Close-End Funds (“CEFs”) are often an income-investor favorite thanks to their big yields (often 6.0% to 11.0%, or higher) which are frequently paid monthly. In this report, we share updated data on over 100 big-yield CEFs (sorted by style, and including a variety of important data points), and then we countdown our top 10 big-yield CEFs (starting with #10 and finishing with our top ideas) for you to consider.

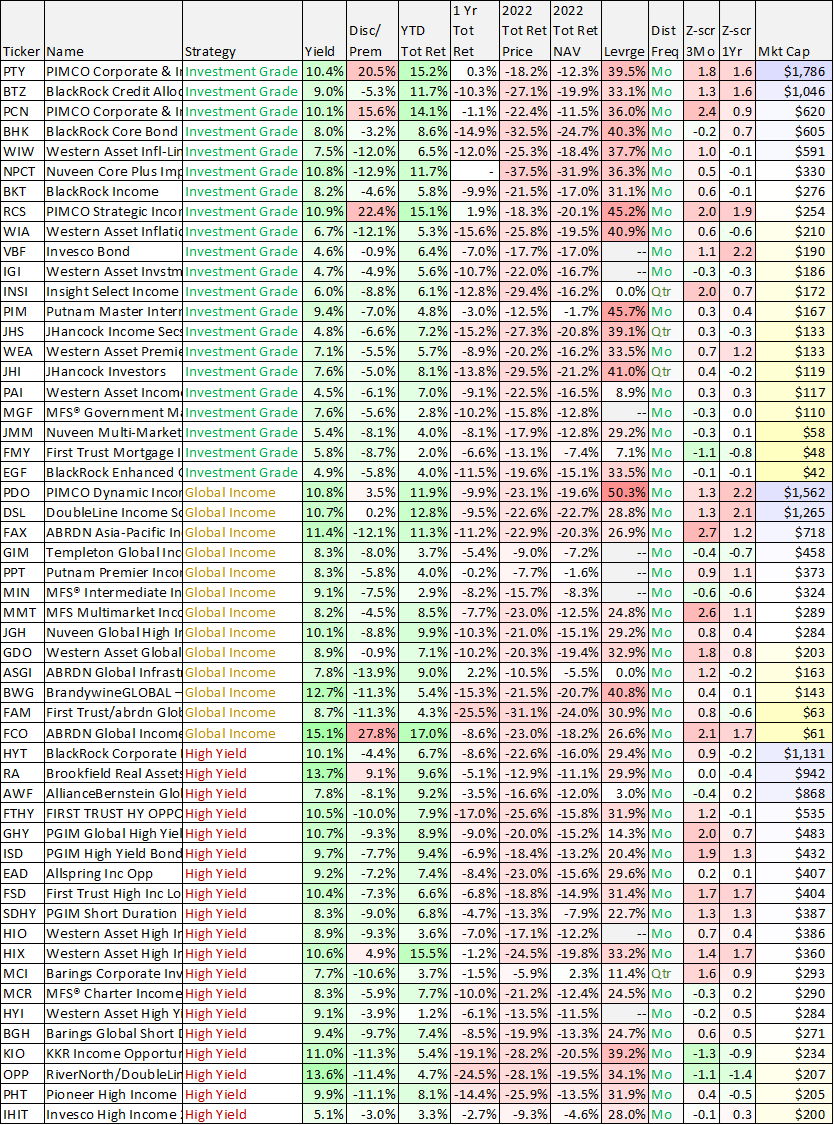

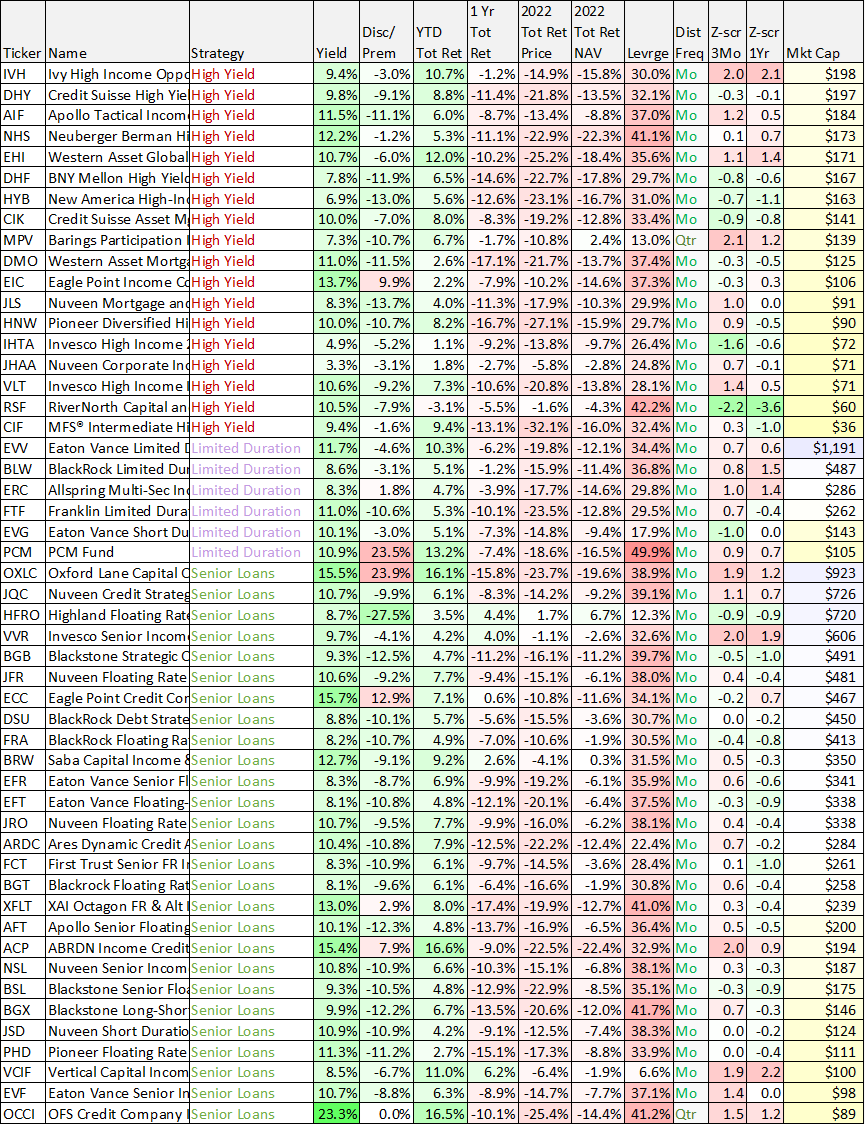

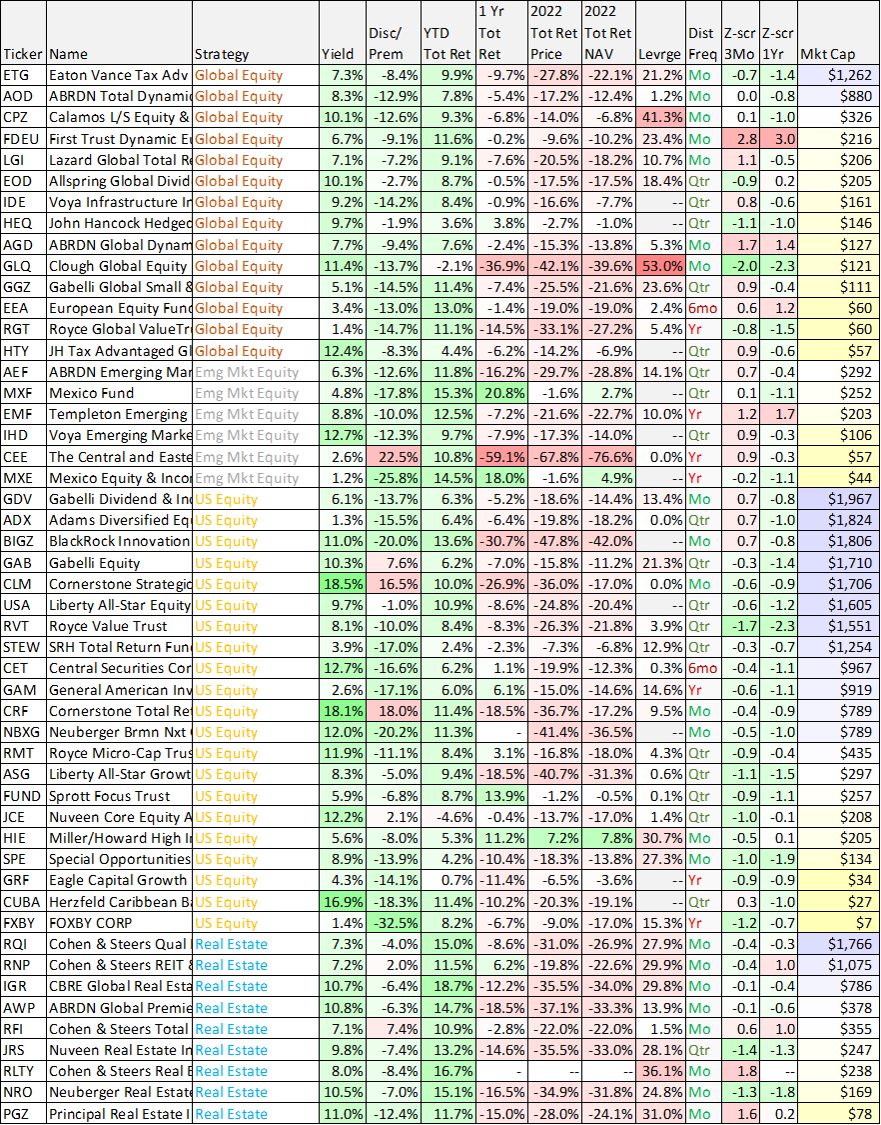

100 Big-Yield CEFs:

Before getting into the countdown, let’s start with some data (see below). This data is sorted by CEF style (“Strategy”) and then by market cap, and includes lots of additional valuable data points (including yield, recent performance, price discount or premium versus net asset value, 3-month and 1-year Z-scores (a comparison of the price discount or premium versus recent history—lower is generally considered better) and more.

Data as of Friday, January 27 2023. A downloadable version of this spreadsheet is available here.

As you can see, the strategies range from bond funds (e.g. multi-sector, high-yield and investment grade) to equity funds (e.g. sector equity, global equity, US equity), and you likely recognize at least a few of your favorites at the top of each section (such as those offered by PIMCO, BlackRock and others). You’ll also notice, most CEFs have performed fairly well this year (after a terrible 2022).

Important CEF Considerations:

Before diving into our favorites, there are a few high-level CEF nuances that investors need to be aware of because they can create significant risks and attractive opportunities.

Holdings: As we alluded to, CEFs have widely different strategies (ranging from bonds, to REITs, to sector-specific equities). And because CEFs are funds they have many underlying holding (often ranging from 50 to 60 underlying holdings and all the way up to 1,000 to 2,000 or more!). This helps create some instant diversification of risks within each fund’s target strategy

Price Discounts and Premiums: Another important characteristic of closed-end funds (which is different from other mutual funds and exchange traded funds) is that CEF’s can trade at wide price premiums and/or discount to the aggregate market value of their underlying holdings (i.e. net asset value, or “NAV”) as you can see in the “Disc/ Prem” column in our table above. This can create significant risks and opportunities, as we will explain with examples later in this report.

Leverage: CEFs often use leverage or borrowed money. This can help magnify returns and income in the good times, but it can also magnify risks and losses in the challenging times (such as 2022). CEFs use a wide range of leverage (depending on their strategies), but bond fund are generally limited to 50% leverage (by regulation) and equity funds to 30%.

Distribution Sources: As you may already know, CEFs don’t usually source 100% of their distribution payments from dividends or income on their underlying holdings. Rather, a portion of the distribution is often comprised of capital gains (short-term versus long-term can have different tax consequences) as well as even a return of capital in some instances (which can act to reduce your cost basis thereby resulting in some unexpected capital gains taxes if/when you do sell, assuming you hold it within a taxable account.

Fees and Expenses: CEFs have a variety of fees and expenses, and this ultimately detracts from your performance. For example, management fees often range from 0.50% to 2.00% per year. Further, operating expenses (including the interest expense on borrowed money—remember some use leverage) also rolls up into the total expense ratio. Some investors avoid CEFs because they cannot stand the fees, whereas others don’t mind the fees as long as the bottom line performance meets their needs. We often prefer to purchase individual securities instead of CEFs (to avoid the fees), but in some cases CEFs are extremely attractive regardless of the fees (for example, some bond funds have access to bonds that we cannot buy on our own, and CEFs also generally have access to lower cost (and more operationally efficient) leverage than do most individual investors—which is a legitimate “value add” for select CEFs).

Top 10 Big-Yield CEFs:

So with that backdrop in mind, let’s get into our top 10 ranking, starting with #10 and finishing with our top ideas.

10. Tekla Life Sciences (HQL), Yield: 8.4%

If we are headed into a recession (as many experts predict) healthcare stocks can continue to hold up well, especially pharmaceutical companies and those that benefit from the healthcare procedures that were postponed during the pandemic lockdowns (as demand continues to resume). Tekla trades at a healthy discount, has compelling z-scores and an attractive yield (paid quarterly). Some investors avoid this one considering the distribution payout bounces around a bit (it has consistently remained high however) and has recently included some return of capital. The total expense ratio is reasonable (recently ~1.4%). Overall, if you are looking for attractive high-income opportunity trading at a significantly discounted price (as compared to NAV and z-scores) this one is worth considering.

9. BlackRock Corp High Yield (HYT), Yield: 10.1%

Some investors prefer PIMCO over BlackRock when it comes to bond CEFs, but BlackRock has incredible resources that put it head and shoulders above most other CEF providers. Further, BlackRock’s management fees are generally much more reasonable (for example, the management fee on this fund was recently 1.3%, which is very low considering that includes the cost of borrowing on this fund that is levered at around 29.4%) Further, high-yield bonds are particularly attractive now as credit spreads remain elevated (an indication that the market is already pricing a lot of risk). If/when credit spread return to normal, the value of this fund will rise. And the recent share price declines of almost all bonds (as interest rates have risen) appear to be approaching and end (as interest rate hikes are set to end this year—hopefully sooner than later). HY also trades at an attractive discount to NAV, and its 20-year distribution history has been very solid. If you are looking for high income (paid monthly) trading at an attractive price—this one is worth considering.

8b. Adams Diversified Equity (ADX), Yield: 6.0%+

A lot of investors don’t like this diversified stock fund that has been paying distributions for over 80 consecutive years because the distributions are lumpy (it pays three smaller quarterly distributions, and then one big one each year in Q4). It guarantees at least a 6.0% annually and usually pays more. It fairly consistently trades at a large discount to NAV (which means you get the income and growth of the underlying holdings at a discounted price) and its recent z-scores are quite reasonable. What’s more, this fund is diversified across public equity sectors, with a health dose of technology stocks, so if/when the market recovers—this one has a lot of contrarian upside. It’s a great long-term investment if you can handle the lumpy distribution payments.

8a. Liberty All-Star Equity (USA), Yield: 9.7%

If you can’t handle the lumpy distribution payments of ADX, try USA instead. It pays monthly (not quarterly), it yields more and distributions are at a steadier rate. USA also invests in US public equities (financials are its largest current sector exposure, followed by technology) and it also trades at a discount to NAV (though not as big). Both funds use essentially zero leverage. Both (ADX and USA) are attractive in our view, depending on your goals.

7. Cohen & Steers Qual Inc Realty (RQI), Yield: 7.3%

If you want exposure to the real estate sector (which is a bit of a contrarian play that we like right now), RQI is a great way to play it. The fund offers a big yield, a discount to NAV, monthly payments, and attractive z-scores. It’s also been successfully paying distributions for over 20 years. The strategy uses a healthy dose of leverage (to help magnify income and returns) currently around 27.9%.

This one likely holds a lot of REITs that you are familiar with (recently Prologis (PLD), Welltower (WELL) and Realty Income (O) were all in the top 10 holdings). The management fee and total expense ratio (recently 1.91%) are a bit on the high side, but reasonable depending on your goals (i.e. if you want instant diversification and a large monthly distribution trading at a discount to NAV).

6. PIMCO Dynamic Inc Opps (PDO), Yield: 10.8%

PIMCO is generally considered to “top dog” when it comes to bond CEFs, and this particular fund is a big one with around $1.5 billion in assets. The fund uses a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds, and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

Because of PIMCO’s popularity and success, its CEFs often trade at large premiums to NAV. However, this one’s premium is modest at a price around 3.5% above NAV. And considering bond funds seem due for a large rebound (as interest rate hikes are expected to finally slow then stop in 2023) PDO is attractive.

The expense ratio is high on this fund (recently around 2.79%), but that includes the cost of borrowing. Also important, this fund is bumping up hard against the regulatory 50% leverage limit for bond funds, and that can create some challenges (i.e. forced asset sales at less than ideal prices). But given PIMCO’s scale and sophistication, they’re better equipped to handle the challenge than others. If you like big income (paid monthly) from a top manager, PDO is attractive and worth considering.

5. BlackRock Credit Alloc Inc (BTZ), Yield: 9.0%

Sticking with bonds and returning to BlackRock, BTZ is attractive. The fund seeks current income, current gains and capital appreciation. Normally, it will invest at least 80% of its total assets in credit-related securities, including, but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these credit-related securities.

Unlike the PIMCO funds, BTZ actually trades at a discount to NAV (currently -5.3%) and remains well positioned to benefit from the end to interest rate hikes. With a duration of over 6 years it has some interest rate risk, but it also uses only around 33% leverage which gives it more flexibility to take advantage of the dynamic environment. BTZ also has a significantly lower total expense ratio of around only 1.12% (much more reasonable). If you are looking for a big monthly distribution payment (and you prefer discounts instead of premiums), BTZ is attractive and worth considering.

4. RiverNorth/DoubleLine Strat (OPP), Yield: 13.6%

The RiverNorth/DoubleLine Strategic Opportunity Fund is a multi-manager closed-end fund that opportunistically invests in fixed income securities, alternative credit instruments and tactically invests in closed-end funds. Recently, 60% of the assets were in DoubleLine’s Opportunistic Income Strategy, 25% was in RiverNorth’s tactical income strategy and 15% was in RiverNorth’s alternative income strategy.

We like this one because it is led by famous bond investor, Jeffrey Gundlach (CEO and CIO at DoubleLine) as well as three additional portfolio managers. The strategy is unique, and the fund is characterized by a big yield (paid monthly), a big discount to NAV and some attractive z-scores. Additionally it uses around 34% leverage and has an acceptable management fee considering the strategy (recently the total expense ratio was 1.93%).

This fund is not for everyone (for one, the distribution bounces around with the market—actually a prudent thing in our view), and it can be volatile. However, the distributions have consistently remained high. We can see the price of this one rebounding nicely in the quarters ahead while simultaneously paying big monthly distributions to investors.

3. PIMCO Dynamic Income Fund (PDI), Yield: 12.9%

PDI is the grand daddy of them all with total assets of around $5 billion (it grew from popularity and from its consolidation with 2 other PIMCO funds just over a year ago). This one pays a huge monthly dividend (and has a history of paying special dividends too). Plus, It has never reduced its distribution (only increased it) since it was launched over 10 years ago.

PDI also trades at a significant premium to NAV (+12.3%) and has a somewhat ugly z-score, but inevitably many income-focused investors don’t mind the potential short-term price volatility as long as it keeps paying those big monthly distributions.

The primary investment objective of PDI is to seek current income, and capital appreciation is a secondary objective. The Fund seeks to achieve its investment objectives by utilizing a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

PDI uses a healthy dose of leverage (48%), and it has a hefty total expense ratio (recently ~2.64%), but as long as it keeps delivering the goods (high monthly income) investors love it. We are not crazy about the premium price, but we do like the fund and the income.

2b. Royce Value Trust (RVT), Yield: 8.1%

2a. Royce Micro-Cap Trust (RMT), Yield: 11.9%

We currently own both of these two Royce funds, and we view this as not only a high income opportunity (paid quarterly), but also as an attractive price appreciation opportunity as we take a contrarian view on small and micro cap stocks—we expect them to rebound hard (ahead of large caps) as the market stabilizes and eventually rebounds. Statistically speaking, now is an attractive time to invest in small caps as a contrarian opportunity, as we explained in our previous Royce articles.

Further, both funds trade at big discounts to NAV (10.0% and 11.1%, respectively), they both offer very reasonable management fees (1.15% and 1.20%, respectively), they have compelling z-scores, and Royce is a small cap specialist with a long track record of success (i.e. beating their benchmarks consistently and handily).

1. PIMCO Access Income (PAXS), Yield: 11.4%

We like PIMCO, we like high income (paid monthly), we like discounted prices and we like price appreciation potential. The PIMCO Access Income Fund has all of these. It’s a new fund launched about one year ago (on January 31, 2022), and we believe its worth considering for investment now before the discount turns into a premium (as is the case with so many other PIMCO funds).

PAXS seeks current income as a primary objective and capital appreciation as a secondary objective. The Fund seeks to achieve its investment objectives by utilizing a dynamic asset allocation strategy among multiple sectors in the global public and private credit markets, including corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers and real estate-related investments.

Further, PAXS already established itself as a special dividend payor (it paid a big special dividend in December of its first year in existence), and it continues to maintain healthy distribution coverage as per its net investment income report. If you are looking for big steady income with share price appreciation potential, and from a top-notch manager, we like PAXs.

The Bottom Line:

We’ve shared a variety of big-yield investment opportunities in this report. However, at the end of the day, you need to select investment opportunities that are right for you—based on your own personal situation and tolerance for risk. We believe disciplined goal-focused long-term investing will continue to be a winning strategy.