFA has significantly higher expense ratio than other non-levered preferred stock ETFs, as you can see in our earlier table.

Preferred Stock CEFs

You will also notice in our earlier tables, that in addition to ETFs, we have also included a variety of active big-yield Preferred Stock CEFs (i.e. Closed-End Funds). Preferred Stock CEFs have some distinct advantages over Preferred Stock ETFs, especially with regards to fund flows, liquidity needs, the use of leverage and significant price premiums/discounts versus NAV.

For starters, you can see in our earlier tables that preferred CEFs have outperformed almost all preferred ETFs over the last 5 years. The main reason isn’t necessarily because the CEFs are great stock pickers, but rather because they all use significant leverage to magnify returns and current yield.

And what makes CEF leverage much safer than ETF leverage is simply that preferred stocks have control of any fund inflows and outflows (in most cases, there are none because they “closed-end”). This it makes it much easier for the CEFs to manage leverage than it is for ETFs (which tend to have big costly fund flows at exactly the wrong time).

Next, CEFs can trade at significant price premiums and discounts versus their net asset values (or NAVs); this creates opportunities and risks. We generally greatly prefer to buy attractive CEFs at a discount because it means we’re getting the income and return potential of the underlying holdings at a discounted price (and the combination of discount and leverage more than offsets the cost of the higher CEF expense ratios in many cases).

And as you can see in the CEF table earlier, several attractive big-yield preferred CEFs are currently trading at compelling discounts to NAV. We know they are compelling because they also have negative z-scores (which is basically a comparison of the current discount or premium versus the historical level, and negative numbers are generally considered better, all else equal).

The Bottom Line:

Preferred stocks can be an attractive big-yield asset class, depending on your goals. They tend NOT to provide as much total return as common stocks over the long-term, but they do generally provide more income and less short-term price volatility. For these reasons, many investors choose to passively invest some of their portfolio in ETF PFF (i.e. they want exposure to the preferred stock asset class for income and for diversification purposes).

We also believe the lower volatility and higher income of preferred stocks makes it an attractive asset class to add a prudent amount of leverage (to magnify returns and income without taking on too much volatility risk). However, we do NOT like the idea of getting that leverage through an ETF (such as PFFA). We greatly prefer the CEF vehicle if you are going to add leverage (because we view it as an attractive way to add prudently leverage while controlling risky fund flows and also getting the opportunity to buy at a significant price discount versus NAV—such as the examples in our earlier table).

At the end of the day, you need to decide which type of investments are right for you and your own personal situation. That includes investing in preferred stocks. We believe prudently-diversified, goal-focused, long-term investing will continue to be a winning strategy.