Dividend growth stocks are particularly compelling in the current market environment because many of them have ample financial wherewithal to easily survive the Fed’s recent sharp interest rates hikes (whereas a lot of volatile pure-growth stocks do not). In this report, we explain the construction methodology behind the popular 100-stock Charles Schwab US Dividend ETF (SCHD), including data on all 100 stocks in that fund. Then we review three specific stocks from SCHD that are particularly attractive. We conclude with a critically important takeaway about the attractiveness (and risks) of investing in specific dividend-growth stocks in the current market environment.

About: Schwab US Dividend ETF (SCHD), Yield: 3.4%

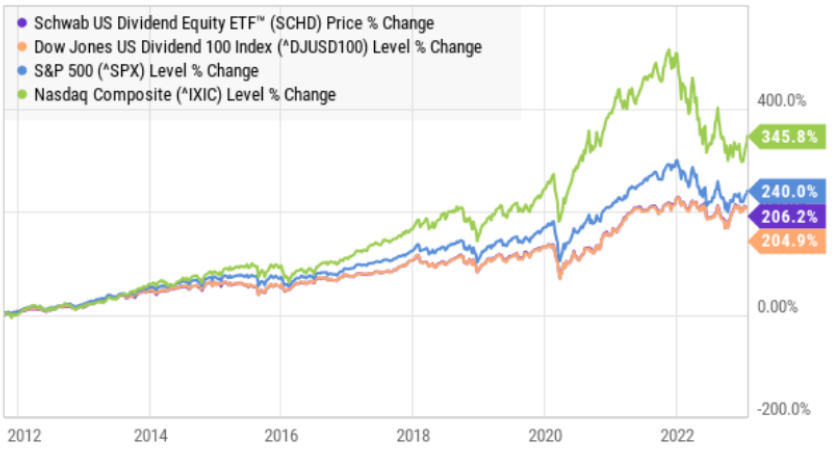

The Schwab U.S. Dividend Equity ETF (SCHD) is a popular fund for income-focused investors. And for good reason. For example, it pays relatively high dividend income (the yield is higher than both the S&P 500 and the Nasdaq), it has a healthy track record of performance (i.e. it’s been doing what it is supposed to do) and dividend-growth investing has a lot of attractive qualities right now considering the current macroeconomic environment.

But what a lot of investors may or may not realize is that SCHD is just a passive fund benchmarked to the Dow Jones U.S. Dividend 100 Index (see performance above). That means Schwab isn’t actively selecting any stocks for the fund, they’re just passively buying all the stocks in the underlying benchmark through a full replication technique. That (combined with economies of scale) is how they keep the SCHD expense ratio fairly low (it’s recently 0.06% annually).

Here is a link explaining how the Dow Jones U.S. Dividend 100 Index (and ultimately SCHD) actually works (see page 19), but in a nutshell it’s basically just using a formula to select high-dividend stocks.

Basically, to be included in the index (and SCHD), a stock has to be in the Dow Jones US Broad Market Index—excluding REITs (this index has around 2400 constituents-excluding REITs), it must have at least 10 consecutive years of dividend growth (this narrows the universe down dramatically), it has to meet minimum market cap and trading volume requirements (this eliminates mainly micro-cap stocks), and then it includes the 100 top-ranked stocks (that score well according to free cash flow, return on equity, yield, and 5-year dividend growth rate) according to dividend yield.

There are more nuances in terms of weightings and rebalancing (as you can read about in the link provided above). It may sound complex, but its just selecting stocks with relatively higher-dividend yields and subject to the financial metric requirements defined in the index methodology.

Who Should Invest In SCHD:

Considering the construction methodology described above, and the current market environment (i.e. we believe “dividend-growth” stocks in general are particularly compelling right now because many of them have the financial wherewithal to survive the Fed’s recent sharp interest rate hikes and the possible looming recession, whereas many “pure-growth” stocks—that thrived when rates were near 0.0%—do not), we believe SCHD is an attractive opportunity for income-focused investors.

However, we do not believe SCHD is a perfect investment by any stretch of the imagination. For example, we do like select REITs right now (as described in the link provided in the concluding paragraph of this report), but SCHD has eliminated all REITs. Also, we like some stocks included in SCHD more than others. For example, we highlight three specific dividend-growth stocks that are included in SCHD that we believe are particularly attractive, depending on your own unique individual goals and situation, later in this report.

SCHD Holdings: 100 Top Dividend-Growth Stocks

Before getting into the three SCHD stocks that we believe are particularly attractive and worth considering (depending on your own unique situation and goals), we first share data on all 100 of the current holdings in SCHD, for your consideration (see table below).

data as of 27-Jan-23, source: Schwab Asset Management website and StockRover

The above table shows recent performance, dividend characteristics and other metrics that may be helpful to you when considering particular dividend-growth opportunities. For example, the average 10-year dividend growth rate, and the “P/E % of 5-Yr Range” metric are interesting. You may also recognize at least a few of your personal favorite dividend-growth stocks in the table above.

Three (3) SCHD Stocks Worth Considering:

And with that backdrop in mind, let’s get into three particular names from the SCHD holdings that we believe are particularly attractive and worth considering, depending on your own unique situation and goals.

1. Altria Group (MO), Yield: 8.5%

You might think a stock yielding over 8% is a red flag (perhaps a company in distress), but Altria has some very attractive qualities, and it may just exactly hit the spot for you, depending on your goals. The main industry (US tobacco) is in secular decline, but revenues and the dividend are set to keep growing steadily (Altria has increased its dividend for 53 years straight) and the shares are a bit undervalued. Altria has some fairly huge competitive advantages (mainly economies of scale and industry regulation that essentially prevents new competition). Plus, there is a lot of room for Altria to keep increasing the price of its Marlboro brand (which has incredible customer loyalty). Plus Altria stands to benefit from its “on!” oral nicotine pouches, strategic investments in ABInBev (e.g. Anheuser-Busch), Juul (vaping) and Cronos Group (cannabis). We recently wrote Altria up in detail, and that members report is available here.

2. LyondellBasell Industries (LYB), Yield: 5.0%

Based in Houston, LyondellBasell is one of the largest plastics, chemicals and refining companies in the world. And it has been facing dramatic market-cycle challenges recently. Specifically, weakness in Chinese markets (due to the zero-COVID policies—i.e. lockdowns) and weakness is North America (because new supply plus “inventory destocking” led to a fall in polyolefin prices).

However, Lyondell has the financial strength to survive, especially considering it will continue to benefit from lower-cost North American natural gas feedstocks that will allow it produce at a significantly lower cost than global competitors. Further, lower natural gas prices and higher oil prices have increased profits in North America—a condition that is likely to persist.

We expect the company’s 11-year track record to dividend increases to continue and the share price to show long-term strength. We recently wrote this one up in detail, and you can read that members report here.

3. Cisco Systems (CSCO), Yield: 3.2%

Founded in 1984, Cisco Systems may seem like a dinosaur to some investors, but in reality this networking company (hardware and software) remains highly relevant (and the market leader) in Internet Protocol networking solutions. In fact, customers pay a premium for Cisco, and the company’s path forward remains bright as a leader in both legacy and future networks.

Furthermore, Cisco’s dividend is very healthy (it has also been increased for 11 years in a row, and the payout ratio remains low), and the 10-year yield on cost is an impressive 7.3%!

In our view, Cisco is attractive in the current economic environment (i.e. slowing macroeconomic growth) because of its high switching costs, sticky subscription revenue and powerful cash position. Further, it can continue to grow both organically and inorganically as its market opportunity (cloud, hybrid-cloud, security) continues to grow. The dividend adds to security during volatile markets, and the valuation suggests the shares are undervalued (perhaps related to the somewhat indiscriminate sell off in the technology sector). If you are looking for steady dividend income increases and long-term share price appreciation, Cisco Systems is attractive and worth considering for investment. We recently wrote it up in detail and you can view that members report here.

Bottom Line Takeaway:

Dividend-growth investing is an attractive long-term income-focused strategy, particularly in the current market environment. And SCHD is a decent passive way to play the dividend-growth space. However, depending on your personal situation and goals, you may prefer to select attractive individual dividend-growth opportunities, such as the three we shared in this report. In fact, we like Altria, LyondellBasell and Cisco so much, that we ranked them #20, #18 and #12 in our new report: Top 20 Dividend-Growth Stocks.

However, at the end of the day, you need to select investment opportunities that are right for you, based on your own personal situation (it’s extremely risky to do anything else). Disciplined, goal-focused, long-term investing will continue to be a winning strategy.