Big-yield BDCs have posted particularly strong gains so far in 2023. However, attractive opportunities remain considering prices are still down from 2022, and the recession that’s already priced into the market may be milder than expected. In this quick note, we share updated data on over 40 BDCs, and then quickly highlight 2 high-yielders that present particularly attractive contrarian opportunities.

40 Big-Yield BDCs:

As you know, BDCs are financing companies that provide loans (and sometimes take equity positions) in small businesses (middle market companies). BDCs vary widely (they can specialize in certain industries, strategies and company sizes). BDCs generally provide the types of financing that are either too small, too risky or too unique for traditional banks. As such, BDCs often end up providing capital at high-yield interest rates, and that’s how they support the big dividends they pay. Also, BDCs are special in that they can avoid corporate income tax if they pay out most of their earnings as dividends to investors (thus the big dividend yields). Here is updated data on over 40 big-yield BDCs.

As you can see in the table above, BDCs have performed very well so far this year, but many of them are still down over the last year.

BDCs can suffer particularly hard in a market recession because the small businesses they typically lend to can be hit particularly hard during a recession (to the point that some of them may default on their loans). However, considering the market continues to show signs of improvement (for example the fed only raised rates 25 basis points instead of 50 basis points on Wednesday), BDCs may still be pricing in too much risk.

Another important caveat is with regards to valuation. Price to Book Value (or P/B) is a common way to value BDCs (from a very high level). But just know that book values are generally just estimates (because there is no readily available market that determines the value of the unique loans BDCs provide), and the book value estimates are generally updated only quarterly. So the book value estimates in the table above are based on current BDC market prices versus the most recently available quarterly book value data (which may still be too pessimistic).

Early Stage Investment BDCs:

BDCs that specialize in early stage investment (i.e. investing in young growth companies) were hit particularly hard as the market sold off in 2022, but may now have particularly large rebounds ahead as the market recovers. For example, here are two we wrote about last quarter (both have posted very strong market price gains since then, but may still have significantly more upside ahead).

Trinity Capital (TRIN): Tempting 17.4% Yield BDC: 20% Discount to Book, But Know the Risks

TriplePoint Venture Growth (TPVG): Attractive High-Growth BDC: 12.0% Yield, Compelling Price

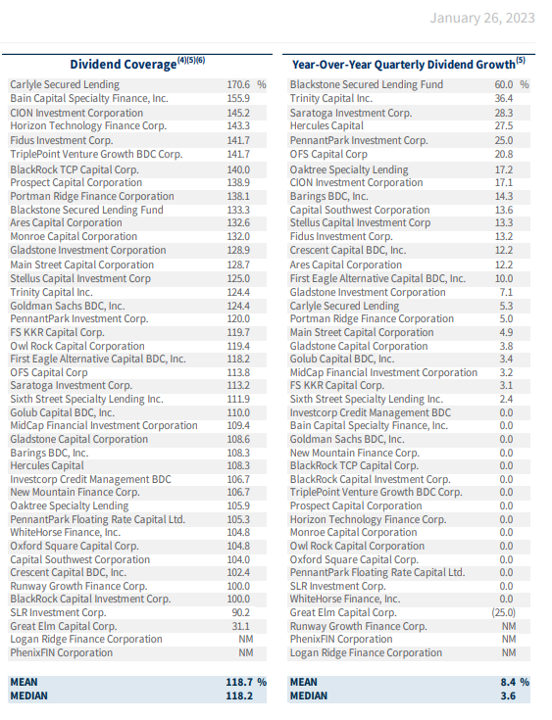

As mentioned, both of these BDCs have posted very strong gains since we shared the above reports, but we believe they still have more powerful long-term gains ahead. Specifically, they trade at attractive price-to-book values (see table above) and they offer well covered dividends (see data below).

Our basic thesis on these two early-stage investment BDCs (TRIN and TPVG) is that they’ve simply sold off too hard, and when the market rebounds (whether that is this quarter, next quarter or next year) they’ve both got a lot of price appreciation potential ahead. And while we wait for the rebound, they both also offer well covered big-dividend payments to investors (see above).

The Bottom Line:

BDCs are risky, especially as we head into a potential recession. However, the market appears to already have priced in an ugly recession—and that recession may not materialize. Early stage investment BDCs are particularly attractive as the market recovers, and their dividends continue to be well covered. We don’t currently have a position in TPVG or TRIN, but we are watching closely for a potential buying opportunity soon.