In this report, we countdown our top 20 dividend-growth stocks. These may not be the biggest current dividend yields (no yield traps here!), but they present some of the best and biggest long-term income opportunities based on their impressive trajectories of dividend growth (all have at least 10 consecutive years of dividend increases) and ongoing price appreciation potential. We’ve selected these 20 from a list of over 150 top dividend-growth stocks (the 150 stock list is included in this report, along with lots of important data on each of the 150 stocks for your consideration). We also explain the important concept of “yield on cost,” and explain why dividend-growth stocks are particularly compelling right now (i.e. macro conditions). Finally, we rank our top 20, providing explanations for each, starting with #20 and counting down to our top ideas.

With that overview, let’s get into it…

What is Yield on Cost?

Yield on cost is the current dividend amount divided by the price you paid for the stock (however long ago that was). It’s different than the current yield (i.e. current dividend amount divided by current stock price), and yield on cost can help many investors avoid yield traps and instead maximize long-term income. Here is an example:

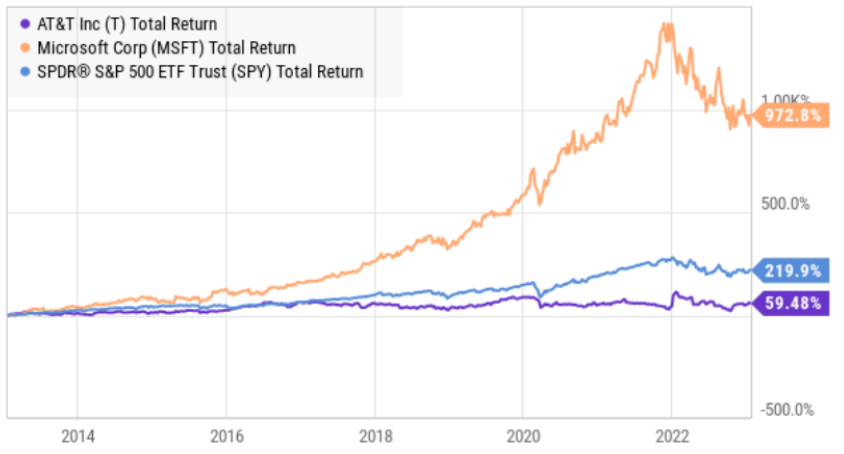

Microsoft’s (MSFT) current yield is only 1.1%, whereas AT&T’s (T) current yield is 5.8%. To some income seekers, AT&T might seem like the obvious better option. But not so fast. Ten years ago, you could have purchased one share of Microsoft and one share of AT&T for about the same price (see chart below), and if you had selected AT&T back then simply because it had a MUCH bigger dividend, you’d actually be receiving MUCH less income today. Specifically, if you bought one share of Microsoft 10 years ago, your current yield on cost would be 9.7% (impressive!), whereas if you bought one share of AT&T ten years ago—your current yield on cost would only be around 5.5%.

Furthermore, dividend-growth investors often benefit from higher total returns (i.e. share price appreciation, plus dividends reinvested) than do investors focused only on current yield. Here is a look at Microsoft’s 10-year total return as compared to AT&T’s and the S&P 500 (SPY). And as you can see, chasing after AT&T’s high yield back then has led to some serious underperformance over the last 10 years.

We tried to warn investors of the dangers of investing in AT&T years ago. For example, here is what we wrote back in 2015 (before the massive dividend cut).

At the end of the day, focusing on healthy dividend-growth stocks (and the important concept of yield on cost) can help you generate more income and better total returns. And with that backdrop in mind, let’s consider some current data.

150 Top Dividend Growth Stocks

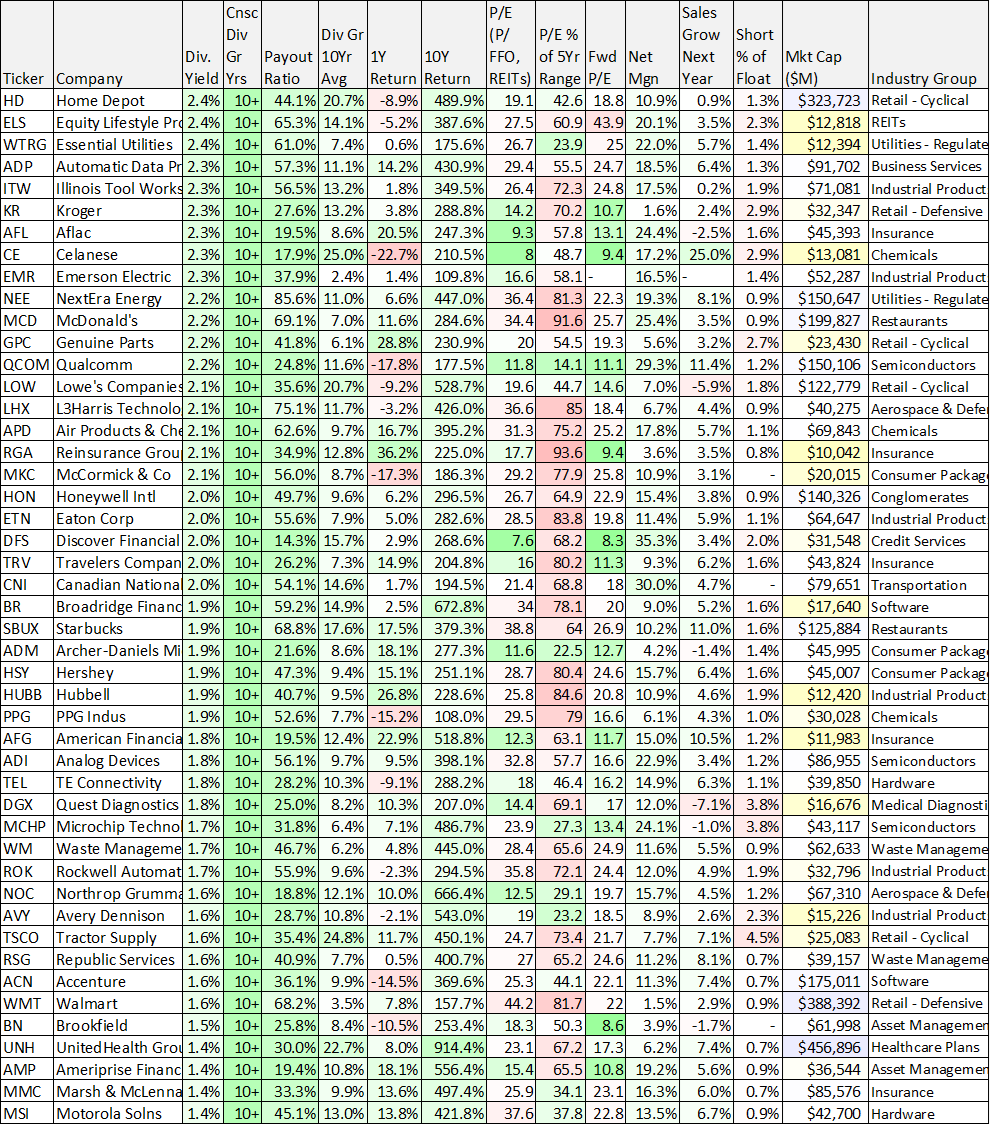

For perspective, we’ve provided current data on over 150 dividend growth stocks (see below). The table is sorted by current dividend yield, and a downloadable (and sortable) spreadsheet of this data is available here.

data as of Fri 27-Jan-23, source: StockRover

The table is sorted by dividend yield. Other metrics include 10-year total return, dividend payout ratio, average 10-year dividend growth, current (and forward) P/E ratios, short interest and more. All of the names in the list have increased their dividend payment for at least 10 years in a row (and many of them more).

Why Dividend Growth Stocks Now?

Before getting into our top idea countdown, it is important to provide some color on why dividend-growth stocks are particularly compelling right now.

For starters, the pandemic “pure-growth” stock bubble has been bursting hard, and there are reasons to believe the pain is not over, whereas “dividend-growth” stocks are particularly compelling in the current macroeconomic environment.

For example, pure-growth stocks soared to incredible heights as the Fed set interest rates near 0.0% during the pandemic thereby making its easy to borrow money (at low rates) to fund growth. But now as the Fed keeps hiking rates (to fight inflation), many of the young growth companies that relied on essentially free money to support their businesses are in big trouble. On the other hand, healthy dividend-growth stocks have the mature businesses and steady cash flows to easily support their businesses regardless of the Fed’s interest rate hikes.

We don’t expect interest rates to go back to 0.0% anytime soon, and it’s going to be extremely difficult for many young pure-growth companies to achieve their previous sky-high stock prices anytime soon (or ever). This is one of the big reasons we like dividend-growth stocks now (i.e. they can continue to thrive in a higher interest rate environment). Another reason we like dividend-growth stocks now is because many of them have inappropriately gotten caught up in the recent indiscriminate market sell off, thereby creating select attractive long-term contrarian buying opportunities.

Top 20 Dividend Growth Stocks, Down Big:

We begin our dividend-growth stock rankings with a few honorable mentions, followed by the countdown (starting with #20 and finishing with our top ideas).

Honorable Mentions:

*Procter & Gamble (PG) is an amazing consumer staples stock that has increased its dividend for 66 years in a row. It’s products are not particularly exciting (it makes fabric softener, shampoo, deodorants and a host of other well-known household products), but the company is profitable, growing (albeit at a slow but steady rate) and it has plenty of cash flow to support ongoing dividend increases.

Procter & Gamble is a staple on many dividend-focused investment portfolios. And although the shares are not particularly over or under-valued right now, we wouldn’t fault anyone for owning it. In fact, we’d feel remiss NOT to mention Procter & Gamble in a report about dividend growth stocks.

*Johnson & Johnson (JNJ) is another steady long-term dividend growth stock (it has increased its dividend for 60 years in a row). Like P&G, J&J is profitable, growing steadily and has plenty of cash flow to support the dividend (J&J is actually one of only two publicly-traded companies with a “AAA” credit rating, Microsoft (MSFT) is the other one). Johnson & Johnson is a diversified healthcare company that we don’t find particularly over or under-valued right now, but we certainly wouldn’t blame anyone for owning it.

*Medical Properties Trust (MPW) is also an honorable mention, but it is quite different than J&J and P&G. In fact, MPW has been ugly over the last year as the shares are more than 40% below their 52-week high and the short interest (e.g. investors betting against the shares) was recently over 20%! We’re including it as an “honorable mention” because its annual dividend has increased for the last 10 years in a row (and the current yield is 8.9%), and it does have some attractive qualities (such as a reasonable payout ratio and a very low valuation). However, the shares are NOT appropriate for the most risk averse investors (they’re simply too risky).

For more background, Medical Properties Trust is “the global source for hospital capital.” Basically, it provides cash to hospitals (often those that are struggling financially) by buying their physical properties (hopefully at a low price, for MPW shareholders’ sake) so the hospitals receive the cash they need to continue (and hopefully improve) their operations. The big problems (risks) for MPW are basically troubled hospital operators (they are struggling mightily to pay their bills) and high debt (especially now that interest rates are higher).

MPW may be worth considering if you can tolerate the volatility and if you hold it within the constructs of a prudently-diversified long-term portfolio, especially considering the improving fundamentals combined with the potential for a massive short-squeeze (i.e. short-sellers may be forced to cover as conditions improve—which would drive shares higher) and the fact that fed interest rate hikes are expected to slow and then cease this year. We recently wrote up MPW in detail (you can access that report here), but the bottom line is that MPW is NOT appropriate for the most risk averse investors, and we are including it only as an “honorable mention” in this report.

20. Altria (MO), Yield: 8.5%

You might think a stock yielding over 8% is a red flag (perhaps a company in distress), but Altria has some very attractive qualities, and it may just exactly hit the spot for you, depending on your goals. The main industry (US tobacco) is in secular decline, but revenues and the dividend are set to keep growing steadily (Altria has increased its dividend for 53 years straight) and the shares are a bit undervalued. Altria has some fairly huge competitive advantages (mainly economies of scale and industry regulation that essentially prevents new competition). Plus, there is a lot of room for Altria to keep increasing the price of its Marlboro brand (which has incredible customer loyalty) and benefits from its “on!” oral nicotine pouches, strategic investments in ABInBev (e.g. Anheuser-Busch), Juul (vaping) and Cronos Group (cannabis). We recently wrote Altria up in detail, and that report is available here.

19. Digital Realty (DLR), Yield: 4.6%

Digital Realty is a data center REIT that experienced incredible growth as the digital revolution and migration to the cloud gathered tremendous momentum over the last 15 years. However, as the pandemic bubble burst, many companies that were associated with “the cloud” (including Digital Realty) sold off hard (DLR shares are down more than 20% over the last year). Furthermore, big tech companies are increasingly building their own data centers, leaving some investors overly fearful with regards to DLR’s future.

However, the digital revolution and migration to the cloud is still in the very early innings, and DLR has a lot of attractive qualities. For example, DLR’s scale makes it one of the clear leaders in the data center REIT space, and its shift toward colocation services gives it increased momentum, especially considering the company’s wide geographic offerings.

With a dividend yield of 4.6% and 10+ consecutive years of dividend increases, DLR is attractive, especially considering it’s now lower share price and that it trades at only around 19.1x Funds from Operations (“FFO”), plus it still has attractive forward growth estimates and opportunities. Fears of technologies allowing companies to do more with less space are overblow, and DLR’s future remains bright.

18. LyondellBasell Industries (LYB), Yield: 5.0%

Based in Houston, LyondellBasell is one of the largest plastics, chemicals and refining companies in the world. And the company has been facing dramatic market-cycle challenges recently. Specifically, weakness in Chinese markets (due to the zero-COVID policies—i.e. lockdowns) and weakness is North America (because new supply plus “inventory destocking” led to a fall in polyolefin prices).

However, Lyondell has the financial strength to survive, especially considering it will continue to benefit from lower-cost North American natural gas feedstocks that will allow it produce at a significantly lower cost than global competitors. Further, lower natural gas prices and higher oil prices have increased profits in North America—a condition that is likely to persist.

We expect the company’s 11-year track record to dividend increases to continue and the share prices to show long-term strength. We recently wrote this one up in detail, and you can read that report here.

17. Bank of New York Mellon (BK), Yield: 3.0%

Bank of New York Mellon is mainly a custody bank, which means investment managers hold their investments at BNY Mellon. However, it also offers various fund accounting and hedge fund administration services, as well as some wealth management / investment management services too. And unlike traditional banks, only around 20% of its revenue is from interest income, thereby making it less sensitive to changing interest rate expectations.

What is attractive about BNY Mellon is its large scale, even as compared to other custody leaders like State Street (STT) and Northern Trust (NTRS). This gives it an important advantage considering margins in custody are low and economies of scale matter. Secondly, BNY Mellon benefits from an extremely sticky customer base. Specifically, it is an absolute royal pain for investment manager clients to switch custodians because of all the detailed processes and procedures in place (it would take years and be very costly for many large managers to shift to a new custodian). These are great competitive advantages for BNY Mellon.

Furthermore, BNY Mellon offers an attractive dividend yield, an attractive forward P/E ratio and offers healthy ongoing long-term growth. The company’s 10-year yield on cost is around 5.4% (not bad), and if you are an income-focused investor—the recent share price declines makes for an increasingly attractive long-term entry point

16. Reaves Utility Income Fund (UTG), Yield: 7.6%

For those of you particularly focused on higher yield, we’re including the Reaves Utility Income Fund (a closed-end fund) because it provides a very large distribution yield, it has increased its distribution for more than 10 years in a row, and it trades at a reasonable price relative to is net asset value and considering the utilities sector (where the fund focuses) has steady long-term growth.

In the “olden days” before all these fancy funds existed (e.g. CEFs, ETFs, Mutual Funds) many income investors simply bought a bunch of Utilities stocks (because they pay high income and they tend to be a lot less volatile than other sectors of the market). However, UTG is somewhat special because it magnifies returns and income by using some leverage—or borrowed money—the leverage ratio was recently 19% (reasonable). It also generates some of the income for the distributions (which are paid monthly) from capital gains (mostly long-term gains). There are fees and expenses associated with this fund (the total expense ratio, including management fees and borrowing expenses, was recently 1.42%) which will detract from your total returns. But if you are looking for quick-and-easy, UTG is not bad, especially considering the Utilities sector is down a bit over the last year (a contrarian opportunity to some).

15. Realty Income (O), Yield: 4.4%

Realty Income (known as the monthly dividend company) is often viewed as a safe haven investment for its steady dividend income (the annual dividend has been increased every year for more than 25 years straight). Realty Income focuses on retail properties, and some investors are left wondering if this is still a good strategy considering the growth in online shopping as well as Realty Income’s increasingly large size for a REIT (its market cap is currently around $45 billion).

In our view, Realty Income remains a very attractive investment for income-focused investors, especially considering it focuses significantly on internet-resistant types of properties (for example, it owns properties occupied by Walgreen’s 7-Eleven, and Dollar General, to name a few), and it has the solid cash flow to support its ongoing acquisition strategy (i.e. complimenting organic growth with inorganic acquisitions growth). Furthermore, trading at a forward Price-to-AFFO ratio of only 17.3x is attractive for such a financially-healthy REIT like Realty Income. We are currently long Realty Income in our Income Equity Portfolio.

14. Apple (AAPL), Yield: 0.7%

A lot of investors still think of this mega-cap stock as a high-growth opportunity. In reality, Apple is a stable value stock with tons of cash flow, an impressive track record of dividend growth, and the shares are trading at a compelling valuation. The current yield remains low (because the share price has risen dramatically over the years), but Apple’s 10-year yield on cost is around 5.7%—impressive!

Going forward, we believe Apple will continue to thrive (and defend its high margins) thanks to its competitive advantages (i.e. premium brand and economies of scale), combined with the uniqueness of its business model (i.e. Apple is unique versus competitors because it designs and develops nearly all of its solutions, including the hardware, operating system and software, whereas competitors lead in hardware—such as Samsung (SSNLF) mobile devices—or Software—such as Google’s Android (GOOGL) operating system—but not both).

With Apple’s shares down more than 20% from their 52-week high, combined with the company’s monstrous cash flows, low dividend payout ratio, ongoing share repurchases, and attractive valuation (forward P/E) as compared to long-term revenue growth opportunities, Apple is attractive. We recently wrote up Apple in detail, and you can read that full report here.

13. Enterprise Products Partners (EPD), Yield: 7.5%

Enterprise Products Partners is a leading provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. It also pays a big steady distribution to investors that has grown every year for 23 years in a row.

EPD’s competitive advantages include its geographic diversity, its large scale, and its steady fee-based revenues (which help protect it—to a significant extent—from volatile oil and gas prices). Importantly, the company’s return on equity (recently 19.5%) and return on invested capital (which exceeds its cost of capital) are impressive and help make the ongoing profitability and income-generating power of this company special. And with a forward EV/EBITDA of around 9.5x, EPD is very reasonably priced.

One caveat with EPD is that it is organized as a Master Limited Partnership (“MLP”). This is not a problem for many investors, but it does create challenges for some considering it generates a K-1 form at tax time instead of the typical 1099 investors are used to (this creates an extra step when filing taxes). Further, depending on your broker, in some cases K-1 investments are simply not allowed in non-taxable accounts (such as IRAs). We’d honestly have ranked EPD higher on this list if it weren’t for the K-1 frustrations it creates for many investors. But if you are able to handle the MLP structure, then EPD remains a very attractive income-producing opportunity.

12. Cisco Systems (CSCO), Yield: 3.2%

Founded in 1984, Cisco Systems may seem like a dinosaur to some investors, but in reality this networking company (hardware and software) remains highly relevant (and the market leader) in Internet Protocol networking solutions. In fact, customers pay a premium for Cisco, and the company’s path forward remains bright as a leader in both legacy networking and future networks.

Furthermore, Cisco’s dividend is very healthy (it has been increased for 11 years in a row, and the payout ratio remains low), and the 10-year yield on cost is an impressive 7.3%!

In our view, Cisco is attractive in the current economic environment (i.e. slowing macroeconomic growth) because of its high switching costs, sticky subscription revenue and powerful cash position. Further, it can continue to grow both organically and inorganically as its market opportunity (cloud, hybrid-cloud, security) continues to grow. The dividend adds to security during volatile markets, and the valuation suggests the shares are undervalued (perhaps related to the somewhat indiscriminate sell off in the technology sector). If you are looking for steady dividend income increases and long-term share price appreciation, Cisco Systems is attractive and worth considering for investment. We recently wrote it up in detail and you can view that report here.

11: Accenture (ACN), Yield: 1.6%

Accenture is an attractive business and technology consulting company with an impressive 10-year yield on cost of 6.2%. A lot of screeners miss the fact that Accenture has increased its annual dividend for more than 10 year straight because it switched from a semiannual to a quarterly dividend in 2019. And in addition to the powerful dividend growth, it also has powerful revenue growth and a business that is able to quickly adapt to varying macroeconomic conditions (as a consulting company, Accenture is easily able to increase or decrease its workforce to meet current market demand, plus it has almost no fixed costs—the main expense is the workforce). What’s more, Accenture provides consulting services across market industries and is able to quickly bring on subject matter experts to meet the demands of changing technologies and innovation. Accenture shares have sold off significantly, but remain attractively priced relative to the company’s ongoing long-term growth (view our previous ACN reports here). We’ve been long ACN shares since its IPO in 2001.

10. US Bancorp (USB), Yield: 3.9%

With interest rates now higher and inflation now finally showing signs of slowing, US Bancorp is in an increasingly attractive spot. Not only will it benefit from high interest rates (i.e. they make more money from now higher net interest margins), the risk of an ugly recession seems to be decreasing now that inflation is slowing (a stronger economy means less defaults and more healthy loan income for the bank). USB also has very strong net interest margins and a high Return on Equity, thanks to its efficient operations and healthy fee revenues. It’s increased its dividend for over 10-years in a row and has a healthy outlook for the year ahead. We’ve owned US Bank in the past, and it’s high on our watch list considering the price has been weak but the business is increasingly strong.

9: STAG Industrial (STAG), Yield: 4.2%

Stag is an industrial REIT with an impressive track record of dividend growth (its 10-year yield on cost is 7.2%). However, many industrial REITs that benefited significantly from supply chain disruption after the onset of the pandemic have now sold off hard, especially as economic growth is set to slow (i.e. recession looms).

Stag’s business was initially higher risk as its many single-tenant properties were located in secondary and tertiary locations. However, as the company has grown over the years, so has the strength of its new and existing properties. Trading at a price to FFO (Funds from Operations) of only around 16.2x is impressive relative to its ongoing long-term growth (the industrial REIT outlook is significantly stronger than office REITs and many retail REITs, for example). If you are looking for healthy dividend growth and share price appreciation potential, Stag is worth considering (view our previous Stag report here).

8. Trinity Industries (TRN), Yield: 3.7%

With the economy still barreling towards recession (courtesy of stubborn inflation and relatively higher interest rates), Trinity Industries (focused on railcars) is attractive for a variety of reasons, including its stable cash flows, ongoing long-term growth potential, hard assets (book value), operational efficiencies, attractive current valuation and its 10+ year history of dividend growth. The company has also been impacted by recent industry labor shortages, but it has the financial wherewithal to thrive in the long-run. We recently wrote this one up in detail, and you can view that report here.

7. Albemarle (ALB), Yield: 0.6%

Albemarle is a special kind of dividend growth stock. It’s been a healthy mining business with steady dividend growth for 28 years in a row. However, with the rapid growth in electric vehicles (that is expected to continue in dramatic-fashion in the years ahead) Albemarle has tremendous new growth opportunities from its lithium mining business (lithium is used in electric vehicle batteries, and it is a difficult-to-come-by material—very good for Albemarle!). Specifically, Albemarle is based in North Carolina, but has very valuable lithium assets via its operations in Chile and in Western Australia (which are very low-cost sources of lithium production as compared to the rest of the world). Its P/E ratio is just over 20x, which may seem rich to some investors, but revenue growth has recently been (and is expected to continue to be) higher than just about any other stock with 10+ years of dividend growth. It also has very strong gross and net profit margins. This is an impressive opportunity that is absolutely worth considering if you are an income-focused investor.

6. Phillips 66 (PSX), Yield: 3.6%

Enterprise Products Partners (mentioned earlier) is an exceptional midstream company that has a truly impressive history of paying growing income to investors—however it is an MLP which some investors prefer to avoid (because of additional tax reporting requirements, and because some investors are simply prohibited from owning it in certain retirement accounts). Phillips 66, however, is also an impressive mostly-midstream company that is NOT an MLP, but its annual dividend has grown every year for 10-years in a row.

Phillips 66 is often categorized as a refining company, but its steady midstream business has grown over the years and it deserves to trade at a higher multiple. Plus, PSX has delivered better 10-year total returns (price appreciation plus distributions reinvested) than EPD, and PSX has more upside ahead. If you are looking for an attractive opportunity in the already strong Energy sector, PSX is worth considering. We own shares in our Income Equity Portfolio.

5. Intuit (INTU), Yield: 0.8%

Intuit is the global financial technology platform behind TurboTax, QuickBooks, MailChimp, CreditKarma and Mint. It’s also a dividend growth machine that has increased its annual dividend for 10 years in a row (its 10-year yield on cost is 5.0%), and it currently trades at an attractive valuation relative to its ongoing long-term growth opportunities. Specifically, Intuit has a nearly $300 billion addressable market opportunity (versus twelve trailing months revenue of $13.3 billion) driven by the market shift to virtual solutions, acceleration to online and omnichannel capabilities and even digital money offerings). Despite Intuit’s small current yield, the ongoing dividend growth potential is impressive and so is the ongoing revenue and earnings growth potential. We have written up Inuit multiple times in the past (view reports here), and we are currently long the shares.

4. Microsoft (MSFT), Yield: 1.1%

Despite its already massive market capitalization, Microsoft shares have dramatically more upside potential in the years ahead, and so does its dividend. As mentioned, Microsoft’s 10-year yield on cost is around 9.7%. And considering its already incredible profit margins, amazingly strong balance sheet (its one of only two publicly-traded companies with a AAA credit rating), and growing strength in the cloud (which is a massive long-term growth opportunity) business productivity and personal computing, Microsoft is attractive.

The shares are down more than 23% versus their 52-week high, and the P/E is very low versus its 5-year average, especially considering its powerful forward growth estimates and opportunities. Given its leadership, competitive advantages, dividend and valuation, Microsoft currently presents an extremely attractive long-term investment opportunity. We’ve written up MSFT multiple times in the past, and you can view those reports here. We are currently long shares of Microsoft.

3. Visa (V), Yield: 0.8%

Don’t overlook Visa, a name we likely all know, and a company that is positioned to keep benefiting from long-term global economic growth, especially as the notion of a “cashless society” continues to grow (in large part courtesy of online shopping as well as Covid reducing people’s use of cash). Aside from Visa’s powerful competitive advantages (it’s accepted almost everywhere) the company has increased its dividend for 14 years in a row, and it has some of the most impressive net profit margins you are ever going to see (over 50%!). What’s more, the valuation remains reasonable. And to add some perspective to Visa’s powerful dividend growth, its 10-year yield on cost is 4.5%—not bad for a company with a 10-year total return of over 500% and lots of healthy upside and growth in the years ahead.

2. Celanese (CE), Yield: 2.3%

Celanese is materials company. It manufactures performance engineered polymers and it is also the world's largest producer of acetic acid (and its chemical derivatives).

Like much of the economy, materials companies were impacted dramatically by pandemic disruption. In particular, lockdowns in the US and internationally caused demand to halt and share prices to plummet. However, with countries and companies continuing to reopen, and the share price still depressed, Celanese presents a highly compelling opportunity.

We recently wrote up Celanese in detail, and you can view that report here. But in a nutshell, if you are looking for an attractively priced contrarian opportunity that also pays a big growing dividend, Celanese is worth considering.

1. Medtronic (MDT), Yield: 3.3%

Medtronic is a highly profitable “wide-moat” business, currently trading at a relatively low valuation multiple, and offering 45 years of dividend increases and a current yield near all-time highs (an indication from management that the shares are undervalued, in our view).

If you don’t know, Medtronic is a medical device company. Specifically, it develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide.

Medtronic shares are more than 25% below their 52-week high as frustrated investors lose patience with the slower-than-expected pace of the post-pandemic recovery (for example, patients put off surgeries during the pandemic). However, the business remains healthy (profitable with tons of cash flow) and growth will return. We recently wrote this one up in detail, and you can review that report here. If you are an income-focused contrarian investor (that likes long-term price appreciation), this impressive dividend grower is absolutely worth considering. We are long.

Conclusion:

Dividend growth investing is often an underappreciated strategy. However, by seeking healthy growing dividends, investors can improve their long-term income (remember “yield on cost”) and total returns. The strategy is particularly attractive right now considering many “pure-growth” stocks will continue to struggle under the weight of higher interest rates, whereas many dividend-growth stocks can continue to thrive.

Every investor needs to select an investment strategy that is right for them. For example, you may prefer higher current yields or you may be willing to accept a lower current yield in exchange for very powerful long-term dividend growth. We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy.